Weekly Series: mREIT And BDC Recommendations (And Price Targets) As Of 10/29/2023

Hi subscribers.

We aim to retain the same layout from week to week. The layout is carried over from last week.

Weekly Notes From CWMF

Positions: Purchased 620 shares of PMT-B (PMT.PB) at $20.13 on Monday (10/23/2023). I'm still interested in preferred shares that float soon.

Consider some equity REIT positions also, though the 10-year Treasury trend still concerns me. 10-year Treasury yields finally had a down week last week. They are at 4.845% today, down from 4.914% a week earlier. That’s not enough to break the upward trend though.

- 25-day moving average: 4.729%

- 50-day moving average: 4.499%

- 100-day moving average: 4.199%

Commentary: I’m starting to get interested in agency mortgage REITs again. We have five agency mortgage REIT upgrades on the week. That’s pretty big, seeing as there are only eight mortgage REITs.

6 out of 8 agency mortgage REITs entered the target buy-under range. Each is within that range by at least 2%. That’s pretty good. AGNC was perpetually listed as overpriced and finally broke through to the neutral range. Price-to-tangible-book value is now estimated at 1.01. That’s down from 1.20 in prior weeks.

AGNC’s share price declined by 14.6% over the last week, while projected BV was up 1.5%.

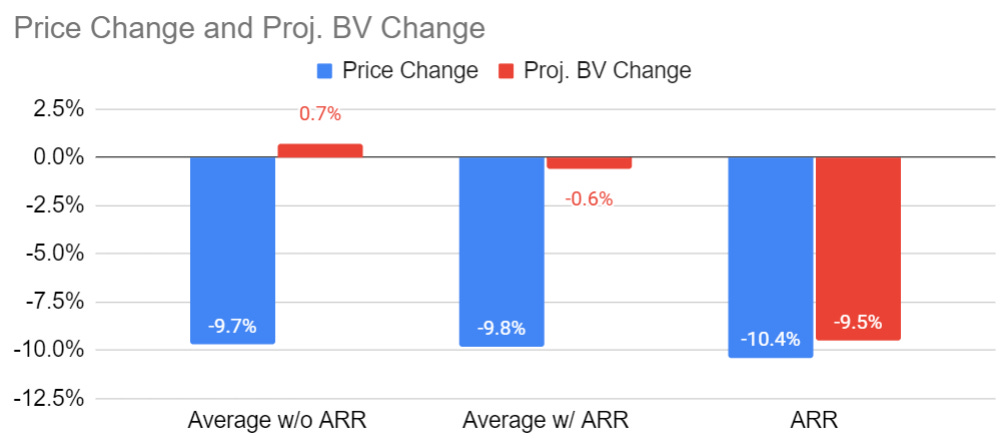

On average, the agency mortgage REIT prices were down 9.8%.

The average projected BV is misleading though. It’s down 0.6%, but ARR is contributing a negative 9.5%.

Here’s a chart comparing the numbers and showing ARR’s impact on average share price and book value:

The only other agency mortgage REIT with a negative adjustment to the projected book value was Two Harbors (TWO). TWO’s projected BV was only down 1.1%.

Looking at the rest of the mortgage REITs, book values were flat (most commercial mortgage REITs) or up (hybrid and originator / servicer).

Both PennyMac (PMT) and Rithm Capital (RITM) delivered positive surprises to book value during earnings. The market responded by giving RITM a 1.4% rally (second best among the mortgage REITs) and PMT an 11.4% rally. The magnitude of the PMT rally is a head-scratcher. It makes me think someone (not us) had bad estimates and was thoroughly surprised.

