WPC Q1 2024 Update & Forward Growth Projections

W.P. Carey (WPC) reported a mediocre start to the year.

AFFO per share guidance was maintained at $4.65 to $4.75. Midpoint $4.70.

Since WPC spun off a bunch of office real estate, we’re not doing a year-over-year comparison.

At least not this time. I might in the future. The office real estate was distributed via a special dividend. We could adjust WPC’s per-share value by the amount of extra shares an investor would have from selling the spin off and using the cash for more WPC. However, that’s still far from a perfect adjustment.

Debt

WPC’s debt is mostly fixed-rate, but they do have a little floating-rate debt.

WPC also had $500 million of debt that was due on April 1st, 2024.

They had about $777 million in cash on hand, so they could handle the maturity.

Since the quarter ended, they also had a bond offering for 650 million euros (worth $702 million).

Note: The expiring debt was in dollars. The new financing is in Euros. The change is probably driven by seeking a lower interest expense.

The bonds mature in about 8 years.

Because euro-denominated debt carries lower yields, they were able to issue it with a coupon rate of 4.25%.

I’m estimating an effective interest expense rate of about 4.38% after adjusting for discounts on issuance.

If they issued in dollars, it probably would’ve been around 6%, maybe a little bit lower.

Interest Rates

WPC has a big challenge over the next several years.

Their debt has a weighted average rate of 3.2% (quite low). However, this is also impacted by getting euro-denominated debt, which can be 1.5% cheaper.

The weighted-average maturity across all outstanding debt was only 3.7 years. Part of the low maturity was having a debt that was due the next day.

If we adjusted all of WPC’s outstanding debt from the end of Q1 2024 to current rates, I would estimate a new rate of about 5.15%.

That assumes 50% of debt in dollars at 5.9% and 50% of debt in euros at 4.4%.

We’re using effective interest expense, rather than coupon rates, because that’s a better calculation of the actual cost.

If all debt was rolled over at a 5.15% average rate, it would increase interest expense by about $0.71 per share.

That is equivalent to 15.1% of current year AFFO per share guidance.

That headwind will be spread across several years, but it is still material.

Cap Rates

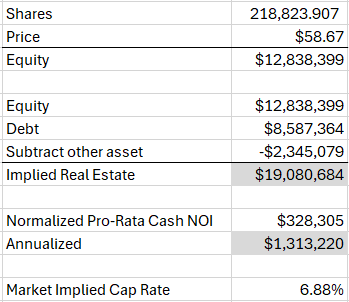

I did some math to find a market implied cap rate for WPC:

When you’re looking at that formula:

- There is some analyst discretion used in deciding which “other assets” to allow.

- The “Normalized Pro-Rata NOI” figure was included in WPC’s supplementary.

- WPC’s projected same-property NOI for the year is essentially flat, so annualizing Q1 was fair.

- The calculation uses the annualized figure divided by the implied real estate value.

Acquisition Targets

WPC’s target cap rate for acquisitions is in the mid 7% to high 7% range.

The impact to AFFO per share will depend on how much overhead costs are impacted.

If there is zero incremental overhead (which is overly optimistic), then these acquisitions could have a nice accretive impact. Assuming moderate overhead impact, the benefit of the acquisitions would be much smaller.

If WPC wants to acquire more real estate than they sell (which is usually the plan), they would need to be issuing more debt at current rates. Consequently, the weighted-average rate would increase.

To make it simple, I wouldn’t project a substantial amount of accretion to AFFO per share from acquisitions unless WPC is able to issue stock at a materially higher price.

Here’s another opportunity to subscribe, just to break up the article a bit.

