Realty Income FAQ

These are your questions about Realty Income (O) , answered quickly. Somewhat quickly. Just pretend.

Found this article online? Smash that subscribe button to improve your inbox.

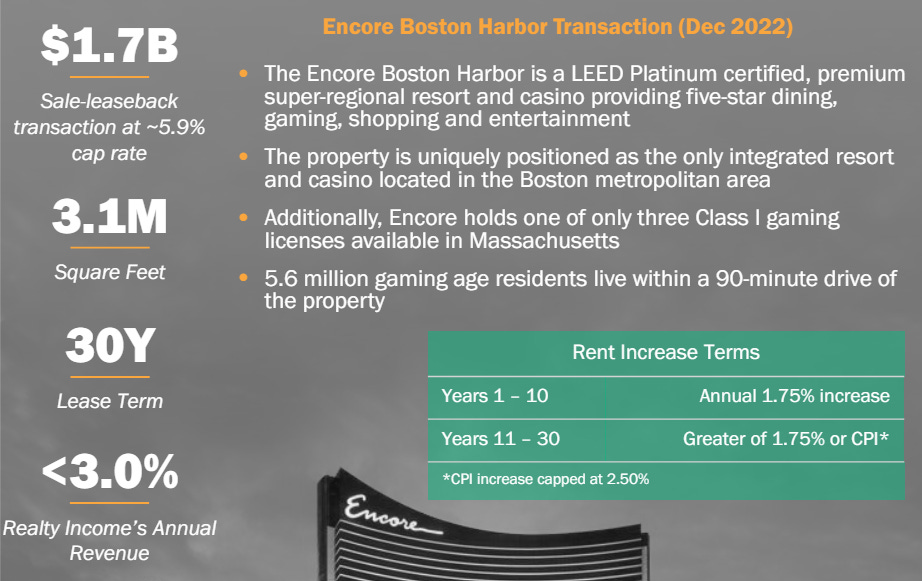

- Are they reaching outside their core competency (acquisitions of casinos, etc.)

A little bit. Gaming properties aren’t their core expertise. However, it’s only 2.9% of the portfolio. It provides some additional diversification and the terms appear to be reasonable:

The one potential concern here could be the 5.9% cap rate. In this environment, that seems pretty low. When Treasury rates were lower, that 5.9% cap rate would’ve looked pretty good.

- What do you think about O preferred (comes from SRC)

Great credit quality. Terrible rate. If investors can catch them around $20 when investors are scared about higher rates, that could be a viable play for capital gains. Currently these shares are trading over $24.00. The yield just isn’t high enough. If we go into a higher-for-longer environment, investors can’t get their money back. Consequently, I wouldn’t buy these shares around $24.00. Sometimes shares bump over $25.00 (great opportunity to take gains), but I wouldn’t want to gamble with it. Too much downside from interest rates and not enough upside because of call risk.

- O’s price target date is 10/3/2023, so what’s new with shares (even though I did quarterly updates).

Updates will be coming. The biggest factor pushing net lease REITs is interest rates. Sometimes prices move with Treasuries. Sometimes they have near zero correlation. It’s really strange. Relative to early October, Treasury rates (as of today) are down across the curve. I thought I published some charts on this. However, I couldn’t find them in my articles. Now I’m wondering what I did with those charts. I may need to ask REIT Forum Support to find them.

- How would interest rate cuts impact O and other triple net lease REITs?

Lower rates would be good for all of the net lease REITs. If rates fall but we slip into Great Depression Part 2: The Remix Noone Wanted, that would still be bad. But absent huge economic shocks, lower rates would be beneficial for almost all equity REITs. Net lease REITs have historically been more impacted by rates than most other types of REITs.

