TWO Preferred Share Update: Free Release

This article was originally posted for paid members of our service on November 9th, 2023. Prices have increased since then:

Two Harbors (TWO) made a big announcement for their preferred shares, but they did it with a whisper. The gem I’m highlighting was hidden in the latest 10-Q. This pertains to

- TWO-A (TWO.PA) (TWO.PR.A)

- TWO-B (TWO.PB) (TWO.PR.B)

No changes to TWO-C (TWO.PC) (TWO.PR.C).

As before, I’ll split this into a brief version and a detailed version.

Article in 38 words

Updates:

- TWO-A and TWO-B status is updated from FTBS (fixed-to-bull-s…) to FTF (fixed-to-floating).

- Risk rating drops from 3.5 to 3.0. Matches TWO-C.

- TWO-A target +2.0%.

- TWO-B target +5.5%.

- Also good for PMT-A and PMT-B.

Full Article

You may recall that we’ve been monitoring preferred shares for:

- Opportunities

- Risks that a company may contradict the “floating” designation in the prospectus.

- Risks that a company may misunderstand and / or violate the LIBOR Act.

We previously classified TWO-A and TWO-B as “FTBS” (fixed-to-bull-s…). That announcement came in:

Full Details On NLY-F, AGNCN, IVR-B, IVR-C, CIM-B, TWO-A, TWO-B, TWO-C

I want to share the relevant section for context.

Prior Article Quote

In the prior review, I said:

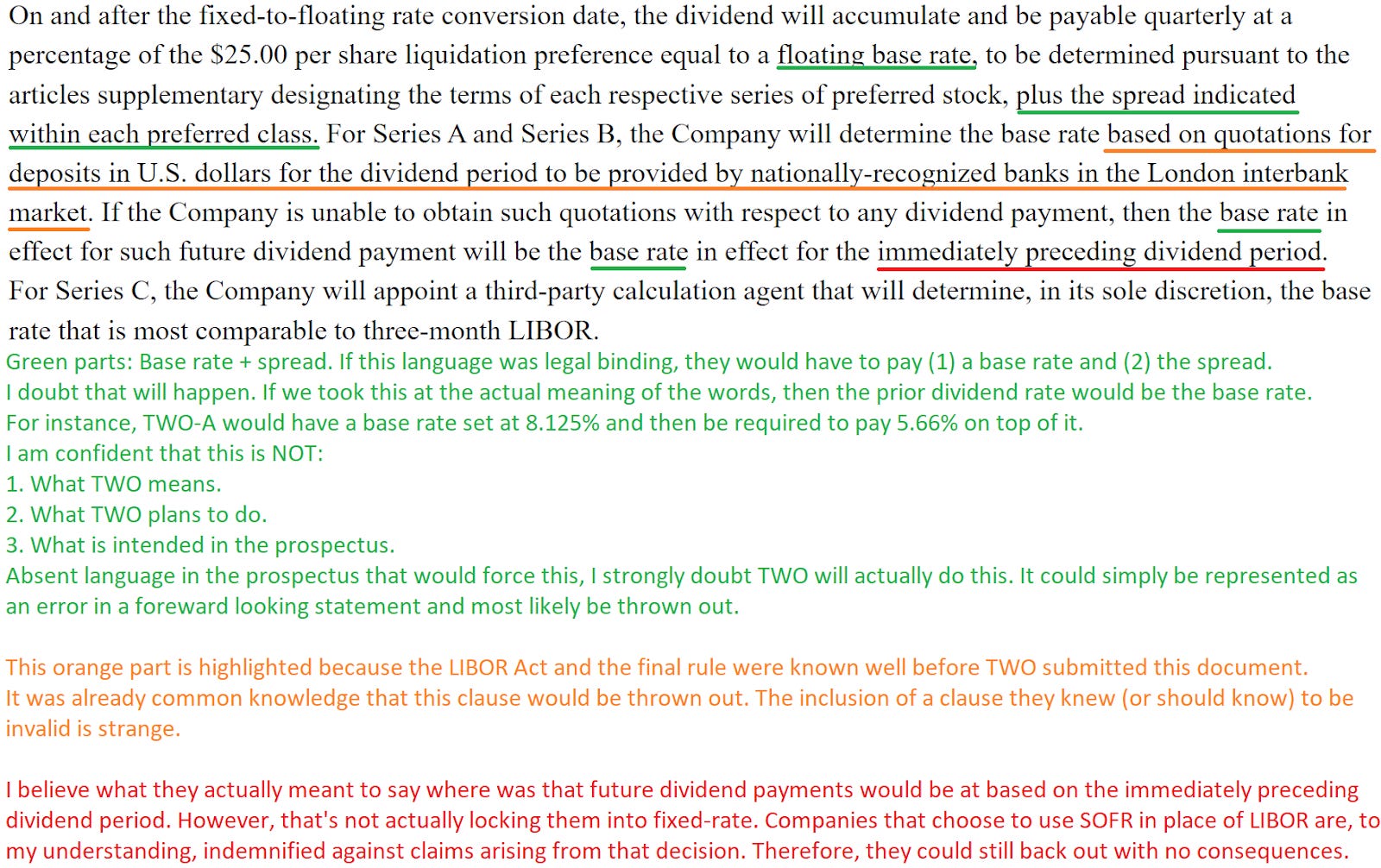

This was the hard part. I take you to page 34 of TWO’s 2023 Q2 10-Q:

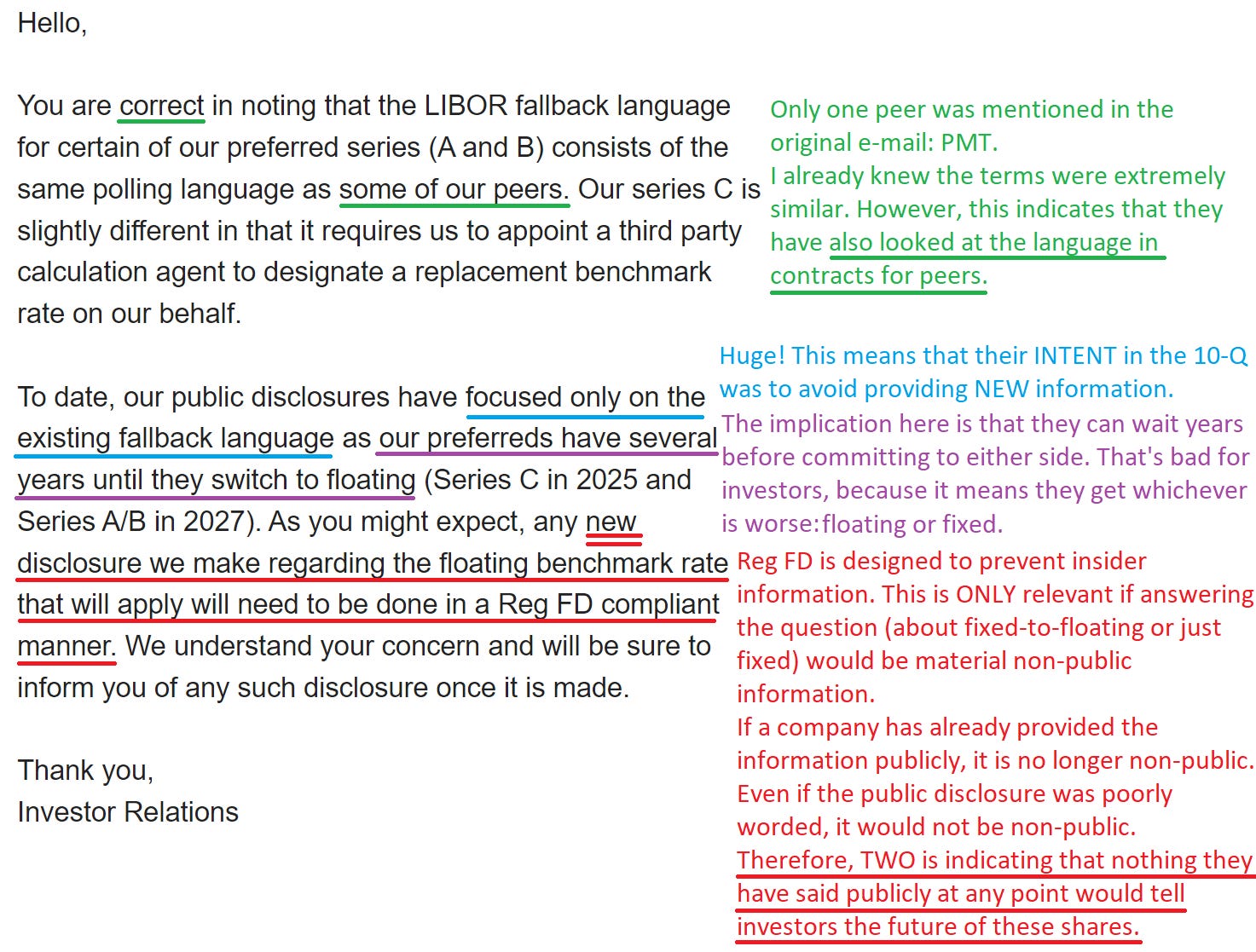

I felt this was pretty good evidence. This had me mostly convinced that TWO was refusing to commit. However, TWO was kind enough to provide the information we needed in an e-mail to a REIT Forum member.

