Sun Communities: Out Of Favor, Still Exceptional

- SUI's AFFO multiple plunged, despite an outstanding history of AFFO per share growth. The temporary headwind to AFFO per share is mostly floating rate debt.

- Since SUI retains a significant amount of cash flow, they have the option to pay down that debt if rates remain high.

- Great REITs demonstrate strong growth in same property NOI. SUI's record over the last 22 years is excellent.

- Demographic tailwinds favor demand for MH parks and RV parks, but regulation limits new MH parks to roughly zero each year.

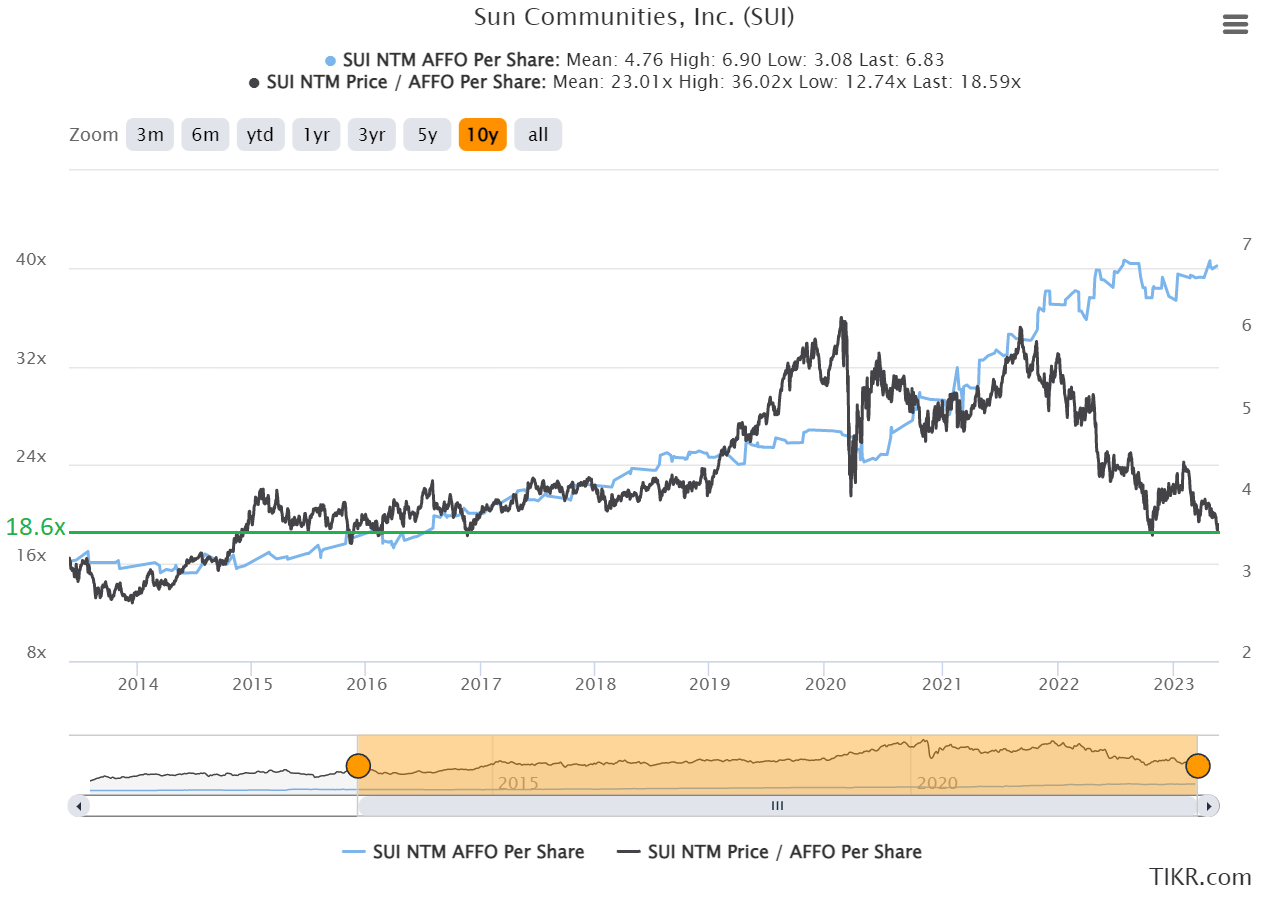

- Since the start of 2015, SUI's forward AFFO multiple has rarely touched the current level of about 18.6x.

