TRNO: Q1 2024 Operating Results, Target Reaffirmed

Terreno (TRNO) reported operating results from Q1 2024.

This doesn’t include everything that would be in an earnings release, but it does give us a bunch of data about the portfolio.

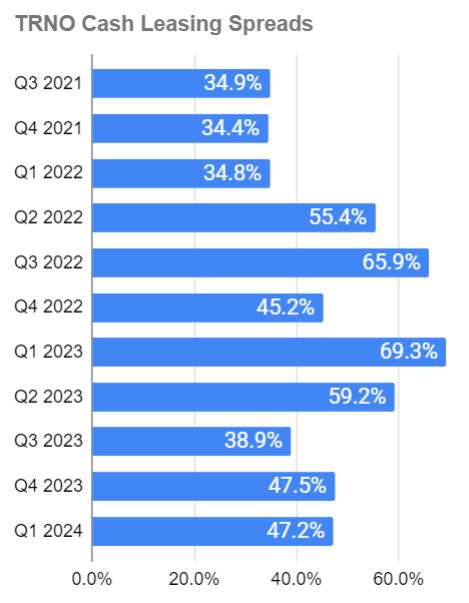

Cash Leasing Spreads

47.2% spreads.

That’s good.

Here’s the history for comparison:

Note: Q3 2023 would’ve came in at 48.6% if it wasn’t for one lease.

Occupancy

There was a dip in occupancy, which is worth noticing. I wouldn’t panic about it though. TRNO’s management team has proven themselves routinely.

Occupancy dipped from 98.5% to 96.2%.

If the tenant was refusing to pay market rate, then TRNO is wise to let them walk. We’re talking about huge cash spreads, so TRNO should be completely capable of bringing in a new tenant.

As it stands, 96.2% isn’t bad for occupancy. Many REITs in other sectors wish they could report 96.2% occupancy. It’s not as great as if the tenants had agreed to pay market rents, but it isn’t a reason to worry yet.

Further, we’ve seen commentary from Prologis (PLD) about 2024 producing some TEMPORARY pressure on occupancy due to completions.

Issuing Shares

Remember how I blasted Rexford (REXR) for issuing shares at prices that were too low?

TRNO issued shares two ways:

- One big issuance at $62.00 per share.

- Through their ATM program at $64.00 per share.

For reference, consensus NAV on TRNO was about $62.00.

Consequently, these issuances are not dilutive to NAV.

TRNO has been pursuing small purchases of properties where they are able to achieve attractive prices. Consequently, the purchases tend to be accretive to AFFO per share.

TRNO only had two acquisitions close during Q1 2024 for a total of $18.5 million. Both properties were vacant, but one is already leased with the tenant starting in May 2024.

Estimated stabilized yields are 5.7% to 5.8%. That’s high enough to be accretive as soon as they are occupied.

More Numbers

- Deals under contract: $448.8 million.

- Total cost of redevelopment in progress: $483.6 million. That should include costs already paid, but the split wasn’t referenced explicitly. That actually makes sense because the update doesn’t include any data on cash balances either.

- Gross proceeds from stock issuance during the quarter: $542.8 million. Net will be a bit lower.

Debt Maturities

- TRNO still has $0 of borrowings on their revolver ($400 million cap).

- $100 million maturity in 2024. Rate: 3.8%.

- Assuming that maturity was refinanced at 5.5%, the annualized headwind would only be $.02 per share.

- $0 of maturities in 2025.

- Obviously, the annualized headwind on $0 of maturities in $0.00 per share.

Conclusion

I’d love to see occupancy staying over 98%, but it’s better to see it dip briefly than have TRNO accommodating weak tenants. The cash leasing spreads remained strong and that’s a major factor for industrial REITs. We are willing to pay higher multiples because there is a ton of built-in growth for AFFO per share from raising rents to match market pricing as leases mature.

Shares were issued around NAV, so no dilution to NAV. Meanwhile the impact quickly becomes accretive to AFFO per share (as soon as the properties are leased).

Given a month or two of vacancy on the properties, that would allow the acquisition to be slightly dilutive in 2024 before turning accretive by a healthy margin in 2025.

I’m happy with the results.

Targets reaffirmed (available in the spreadsheets for paid members).

Disclosure: Long TRNO, REXR, PLD.

Enjoy our work? Subscribe or upgrade to a paid membership.

Member discussion