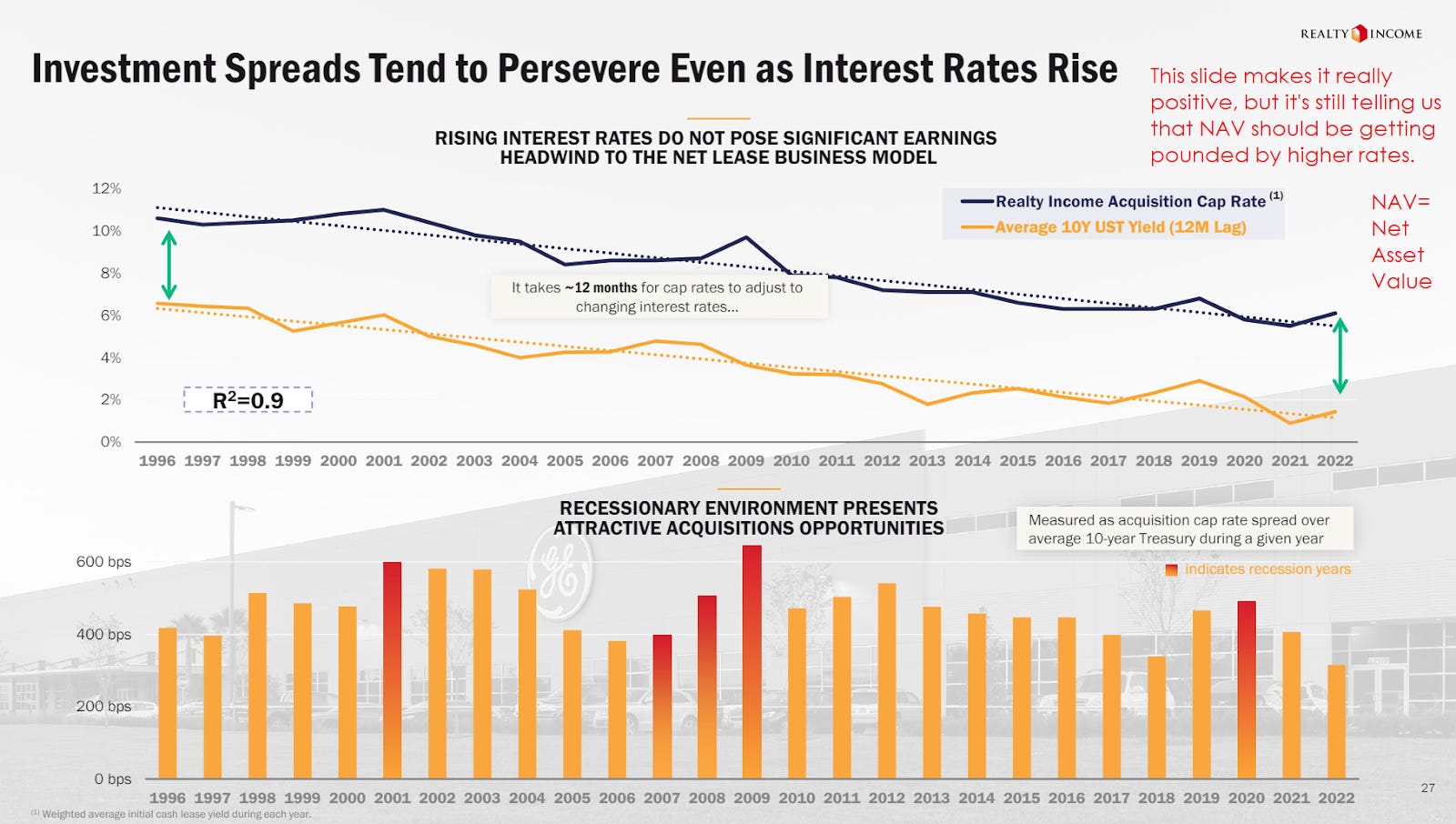

O argues that it doesn’t really impact them because higher rates should allow them to acquire properties at higher cap rates.

That is world class polishing for the turd.

This also ignores that higher rates drive higher costs for refinancing maturing debt, which creates an additional headwind to AFFO growth.

