Scott Kennedy’s BDC Earnings Series: Assessing Golub Capital BDC’s Performance For Calendar Q1 2024

Summary

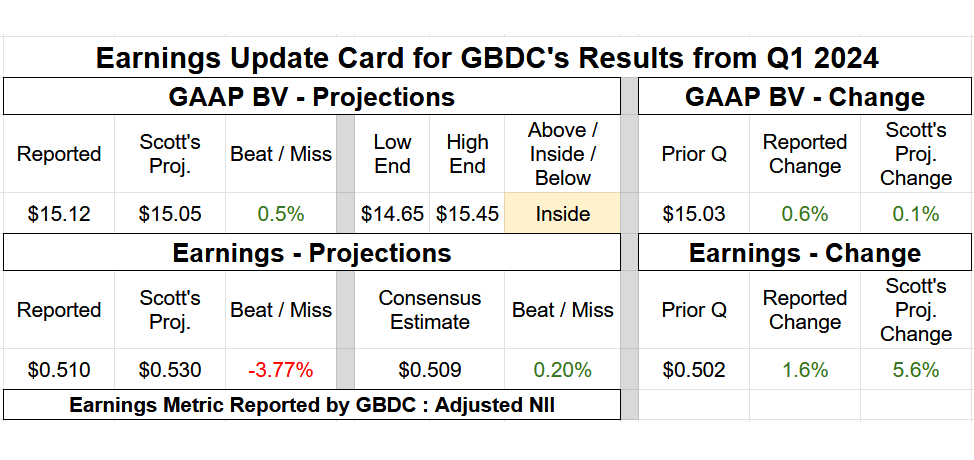

- This earnings assessment article reviews GBDC’s NAV and NII performance during Q1 2024 and compares results to my expectations. Earnings remain a key driver to stock performance.

- GBDC’s quarterly NAV basically matched expectations (within 0.5%). GBDC’s adjusted NII was a minor underperformance (within range). GBDC remains a well-run BDC.

- GBDC’s minor quarterly adjusted NII underperformance likely resided within the company’s low quarterly originations which directly led to a lower investment portfolio size versus my expectations.

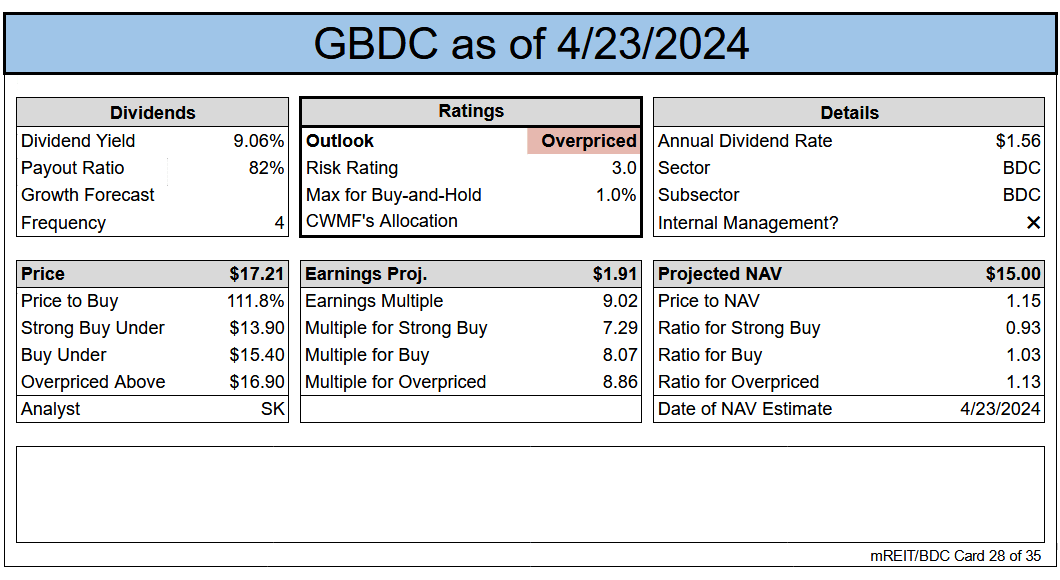

- No change in GBDC’s percentage recommendation ranges or risk/performance rating. GBDC is currently deemed slightly overvalued (SELL). A pullback would first need to occur prior to myself considering a purchase.

- Due to GBDC’s recent decrease in incentive fees paid to its external manager and upcoming affiliate merger, this BDC received a recommendation range upgrade/price target increase last quarter (February 2024).

Formatting Change to this Article Series

- We have recently changed the format of this earnings-related article series (less wording, more visual images). This process remains ongoing and future changes will likely occur.

Commentary

- Quarterly NAV Fluctuation: Basically an Exact Match (Within a 0.5% Variance).

- NII: A Minor Underperformance ($0.02 Per Share Variance).

