REXR & PLD Combined Quick Update

Prologis (PLD) sent industrial REITs down with their Q1 2024 update this morning.

The commentary was pretty negative in the short-term about high-rent markets, though it remained positive long-term.

This is an issue of tenants delaying leasing space, not abandoning plans.

Rexford (REXR) had a pretty good quarter though, given the challenging backdrop.

Guidance

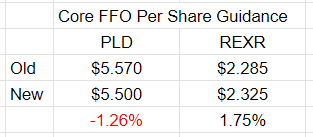

REXR raised guidance for annual Core FFO, which is the opposite of PLD’s change:

REXR’s guidance is still below the consensus analyst estimate, but it’s an increase in guidance. After PLD’s commentary this morning (driving PLD’s price down more than 7.2% and REXR’s price down about 5.4%), this is a ray of sunshine.

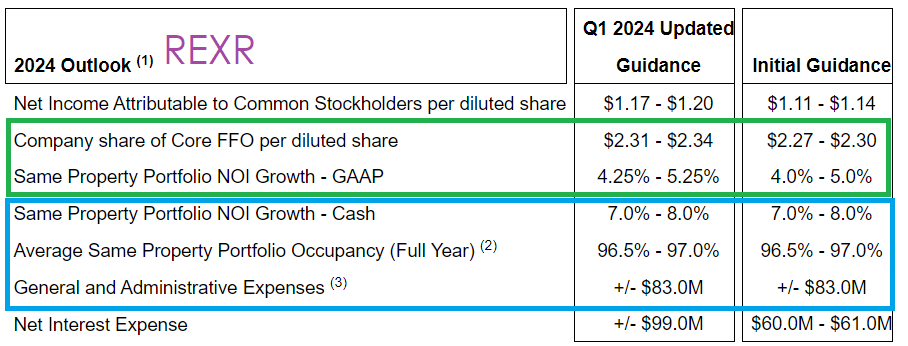

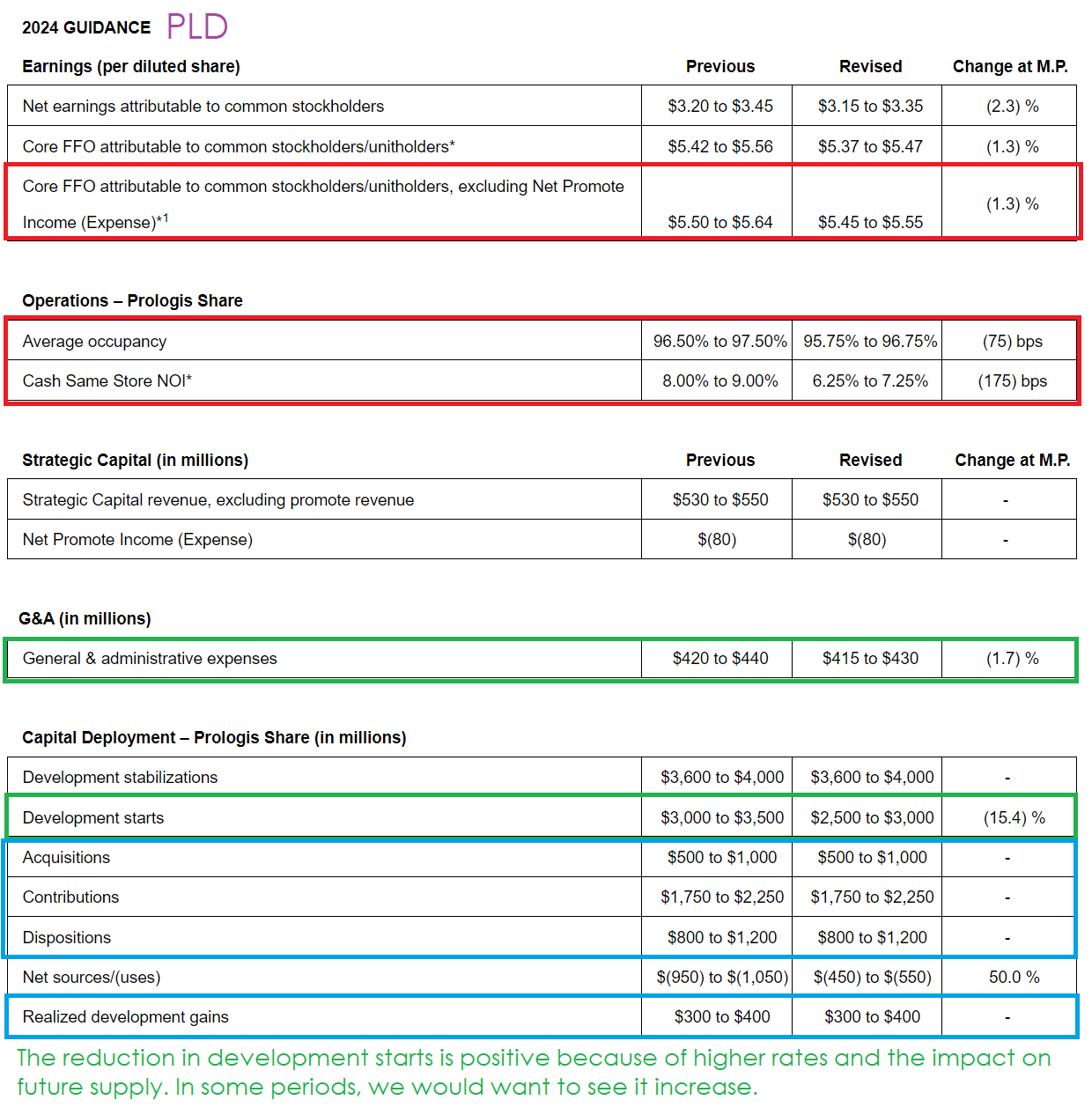

I pulled the images from each press release and highlighted the relevant boxes.

· Green is good.

· Blue is maintained and relevant.

· Red is bad.

Things with no boxes are not particularly important to us or were already known.

The complete batch of guidance updates is shown here for REXR:

Note: The increase in net interest expense is because REXR issued bonds to buy the Blackstone portfolio. We’ve already covered that.

Here’s the batch for PLD:

REXR’s report looks significantly better. That's impressive given that they are in Southern California and it is currently the most challenged market.

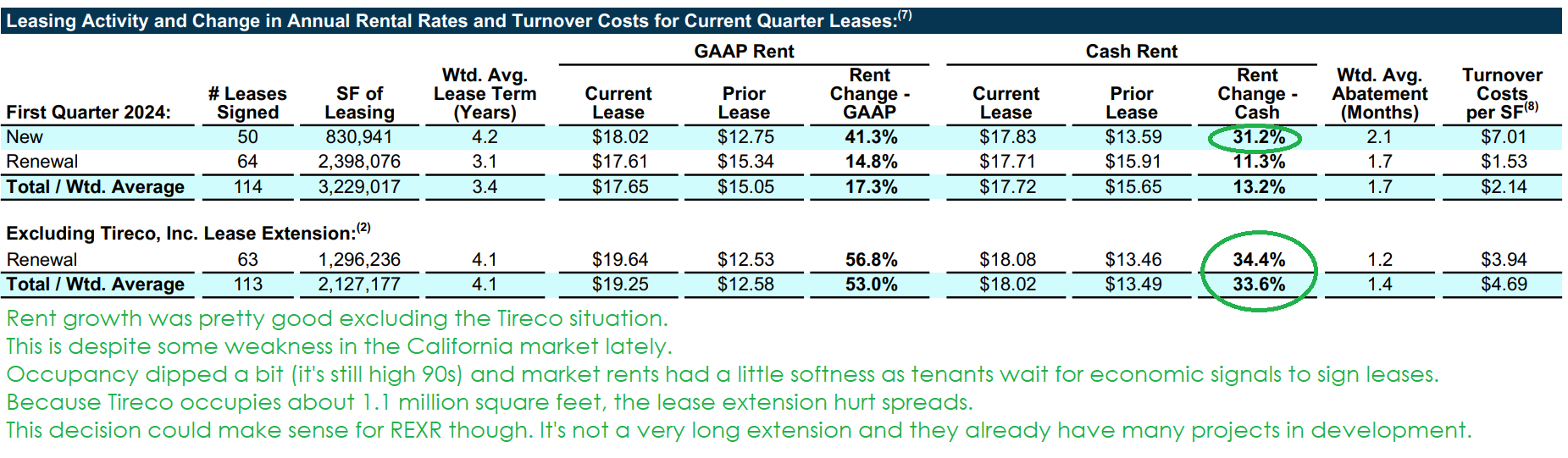

There is one negative aspect, but it was an issue REXR referenced in advance. They were extending a lease for one tenant. That one lease didn’t have a big increase and it was covering a large amount of space, so it was messing with the results for the quarter.

Market Rent Vs. Leasing Spreads

Leasing spreads are still substantially positive (excluding Tireco). However, market rents were dipping in California.

Overall, I’m treating this as a positive quarter for REXR.

Their decision to issue shares at $48.95 looks much better after the price fell to $42.24.

I wasn’t a fan of issuing that equity, but it’s looking a bit better now.

REXR has to be looking at the weakness in the real estate market and wanting to scoop up some properties. It wouldn’t be surprising to hear of some more property acquisitions in the next quarter or two.

Using closing prices from today, REXR had the biggest discount to our targets among the industrial REITs.

I may go in to pick up some more. As share prices dipped and we were putting capital to work in other REITs, our REXR allocation declined to only 3.88% of the portfolio.

I would be comfortable raising that level. I’m still looking at everything from the perspective of gradually building positions when we see a big pull back in pricing. If prices remain weak, I may put in a modest purchase. That would be adding more than 0.4%, but less than 1.1% of the total portfolio.

Disclosure: We are long PLD, REXR, and TRNO.

Member discussion