Trade Alert 01/28/2024

Trades placed:

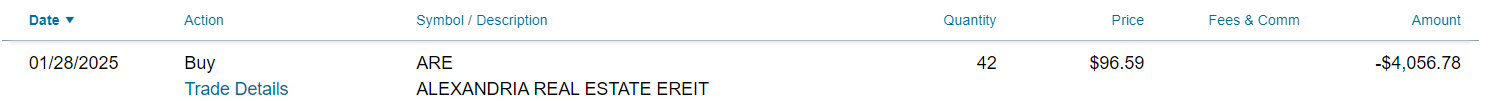

- Purchased 42 shares of Alexandria Real Estate (ARE) at $96.59 per share.

This is only a slight increase in my position. Prior to this trade ARE was about 2.13% of my portfolio. This trade will add a bit under 0.25% to that. So the new total value should be around 2.35%.

Foreshadowing

This trade was foreshadowed:

- In the Alexandria Q4 2024 Update published yesterday.

It's a bit of a strange foreshadowing as I didn't expect to place the trade. I didn't expect ARE would be down about 5.4% today.

I closed that article saying:

"No plan to place trades in the immediate future. But if I do place them, I might nibble (small buy) a tiny bit more ARE. The discount to targets is nice and the buybacks are positive. We've seen interest rates dipping over the last 2 weeks, but they haven't even broken below the upward trend line yet.

The big challenges here are still interest rates and the amount of time it will take for the market to absorb the amount of supply brought to market over the last few years by aggressive developers (building without tenants)."

The price fell about 5.4% today while:

- VNQ (the largest equity REIT ETF) is down 1.24% and

- Treasury rates are only a hair higher.

That was a big enough disparity that I decided to add a little bit more to my position. This trade was funded with idle cash in my taxable account from dividend income.

My Execution

Source: Schwab

Disclosure: Long ARE. I think that's pretty clear.

Member discussion