SBAC Q4 2023 Update

SBA Communications (SBAC) announced Q4 2023 results.

- AFFO per share: $3.37

- AFFO per share attributable to SBAC: $3.36

That’s a bit better than consensus estimates of $3.34.

It was generally a strong quarter. Results for Q4 2023 were good. Guidance was a bit weak.

Shares may be under some pressure from guidance.

- Full Year 2023 AFFO per share: $13.08

- 2024 Guidance: $13.33

- 2024 Consensus: $13.62

That seems a bit weak. We expect SBAC to be one of the REITs with strong growth in AFFO per share.

I wouldn’t go into a panic yet. Sometimes SBAC provides guidance lower than what they can achieve.

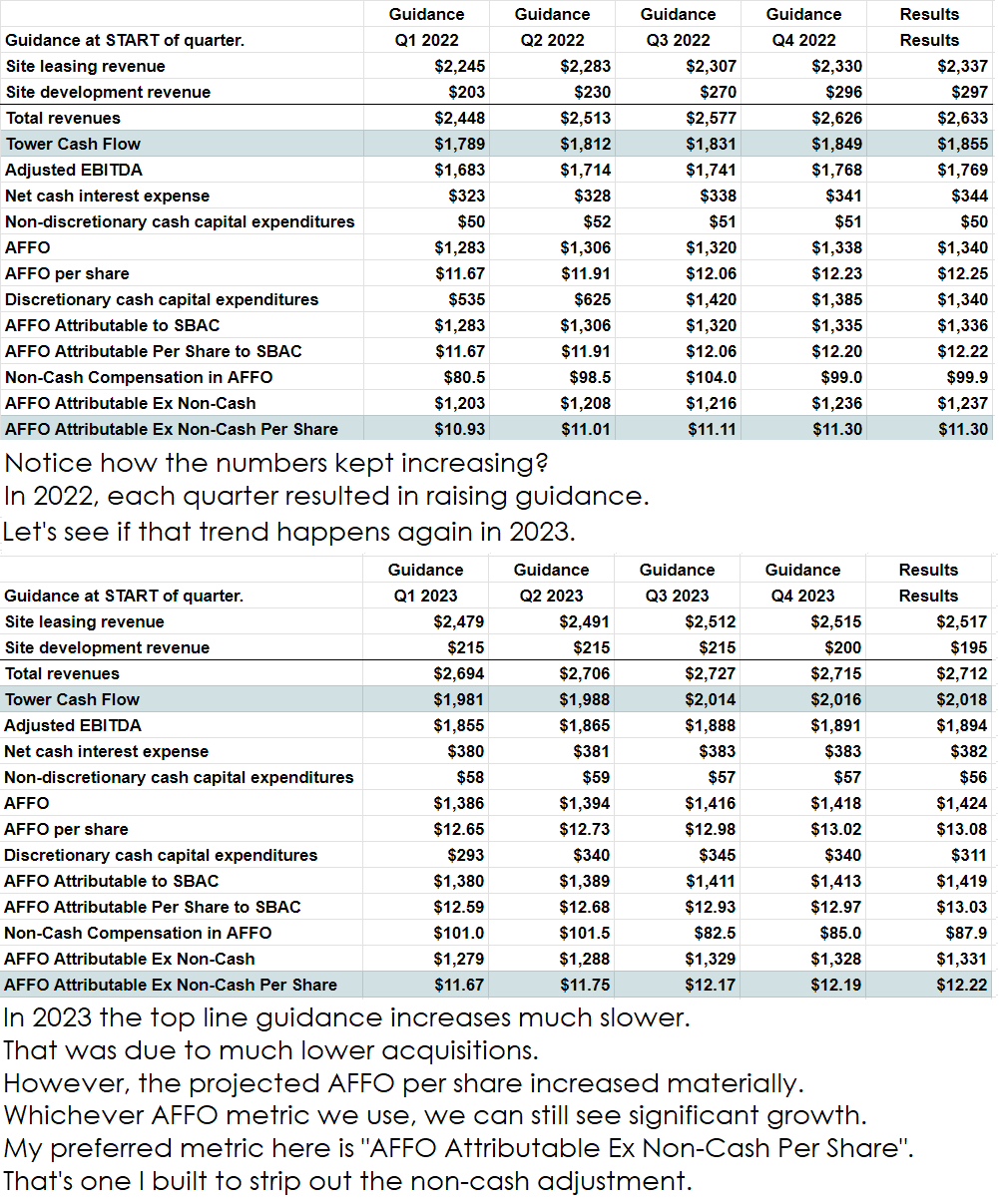

I put together the guidance as of the start of each quarter for the last 8 quarters. For each year, I also placed the results on the far right.

See if you spot a trend:

Each AFFO metric ended the year 3.4% to 5.0% above initial guidance.

