SUI: Brief Q2 2023 Update

Sun Communities' (SUI) Q2 2023 results are all about guidance. We’ve got a mixed bag here.

NOI Guidance

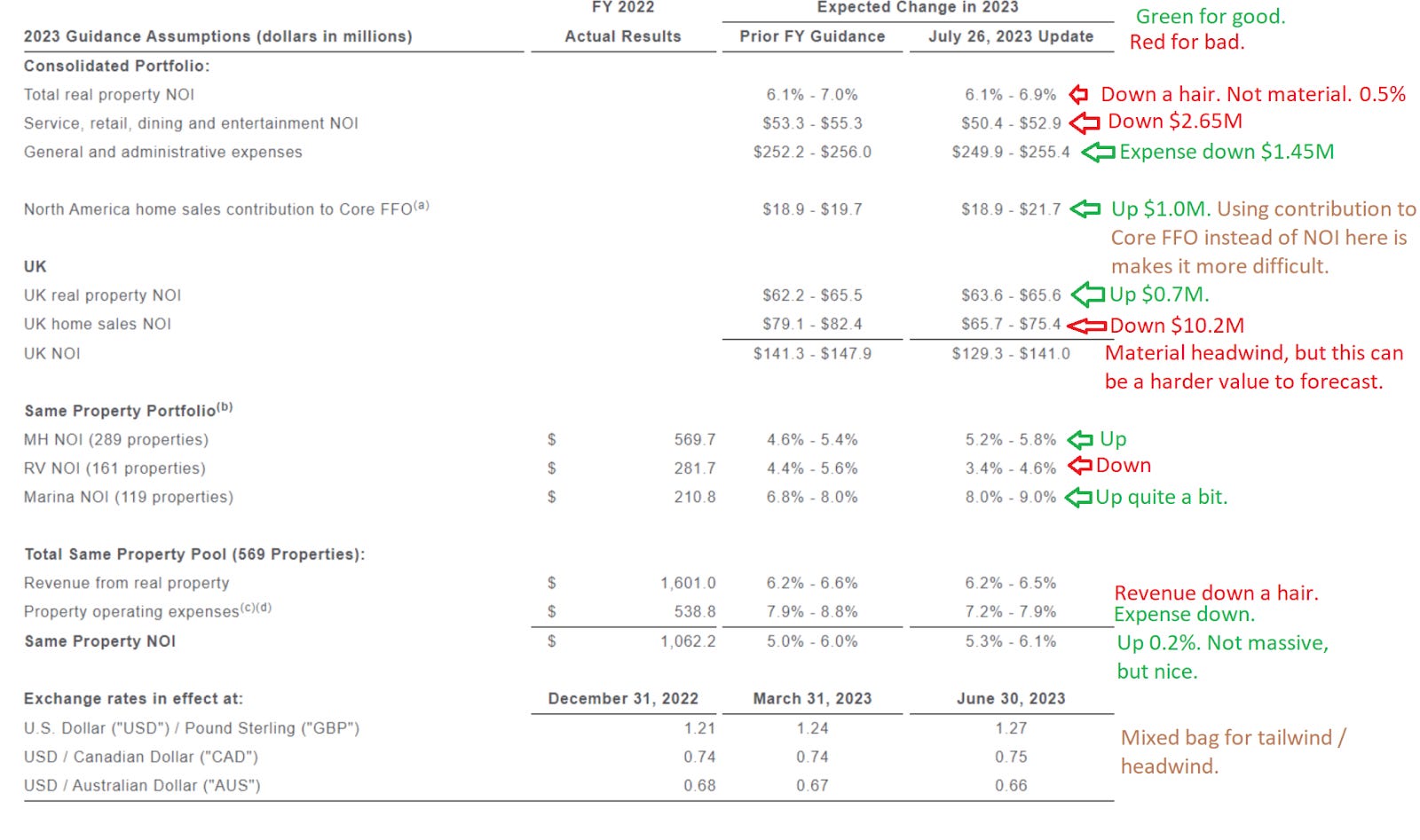

Rather than review each section in NOI (Net Operating Income) separately, I took a screenshot from the press release and highlighted which parts are good or bad.

Guidance on same-property NOI is usually one of the most important things for any equity REIT. SUI increased guidance there by 0.2%. It’s not huge, but it’s still positive. The improvement came from a reduction in expenses rather than higher revenue.

Total real property NOI forecasts were down by a hair. So some other properties are weighing on the result. In general, same-property NOI is the first metric you’ll check to strip out the noise.

Core FFO Guidance

We saw a drop in guidance for Core FFO.

The midpoint fell $.16, from $7.32 to $7.16. Sounds worse than it is.

Based on weighted-average shares outstanding, Core FFO guidance is down by about $19.75 million. We know UK home sales NOI contributes $10.2 million.

We have 3 culprits identified by management (in no particular order):

- UK home sales NOI

- Modest reduction to expected service, retail, dining, and entertainment NOI

- Higher interest expense related to short-term interest rate increases

We already know the first item is $10.2 million and the second item is $2.65 million. That would leave $6.9 million for interest, but other positive factors are impacting results.

Debt and Interest Expenses

Floating rate debt accounts 17.9% of SUI’s total debt. Near-term debt maturities are pretty small, so SUI shouldn’t have much rolling over. Interest expense is important, but it is less important than several other metrics when evaluating long-term performance. SUI keeps the total debt level reasonable, so there is no difficulty servicing this debt or covering dividends.

If you were comparing two almost identical REITs where only difference between the two was that one used 18% floating-rate debt and the other had that 18% locked in as fixed-rate debt for 1 year, what’s the actual difference in value? It’s the spread in rates for 1 year.

If that additional interest costs the REIT $.10 per share over the next year, the difference in underlying value would be $.10. However, if the market applied 18x AFFO multiples, it would incorrectly treat the $.10 as being worth $1.80.

We don’t want to make that mistake. We want to be aware of the interest expense but don’t want to overstate the importance.

Conclusion

Thoroughly mixed quarter. Same property NOI is clearly positive. The reduction to Core FFO is clearly negative, but the specific line items are favorable. If we had a 2.2% reduction in Core FFO that was entirely attributed to same-property NOI from marinas, I would be concerned. That would indicate a flaw with the real estate.

Because the reduction comes from line items outside same-property NOI, it’s significantly less of an issue. Real estate is still performing well.

Thoroughly mixed quarter. Same property NOI is clearly positive. The reduction to Core FFO is clearly negative, but the specific line items are favorable. If we had a 2.2% reduction in Core FFO that was entirely attributed to same-property NOI from marinas, I would be concerned. That would indicate a flaw with the real estate.

Note: Guidance on same property NOI for marinas was significantly positive.

Because the reduction comes from line items outside same property NOI, it’s significantly less of an issue. Real estate is still performing well.

I’d rate the quarter as a 6 to a 7.

Feels appropriate for a report that had high points and low points. It could’ve gone much further in either direction if we didn’t have the two big factors offsetting each other.

SUI is one of the largest positions in my portfolio and a core holding. Great management with a great record of producing value for shareholders. I don't expect any changes to my position in the near term or selling any shares within the foreseeable future. If there are any transactions, it would probably be adding shares on a dip.

Like the article? Feel free to share it.

Member discussion