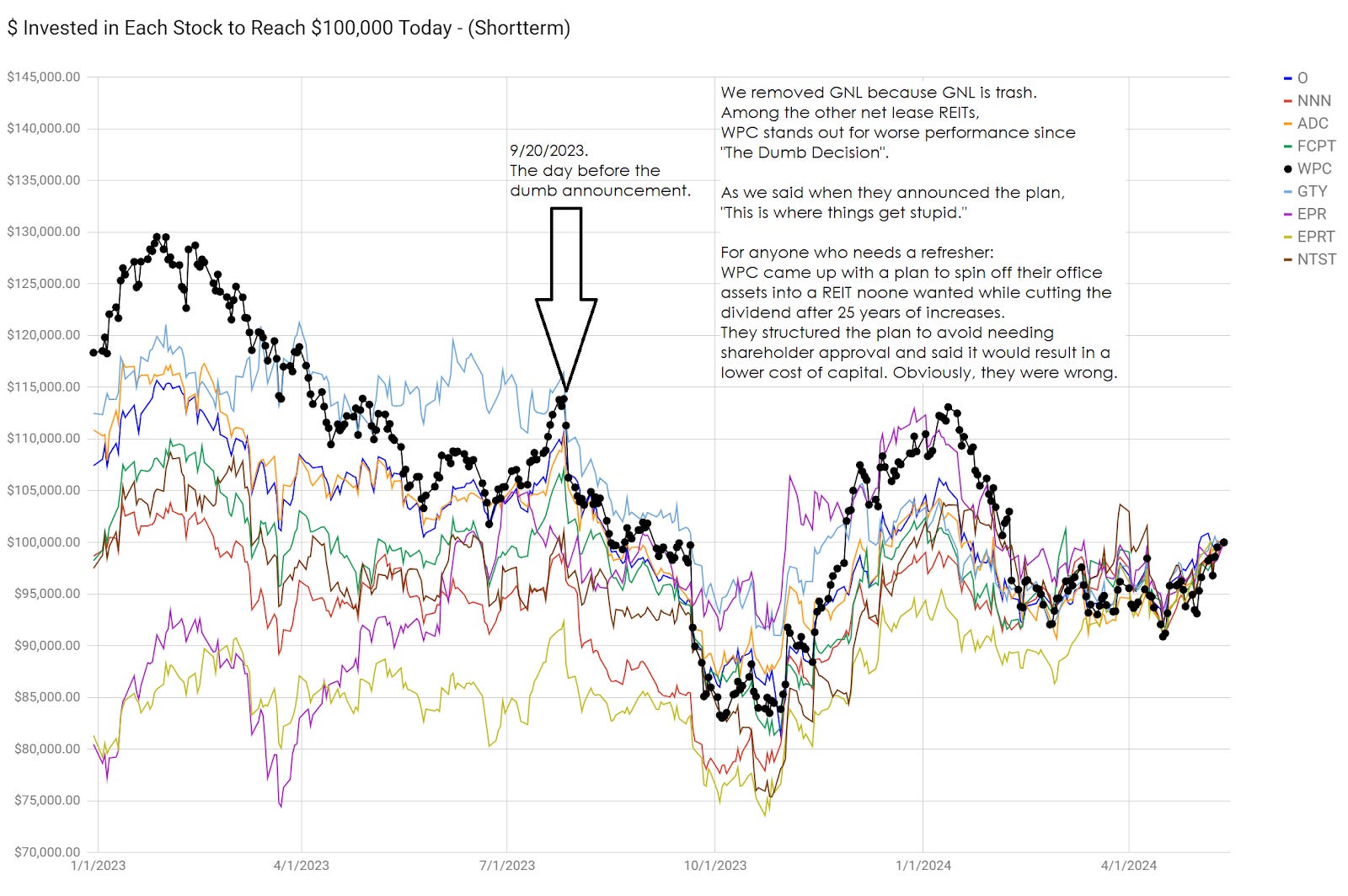

The $100k Chart with The Dumb Decision

I highlighted 9/20/2023 on the chart because it is the day before management unveiled their horrible plan (spin off office & cut dividend).

We can see that WPC’s performance since then hasn’t been great. They were basically tied for the worst in the sector.