- Is O getting so big that growth will be slower than in the past, as other analysts have asserted.

Yes and no. It depends on how far we’re looking into the future.

Realty Income argues that the investable market for net lease assets is immense. That’s true, but we’re dealing with compound growth. It may not be a huge challenge in the next few years, but it’s still coming.

If we start with 2002 and end with 2023, the CAGR (compound annual growth rate) of total revenue was 17.8%.

Values in millions of USD:

- Total revenue increased from $129.93 to $4,081.54. That’s 31.4x the starting value.

- If O manages to sustain that rate for another 21 years, the gross revenue would be $128,215.

That would suggest around $2 trillion of net lease real estate. Currently O estimates that the potential global net lease market is $13 trillion. Of course, the market should grow. But it will be hard to be as careful with acquisitions.

In the final year of our hypothetical (21 years from now), O would be looking to acquire over $300 billion in net lease real estate. The acquisitions would be more than 4 times the current Realty Income portfolio. To be fair, thanks to inflation, it wouldn’t really be 4x the amount of real estate. However, it would still be massive. Akin to acquiring at least 2 Realty Income’s in a single year.

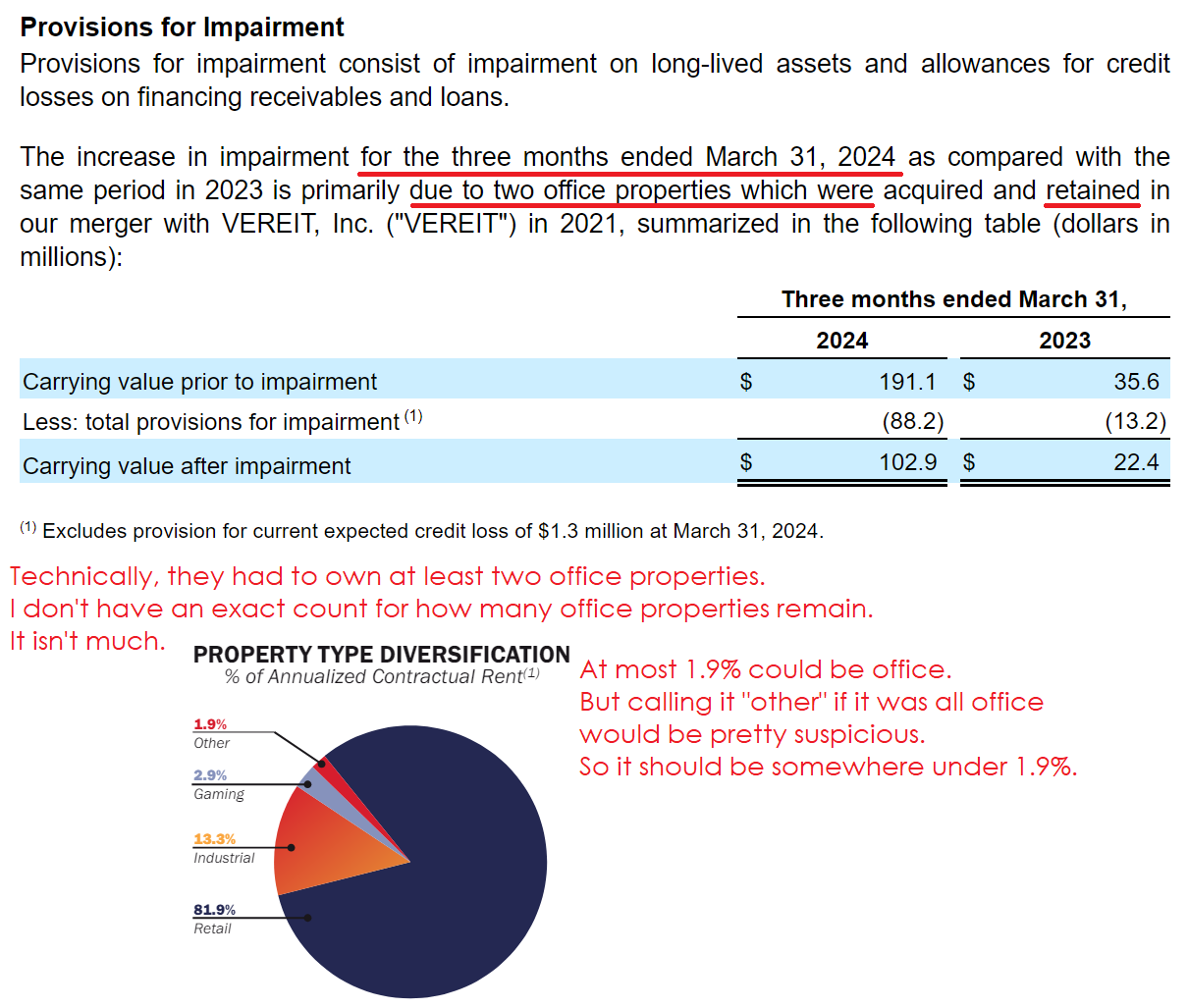

- Has O completely exited office?

Technically “no”. But they are so close it doesn’t really matter much.

- Is O trading as much, or more, on its legendary success reputation than the likelihood it can sustain that success?