Note: The member was kind enough to forward the e-mail chain (original and reply) to me.

This is one reason investor relations may ghost many e-mails, even when they ask a simple question. There is the risk that an analyst gets their hands on the e-mail and dissects it.

For instance, that could look like this:

Given the e-mail, I feel confident in saying that TWO intends to wait before making the determination. For TWO-A and TWO-B, they may be able to wait quite a while. So if we approach 2027 and short-term rates are 6%, TWO-A and TWO-B will get a “fixed-rate” announcement. If we approach 2027 and short-term rates are 0.15%, we will get a “floating-rate” announcement. If short-term rates are about 2% to 2.5%, it will be hard to predict.

Consequently, targets for TWO-A and TWO-B need to reflect a reality where the shares perform poorly in a high-rate environment (become fixed-rate) but also struggle in a low-rate environment (become floating-rate). Investors can only “win” by the situation reversing after TWO makes a decision or by short-term rates running about 2% to 2.5%.

There are no other shares we cover that can get the worst of both worlds (fixed and floating). I believe this is absolutely antithetical to the LIBOR Act, which was created specifically to reduce uncertainty. Instead, it appears TWO wants to use it to create a shield for waiting years to make a decision. Consequently, these shares must trade at a discount to alternatives.

Update

TWO-A and TWO-B are upgraded from Fixed-to-BS to FTF (Fixed-to-Floating)!

It appears TWO had enough time to consult with their lawyers.

