Trade Alert 2023-10-06

The market is still a bit jittery. High-yield credit spreads opened up a bit over the last few weeks, which can put pressure on many asset classes. That was a bit of a concern. However, I still really like the risk/reward profile on these shares.

The yield on fixed-rate shares from the same REIT is about 10.3%. When these shares float, if short-term rates are unchanged, the yield on cost would be around 13.5%. For shares to carry a 10.3% yield after floating (if short-term rates remain this high), shares would have to trade above call value. I don’t expect them to get that high, but I do see the potential for a material gain.

If we don’t slide into a recession or see rates cut significantly, then I think these shares could trade a few bucks higher. In the case of a preferred share, getting “a few bucks” plus the dividends while waiting would create a very attractive annualized rate of return. If they make it up to $25.00 by the day they start floating, the annualized rate of return would be better than 50%. Even if they only rally half the way between the current price and $25.00, it would still be an exceptional rate of return.

There was a nice dip in the price today. The preferred share index ETFs were roughly flat, so this isn’t hitting the entire sector.

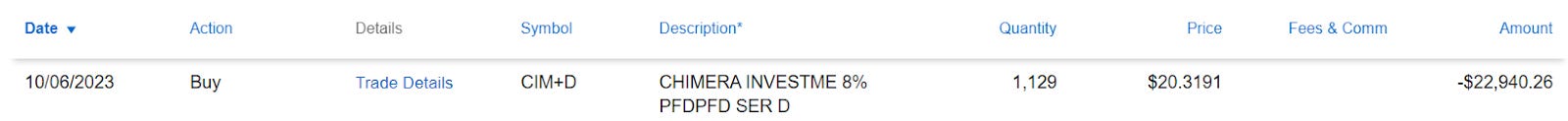

Trades Placed

- Purchased 1,129 shares of CIM-D at $20.3191 per share.

Commentary on Chimera Preferred Shares

CIM-D (CIM.PD) (CIM.PR.D) is one of the fixed-to-floating shares with a near-term floating date. CIM-D begins floating on 3/30/2024. We already owned some shares of CIM-D and we have some shares of CIM-B (CIM.PB) (CIM.PR.B) purchased before the announcement that CIM-B would float (as expected).

I was looking at PMT-B (PMT.PB) (PMT.PR.B) after our article last night. However, we published it pretty recently and I don’t want to be jumping ahead of readers. I’ll be keeping an eye on it though and hoping I can still get a nice entry point.

With CIM-B down about 1.8% on the day and about 5% over the last 2 months (partially offset by the ex-dividend date), I decided to raise the position. This fits my recent commentary about focusing on fixed-to-floating shares with upcoming floating dates in the next 6 to 18 months.

Account

This goes in the tax-advantaged accounts. I want to be able to trade these positions actively.

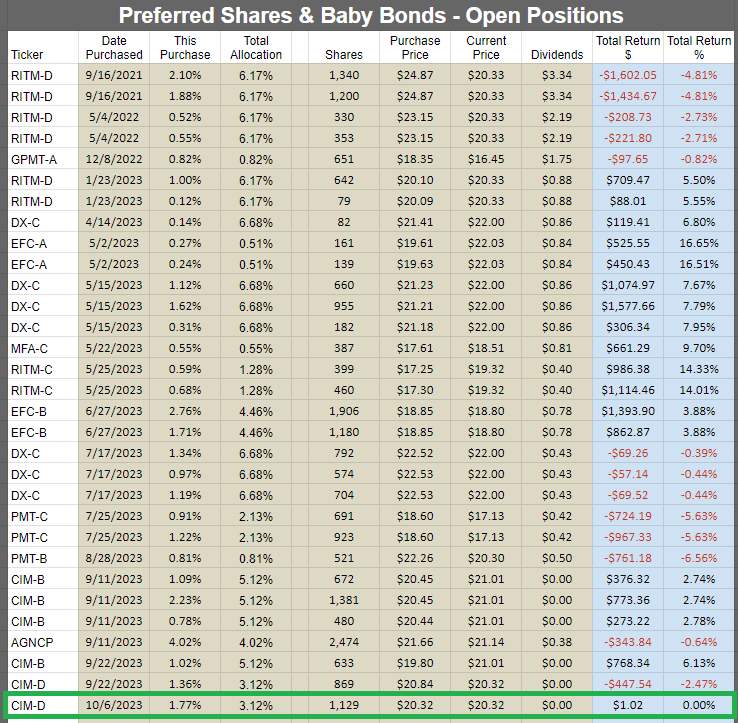

Returns for Open Positions

Conclusion

Interest rates are still a major concern as they can impact sentiment, create recessions, and cause investors to demand a higher rate of return. Most of my purchases will probably be focused on preferred shares (and flow through the tax-advantaged accounts).

Execution Screenshots

Since the main purpose of adding these screenshots is to guarantee transparency, I think it makes sense to include them after all the discussion.

Source: Schwab

Note: Schwab's new layout for trade tickets and order history leaves something to be desired. I'm screenshotting from the "History" tab because it provides a vastly better summary of transactions.

Disclosure: I am long all shares in CWMF’s Portfolio.

Member discussion