SBAC: Q2 2023. Back-to-Back 10s.

SBA Communications (SBAC) delivered a monster report. Knocked it completely out of the park. With the market betting against SBAC and shares running up against a 52-week low, they came through in the clutch again.

Who Stole The Big Customer?

You’ve heard from Crown Castle International (CCI) and American Tower (AMT) as they cut guidance on services due to a more difficult environment. SBAC generates a material portion of its revenue from site development (a type of service), but SBAC didn’t cut guidance for site development revenues.

The REIT Forum is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Instead, they reiterated that guidance while raising several other items.

How can they be confident? Well, they had an announcement to make:

We are also very pleased to announce our newly signed master lease agreement with AT&T. This agreement serves to expand upon our existing strong relationship with AT&T, providing for future leasing growth from AT&T at our tower sites and enhancing efficiencies in the day-to-day operations between our two companies. We are excited about this next phase in our relationship. Based on second quarter results, our current expectations for the remainder of 2023 and our new MLA with AT&T, we have adjusted our full year outlook in a number of areas, including increases to Site Leasing Revenue, Tower Cash Flow, Adjusted EBITDA, AFFO and AFFO per share.

For all that talk about how much carriers are cutting their capital expenditures, SBAC landed more business with one of the biggest clients.

Updated Guidance

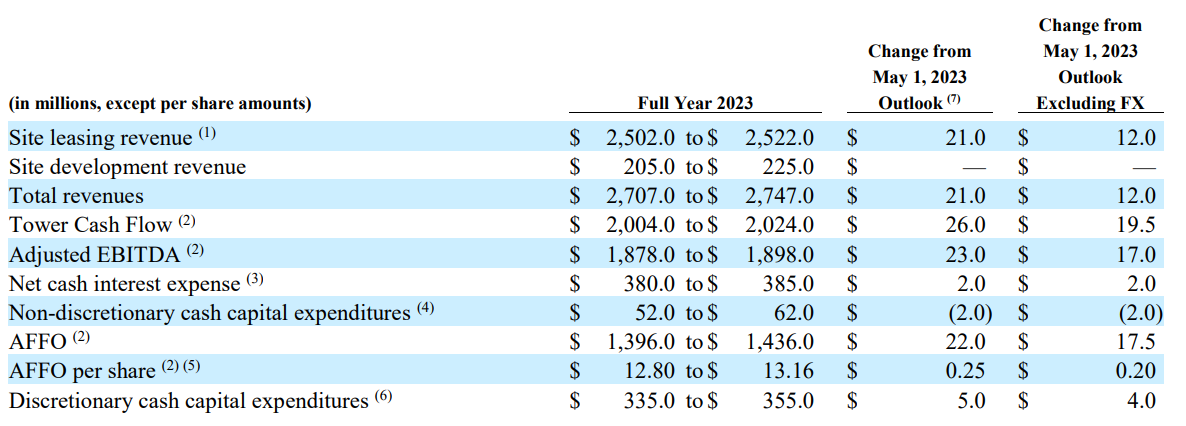

SBAC’s updated guidance is included below:

The only number going down is maintenance capex (non-discretionary cash capital expenditures). That’s great. They get a tiny boost from favorable movements in foreign exchange rates, but it’s pretty small. Most of this is just improved fundamentals.