Any list of the best REITs should include Sun Communities (SUI). Yet the market hasn’t been showing it much love. Share prices suffered significantly over the last year as the AFFO multiple plunged.

The First Test - AFFO Per Share

The first test for an equity REIT is whether they’ve generated growth in AFFO in per share. If a REIT has a negative trend in AFFO per share over several years, that REIT is probably bad. Exceptions are rare.

If the REIT generates significant growth in AFFO per share, then it warrants a deeper look. Not all REITs with growth in AFFO per share are great. However, there is an extremely strong correlation.

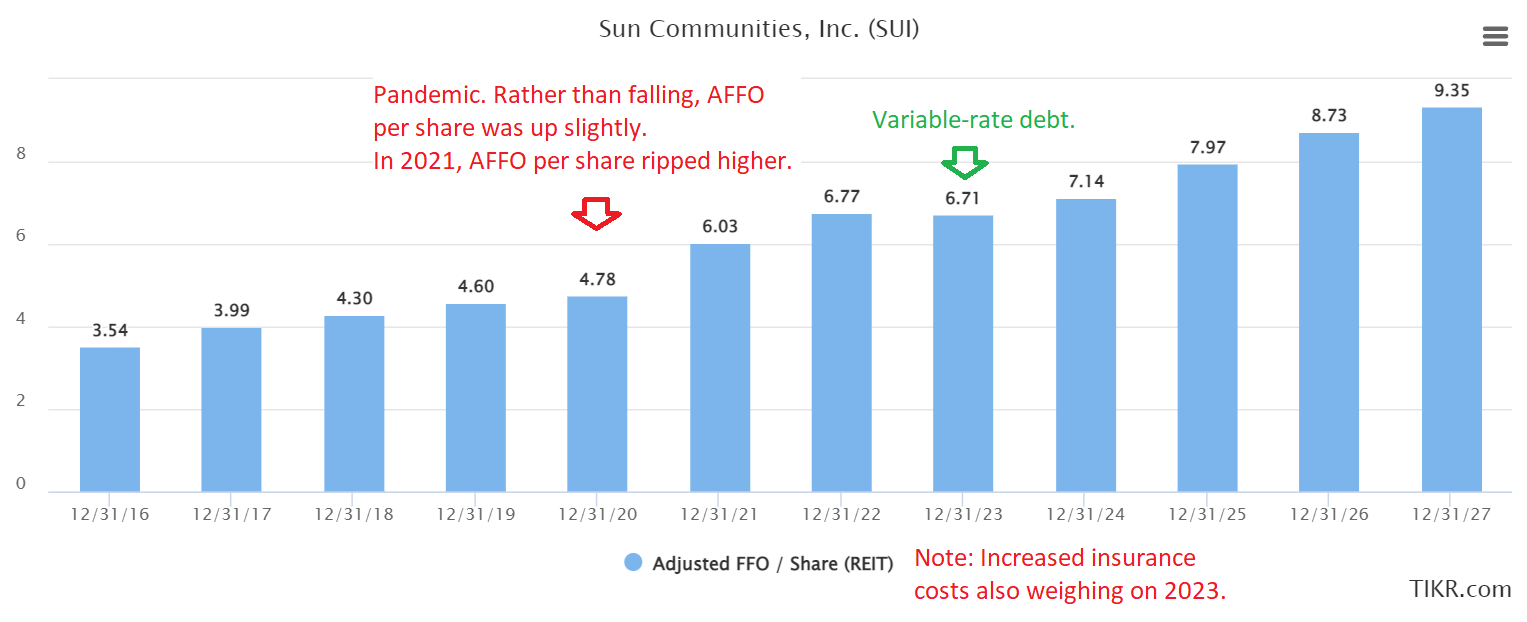

You can see the forward (next twelve months) estimated AFFO per share for SUI since late 2010 in this chart:

That’s as far back as TIKR’s AFFO estimates go for the REIT.