An “as expected” quarter regarding Golub Capital BDC’s (GBDC) NAV in my opinion. GBDC generated a very minor quarterly NAV gain which was correctly anticipated. As such, GBDC’s underlying portfolio company valuations (both realized and unrealized) largely matched expectations.

A slightly underperforming quarter regarding GBDC’s adjusted NII in my opinion. I believe this likely resided within GBDC’s quarterly loan originations. GBDC reported loan originations of only $22 million during the calendar first quarter of 2024. Simply put, this came in below my expectations. In comparison, GBDC reported loan originations of $59 million during the prior quarter. This directly led to an overall smaller investment portfolio size when compared to my expectations which negatively impacted adjusted NII. That said, I will also have to review GBDC’s weighted average annualized yield when the company officially reports results on 5/6/2024.

As of 12/31/2023, GBDC had 9 portfolio companies on non-accrual status. GBDC estimates the company will continue to have 9 portfolio companies on non-accrual status as of 3/31/2024. That said, this includes 1 non-accrual portfolio company exit/disposition (likely partially/fully written-off; likely a negative catalyst/trend), 2 previous non-accrual portfolio companies being placed back on accrual status (a positive catalyst/trend), and 3 portfolio companies being placed on non-accrual status during the quarter (a negative catalyst/trend). Specific portfolio company names were not provided yet. I will fully analyze these credit-related events (and compare to my underlying portfolio company credit tracking/modeling) when GBDC officially announces earnings next month.

As of 3/31/2024, GBDC’s non-accrual percentage, based on amortized cost basis and FMV, was estimated to be 1.5% and 0.9%, respectively. This was relatively unchanged/a very minor decrease from 1.7% and 1.1% as of 12/31/2023, respectively. So, another pretty good quarter for GBDC from a general credit risk perspective. That said, as noted last quarter, I continue to anticipate credit risk/portfolio pressure on several MM investments over the next several quarters. Just something to be mindful of. Credit risk will remain a key metric to track over the foreseeable future.

Change or Maintain

- NAV Adjustment: Our projection for current NAV per share was adjusted: Up $0.05 (To Account for the Actual 3/31/2024 NAV Vs. Prior Projection). Price targets have already been adjusted to reflect the change in NAV. The update is included in the card below and the subscriber spreadsheets.

- Percentage Recommendation Range (Relative to CURRENT NAV): No Change.

- Risk/Performance Rating: No Change. Remains at 3.

Earnings Results

Note: NAV at the end of the quarter. Subscriber spreadsheets and targets use current estimates, not trailing values.

