Realty Income Q2 2024: Acquisitions Fuel Growth

Realty Income (O) reported Q2 2024 results.

This will be a brief update. The only thing of particular interest is the magnitude of the impact of acquisitions on growth in FFO and AFFO per share.

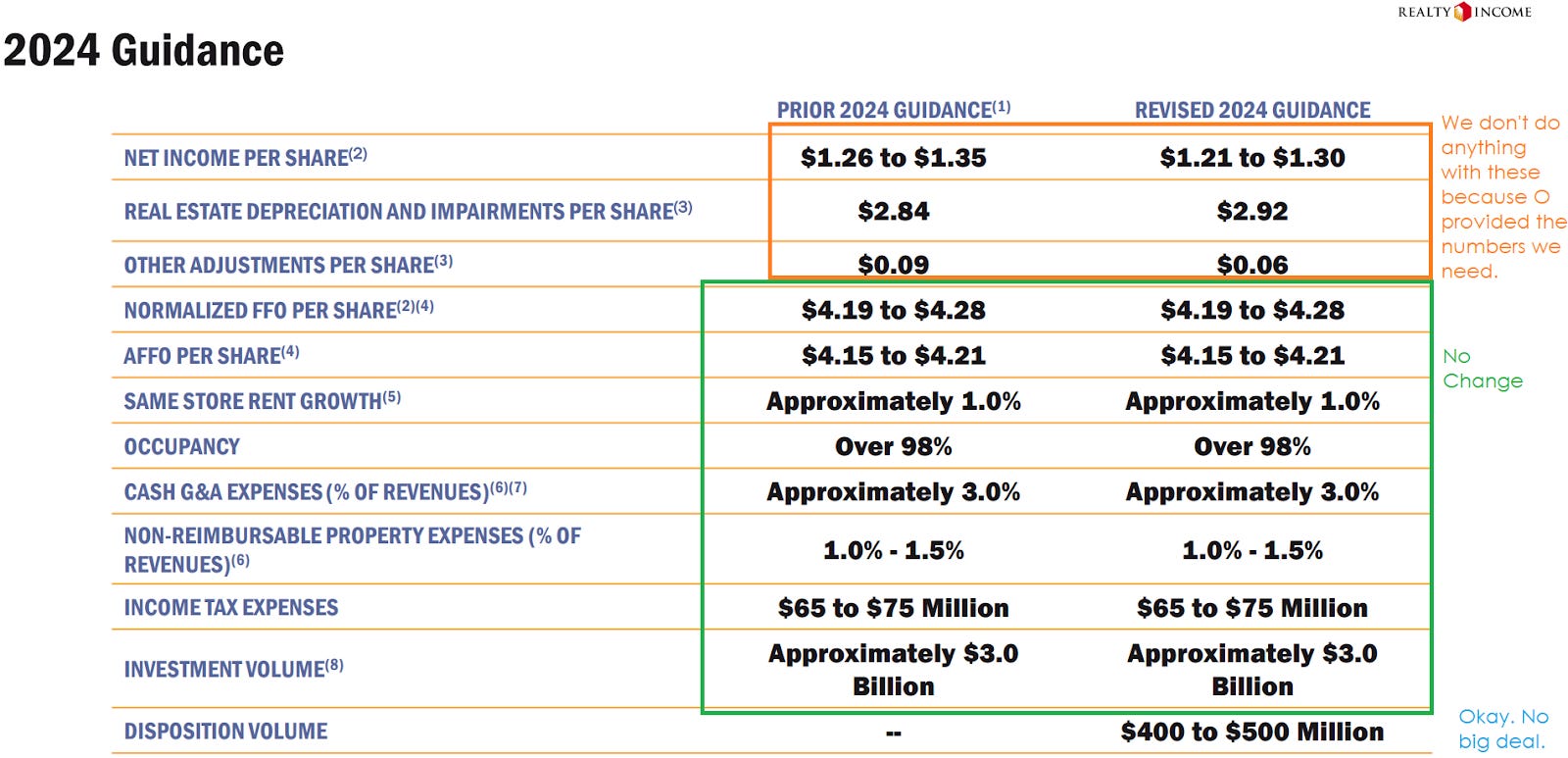

Here’s the guidance update:

Basically nothing changes.