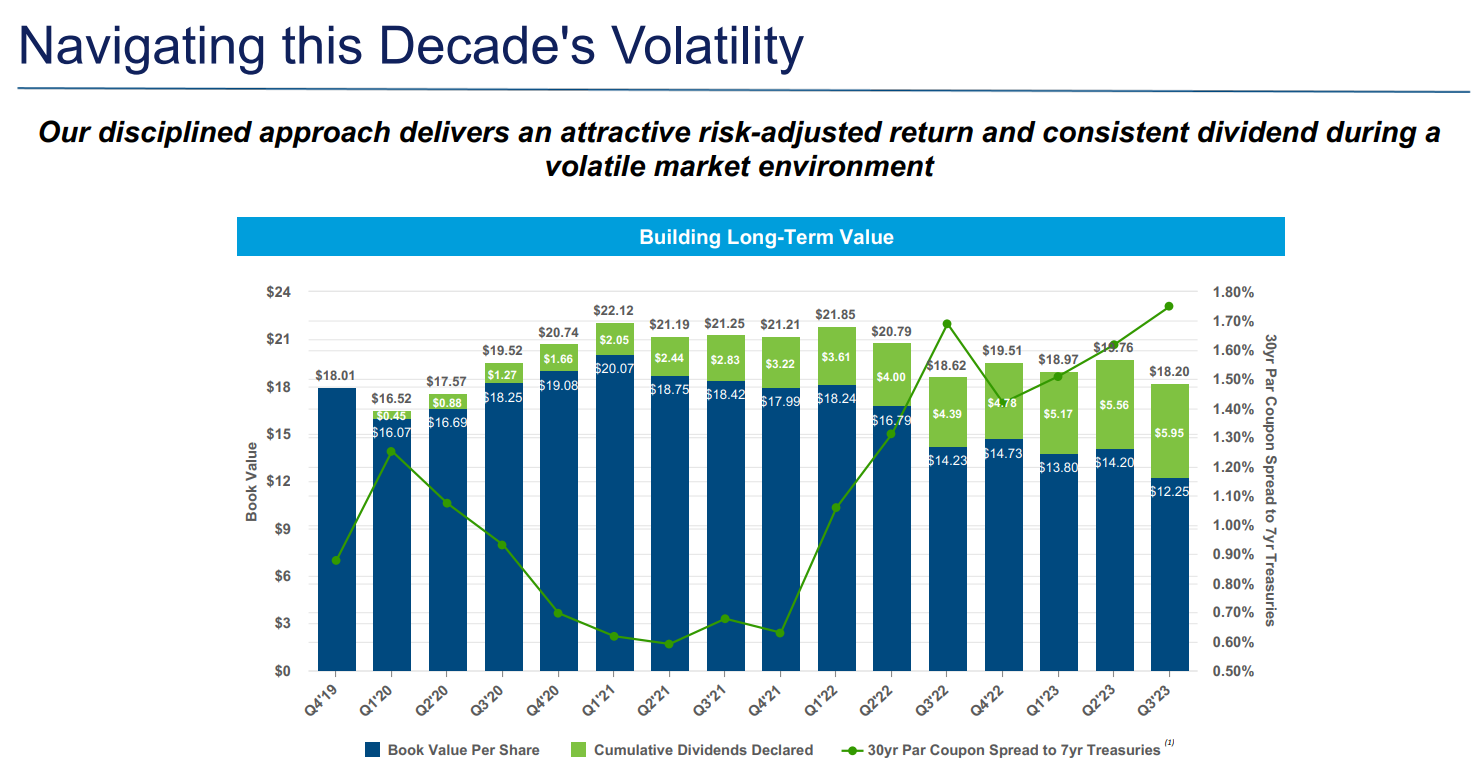

MBS to Treasury spreads still look pretty wide. The 30-year fixed-rate agency MBS that would trade at face value today would need a coupon rate of about 6.7%. Maybe a tiny bit higher.

Relative to Treasuries, that is a spread of:

- 193 basis points vs. 5-year Treasury

- 186 basis points vs 7-year Treasury

- 186 basis points vs. 10-year Treasury (same as 7-year)

Due to high interest rate volatility, I expect these spreads to be pretty high. However, that’s still pretty big.

Dynex Capital provided a slide that demonstrates this spread over time:

The value today, about 186 basis points, would be above the top bar on the chart.

In short:

- Spreads are really good

- Momentum is really bad.

- Discounts are only moderately good.

Therefore, the sector is starting to become appealing. Given all the other opportunities, I’ll wait and see if further weakness develops or if the momentum stalls out. We’re seeing fear in the spreads (really big), but was this capitulation for the sector? Shares fell hard, but price-to-book for the best 3 agency mREITs (AGNC, NLY, and DX) are still in the 1.01 to .87 range. Getting low, but not showing a real panic. Sure, some have bigger discounts. Cherry Hill Mortgage (CHMI) is around .67 on price-to-projected book value. But shares are at $2.81. Seems like a reverse split should be coming for them at some point. Best case scenario for them, in my opinion, would be a buyout. When will management admit that they should throw in the towel?

If I get the urge to play with a weak REIT at a big discount, I’d be more likely to pick AG Mortgage (MITT). The price-to-projected book sits at .45. That’s not an urge I often get. There are still several alternatives with lower risk that still offer huge upside.

Weekly Notes From Scott

Positions: I increased my position in MITT-C on Friday (10/27/2023). No sold positions.

BDC Weekly Change: NAVs relatively unchanged. Spreads relatively unchanged.

Other Comments: Similar to the prior 2 weeks, muted volatility in high yield/speculative-grade debt this week. Earnings season for the BDC sector picks up this week. CSWC, TPVG, GAIN, TCPC, TSLX, and MAIN will be reporting.

Underlying Portfolio Company Credit Changes Held by BDCs (Weekly): 0 downgrades, 0 upgrades

Underlying Portfolio Company Credit Changes Held by BDCs (Current Quarter-to-Date):

This is a running tally of the credit upgrades and downgrades for companies held by each BDC.

- ARCC: 1 Up

- PSEC: (1) Down

Underlying Portfolio Company Credit Changes Held by BDCs (Prior Quarter):

This is a running tally of the credit upgrades and downgrades for companies held by each BDC.

