Trade Alert

We’re raising our position in one of our favorite companies again.

The sector has been hammered over the last couple of years as interest rates went higher. Fundamentally, the company doesn’t rely on cheap debt that much. They have enough free cash flow that they can afford to pay down debt or repurchase shares.

During Q3 2023, the company was repurchasing stock with a weighted average price of $197.89. That was extremely close to the bottom for the quarter. Those purchases also occurred while interest rates were higher. Management has been focused on growing AFFO per share. With higher interest rates, they were focused on paying down variable-rate debts (which are quite low) until their stock was severely beaten up. I wouldn’t be surprised if they remain interested in buying back their stock around $200, or perhaps a bit higher. At the time, they still had a hair over $400 million available on their existing buyback authorization.

Today, I’m getting shares under $208. I’m quite happy with that price, as it represents a favorable AFFO multiple for one of the REITs that has delivered strong long-term growth in AFFO per share. That’s about 15.4x forward AFFO estimates of $13.47.

I already have another article on the stock in progress. It’s taking a bit longer because I accidentally made it so engaging that Seeking Alpha might object to it. I may need to revise the public version back a bit and just include more of the best parts for our members.

Trades:

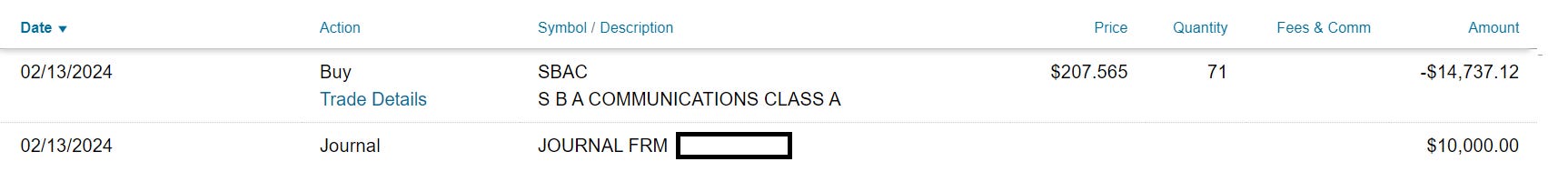

- Purchased 71 shares of SBA Communications (SBAC) in our taxable account at $207.565.

- Added another $10,000 of cash to the account to fund the purchase.

I could’ve bought these shares in the tax-advantaged accounts, but I expect to hold these shares for years. With the low dividend yield and no expectation for realized short-term capital gains, I don’t get much benefit from using the tax-advantaged account. I’d rather save that space for our trading activity with the mREITs, BDCs, and preferred shares.

Why is SBA Communications Getting Hammered

The report on CPI (Consumer Price Index) came in a little bit hot. Any bad news on inflation pushes rates higher. The Federal Reserve has been looking for reasons to keep rates elevated. Therefore, this gives the Federal Reserve more ammo for keeping short-term rates propped up.

That impacts interest rates across the yield curve.

- The 2-year rate is up 18 basis points.

- The 5-year rate is up 17 basis points.

- The 10-year rate is up 12.4 basis points.

- The 30-year rate is even up 7 basis points.

Investors are less excited about REITs in general when interest rates are going up. However, they have been particularly harsh toward a few types of REITs. One of those is tower REITs.

SBAC’s dividend yield, around 1.64%, isn’t going to get investors pumped up. The REIT isn’t designed to offer a big dividend yield today. They retain the substantial majority of AFFO. This is a growth stock using the REIT label to reduce tax burdens. Because towers are legitimately a real estate investment, the tower companies can take the REIT classification.

It also makes sense for them to be REITs, because we want to strip out depreciation and factor in recurring capitalized expenditures. The REIT accounting simply does a good job of matching the fundamentals of how the REIT operates. The only thing they don’t do is pay out a large portion of their cash flow.

General Yield Exposure

I don’t expect to be rapidly raising our equity REIT positions because we’ve been arguing that the Federal Reserve would cut rates slower than the market expected. Lately, the market has been coming around to that idea, and it’s been dumping REITs in the process. If REITs keep falling, I could get more aggressive. Otherwise, I’ll probably remain pretty gradual.

This doesn’t hurt the case for preferred shares with the fixed-to-floating feature. I still expect to emphasize those shares in my allocations. This was one trade to get a bit more SBAC because I believe it is a great company at a great price for long-term investors.