Headlines

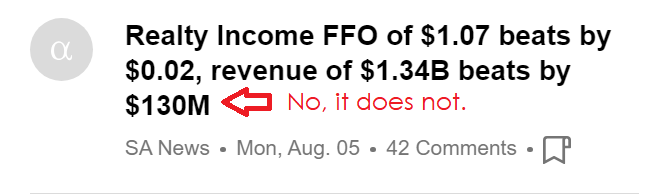

Disregard the headlines, as usual:

No analyst worth a single penny was predicting total revenue for Realty Income would be $1.21 billion.

Results

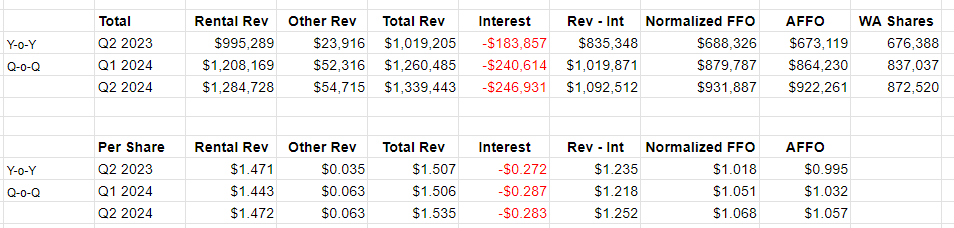

As demonstrated last quarter, the numbers can be broken down as seen below:

Rental revenue last quarter was nearly $1.21 billion. Including other revenue would make it about $1.26 billion.

No one is predicting $1.21 billion for total revenue.

Guidance for Realty Income called for acquisitions. Prior to Q2 2024, it did not call for dispositions.

Knowing that Realty Income would have a full quarter with their Q1 acquisitions plus some Q2 mid-quarter acquisitions, you have to expect rental revenue to increase.

It's possible that some analysts were predicting rental revenue around $1.21 billion. That would be a slight increase from $1.208 billion in the prior quarter. It would still be a weak estimate given:

- The escalations written into the contract.

- The full quarter of contribution from prior acquisitions

- The partial period from new acquisitions.

But sometimes the average may be artificially low because a few analysts either failed to update their models for acquisitions so far this year or didn't update their last public estimate.

FFO

Normalized FFO and AFFO are both useful metrics here.

No change to guidance on either.

Solid year-over-year growth in both figures on a per-share basis.

Why did shares outstanding increase so much?

Because that’s how Realty Income raises cash to purchase additional properties.

If Realty Income issued zero shares and zero debt, the growth in revenue would be extremely small.

Realty Income’s stock issuance and subsequent acquisitions were a major factor driving growth in FFO and AFFO per share.

Acquisitions

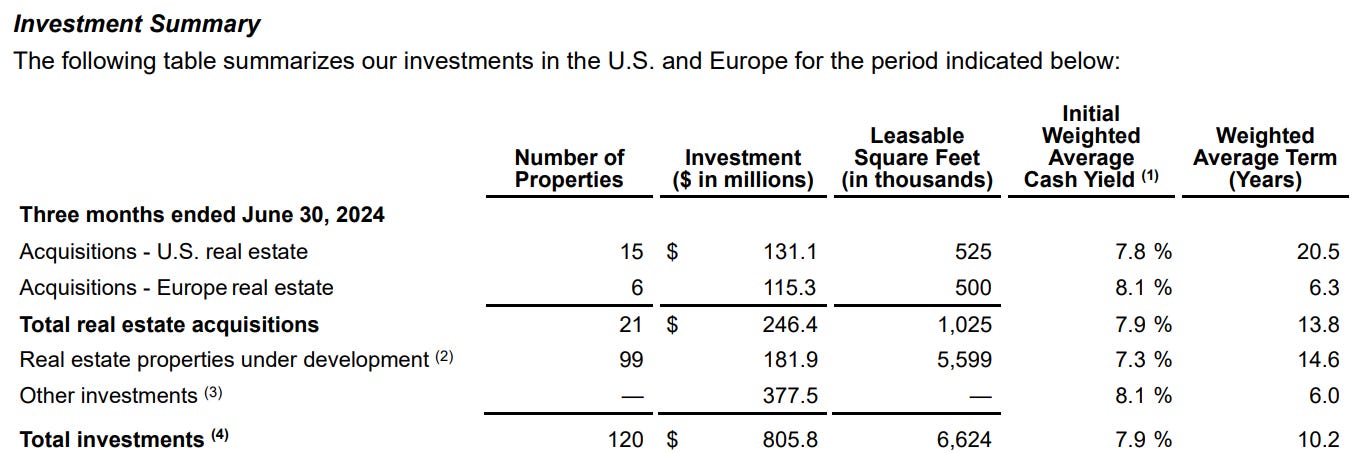

During Q2 2024 alone, Realty Income had about $805.8 million in investments.