Note: This chart demonstrates how much had to be invested previously to reach $100k today. It is adjusted for dividends. By forcing every value to reach $100k today, investors can pick any start date. If we used a normal chart, investors would be locked into one starting date. That would stink. Consequently, this is a much better way to evaluate historical performance.

Dividend Future

WPC reset their quarterly dividend to $.860 per share. Down from $1.071 per share.

Subsequently, they “raised” it to $.865 per share.

That gives them a payout ratio of 73.6% based on management’s guidance for AFFO.

That’s about normal for a net lease REIT.

Growth in AFFO per share should come from a few major sources:

- Growth in same-property NOI (WPC is guiding for flat same property NOI)

- Accretive Acquisitions / Development / Buybacks (potential modest accretion)

- Change in interest rates (this is currently a headwind for everyone, bigger for those with more maturities)

I’m expecting AFFO per share growth to struggle because I see the change in interest rates as a big enough headwind to largely offset the first two.

Assuming a relatively steady payout ratio on AFFO per share, we should expect AFFO per share and dividends to be very strongly correlated over long periods.

Therefore, we should assume dividend growth and AFFO growth run at similar rates. I will focus on AFFO per share projections.

Same-Store Full Year Guidance

Note: Most REITs would use NOI (Net Operating Income) instead of rent. However, since the vast majority of expenses are passed on to tenants, it is not unusual for a net lease REIT to simply report changes in rent rather than NOI. WPC reports this as “comprehensive same-store growth”.