An alternative method is to use the AFFO per share figures in a bar chart, which is nice for comparing what happened in individual years:

You can see that the pandemic only slightly slowed growth in AFFO per share.

At the end of 2022, SUI still had a substantial amount of floating-rate debt. That debt weighed on their projected results. In 2024, they may still have quite a bit of it. However, the base year will be 2023. Since rates started high and hikes were in the first months (probably stopping soon, some risk of one last hike), 2023 is a much easier base year.

That benefits 2024. However, it also benefits future years.

Interest Rate Scenarios

Scenario 1 - Steady Rates: Let’s say interest rates remain around 5.0% to 5.5% on the fed funds rate. The cost of borrowing probably runs in the 6% to 6.5% range.

SUI has a substantial amount of free cash flow retained after the dividend. The dividend yield is only 2.9%, but the free cash flow is materially higher. This gives SUI a stream of cash flow that can be used to pay down debt at rates above 6%. That’s a low-risk way to enhance future AFFO per share.

It is worth mentioning that Wall Street doesn’t find this method of AFFO growth sexy enough. They want to see buybacks. SBAC is busy executing this strategy to deliver significant growth in AFFO per share and Wall Street is pouting. However, there isn’t much risk to paying off your own variable-rate debt.

Scenario 2 - Falling Rates: The Federal Reserve cuts rates later this year or early in 2024 to combat the pending recession. In this scenario, the cost of floating-rate debt falls. If Net Operating Income is roughly flat (which would be low for a REIT that consistently posts strong growth in same-property NOI), the plunging interest expense would result in a significant boost to AFFO per share. The bond market believes short-term rates will fall later this year.

Scenario 3 - Rising Rates: The higher-risk scenario is that we slide into a deep recession and the Federal Reserve continues to push rates. I find this unlikely, though not impossible. Chairman Jerome Powell is literally not an economist. He was a lawyer. He is not surrounded by the best and brightest. He is surrounded by other board members who focus on the rearview mirror and have little to no experience building a business of their own. This scenario would hurt SUI due to higher rates and could lead to far more bank failures. This is unlikely and would be bad for basically every part of the economy (in both the short-term and long-term).

Same Property NOI

REITs that deliver over long periods usually demonstrate the ability to generate growth in same-property NOI over long periods. SUI has done that extremely well. In 2023, they are facing headwinds from insurance costs. That makes sense since the cost of replacing assets increased.

