Why Did Book Values Surge? Easy Mortgage REIT Guide to Tightening.

I’ve gotten a few questions since the weekly update about the jump in book values.

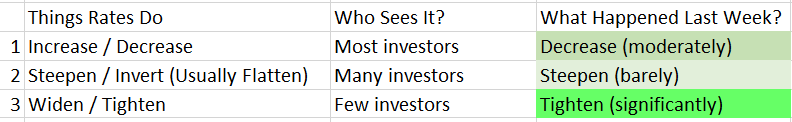

Rates are known to do a few things:

Last week, all 3 categories saw movement. However, there is one easy narrative because it fits with what most investors have been taught. They see this story:

- Rates went down (true).

- Book values went up (true).

- Therefore, rates going down caused book value to go up (not this simple).

Was the decline in rates related to book values going up? Yes, it was related. Was it “the cause”? Not really. To say this is about rates going down is like saying a team won because a benchwarmer scored 4 points in the second quarter. It helped, but it isn’t the story.

Simplifying Hedges

For simplicity, I’m going to combine 3 major types of hedges:

- LIBOR swaps

- SOFR swaps

- Treasury Futures

For our purposes, we’re just going to reference these as “hedges”. Technically, each references different interest rate indexes. However, we’re going to simplify by pretending all hedges move with Treasury rates. They don’t move perfectly with Treasury rates, but there is a very strong correlation.

What Happens When Rates Fall?

If interest rates fall on Treasuries and MBS:

- The mREIT has an unrealized loss on hedges.

- The mREIT has an unrealized gain on MBS.

If rates increased, it would be the opposite.

Last week:

- Treasury rates fell. Therefore, there was an unrealized loss on hedges.

- MBS rates fell materially further. Therefore, there was a much bigger gain on MBS.

Therefore, “spreads tightened”. That’s the key story here. It is the tightening driving book value.

MBS spreads have been wide relative to Treasury spreads. How wide they are (or were) depends on which technique we use to measure them.

We want to keep it simple, so I’ll just use some actual numbers from last week.