I’m not asserting that it will happen by that magnitude this year, but it wouldn’t be surprising if we see guidance go up during the year.

Dividends

SBAC raised the quarterly dividend from $.85 to $.98. That’s about 15.3%. The payout ratio will still be very low, giving SBAC more cash flow to reinvest.

Quote From the Call

One quote I wanted to highlight from the Q&A (question and answer) portion of the earnings call:

“So, Mike, the numbers that we typically report on, we report on because we think they're the most important. I think the number one metric in our view here and with our Board and frankly, with many of our investors is AFFO per share because it represents that amount of actual free cash flow that is available to be returned to shareholders in some form or fashion, whether that be reinvested into the business, or be paid out as a dividend or be used for stock buybacks, whatever the usage is, it's effectively what's available at the end of the day after everything has been paid for. And so that's the metric that we focus on most of all.

Having said that, obviously, the next few years, there are some challenges to our AFFO per share metric, largely because of two things that are not new. Interest rates, we've done an excellent job over the last many years locking in very low-cost debt, but the market is what it is. And at some point, you have to refinance at least some of that debt. And so you're going to see higher interest costs that weighs on that a little bit. And of course, the Sprint churn, in particular, that is kind of out there that we know we have ahead of us, and we've scoped for you as to what that looks like.

But outside of that, the real goal, frankly, is to see that number go up over an extended period of time. This is a business that is a very long-term business at its core. We have very long-term contracts. Our relationships are long-term. The assets are long-term. And so we look at how we're going to maximize that number over an extended period of time. As a public company, it can be challenging because you're reporting every single quarter, and so it gets scrutinized every quarter, but the nature of the business is long-term. So we try to take that long-term view on how we're going to grow that number out over a period of five to 10 years. And I think we'll be well positioned to do that.”

Dish Network

With the T-Mobile and Sprint merger, there was supposed to be a fourth carrier in Dish.

Dish Network (DISH) is a company that looked at AT&T (T) and Verizon (VZ) and thought:

“Wow, look at how those guys destroy shareholder value. I bet we can do it even faster.”

Over the last 10 years, DISH paid out no dividends and saw the share price decline by about 89.98%. Special.

DISH agreed to be acquired by EchoStar Corporation (SATS) .

EchoStar is another outstanding company (that’s sarcastic) delivering a negative 76% return to shareholders over the last year.

That includes a one-day 38% return, which still leaves shares down more than 26% year-to-date.

The inability of DISH, at least so far, to do much other than lose money has been a headwind for landlords who would appreciate another carrier in the market.

Other Notes

Several other quick notes:

- Higher debt costs will be a headwind for almost every REIT, but the magnitude and timing of the impact will differ. Realistically, it will also be a headwind for other companies that operate with a significant amount of debt.

- SBAC benefits from having mostly fixed-rate debts, but will still need to continue paying down debts as maturities will roll over.

- Guidance for net cash interest expense is actually down year-over-year as SBAC has been reducing their outstanding debts. They have been handling the debt load responsibility, though paying down debt is generally a slower route to growth.

- Overall, I think the report will be seen in a negative light even though the REIT regularly exceeds and increases guidance.

- Am I thinking about closing or reducing my position? Not at all.

- I appreciate the frequent increases in guidance and I see the underlying business model as a resilient source of cash flow.

- I expect full-year performance for SBAC on the fundamentals to exceed guidance. I think they are being a bit conservative and setting the bar lower.

- Revenue growth rate is negatively impacted by lingering churn impacts from the old T-Mobile and Sprint merger.

- Fixed wireless customers are consuming around 20x the data of mobile customers.

- SBAC paid down their revolver to only $70 million, but raised the cap from $1.75 billion to $2 billion. Leverage is at lower than normal levels for them. If they see an opportunity to acquire assets at discounted valuations, they may move on it. Think of this as focusing on flexibility.

- SBAC sold some assets in Argentina. Those should be trading at much higher cap rates. However, the impact is minimal. It’s not even 1% of revenue and well under 1% of EBITDA.

No changes to our outlook. Targets could see a modest negative impact (low to mid-single digits). However, SBAC would still be at a substantial discount. I believe SBAC continues to offer a compelling long-term investment.

If SBAC gets beat up again, there’s a chance of continuing to build on our position. Given our large weight (SBAC is our largest non-cash position), purchases would probably be relatively small. I could add an opportunistic (shorter-term) position, but I’ve mainly focused on SBAC as a long-term growth play. I toss shares in the taxable account and figure I’ll sit on them for the next decade (or more). Despite the near-term growth headwinds, this remains a strong REIT with a good management team and a good strategy.

American Tower (AMT) reports tomorrow, which may make things more hectic as investors are digesting two sets of earnings. We have significant positions in both REITs.

I would normally review and report on AMT very shortly after their release. However, tomorrow I will most likely be out of the office for my wife’s birthday.

The REIT Forum is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Member discussion