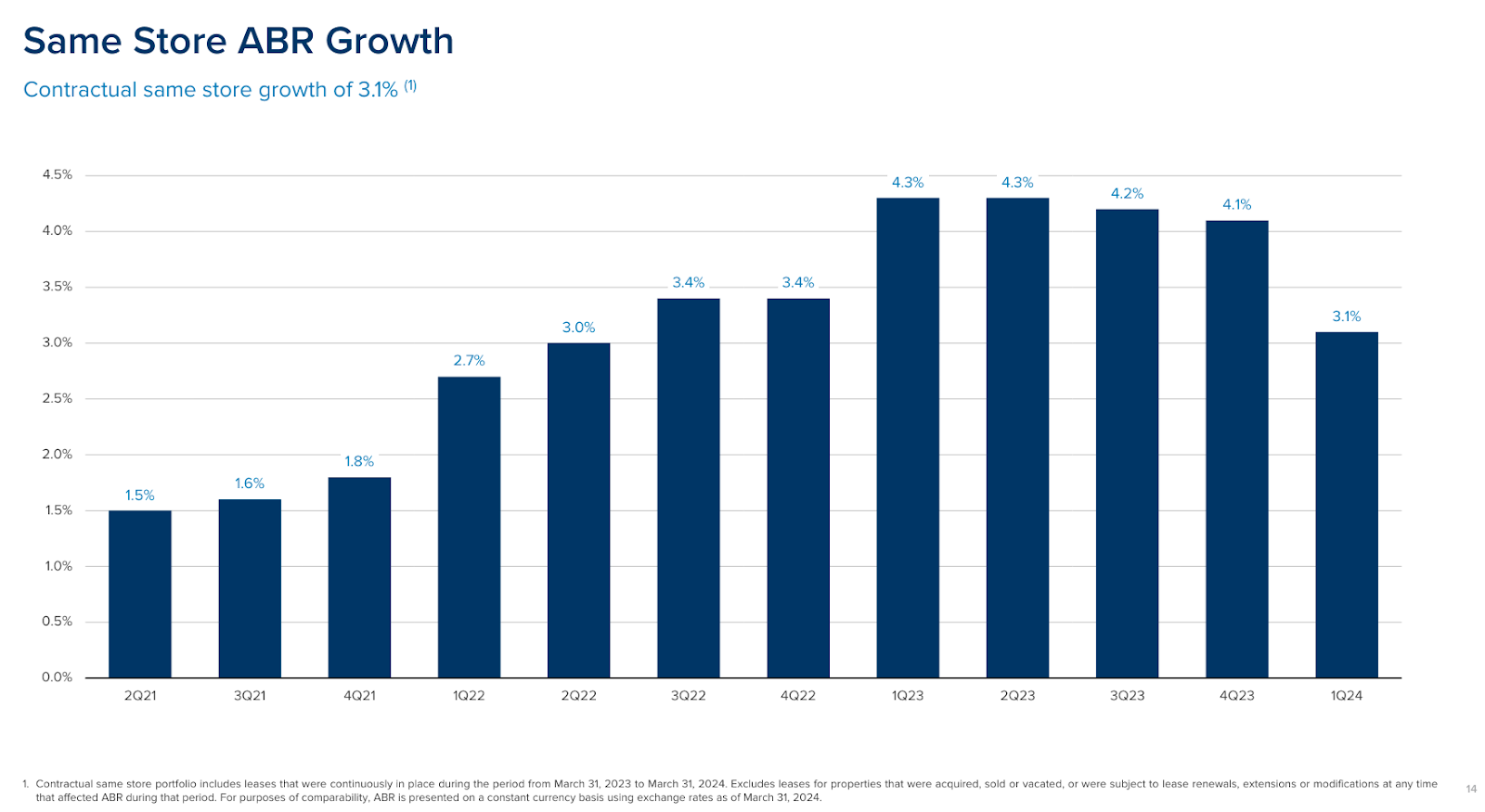

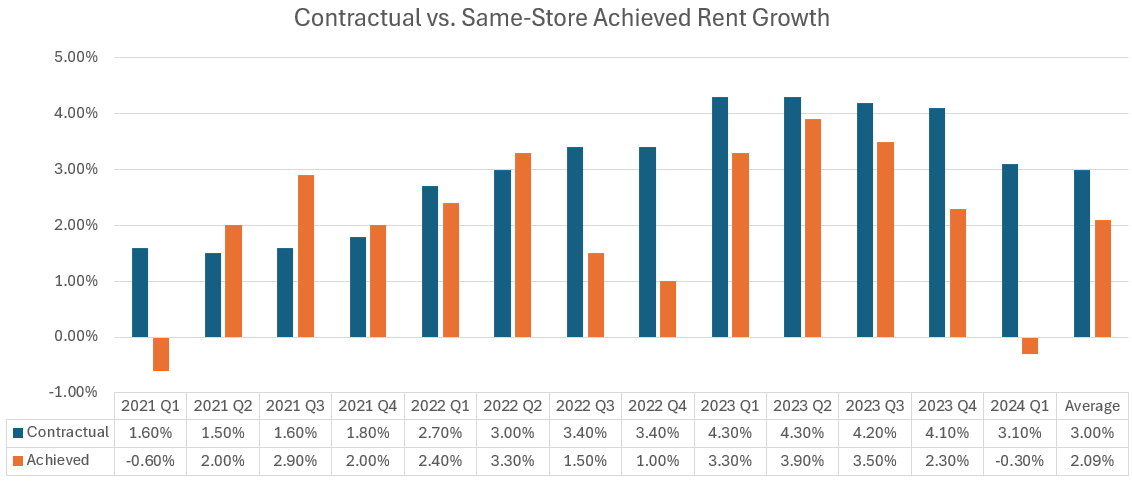

Contractual revenue growth is running at 3.1% (includes inflation-linked contracts, which increases the average and should dip in future years).

WPC’s management projects same-store comprehensive rent growth to be roughly flat for the year. That means about 0%.

Clearly, 0% is quite a bit lower than 3.1%. That’s probably a bit disappointing for most investors since WPC was already getting rid of their office properties.

Same-Store Result

In Q1 2024 the actual same-store rent growth achieved was negative 0.3%.

It would’ve been over 2% (I’m estimating 2.3%) if it weren’t for one crappy tenant (Hellweg).

The tenant received “rent abatement” for the quarter, which means the tenant’s rent bill was simply forgiven for the quarter.