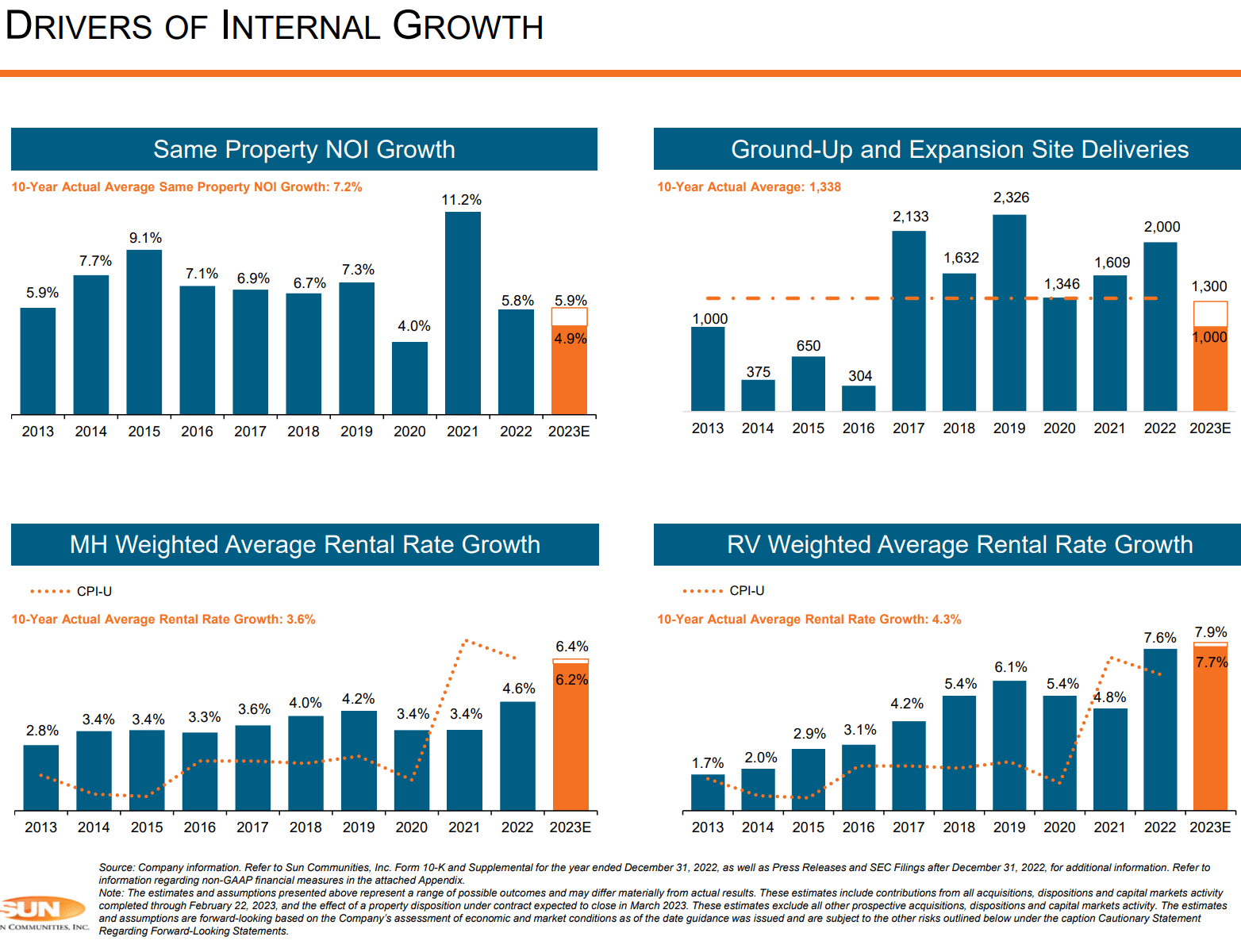

SUI generated strong growth in same-property NOI, which included significant growth in rental rates:

Note: I’m going to post some earnings slides because I think SUI’s slides are actually very helpful in describing the business.

You may notice that 2023 is actually demonstrating the highest revenue growth rate. However, operating expenses are forecast to increase significantly for 2023 relative to 2022. While that sets a higher base year for expenses, I wouldn’t expect the growth to be as high next year. Property expenses aren't going to grow at about 9% to 10% per year indefinitely. That's not how real estate works.