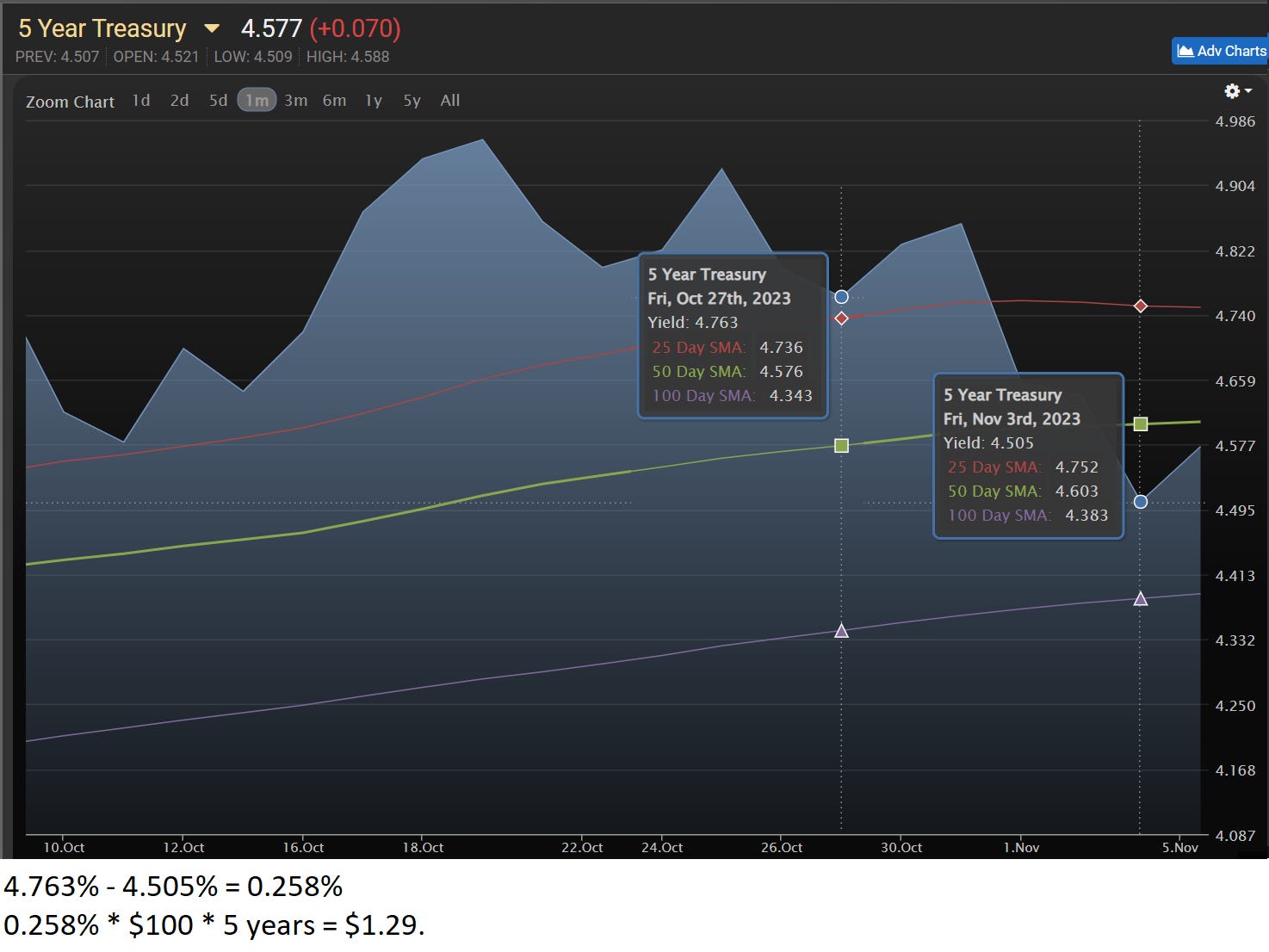

5-year Treasury rates:

- Friday: 4.505%

- One week earlier: 4.763%

- Change: -0.258%

- Price change: 0.258% * $100 * 5 years = $1.29

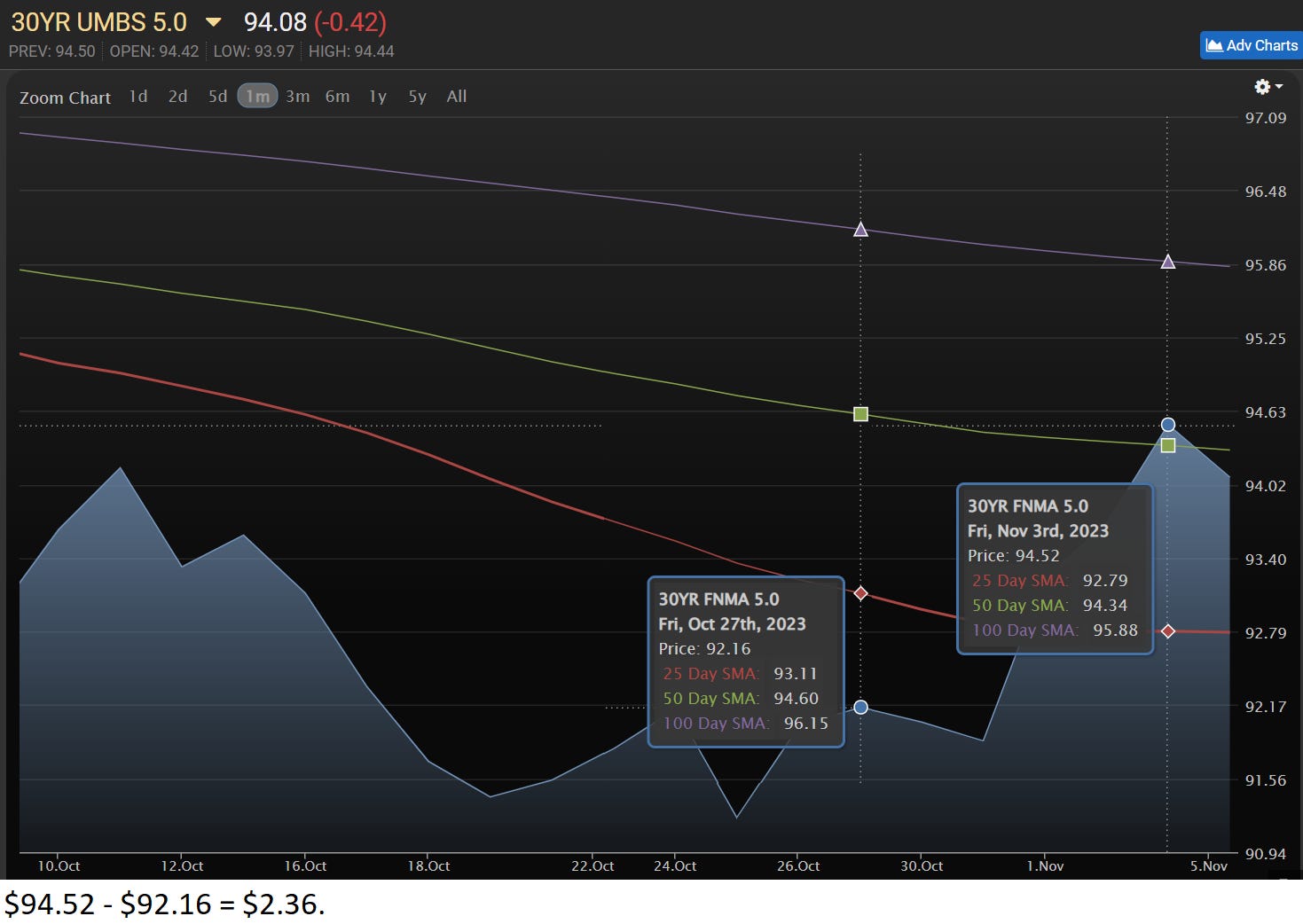

Let’s compare that to an MBS. We will use the 30-year fixed-rate agency MBS with a 5% coupon.