Further, the tenant used the fact that their business sucks to negotiate a 14% to 15% reduction in their annual rental rate.

The free rent hit in Q1 2024. The lower rent begins at the start of Q2 2024.

What did WPC get? The lease maturity (at a lower rate) was increased by 7 years (to February 2044).

Hellweg’s business may stink, but their negotiating is outstanding.

My Math

Hellweg’s rental rate was 27.3 million euros. At $1.08 per euro, that’s $29.484 million.

Getting 3 months free cost the landlord $7.37 million. That reduced Q1 2024 AFFO by $.033 per share.

The rental rate was also reduced by 4 million euros ($4.32 million) per year. The run-rate impact is about $.02 per share per year for the next 20 years.

This is not enough to explain the weak same-store rent guidance for the year.

Contractual rent growth = 3.1% = $33.9 million.

Hellweg impact = $7.37 million in Q1 + about $1.08 million per remaining quarter = $10.6 million.

For comprehensive rent growth to be roughly flat, WPC would be missing out on about $23 million of rent elsewhere.

Forward Growth Projections

Contractual growth of 3.1% is unusually high for net lease REITs and reflects the recent inflation:

If inflation persists, then maybe it normalizes around 3%. I’m theorizing that it settles below 3%. I’ll go with 2.0% to 2.5% as a more likely range in a year or two.

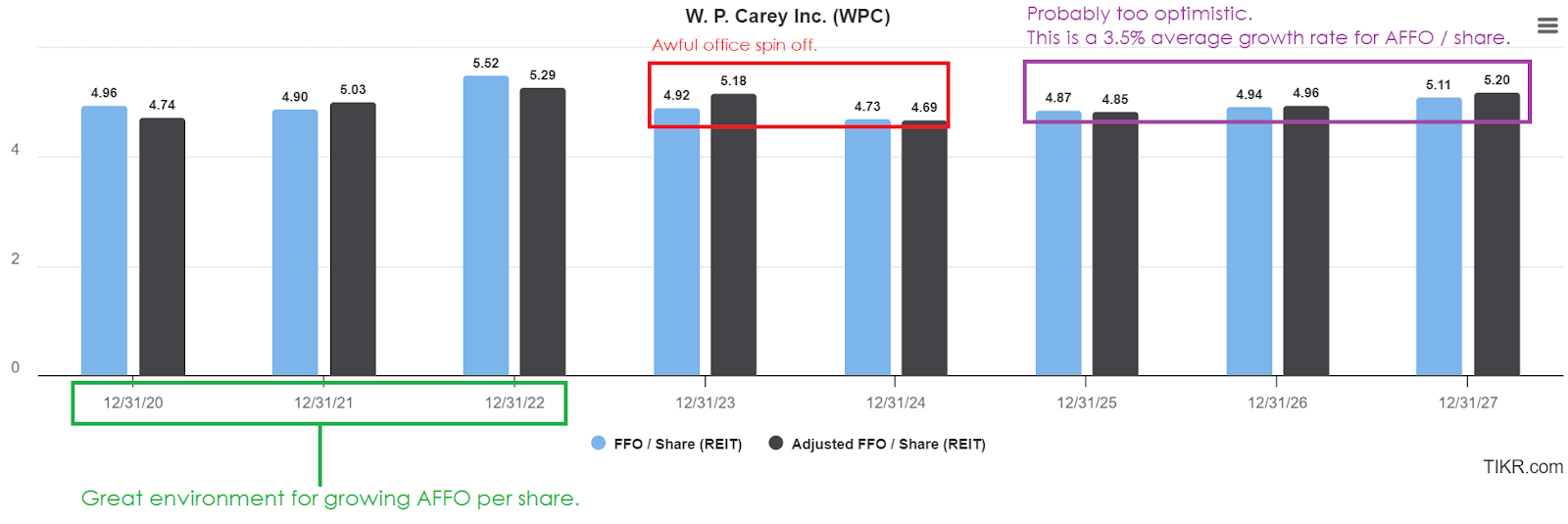

I grabbed a chart for FFO and AFFO per share for WPC. We’re going to focus on the AFFO figure. Notice that the chart includes recent history and forward consensus estimates.