Valuation

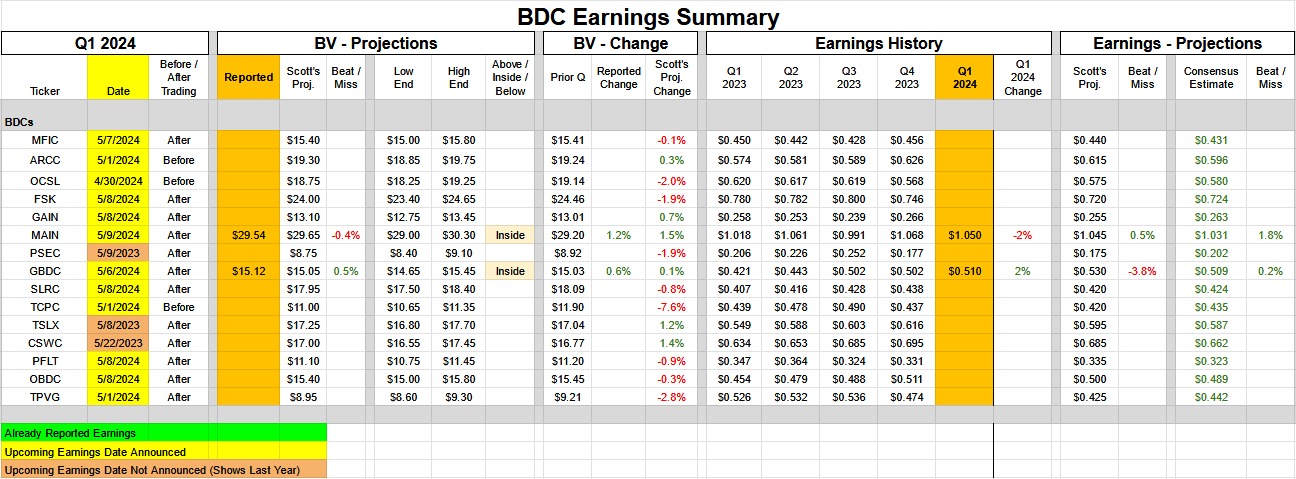

Peer Earnings Comparison

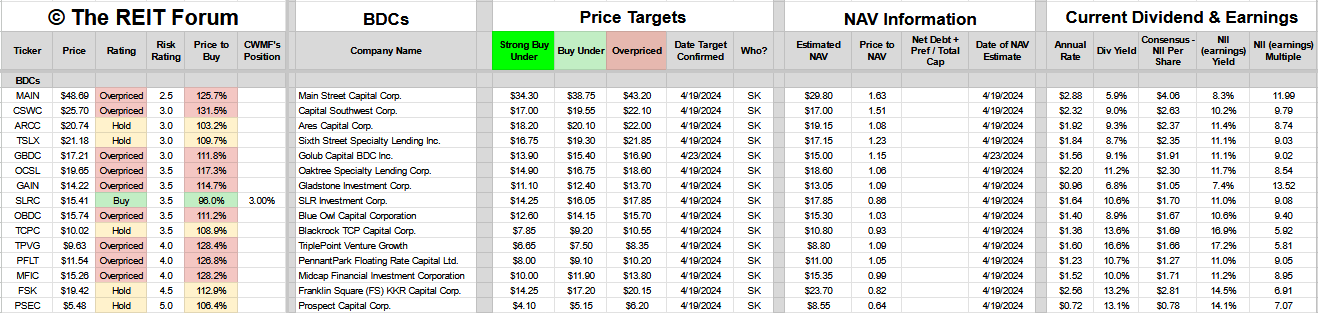

Peer Valuation Comparison

Glossary

- NAV = Net Asset Value

- NII = Net Investment Income. Revenues less operational expenses (prior to valuation fluctuations).

- FMV = Fair Market Value

- LMM = Lower Middle Market

- MM = Middle Market

- LIBOR = London Interbank Offered Rate. Previously was the broadly accepted benchmark interest rate for financial markets. After the LIBOR-rigging scandal, this rate has been discontinued since June 2023 (a minor portion of BDC legacy loans have this rate “grandfathered” in).

- SOFR = Secured Overnight Financing Rate. Became the broadly accepted alternative benchmark interest rate for financial markets after the discontinuance of LIBOR. Measure of the cost of borrowing cash overnight (typically based on the collateralization of U.S. Treasury Securities).

- PRIME = The interest rate that commercial banks charge their most creditworthy customers (generally based on the Federal Reserve's Federal Funds Overnight Rate).

- ICTI = Investment Company Taxable Income. A technical term for taxable income.

- BDC = Business Development Company

- IRC = Internal Revenue Code

- RIC = Regulated Investment Company. Technical/Taxation term for a BDC.

- UTI = Undistributed Taxable Income. A measure of cumulative/“built up” taxable income after dividends for an applicable period are declared.

Ending Notes/Commentary:

Another good quarter for GBDC. GBDC remains a well-run BDC but is now a bit “pricey”. I am still looking forward to GBDC’s proposed merger with another private affiliate, Golub Capital BDC 3, Inc. (“GBDC 3”). This is the second affiliated merger within the past several years. This will enhance GBDC’s scale by increasing total investments to ~$8 billion. As important, GBDC 3’s investment portfolio has an overlap of over 99% with GBDC. Simply put, GBDC 3 has the same underlying portfolio companies as GBDC. This merger will result in lower combined operating expenses, along with more favorable credit terms on future outstanding borrowings/debt. The merger vote is scheduled for 5/29/2024. Another key part of this proposed merger is GBDC’s external manager has already pre-emptively lowered incentive fees from a maximum of 20% of pre-incentive fee NII to 15% which started on 1/1/2024. Simply put, this (5%) permanent incentive fee reduction will drive future earnings benefits. In addition, after this merger officially occurs/closes, GBDC plans to declare additional special periodic dividends of $0.05 per share for 3 consecutive quarters beginning in the calendar third quarter of 2024. GBDC also implied that other special periodic dividends will continue to be declared on top of these future “additional special” periodic dividends. That said, no special periodic dividend per share amount/ranges were provided in GBDC’s preliminary results regarding which does leave some uncertainty.

While the fairly recent rapid increase in LIBOR/SOFR/PRIME has been a net positive for GBDC (and the BDC sector as a whole regarding NII growth), I continue to believe sector-wide NII’s are at or nearing their peak this interest rate cycle. However, with GBDC, this BDC has a bit more “legs to run” regarding adjusted NII growth with the upcoming merger and recent incentive fee reduction. We saw this come to fruition during the calendar first quarter of 2024 (just not as enhanced as my expectations). I also continue to believe recessionary/credit risk will be on the rise over the foreseeable future. As such, a bit of caution in general (which is already reflected in sector recommendations/pricing).

Analyst's Disclosure: I/we have a beneficial long position in the shares of ARCC, ECCC, SLRC either through stock ownership, options, or other derivatives.

I currently have no position in BDCZ, CSWC, ECC, FSK, GAIN, GBDC, MAIN, MFIC, OBDC, OCSL, PFLT, PSEC, TCPC, TPVG, or TSLX. Colorado Wealth Management Fund is long: SLRC.

Member discussion