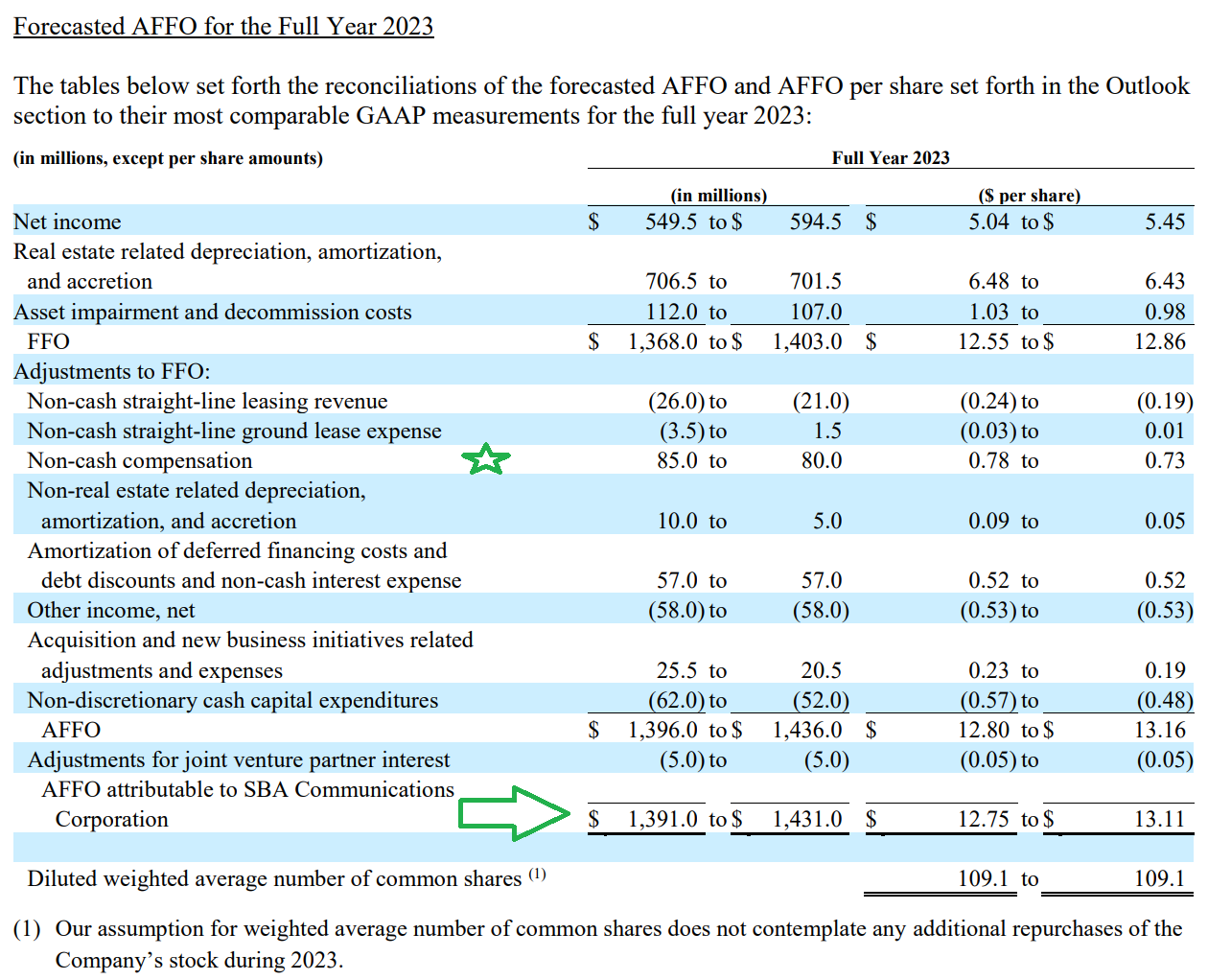

Regarding AFFO, I prefer to use “AFFO attributable to SBA Communications”. It is adjusted for some joint venture calculations.

That metric requires looking deeper into the press release:

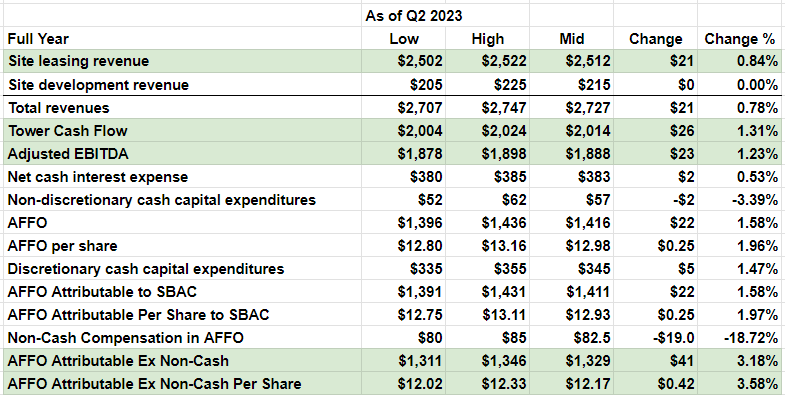

While AFFO attributable to SBAC is a good metric, I still prefer to strip out stock-based compensation adjustments. I’ve done that in the table I prepare for evaluating the guidance:

The deeper we go, the better it gets. Stock-based compensation guidance went down. That could mean more of the expense gets paid in cash, or it could be a reduction in expense. Either way, we can see that AFFO (excluding that adjustment) is up by an even bigger margin.

Conclusion

SBAC gave us exactly what we wanted. Guidance increased. The way we prefer to calculate AFFO, guidance was increased even further. They fueled that boost by signing a new master lease agreement with one of the big carriers. Outstanding quarter. SBAC takes the first 10 for Q2 2023.

It continues a solid run for SBAC. In Q1 2023, SBAC scored a ten on their boost to AFFO guidance. This time they boosted guidance even further and added the new leasing announcement.

Disclosure: Long all shares in CWMF’s Portfolio, which includes AMT, CCI, and SBAC.

The REIT Forum is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Member discussion