Trade Alert 2024-08-02

This is a double trade alert. Scott placed a trade, and I decided to follow him on it.

This was Scott’s note:

“Hi subscribers, quick trade alert during lunch. Today, I increased my position in GBDC at a weighted average purchase price of $14.750 per share. As noted in prior purchases, an attractive price for this BDC stock in the current environment (remains one of the more decently-priced names). With GBDC's recent move lower in share price, I believe this only creates more value once the selling subsides. Today's purchase was the same share size of my last purchase. I will continue to look to "layer into" my position if volatility persists. I hope this helps with subscribers assessments/strategies.”

Trade Placed

I’m following Scott on the trade and initiating a position. My first position is pretty small, but that’s just because I wanted to stick it in the Fidelity account so I used the cash available there. It’s still a tax-advantaged account, which is nice for these high-yielding shares and for anything where we typically have shorter investment periods.

If I had a bit more cash in that account, I would’ve made the position modestly larger. I like Scott’s technique of layering into positions and that’s my plan here as well.

I prefer to put my preferred share trades through the tax-advantaged accounts at Schwab, so sticking the BDC in the Fidelity account made sense.

- Purchased 533 shares of Golub Capital BDC (GBDC) at $14.8099.

Commentary

This is my first purchase in GBDC, but Scott’s picked up shares a few times recently.

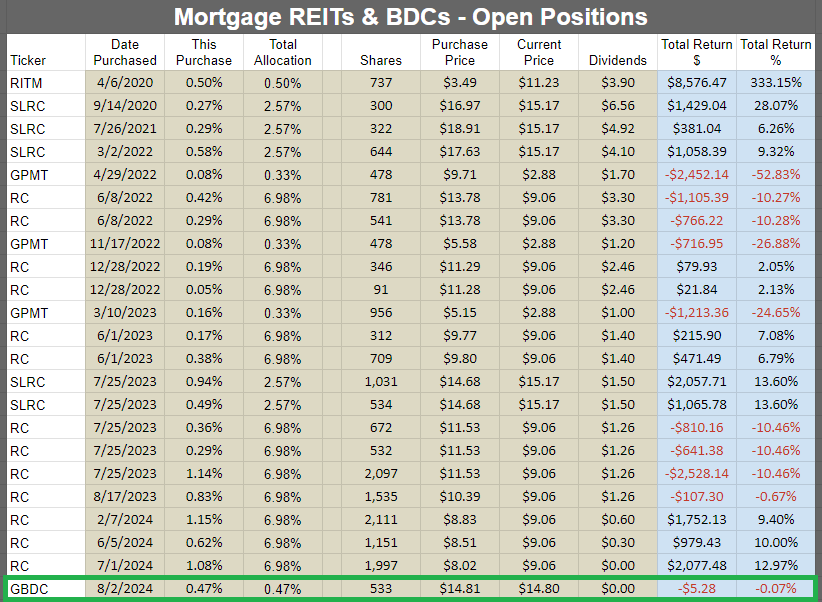

Open Positions

Execution

Below is the screenshot from my Fidelity account:

This position is in a tax-advantaged account. I’m looking for an improvement in the price-to-NAV ratio while collecting the dividends. I don’t have an exact time frame for this position. I don’t expect to close it out immediately, but there’s no reason to think it needs to be a long-term position. When the price-to-NAV ratio is higher, I’ll be less interested in the shares and look for alternatives.

Member discussion