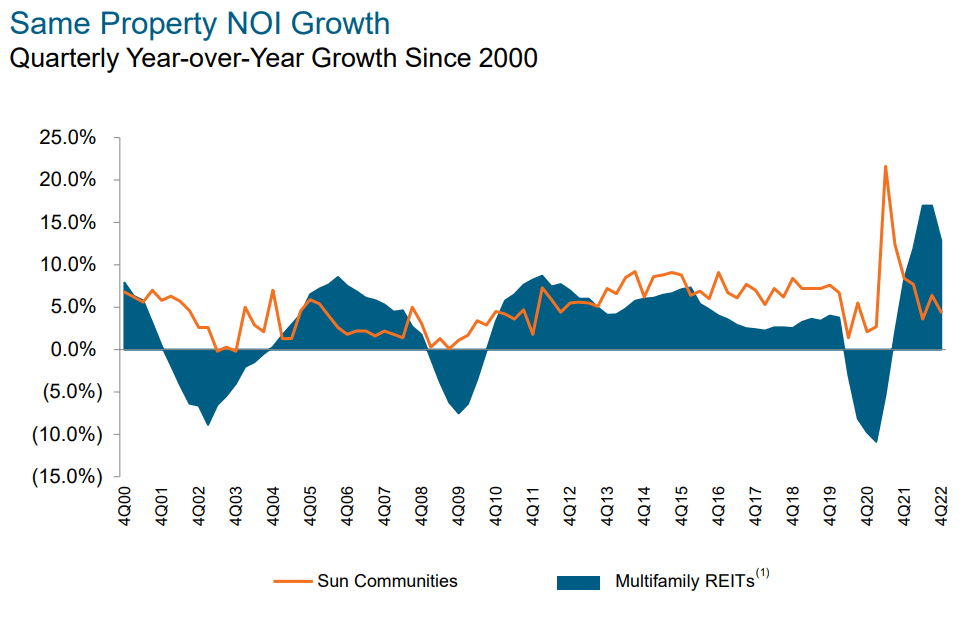

SUI also provides a chart for same-property NOI growth (year-over-year) for each quarter going back to the start of the century:

That’s excellent growth. There was a brief period with insane values during 2021 because of the year-over-year comparison. However, outside of that, we’re generally looking at 0% to 7%. The worst periods align with recessions, but apartments were dealing with negative same-property NOI growth during those periods.

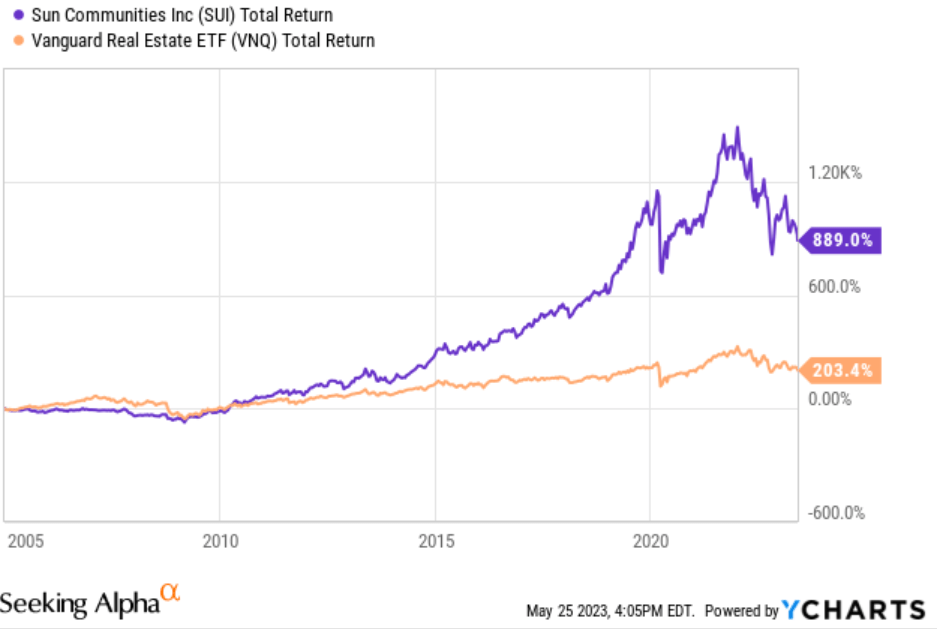

The strong average growth rates in same-property NOI fueled outstanding returns for investors.

The Baby Boomer Tailwind

The retirement wave is already underway. It started with the pandemic and it will continue for many years. I’ve argued previously (and correctly) that the baby boomers would not support the industry for expensive “senior housing”.

What many of those baby boomers want is the ability to travel the country and enjoy retirement. That’s great for SUI’s RV parks. However, many of those baby boomers will also want to downsize their homes and free up some capital. That’s great for the higher-end MH parks (SUI doesn’t buy the dumpy ones). I expect a significant shift towards retirees choosing the MH parks owned by SUI and Equity Lifestyle (ELS) over maintaining a larger house. I own some ELS, but it's a smaller position at 2.24% of the portfolio compared to the 6.4% for SUI.

