Realty Income Q3 2023 Update

Just a few quick notes. Realty Income (O) is generally one of the easiest REITs to analyze. Given the interest in it, it really should get into reports more often.

Guidance Updates

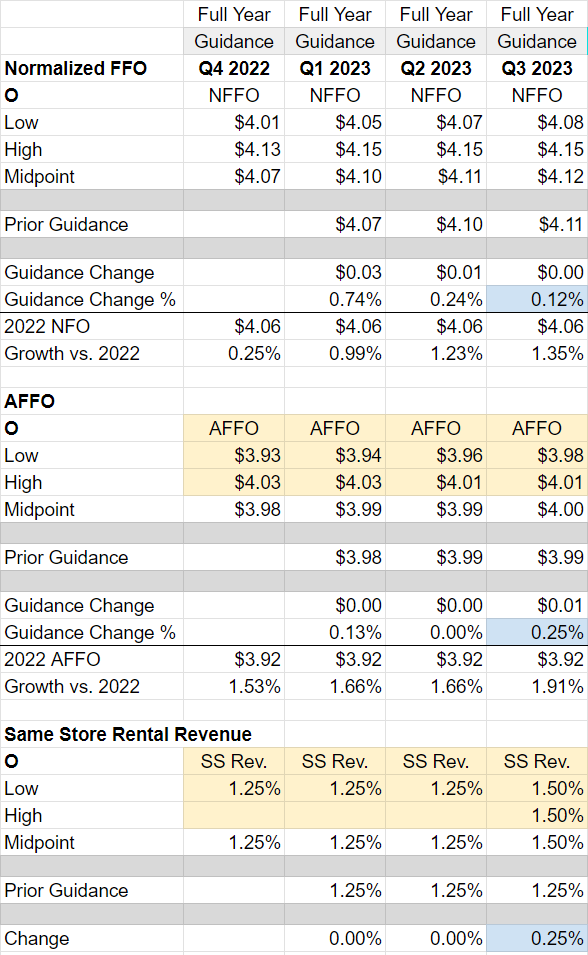

The following image provides the full-year guidance from the end of each quarter.

I think that presentation has some potential, but it could still use some polish.

Realty Income slightly raised guidance across each metric. For net lease REITs, it is pretty rare to see any meaningful change to guidance. The beauty of the business model is that the vast majority of the data is already known.

Most of the revenue is contracted well in advance. Most of the operating expenses are paid by tenants. So long as interest expense is locked in, there isn’t much variability unless the REIT is issuing shares for acquisitions.

Issuing Shares

The average share price for issuing stock was $58.58. That’s 16% higher than the current share price of $50.46. That higher price makes it much easier to achieve accretive acquisitions.

Assessment

Good quarter. Guidance up slightly. I think they overpaid a bit for Spirit Realty Capital (SRC), but the rest of the quarter looks nice.

Wall Street Making Analysts Look Bad

When I saw this Seeking Alpha headline, I thought the editor made a mistake with revenue forecasts:

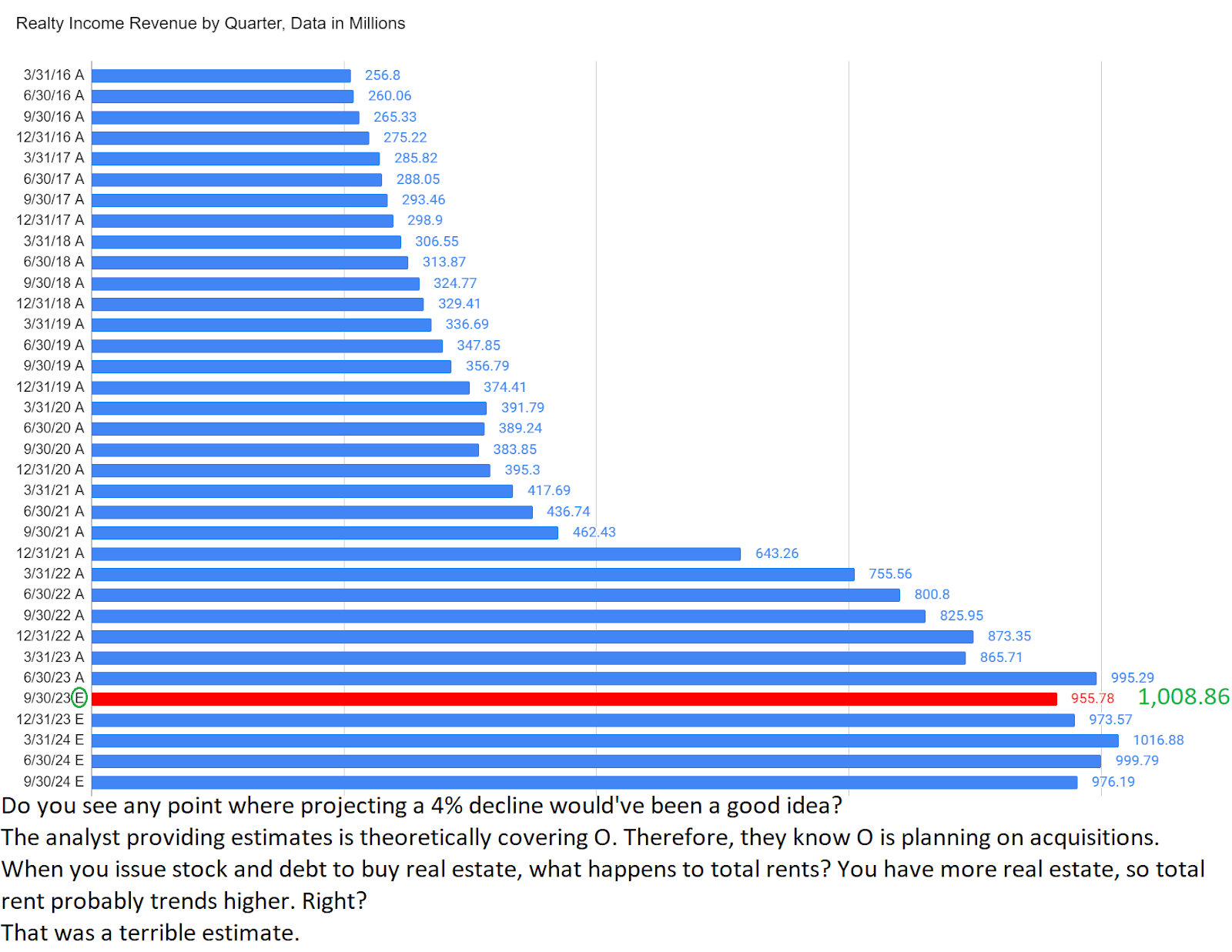

Nope, that’s just Wall Street demonstrating that skill is not a requirement.

Does that sound harsh?

I’m going to show you the chart. You tell me if you could’ve done better than the consensus estimate:

Conclusion

Pretty good quarter. I’ll give it a 7.5. They did raise guidance by a hair, so that’s good. It would be an 8 if they got a better deal on SRC, or an 8.5 if they got a great deal on SRC.

Member discussion