- ARCC: 1 Up, (2) Down

- CSWC: (2) Down

- FSK: 1 Up, (1) Down

- MAIN: 1 Up, (2) Down

- OCSL: (1) Down

- PFLT: 1 Up (JV Portfolio Company), (1) Down (Includes JV Portfolio Company)

- PSEC: 3 Up (Includes 1 Restructuring), (3) Down (Including 1 Bankruptcy)

- GBDC: (1) Down

- SLRC: (1) Down

- TCPC: 1 Up

- OBDC: 1 Up, (1) Down (JV Portfolio Company)

- TPVG: (1) Down (Declared Bankruptcy)

View: Same as last week. - Continuing the June - September 2023 trend, the market remains “cautiously optimistic” on high yield debt/speculative-grade credit. Spreads, for the most part, remain resilient as the market continues to “grapple” between plateauing short-term interest rates and economic uncertainty (typically impacting the longer-end of the yield curve). Still expect an eventual mild recession to pressure NAVs late 2023 - 2024. Factored into price-to-book targets. Spreads will likely widen beginning in fall 2023. Still tight relative to history. Due to TCPC’s announced merger with BKCC, along with a (2.5%) base management free reduction (which positively impacts future operating performance/net investment income [NII]), this BDC received a 5.5% percentage recommendation range upgrade in early September 2023. Continuing to watch the broader/macroeconomic impacts from the upcoming end of the 3-year student loan repayment pause (due to COVID-19) in October (and any new updates regarding this event). Correctly assumed either a “last minute” government shutdown solution (albeit only 45 days) or a very short-lived government shutdown (under 1 week). The 1st scenario recently prevailed and the next potential government shutdown in mid-November will be continually monitored. I/We will continue to monitor the recent developments in the mid-East and broader macroeconomic impacts in the United States regarding private debt/credit markets.

MREIT Weekly Change: Unlike the horrific prior week, most agency mREIT BVs slightly rebounded during the week. Agency MBS spreads slightly tightened. However, big picture, only a very minor reversal this past week. Most hybrid, originator + servicer, and commercial whole loan mREITs also experienced relatively unchanged - minor BV increases.

Other comments: Regarding weekly recommendation changes (mainly due to stock price and projected BV changes), a handful of peers were upgraded. All agency mREIT weekly stock prices were hammered (playing “catch up” to previous BV declines) while BV projections slightly rebounded. Cautious investors should wait for agency MBS spreads to stabilize. In the current environment, I believe it makes sense to wait for a STRONG BUY/notably undervalued recommendation in most agency mREIT names. PMT was downgraded to a BUY/undervalued recommendation strictly based on valuation (directly due to the 14%+ move higher in stock price on Friday).

Regarding weekly agency mREIT BV movements, all agency MBS coupons experienced modest price increases (including all specified pools; mainly HARP and LLB loans). All (short) derivative instrument valuations slightly - modestly decreased. Simply put, the vast majority of spread relationships I/we track (over 100 combinations) very slightly - slightly tightened. That said, agency MBS spreads remain well above October 2022 levels (negative catalyst/trend). Still, I anticipate this severity of widening to be a relatively short-term event. Spreads should tighten somewhat heading into 2024 but subscribers need to be patient for this to play out. Even though agency mREIT valuations (AGNC aside) are getting more attractive, before considering an investment in this sub-sector based on valuation, I want to see some spread stabilization to occur that lasts more than a week - a couple weeks. Repo financing was relatively unchanged during the week.

View: Same as last week. Agency mREIT sub-sector valuations are starting to become attractive but, again, I would remain cautious. Some market participants thought agency mREIT valuations were attractive a few months ago. Simply put, as continuously noted, the market was “ahead of itself” regarding agency mREIT valuations. A perfect example of this was the sell-off the past 6 weeks which we correctly warned subscribers beforehand (regarding this sub-sector being overvalued prior to this recent sell-off; in particular AGNC). Most agency mREITs were recently in common share issuance mode (rebuild capital as MBS pricing remains historically attractive). However, some agency mREITs trading at notable discounts to estimated CURRENT BV will likely temporarily stop or notably reduce common stock issuance unless deemed necessary (due to greater BV dilution). MSR valuations are likely near their peak and remain elevated versus historical trends. However, I/We do not anticipate a notable drop in MSR valuations over the foreseeable future (especially within lower coupons). The rate of financing cost acceleration has slowed over the past several months (which was previously correctly anticipated). Repo financing rates should peak in late 2023. Agency net interest spreads (excluding current period hedging income) are slightly - modestly negative. However, dependent on the utilization of interest rate payer swaps, adjusted net interest spreads remain acceptable for most peers (though will continue to slightly - modestly decrease over the next couple quarters). Net interest spreads will continue moving lower during the second half of 2023 and will likely “bottom out” close to year-end. Then, a slow, gradual increase will likely begin in the first half of 2024.

There will continue to be pressure in commercial whole loan pricing/valuations, especially in office loans (BXMT was a perfect example of this during Q3 2023; 3 new non-accrual office loans). Simply put, continued credit/recession risk. However, there continues to be a bright spot for industrial loans (especially with the notion of a possible “soft landing” for the economy as a whole). Could even throw hospitality and retail loans in that mix (certainly better than the COVID-19 trends) but isolated credit events will occur in these sub-sector as well. This included updated modeling in late June 2023 of all 3 sub-sector peer’s peak non-accrual rate this credit cycle towards the high end of my/our previous range. This negatively impacted per share recommendation ranges a bit back in late June 2023. ACRE, BXMT, and GPMT will continue to have heightened monitoring regarding asset/loan resolution within the office sub-sector and all other troubled loans. As the risk ratings indicate, BXMT should come out of this credit cycle the least harmed out of the 3 covered sub-sector peers. This notion was only solidified after fully analyzing BXMT’s Q2 2023 earnings results in late July 2023. This should be followed by ACRE and then GPMT. While GPMT should be trading at a discount to estimated CURRENT BV, I continue to believe the level of discount the market is pricing in is excessive (thus keeping GPMT very attractively valued). Just know GPMT is assigned a risk rating of 5 (very high risk; potential for very high reward) and it will take time to see this valuation strategy play out (very likely 1+ year out).