Weighted average cash yield of 7.9% on investments.

Yeah, that’s immediately accretive. I may show the math in the future. I would do it today, but it still takes a while to get any REIT plugged into the model.

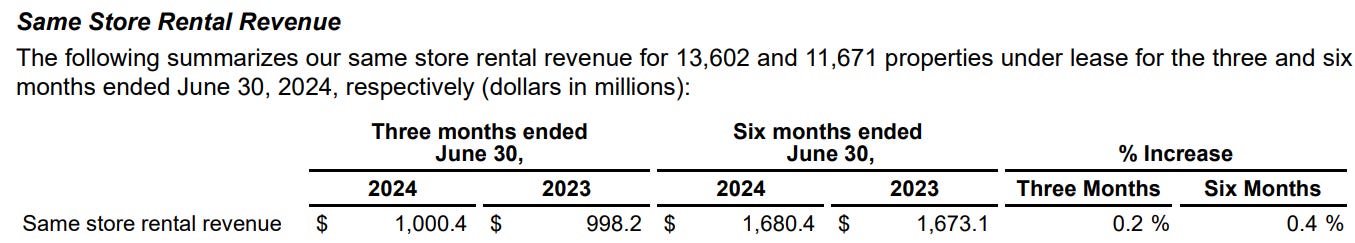

Same Store Rental Revenue

Realty Income also provides their same store rental revenue.

You’ll notice that it increased very slightly.

Slight growth is what investors should typically expect:

It wasn’t the same store portfolio driving the growth in normalized FFO and AFFO per share. It was the acquisitions.

Another Solid Quarter

Does it warrant a big increase in the targets? No. This is exactly what Realty Income is designed to do.

I’ll grant that the improvement in normalized FFO and AFFO per share is pretty impressive though.

Regardless, no change to guidance. Realty Income also issued some shares at a less favorable price.

Keep in mind, “less favorable” is not inherently unfavorable.

Because of the cap rates available on investments, Realty Income does not need to achieve top dollar when selling shares. It would definitely help, but it isn’t mandatory.

New Shares Issued

Realty Income sold another 3.5 million common shares during the quarter under their forward sale agreement, but did not settle the transactions yet.

I will explain.

Realty Income has 4.7 million common shares that have already been sold, but not settled. These transactions are legally binding. The weighted average price for these shares is $53.32. Clearly, Realty Income would rather be locking in issuance around today’s price ($60.16) than at $53.32. However, the terms are already locked in place. If prices went down, the locked price could’ve been favorable. Because Realty Income is achieving such attractive spreads on acquisitions, they continue to issue stock and invest in new assets.

How Forward Sales Work

When the transactions settle, shares are created and Realty Income receives cash.

Realty Income decides when to settle the transaction. They can base that decision on the timing of acquisitions.

They can settle the shares right before a transaction closes.

That is particularly useful for controlling all of the REIT earnings metrics.

If Realty Income settled all the shares immediately, they would be sitting on cash they do not need. That would reduce revenue per share, normalized FFO per share, and AFFO per share.

Then when they did invest the cash, it would cause those numbers to surge higher.

That would introduce more volatility to their financial statements.

Consequently, it is intelligent for the company to use forward sale agreements to align the issuance of shares with the purchase of new real estate.

That table for results would be dramatically more volatile if Realty Income was not aligning the issuance of shares with the purchase of new real estate.

Conclusion

Good quarter. No surprises.

Adjusting targets has two primary parts:

- Change in projected fundamentals.

- Change in interest rates.

There is no change in the projected fundamentals, but interest rates have been becoming more favorable.

I may apply another small adjustment after I finish reviewing the net lease REITs:

Member discussion