SBAC: My Largest Position

SBA Communications (SBAC) is my largest individual position.

What is SBAC?

SBAC doesn’t get much attention on Seeking Alpha. Hardly anyone covers the stock because it has a low dividend yield. It’s not a small REIT. The equity market cap is currently around $26 billion. However, few investors read about a REIT with a low dividend yield. Consequently, it’s rare to see articles about it.

SBAC is a cell tower REIT. They have two types of assets:

- Domestic towers

- International towers

The domestic towers represent a materially larger portion of the total value. However, the international tower segment is also big enough to be quite material.

2023 revenue guidance:

● $1,846 million domestic leasing revenue

● $669 international leasing revenue

NOI (Net Operating Income) margins are good in both areas. The domestic NOI earns a higher valuation (lower cap rate).

The domestic leasing revenue is a bit more than 73% of consolidated leasing revenue. However, it’s materially more than 73% of the total value of the company.

Organic Growth Continues

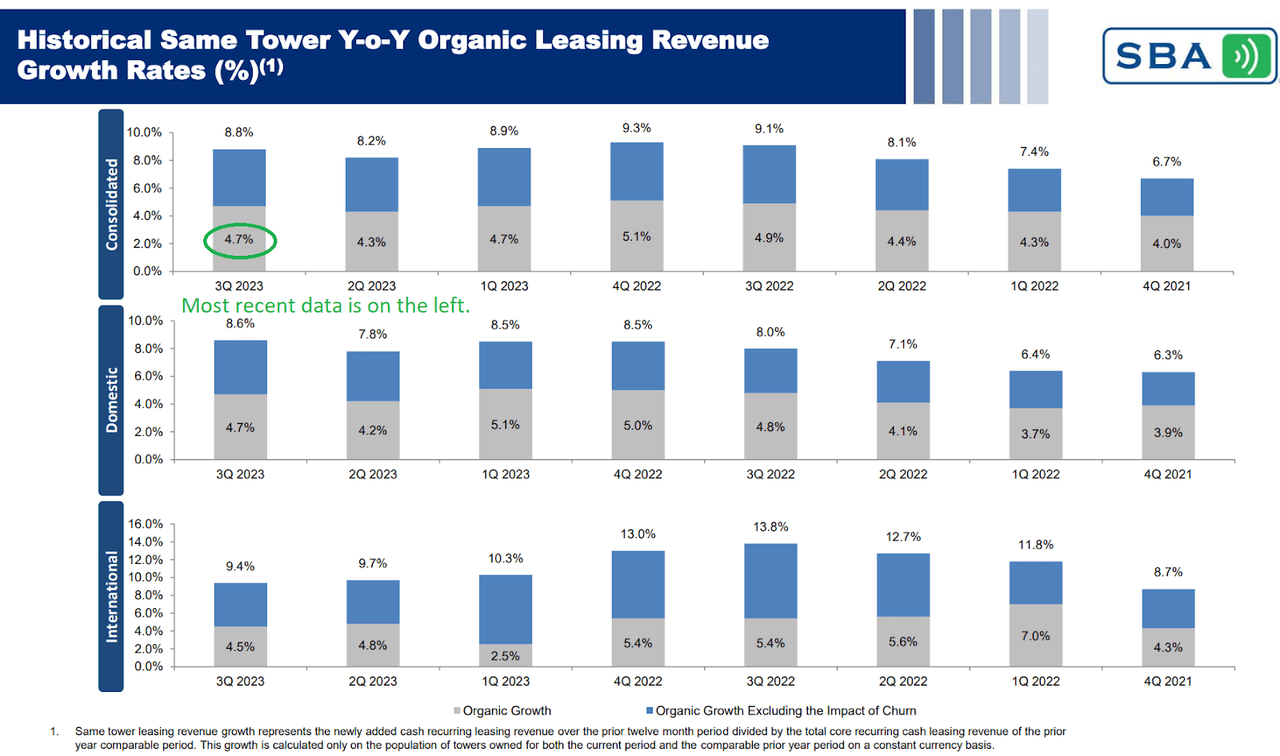

Some investors believed that we were already seeing the end of tower leasing. They felt organic tower growth was over. Clearly, that isn’t the case.

That’s pretty good. Average consolidated tower organic growth has been a tiny bit stronger across the first 3 quarters of 2023 (4.7%, 4.3%, and 4.7%) than it was for the first 3 quarters of 2022 (4.3%, 4.4%, and 4.9%). The international growth rate was lower, but domestic growth was stronger.

Leasing revenue and NOI go hand in hand. Posting such strong growth in revenue leads to strong growth in NOI. SBA Communications delivered excellent growth in AFFO per share because they were able to enhance their revenue and NOI from these assets.

Easy Access to the Rest

To maintain a presence on Seeking Alpha, I still need to publish some articles on the premium platform. That creates challenges for cross-publication. However, I can still include a link to view the article that does not require an SA account. No login. No account. No payment. Click here to get the rest of the article.

Please reply to this e-mail if you have any difficulty accessing it.

To get alerts whenever I publish an article on our Substack page, just click the button below.

Member discussion