Few New Parks

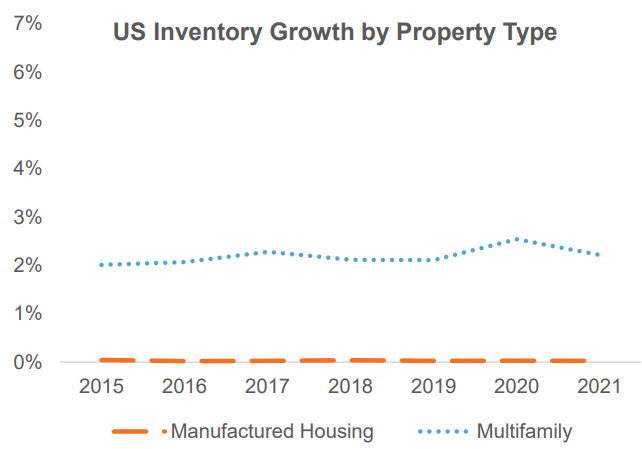

There is a building boom going on in apartments. We warned about it over a year ago. It was our major concern for the sector at the time since valuations did not reflect the risk of a major increase in supply. Typically, we see the total number of apartments grow by somewhere around 2% year-over-year. The total number of MH parks usually grows by about 0%.

So all those retiring baby boomers won’t be moving into a brand new MH park. This lack of supply is great for the landlords. MH parks compete with apartments to some degree, but they generally target a different demographic. That is especially true for many of the nicer properties, which are designed exclusively for retirees.

Great Management

Without going into much depth, I’ve found the SUI management team exceptional. They’ve consistently made decisions to improve long-term performance for shareholders. Sure, everyone wishes they had locked in more of their debt before rates rose, but that’s not a sign of bad management. That’s just not forecasting that rates would rise so dramatically. If the major bond traders of the world were able to forecast that rates would rise that dramatically, they would’ve been shorting bonds to create that change in prices before it happened. We won’t punish SUI for not guessing future interest rates. However, I will point out that their overall leverage is still reasonable and that the pain from higher floating rates is already present in the 2023 guidance.

Valuation

We’ve covered why SUI is a great REIT. We’ve covered why they should see growth in same-property NOI and growth in revenues. However, we haven’t touched on the valuation. It was regularly hard to find SUI at bargain prices. Dips were rare and didn’t last particularly long. However, we’re seeing shares trade at a multiple that has only been touched a few times since the start of 2015:

Note: Our Google Sheets show 18.77x because they use a consensus estimate of $6.76 per share. That's slightly lower than the latest forward estimate of $6.83 per share.

That’s a bargain. Share prices were actually lower during the pandemic, but AFFO per share was dramatically lower. Today, SUI’s properties are generating far more cash flow per share. This is bargain pricing on one of the very best REITs. Despite one year of weak performance on AFFO per share growth, driven primarily by interest expense (and a little bit by property operating expenses), SUI is easily among the best REITs.

They demonstrated that by dominating the REIT index ETFs:

That kind of beating isn’t just a changing multiple. It was massive growth in AFFO per share. That’s the key to long-term performance in equity REITs.