As anticipated, RC recently announced a quarterly dividend reduction from $0.40 per common share to $0.36 per common share. Simply put, no surprise. This reduction was within my/our $0.35 - $0.40 per common share projection (much higher probability was assigned to a cut to $0.35 per common share versus an unchanged $0.40 per common share dividend). After my dividend projection was provided several months ago, management recently "hinted" there would be a cut (again, within my previously-projected range). No change in RC’s percentage recommendation ranges or risk rating from this declaration. Simply put, this dividend reduction was already "baked" into RC recommendation ranges in conjunction with the announced BRMK merger months back. I continue to anticipate a RC dividend at or above $0.35 per common share over the foreseeable future (through, at a minimum, Q2 2024). After a projected RC core earnings “dip” for Q3 2023 (mainly due to non-utilized capital obtained via the BRMK merger), I anticipate an increase heading into 2024 to support the dividend (as capital is deployed).

RITM’s BV was recently negatively impacted, to a very minor - minor extent, by the company’s revised proposed purchase price of Sculptor Capital Management (“SCU”) from $11.15 to $12.70 per Class A common share. Simply something I am already factoring in. Due to immateriality (again, consider the size of this potential merger when compared to RITM’s existing equity), this revised purchase price does not negatively impact RITM’s percentage recommendation ranges (relative to estimated CURRENT BV) or risk rating. A very minor - minor CURRENT BV “true down” adjustment in October 2023 sufficed. If SCU shareholders reject the merger proposal on 11/16/2023, RITM would receive an increased termination fee from $16.6 million to $20.3 million.

EFC’s BV was negatively impacted in October 2023, to a minor extent, by the company’s termination of its previously announced merger with Great Ajax Corp. (AJX). Termination fee aside, I don't mind this development/decision. Out of EFC’s 2 previously announced mergers, AAIC is more important/appealing in my opinion. That said, I am not thrilled by the $16 million termination fee EFC will pay but probably the lesser of 2 evils down-the-road. If I had to take a guess, EFC backed out of the deal. EFC is receiving a minor position in AJX via part of the termination fee but at a price of $6.60 per common share which is not great. AJX’s stock price was hit hard from this news. This general downward movement makes sense as AJX’s stock price had recently held up much better versus basically all mREIT peers (merger price is now “off the table”). I expect the AAIC/EFC merger to continue. AAIC basically fully hedged itself (asset-to-asset) leading up to the merger. A minor EFC CURRENT BV “true down” adjustment sufficed during the 3rd week in October.

Weekly Recommendations

NOTE: This article is usually published Sunday evening or Monday morning. Sometimes it takes a bit longer.

The updates below were live in the spreadsheets by Sunday night, so the delay is just in preparing and posting this article.

The mREITs:

The BDCs:

Please check the Google shared spreadsheets regarding intra-week recommendations, as stock prices fluctuate.

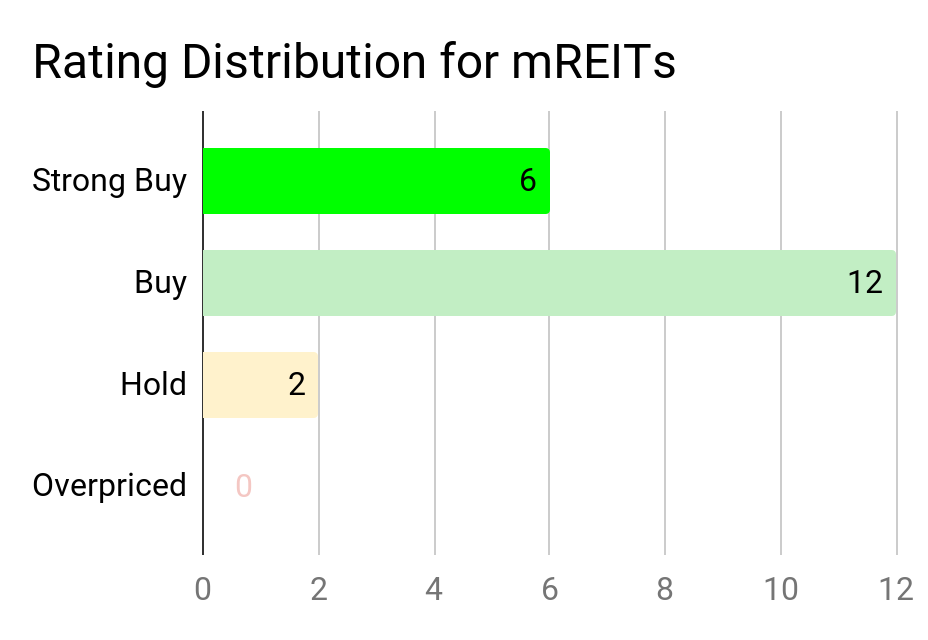

Looking at mREIT and BDC valuations, as a whole, the current ratings breakdown as follows for mREITs:

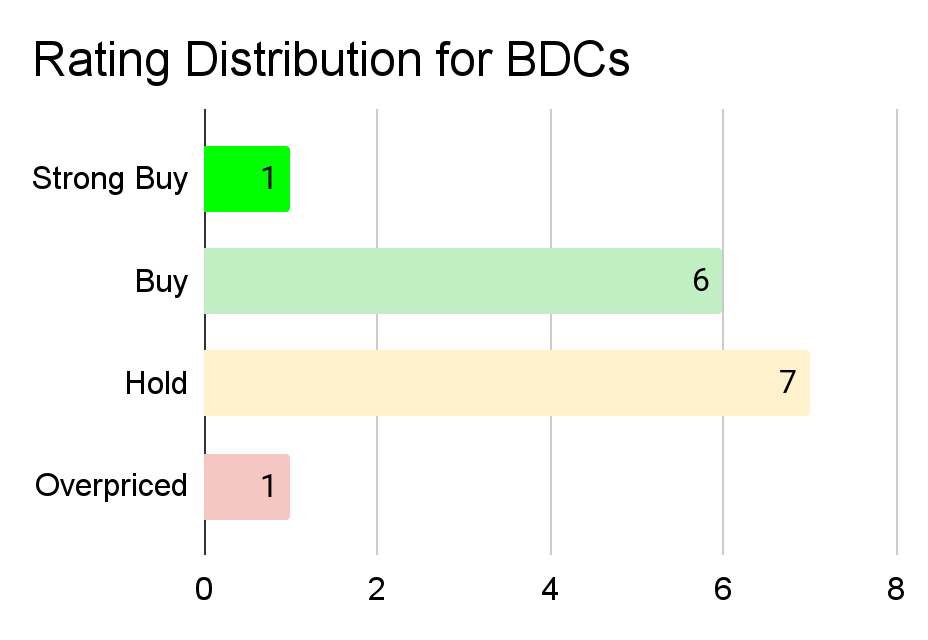

For BDCs:

Positions

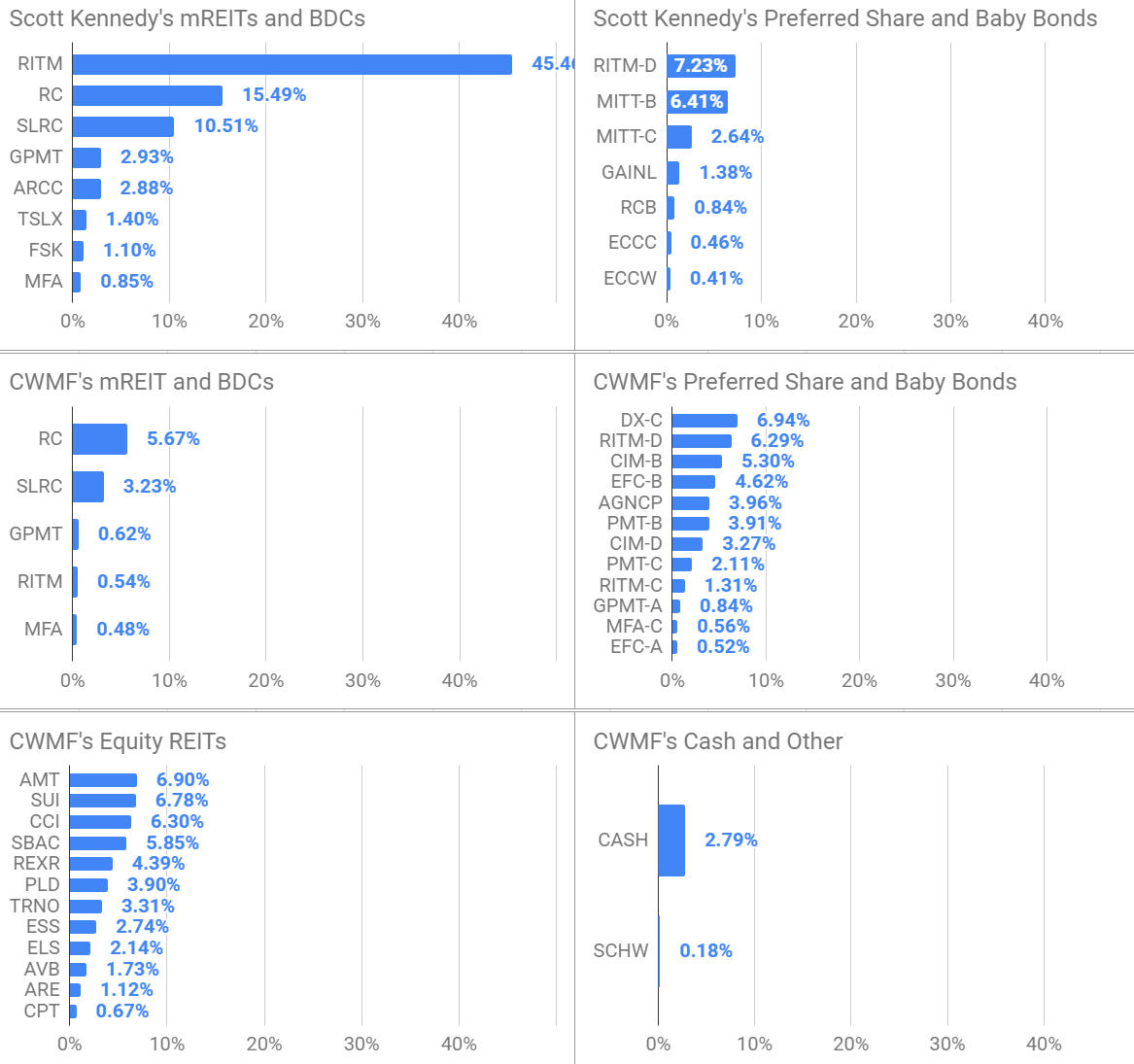

The following charts show positions for Scott Kennedy and CWMF as of Friday night:

CWMF’s portfolio also includes equity REITs and cash; this presentation includes those positions.