Returns

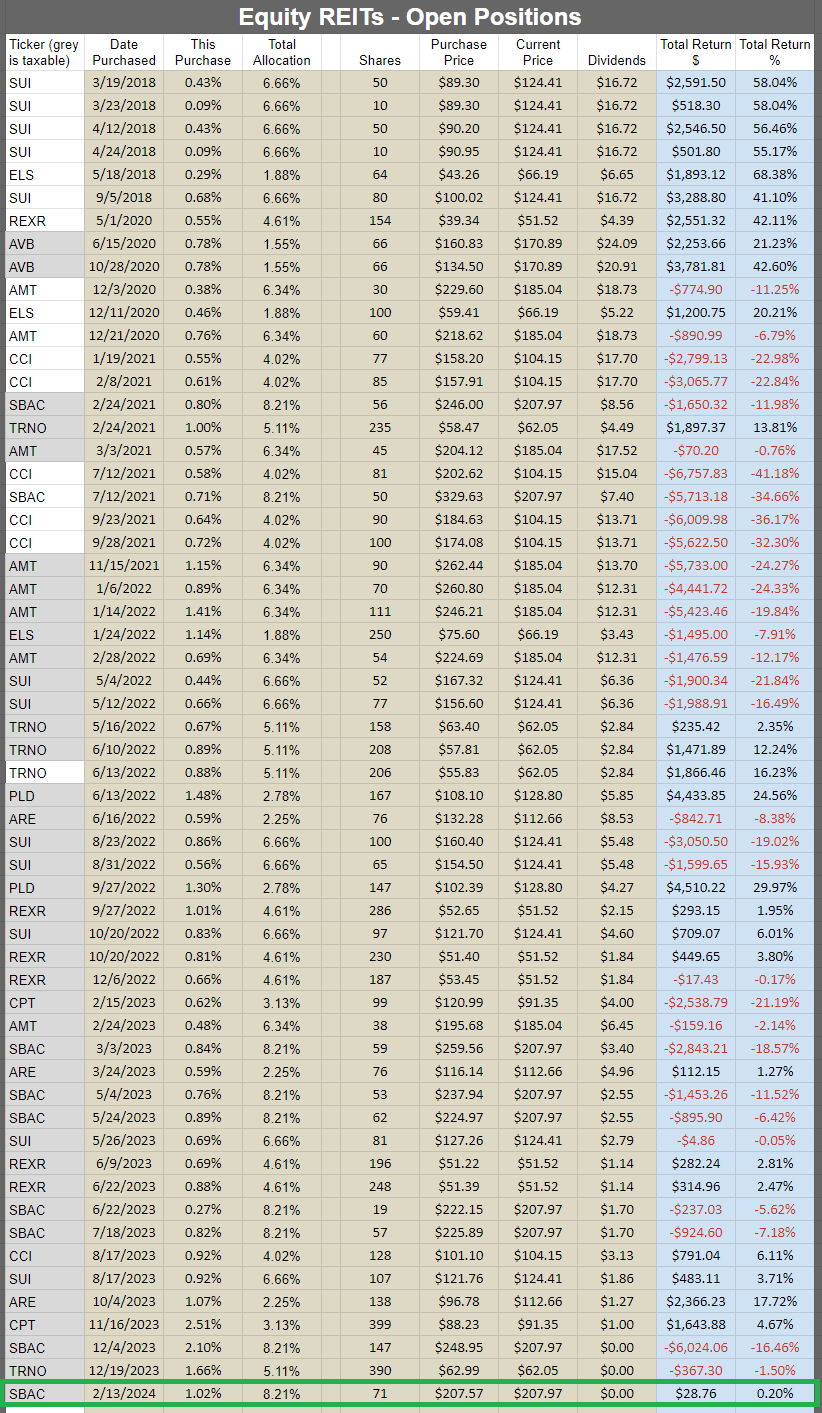

All our open equity REIT positions are shown here.

Execution Screenshots

Source: Schwab

I’ve got this trade already live in the sheets. This purchase puts SBAC back over 8.21% again.

It’s fair to recognize that SBAC’s weak share price performance over the last 2 years has weighed on our total portfolio results. This is our lowest purchase price so far. Given the low dividend yield, that means all our existing positions are currently in an unrealized loss. Regardless, the company has performed well on fundamentals in their earnings releases (even as they continued to fall) and I still see a strong future.

What we’re witnessing is primarily a share price change driven by the movement in Treasury rates. That’s the big factor here. While I don’t expect big rate cuts in the near future, I do expect rates to eventually trend lower.

Regardless of whether rates trend lower, at 15.4x forward AFFO, SBAC is not being valued as a high-growth REIT. That multiple is below the average for apartment REITs (facing oversupply), far below the average for single-family rental REITs (some headwinds from apartment supply), and below the average for shopping center REITs.

I believe SBAC deserves a premium multiple, as they should thoroughly beat those sectors in AFFO per share growth across the rest of the decade. I would expect them to win by a material margin over the average growth rate for each of those sectors when measured through 2030.

Member discussion