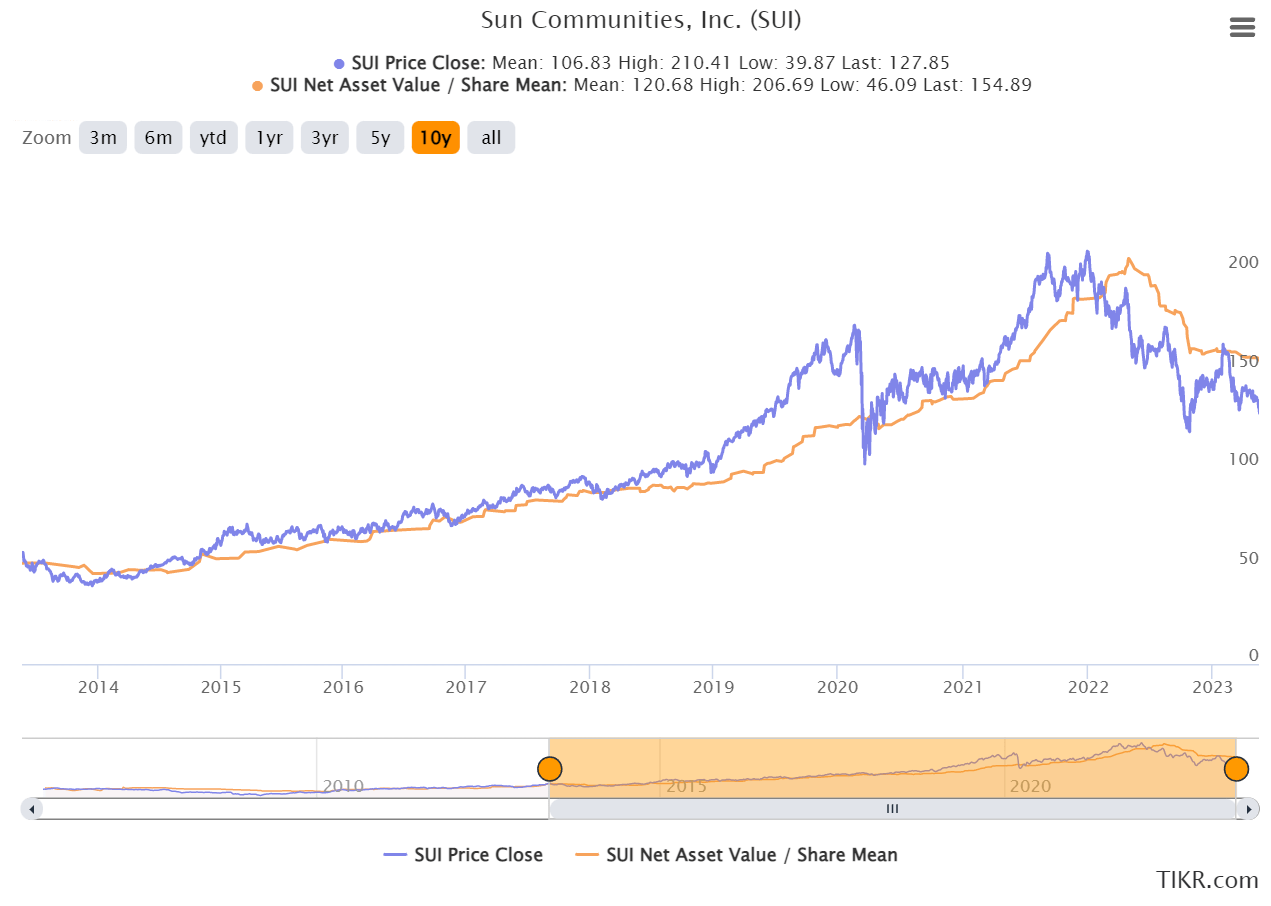

NAV Trailing Price

For equity REITs, NAV (Net Asset Value) is less important. It is still one important factor to consider, but in some cases, the consensus analyst estimate is really just trailing the share price:

Those consensus estimates were not updated until well after the price demonstrated a clear move. Not super impressive. You might also notice that before 2022, discounts were extremely brief. That's because this has been one of the great REITs where investors were often eager to buy the dip.

However, you might also notice that from 2014 to 2020 the share price was remarkably stable. It was trending higher, but the volatility was very low. We’ve seen far more volatility lately. However, it seems analysts finished updating NAV estimates for now, as those estimates have been in the mid-to-high $150s since late October 2022.

I spend more time focused on determining which REITs will generate strong growth in AFFO per share (without compromising quality). If you find those REITs, you’ll usually find good long-term picks. After that, it’s simply a matter of determining when prices look pretty good for buying for a great company.

Conclusion

SUI remains an outstanding REIT. They have everything we want to see. Relevant assets that should see growth in demand over the next two decades. Barriers to major new supply. A strong history of generating growth in NOI and AFFO per share. Zero red flags. Strong management. Current headwinds to AFFO per share growth rate include non-recurring factors like a surge in short-term rates. Shares of SUI closed at $126.87 recently.

I added to my position at $127.26.

SUI has been one of the cornerstones of our portfolio for several years. I don't see any scenario where that changes.

When we run through the housing REIT targets, I'm forecasting minor negative revisions throughout the sector. SUI will probably see a negative adjustment in the 1% to 3% range to reflect the current macro trends. That would hardly put a dent in the discount. SUI is easily a strong buy.

Like our work? You can subscribe to see more:

Or you can share it with someone you know:

Thanks for reading.

Member discussion