Note: My CWMF’s cash position may not be updated immediately for dividends arriving.

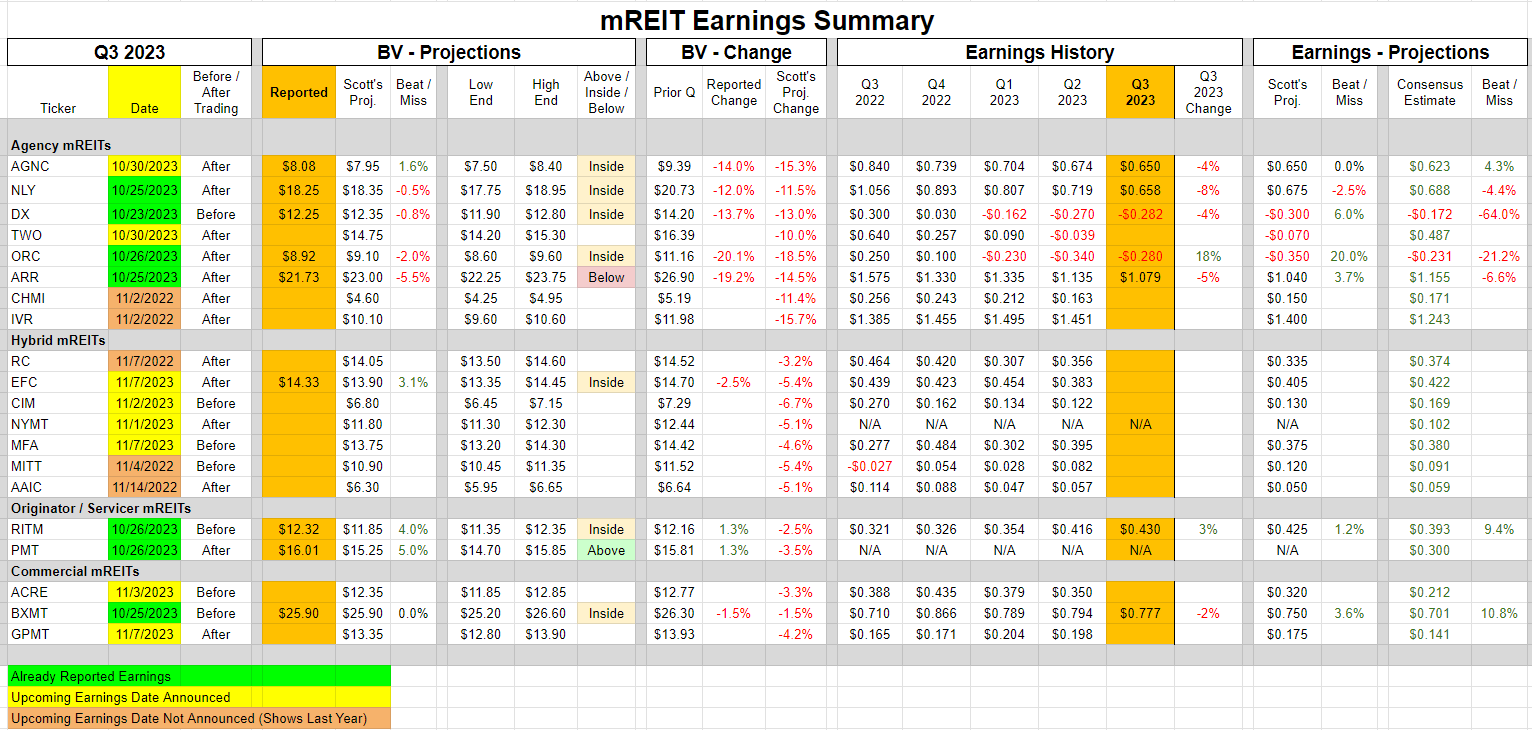

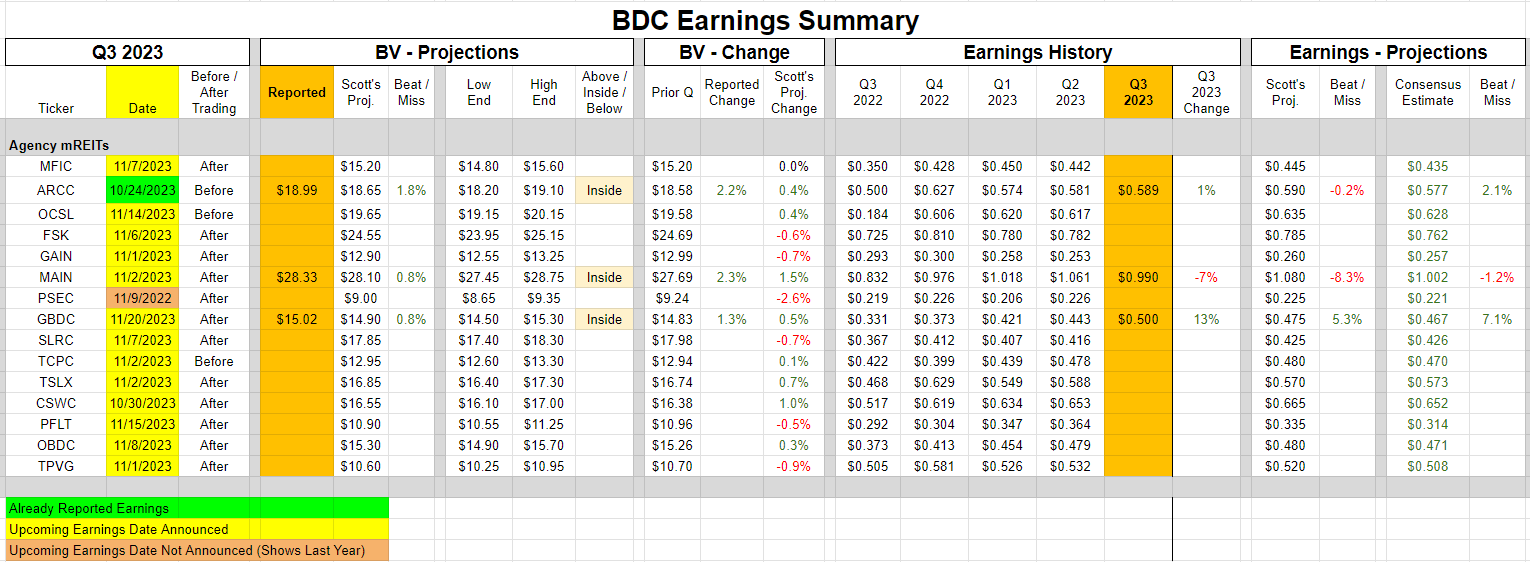

Earnings Estimates and Performance - Q3 2023