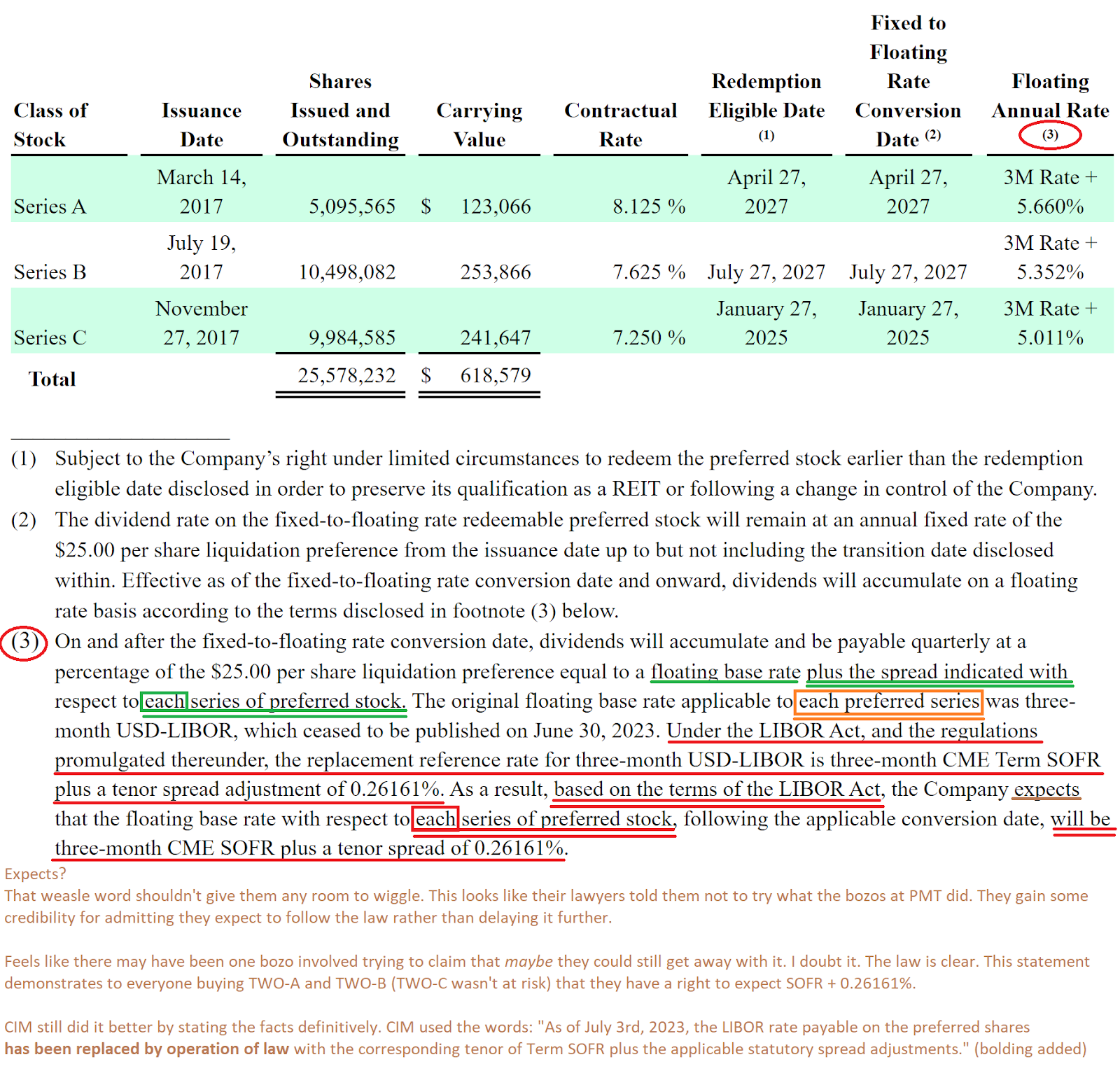

That section I quoted previously was replaced with this:

That moves the odds of Two Harbors trying any stunt to near zero. They specifically referenced that each preferred series should transition to SOFR under the LIBOR Act.

The Score Card

There were several shares that had problematic clauses with the “immediately preceding dividend period” and / or did not reference an agent picking a replacement rate. Below is a list of those shares (for mortgage REITs) and the outcome:

- NLY-F (NLY.PF) (NLY.PR.F): Was already floating. Referenced using SOFR in investor FAQ.

- AGNCN (AGNCN): Was already floating. Referenced using SOFR on their website.

- CIM-B (CIM.PB) (CIM.PR.B): Language wasn’t perfect. After we encouraged shareholders to contact CIM’s board for ethics, CIM filed an update within a few business days stating that CIM-B’s LIBOR rate was replaced with SOFR by operation of law.

- IVR-B (IVR.PB) (IVR.PR.B) and IVR-C (IVR.PC) (IVR.PR.C): By the Q2 10-Q, they had a statement in their 10-Q indicating shares will float based on SOFR.

Now we have an answer for Two Harbors:

- TWO-A (TWO.PA) (TWO.PR.A) and TWO-B (TWO.PB) (TWO.PR.B): The 10-Q for Q3 2023 indicates that each series of preferred shares will use SOFR under the LIBOR Act. TWO-C (TWO.PC) (TWO.PR.C) was always going to float.

That leaves one management team standing alone by their poor interpretation:

- PMT-A (PMT.PA) (PMT.PR.A) and PMT-B (PMT.PB) (PMT.PR.B): Management stands alone as the only team that (it appears to me, opinion warning!) didn’t get good legal guidance. Every other REIT, including those with extremely similar language, concluded that their shares would float under the LIBOR Act.

Either:

- PMT is right. We just don’t understand what words mean.

- All the other lawyers are right.

Therefore, this announcement is bullish for:

- TWO-A and TWO-B because the company has confirmed they will float using SOFR. They could’ve procrastinated, but they apparently saw the writing on the wall.

- PMT-A and PMT-B because the only other REIT (Two Harbors) holding onto hope of a fixed-rate just agreed with our understanding of the law and and indicated they would follow it.

Note: I previously went into extensive detail on why the fixed-to-floating shares would be forced to actually float. That was in:

PMT: Before the Market Catches On (this is the subscriber release; I’m about to post a public version).

Disclosure: I am not a lawyer or a judge. I have never practiced law. This article represents my opinion.

Replacing the Big Table

Previously, I had a big table laying out the relevant clauses and status of each fixed-to-floating share. There is no longer any need for the big table. It is just two bullet points:

- PMT claims PMT-A and PMT-B will remain fixed-rate shares. I disagree.

- Every other mortgage REIT preferred share that was supposed to be fixed-to-floating with 3-month LIBOR is committed to using 3-month SOFR plus 0.26161% in accordance with the LIBOR Act.

Who needs a table for that? That’s pretty hard to misconstrue.

Position Disclosure: Long PMT-B, PMT-C, CIM-B, CIM-D, and all other shares in CWMF’s Portfolio. All my positions can be seen using our Google Sheets. Those sheets are all linked on this page.

Secondary Disclosure: Since this is for the public release and the Google Sheets page is only available to paid members, as of 11/16/2023, I am long the following shares:

RITM-D, GPMT-A, DX-C, EFC-A, MFA-C, RITM-C, EFC-B, PMT-C, PMT-B, CIM-B, AGNCP, CIM-D, RITM, SLRC, MFA, GPMT, RC

I actively trade between positions, so those positions may change at any time.

Member discussion