What's Wrong With the 9% Yield From RC-E?

The market doesn’t care for shares of RC-E (RC.PE) lately.

Share prices are:

- Down since the start of March 2023.

- Roughly flat since late March 2023

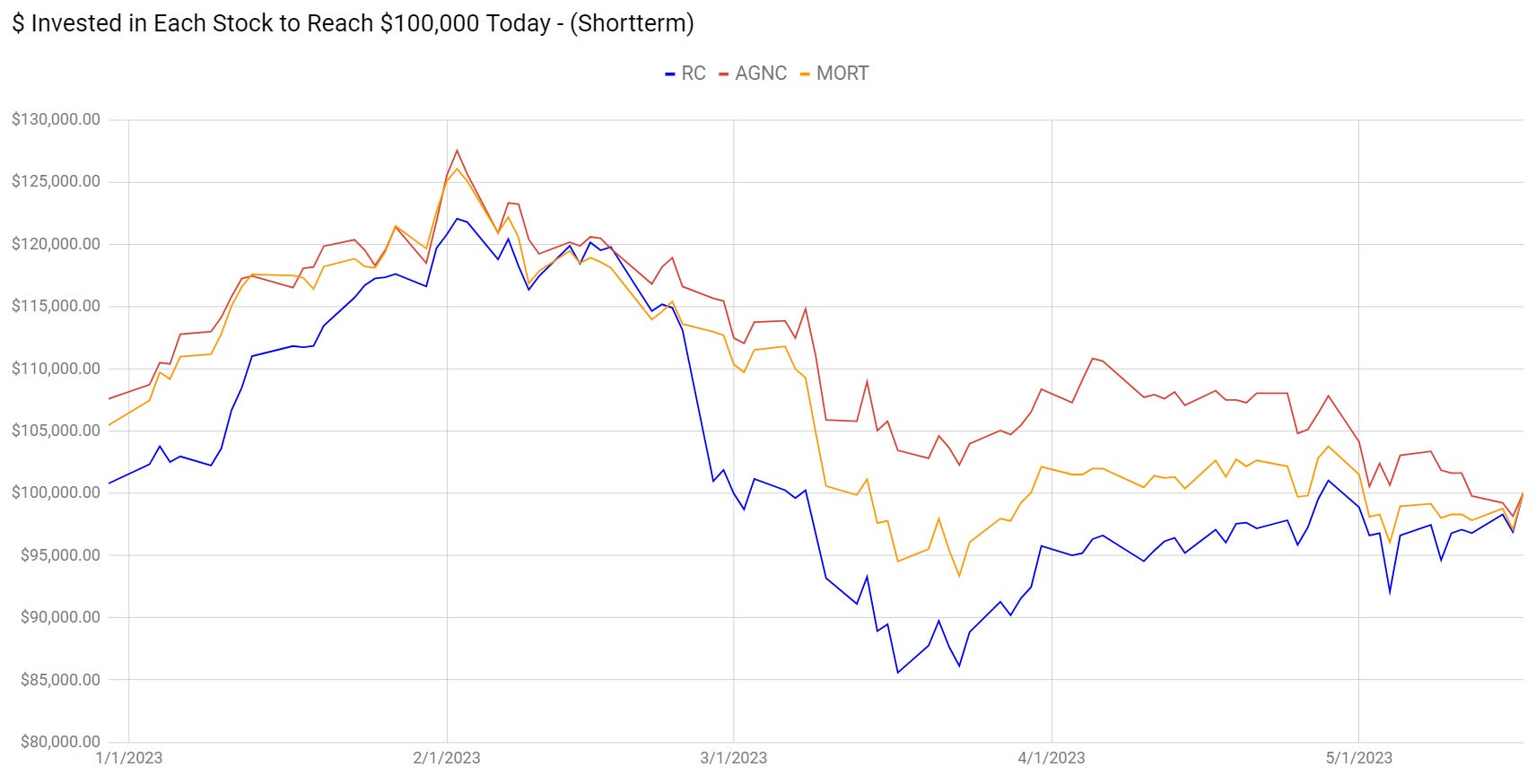

That’s particularly interesting because the common stock for Ready Capital (RC) has beaten several peers. For instance, you can see how RC recently outperformed AGNC Investment (AGNC) and the VanEck Mortgage REIT income ETF (MORT):

The chart shows you how much had to be invested previously to reach $100k today (with dividends reinvested). Much like a normal stock chart, moving up and to the right indicates an increase in values. However, because this chart forces the prices to end at the same point, you can easily see how the price has changed relative to any other day.

We can see RC outperformed AGNC, but how about the preferred shares?

RC-E did not outperform. Starting from 3/1/2023 or 4/1/2023, RC-E was the weaker performer.

Was it because interest rates were soaring higher? No.

Source: MBSLive

The highest 10-year Treasury rates happened right around the start of March 2023. They plunged significantly after that. The 10-year Treasury rate was 3.553% on 3/30/2023. It dipped down to 3.47% to close out the month.

Today it is 3.57%.

That doesn’t explain RC-E’s weak performance when RC’s common shares were doing relatively well.

The fixed-rate dividend on RC-E looks pretty nice at a yield of about 9%. Sure, RC could call the shares if interest rates come down. However, the call value is $25.00. I don’t think a call is likely, but the call value is a soft ceiling, not a floor. There’s plenty of room for RC-E prices to rise.

Disclosure: Our positions include a long position in RC, RC-E, AGNCP, and AGNCO. We recently closed out our position in AGNCM. Part of the funds from selling AGNCM were used to purchase more shares of RC-E. We utilize relative values in the sector to find opportunities to change between positions. We won’t be in these positions forever, but the prices look good today.

We also have several other positions in the sector, which are not referenced in this article.

At the time of writing:

- AGNC $9.19

- RC $10.62

- AGNCM $21.49

- AGNCO $20.95

- AGNCP $19.94

- RC-E $18.18

Like our work? Subscribe (free) or share our work with a friend.

Member discussion