The mREITs:

The BDCs:

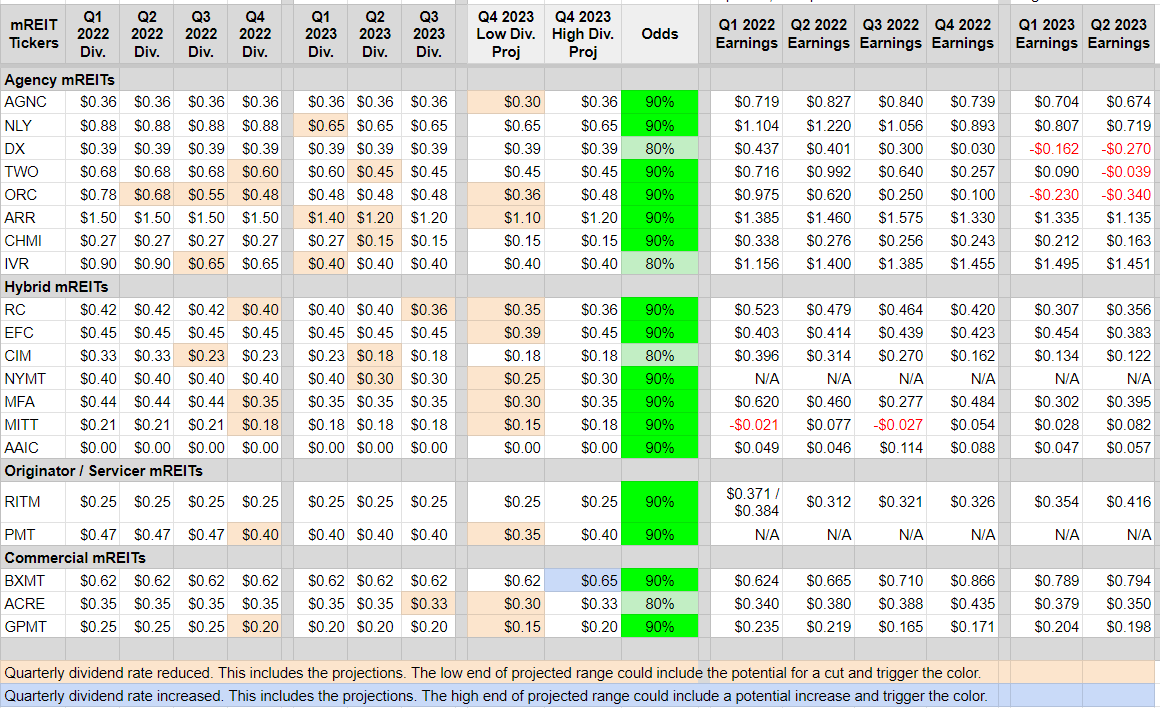

Dividend Projections for Q3 2023

The mREITs:

Note: Most mREITs declare Q4 Dividends in December 2023.