- Friday: $94.52

- One week earlier: $92.16

- Price change: $2.36

The gain of $2.36 is much bigger than a loss of $1.29.

That would be a gain of $2.36 - $1.29 = $1.07 per $100.

If that doesn’t seem like much, apply some leverage. Remember, mortgage REITs are heavily leveraged. Consequently, that $1.07 gain could be more like $10.70.

I put together some charts to show the price history.

5-year Treasury:

30-year fixed-rate agency MBS with 5% coupon:

Can spreads tighten indefinitely? No.

Can they still tighten from here? Yes, significantly.

What could cause them to tighten? A reduction in volatility.

When interest rate volatility is low, investors expect volatility to be low in the future. Therefore, they become less concerned by the risk of prepayments. Prepayments occur when the homeowner:

- Refinances

- Moves

Refinancing plunges when rates soar higher. Refinancing to a much higher rate is stupid. The option belongs to the homeowner. Because rates have increased so much, moving is also far less attractive.

What If Rates Plunge?

Quick experiment.

Pretend interest rates plunge.

The 5-year Treasury yield was 1.263% on December 31st, 2021.

What if the 5-year Treasury yield returned to that level abruptly?

5-year Treasury rates:

- Friday: 4.505%

- Hypothetical: 1.263%

- Change: +3.242%

- Price change: 3.242% * $100 * 5 years = $16.21

Hypothetically, the mortgage REIT loses $16.21 on $100 of hedges.

How much is that mortgage worth?

Let’s assume the 30-year fixed-rate agency MBS with a 5% coupon trades at the same price it did on 12/31/2021. That price was $108.73.

- Friday: $94.52

- Hypothetical: $108.73

- Price change: $14.21

The loss of $16.21 on hedges is bigger than the gain of $14.21 on MBS.

Therefore, the net result is a loss: $14.21 - $16.21 = -$2.00

Apply leverage, and that could be a loss of about $20.00 on $100 of book value.

To be fair, this hypothetical plunge in rates is very unlikely. However, it should help investors recognize that plunging rates are not inherently positive.

Spreads Were Tight On 12/31/2021

The funny thing about using 12/31/2021 as our reference point is that it would involve a substantial amount of spread tightening. Without that, the losses would be bigger.

On 12/31/2021, investors were not particularly scared about interest rate risk.

The 30-year fixed-rate agency MBS with a coupon rate of 2% traded at $99.69.

The 30-year fixed-rate agency MBS that would trade at face value ($100.00 per $100.00 of principal) would’ve had a coupon of about 2.06%. Relative to Treasury rates, that was:

- 0.80% above 5-year Treasury rates (1.26%).

- 0.62% above 7-year Treasury rates (1.44%).

- 0.55% above 10-year Treasury rates (1.51%).

That is very tight by historical measurements.

Spreads Today

For comparison, as of mid-day on 11/6/2023, the MBS that would trade at face value would have a coupon rate of about 6.34%. Relative to Treasury rates, that is:

- 1.77% above 5-year Treasury rates (4.57%).

- 1.71% above 7-year Treasury rates (4.63%).

- 1.70% above 10-year Treasury rates (4.64%).

The wide spreads today are providing a significant shield.

Spreads A Week Ago

A week earlier, spreads were even wider. As the spreads tightened, they drove book value up.

The biggest involvement from rates may be that it gave investors some hope that rates wouldn’t continue climbing indefinitely.

Recap

Over the last week (October 27th, 2023, to November 3rd, 2023) rates declined.

Most investors saw the decline, but it was the spread tightening that really mattered.

When spreads tighten, book value goes up. When spreads widen, book value goes down. The impact of spreads widening or tightening can easily overwhelm the impact of a moderate change in rates.

In this case, investors attributing the gain in book value simply to rates falling are attributing the entire team’s performance to one bench player. Their contribution matters, but it was only a fraction of the story.

