SBAC: Q3 2023 Update

SBA Communications (SBAC) delivered AFFO at $3.34. That solidly beat consensus estimates of $3.24. That's on analysts. Consensus estimates for the year were less than guidance. That's just an analyst mistake.

Note: Ignore headlines reporting a beat by $.17. That’s just an editor pulling consensus estimates for FFO, pulling the reported value for AFFO, then declaring AFFO as FFO and comparing it to the estimate.

Guidance

AFFO guidance is slightly up, excluding stock comp. Up $.04 per share, which is $.09 above consensus estimates.

We don't like to exclude stock comp. When we adjust to include the stock comp, AFFO per share guidance is still up $.02 per share.

Guidance for tower cash flow is up by a hair.

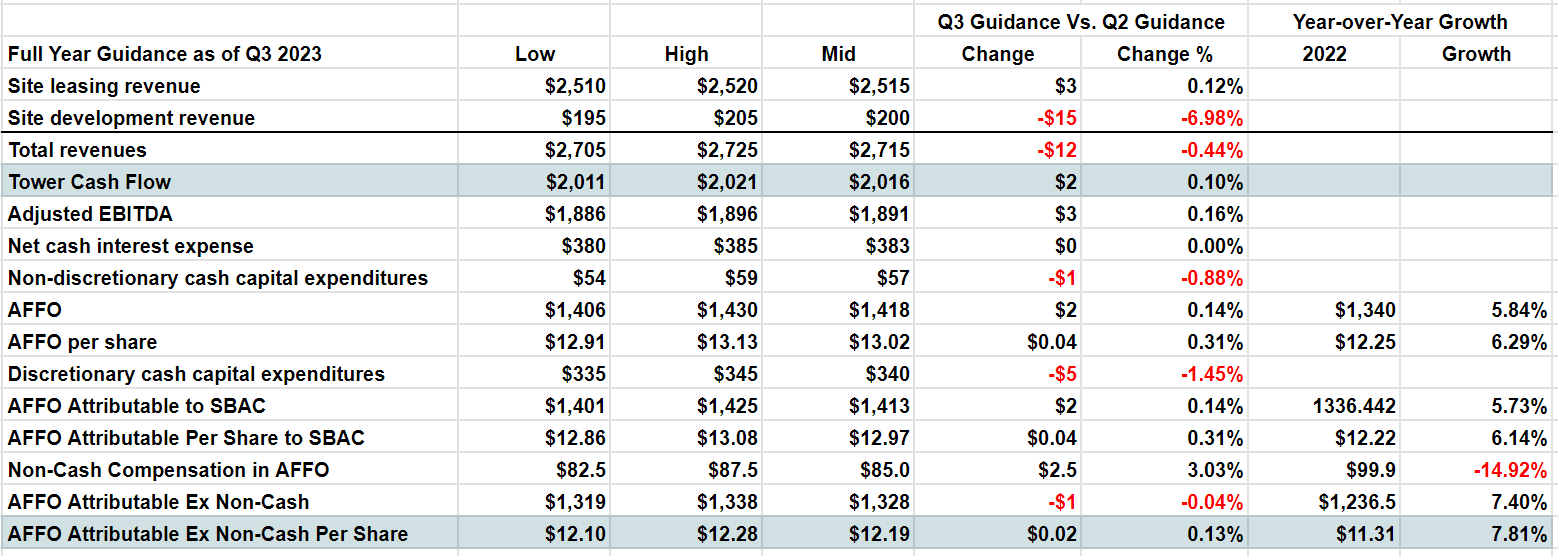

Those values are highlighted below in our image comparing Q3 2023 guidance with Q2 2023 guidance:

I expanded the chart to include year-over-year comparisons for some of the variables. The most relevant being the bottom line. SBAC is still posting a very respectable growth rate.

If we excluded foreign exchange rates (a very reasonable thing to do for comparisons), the guidance would be up by an additional penny. Not enough to really matter, but it means foreign exchange rates were doing nothing to help. This was just solid execution.

Buybacks

The most important development is that SBAC finally started buying back shares. SBAC spent $100 million buying stock back at an average price of $197.89. Still have $404.7 million available under the existing repurchase plan. Solid quarter. Nothing bad. Nothing else particularly stands out beyond them finally putting the repurchase authorization to work and setting guidance above consensus estimates.

I’m glad to see SBAC using that buyback authorization. Prudent time to take some shares off the market. They got an outstanding average price on those shares.

They also used cash to pay down their floating-rate debts. Those are getting pretty low.

That’s kind of how it’s been going for SBAC:

- Set new 52-week low.

- Beat and raise.

- Repeat.

It will be interesting to see how long bears maintain their position as SBAC continues to deliver.

Disclosure: Long SBAC.

Member discussion