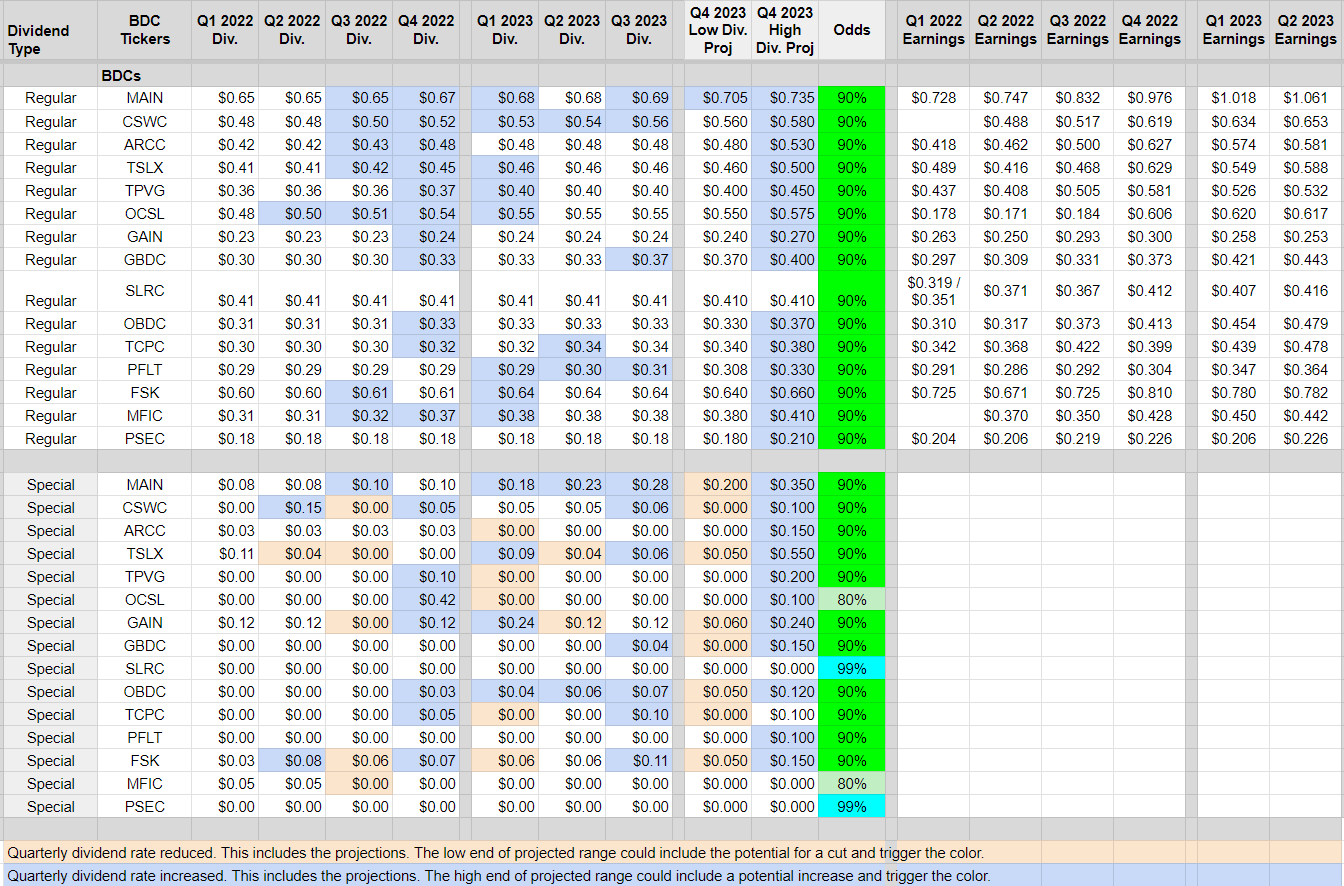

The BDCs can be a bit more confusing to demonstrate because they often include “special” dividends in addition to the regular quarterly dividend. Consequently, we wanted to split this out into a second category. Therefore, you have the regular dividends in the top section and then the special dividends in the bottom section.

The BDCs:

Note: Most BDCs declare Calendar Q4 2023 Dividends in November 2023.

Who Does What? (Repeated)

Scott provides full coverage for:

- 20 Mortgage REIT common stocks

- 15 BDC common stocks

For each stock that includes:

- Research and data

- Modeling projected book values / net asset values (BV/NAV)

- Setting common stock recommendation ranges (targets / ratings)

- Answering a few questions on the stocks

Colorado (“CO” / “CWMF”) Wealth Management Fund provides coverage on:

- Equity REIT common stocks

- Mortgage REIT preferred stocks

- Introductory articles for relevant concepts

- Macroeconomic trends

Investing (Repeated)

As continuously stated to subscribers, Scott will continue to “nibble on” some mREIT common and BDC positions when they have at least a BUY (if not STRONG BUY) recommendation. Also, just because I find a handful of mREIT and BDC stocks attractively-very attractively valued at any given point in time, this does not mean I am going to initiate a position in each and every stock.

Moving on, if a subscriber has a LOW-MEDIUM tolerance for risk, an alternative could be to look towards the mREIT preferred stock sector which is covered by CO. Subscribers can also look at the other REIT sectors covered by this service (which are covered by CWMF and his team).

Disclosure

Disclosure: CWMF is long the positions in CWMF’s Portfolio. Scott Kennedy is long the positions in Scott Kennedy’s Portfolio. Positions can be seen in this weekly article and checked using our Google Sheets. Those sheets are all linked on this page.

Member discussion