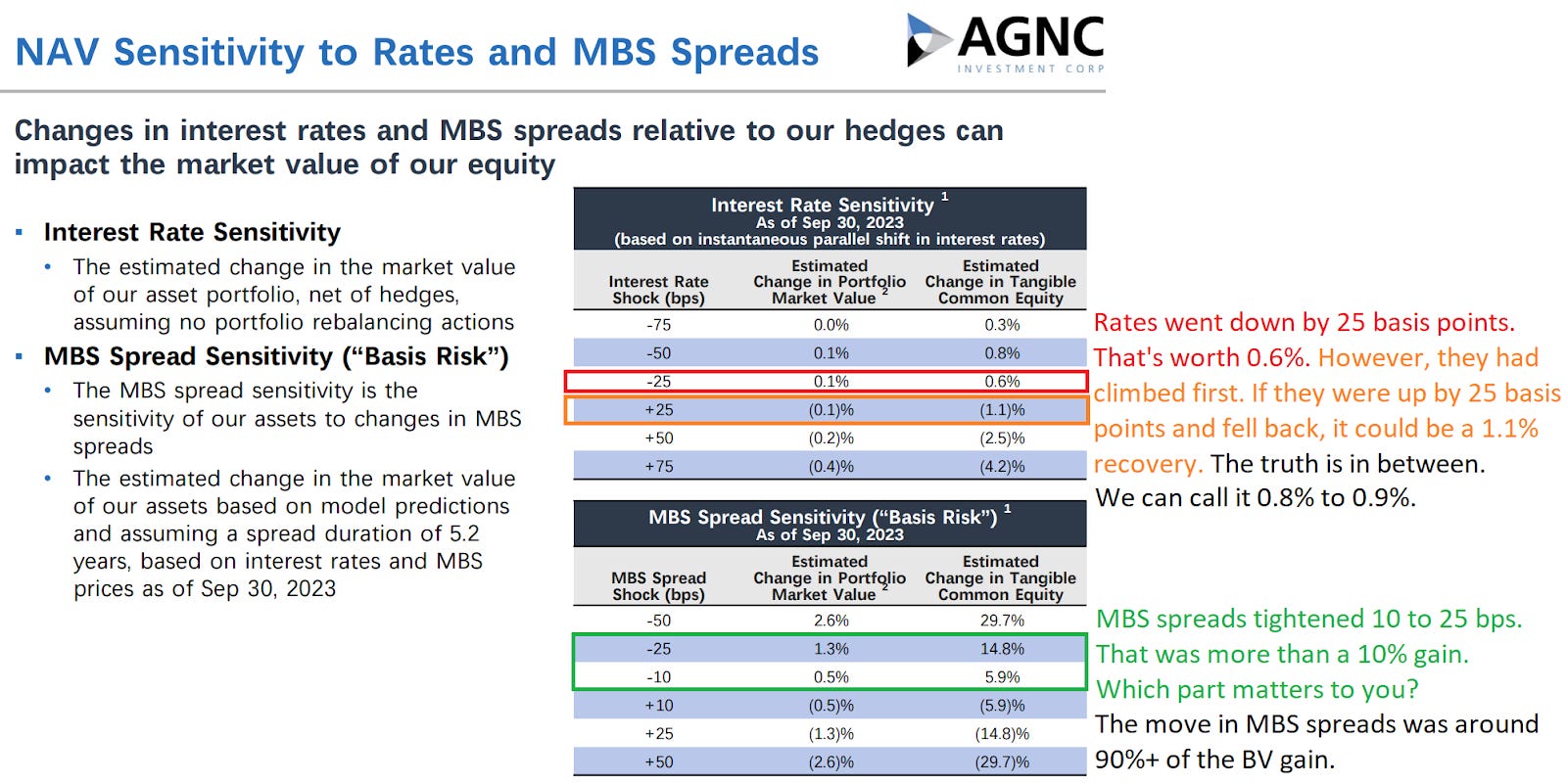

AGNC Told Investors

AGNC tells investors about this dynamic every quarter, but most investors skip over it. I’ve added some notes to the slide:

According to AGNC’s management, rates falling 0.25% would only have given them a gain of about 0.6% in book value. That is after leverage. Before leverage, it is rounded up to reach 0.1%. Even if we factor in that rates had increased moderately quarter-to-date before the decline, it would still be less than a 1% increase for the week.

This is a story about MBS spreads tightening.

Conclusion

Spreads are still pretty wide if we use the MBS that trades at face value relative to Treasury yields. Part of the wider spread today is adjusting for greater interest rate volatility. Part of it is simply enhancing the potential rewards. It’s important to recognize that spreads will widen and tighten over time.

When spreads do not tighten or widen meaningfully, then the change in rates has a more powerful impact on book value. When spreads move significantly, it is much more powerful than the change in rates

If yields fell without tightening, we would’ve seen book value increasing around 1%. If spreads tightened without yields falling, book value still would’ve surged higher.

Could falling rates have contributed to spreads tightening? Yes, that’s possible. Historically, falling rates do not cause spread tightening. However, it may have been a factor this time because the trend towards higher interest rates was so strong. Regardless, investors shouldn’t confuse rates falling with tightening. Tightening was over 90% of the story.

Like our work? Share it with a friend.

Member discussion