If we reset expectations based on the 2024 figure ($4.69 consensus estimate, $4.70 midpoint of guidance), then growth for the next 3 years would be projected at a 3.5% annualized rate.

Since net lease REITs have minimal expenses, most of the rent growth should reach EBITDA.

We begin by assuming no acquisitions. We can add them on afterwards.

Note: All figures here are going to be “normalized”. So if there’s some weird one-time charge (or gain), we’re ignoring it.

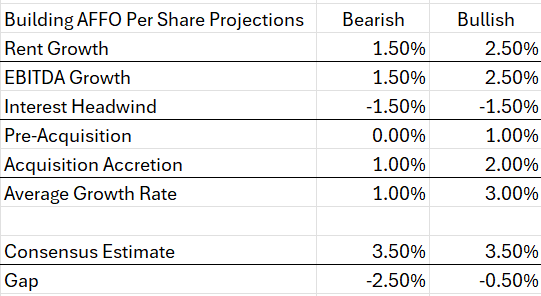

Here’s the table:

My estimate for 2025 to 2027 average annual AFFO per share growth is 1.0% to 3.0%.

Explanation (skip if table made perfect sense):

Assuming rent growth runs around 1.5% to 2.5% (better than WPC is doing now, but lower than current contractual rent growth), that means EBITDA goes up about 1.5% to 2.5%.

Since we assume no acquisitions for the base model, we also assume shares outstanding don’t change. This is fine because when shares outstanding changes it will be related to acquisitions.

We can look at the upcoming maturities for WPC and project that if WPC maintained the same currency exposure, it would result in about a 4.5% headwind for 2027 relative to 2024. Therefore, it would be about 1.5% per year.

We can simply subtract that from the projected EBITDA growth and get 0.5% to 1.0% per year. This is a very rough proxy for the impact to AFFO.

That’s going to be the baseline.

WPC also wants to issue new shares and debt to acquire properties.

To make that highly accretive, WPC would need any of the following:

- Higher cap rates on acquisitions.

- Higher share prices (lower cost of issuing equity).

- Lower interest rates (could also be replacing dollar debt with euro debt).

Assuming none of those, the acquisitions would probably be modestly accretive.

In my opinion, modestly accretive acquisitions probably wouldn’t be enough to drive more than about 1% growth in AFFO per share. If acquisitions can add 2.0% to annual AFFO per share growth in this environment, that would be a positive surprise.

Even at 2.0% from acquisitions, our bullish scenario only reaches 3.0%, which is lower than the 3.5% average growth rate in the consensus projections.

Therefore, I’m thinking WPC probably delivers lower AFFO per share growth than consensus estimates.

Comprehensive Same-Store vs. Contractual

In the example above, I assumed “comprehensive same-store” rent growth would run 1.5% to 2.5%. I think that was fair.

The “contractual rent growth” has regularly overstated the level that is achieved.

Therefore, I think 1.5% to 2.5% is a better estimate than the current contractual rent growth of 3.1%.

Conclusion

We can’t have great AFFO per share comparisons when a REIT is spinning off their worst properties. That’s naturally going to be dilutive to AFFO per share.

Guidance for AFFO being maintained is fine.

I think the consensus estimates are a bit too optimistic. I would project the actual growth in AFFO per share to be lower, unless WPC finds some acquisitions at materially higher rates or achieves a lower weighted-average cost of capital (higher share price or lower interest rate).

Projecting lower growth than consensus forecasts is generally a negative symbol. On the other hand, interest rates are more favorable now than in the prior update.

Therefore, impacts to price targets are not settled yet. I would anticipate relatively small adjustments in the next net lease sector update. However, if rates run much lower (bullish) or much higher (bearish), it would influence the adjustment.

If you appreciated this article, consider signing up to receive our new articles as they come out.

Member discussion