WPC Q2 2024: Thoroughly Re-Rated

W.P. Carey (WPC) followed the mediocre first quarter with a disappointing second quarter.

WPC reduced guidance for AFFO per share.

Old midpoint: $4.70

New midpoint: $4.68

That’s not a huge reduction. It’s actually pretty small. But WPC is under pressure to do something positive since this management produced the catastrophic flop of spinning off office properties and slashing the dividend after 25 years of consecutive increases. Of course, this is also a decision that WPC could’ve brought to shareholders but didn’t.

Let’s remember how this works:

- Realty Income (O) spins off crappy office properties and raises the dividend.

- WPC spins off crappy office properties, slashes the dividend, and claims the market will “re-rate” them.

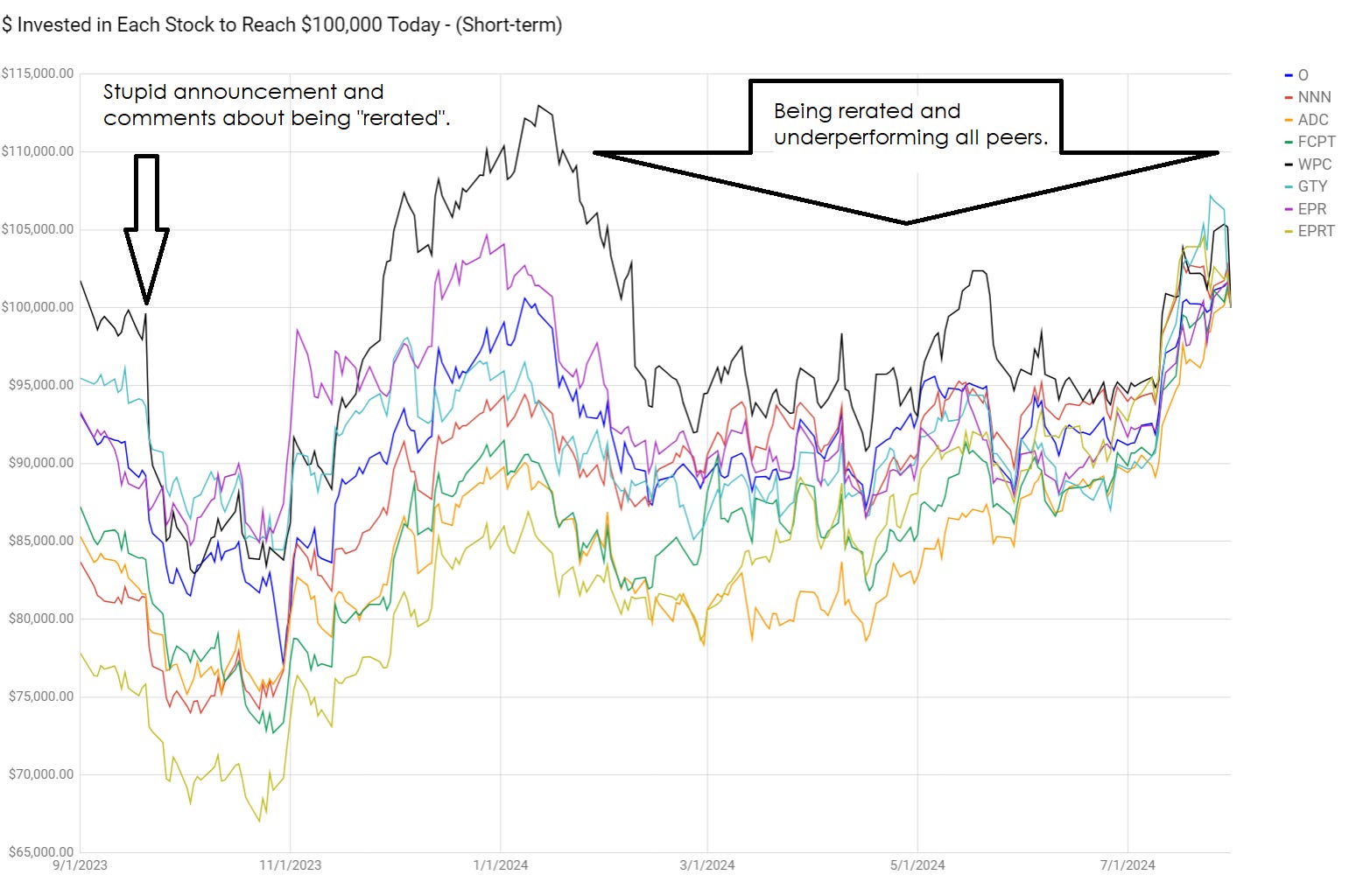

- The market absolutely “re-rated” them in precisely the way every investor expected. WPC underperformed all sector peers. Some by a moderate margin and others by a substantial margin.

Here’s the chart showing WPC’s performance:

Note: This chart only goes through about 7/31/2024.

As you can see, this decision turned out poorly. That’s really not surprising, given that dividend aristocrat status helps REITs generate a higher valuation. When WPC threw that in the trash and burned it, obviously it wasn’t going to improve their valuation.

Same-Store Rent Growth

I updated the chart for WPC’s Contractual Rent Growth reported at the end of each quarter and the actual rent growth they achieved. However, before we get to it, I'll need you to sign in if you haven't already. If you're not signed in, you'll see a gray box below. If you are signed in, we'll go straight to the chart.