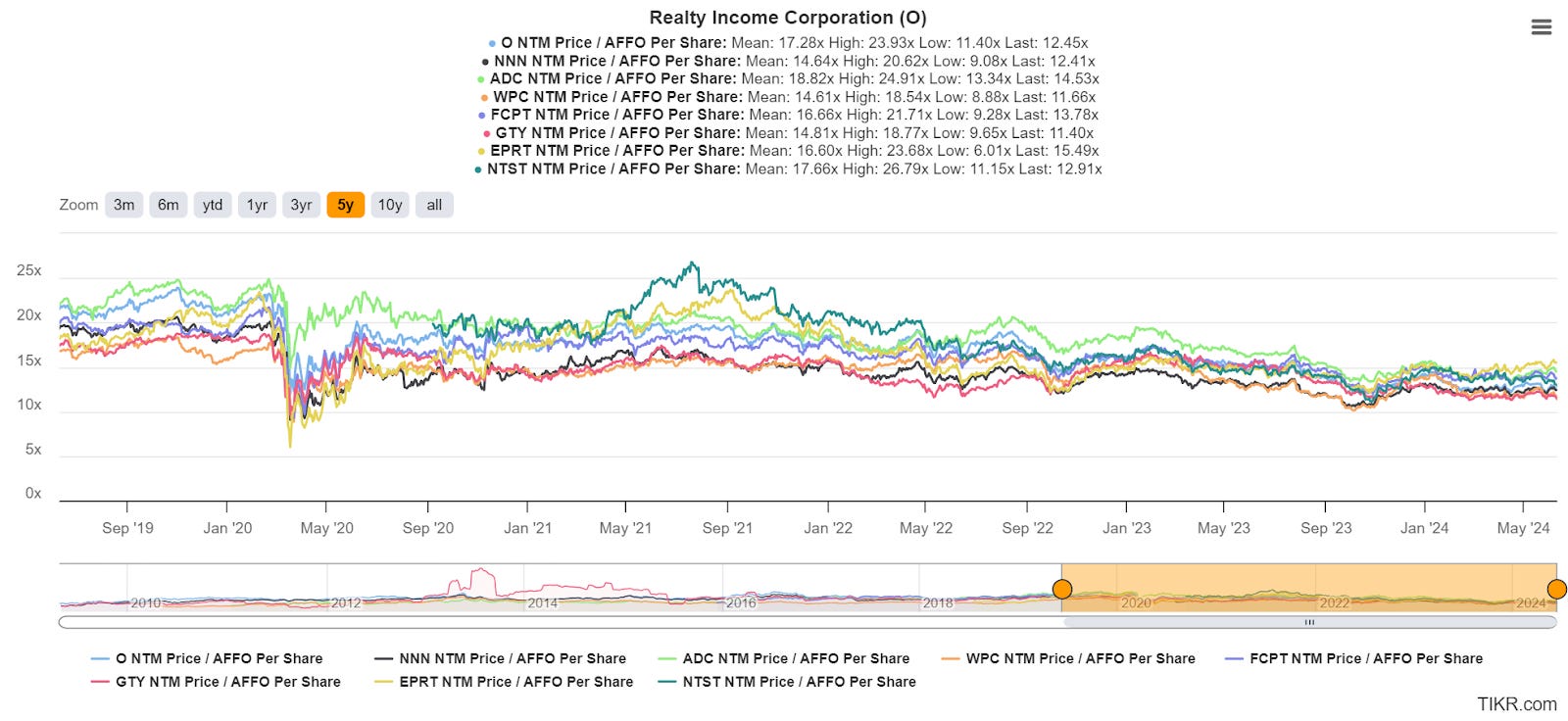

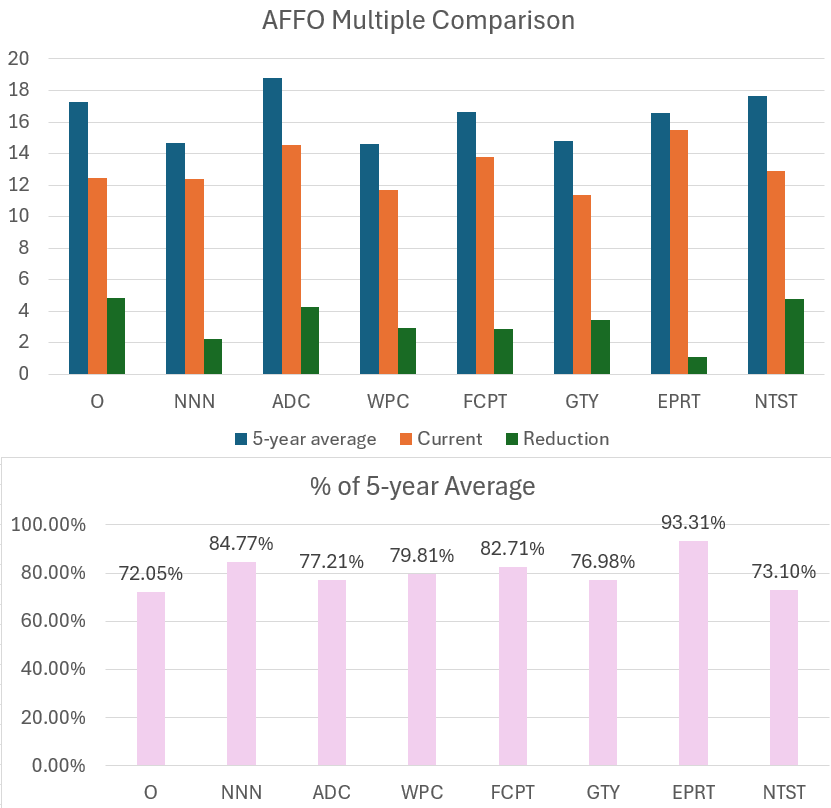

Seems like an easy question. Actually, it's pretty hard. Quick test using AFFO multiples over time for several net lease REITs:

Okay, that chart is actually pretty hard to read. The lines overlap too much. There’s too many lines and the chart isn’t tall enough. I love using TIKR.com, but I need to transform this data:

O is currently trading at the largest discount to their 5-year average AFFO multiple. It’s a close competition, but O has a bigger discount.

Therefore, I can’t say O is just trading on historical success.

However, I do think the net lease sector is a bit less attractive, on average, than some of the other sectors.

- What are equal or better net lease REITs for now and into the future.

I tend to like Agree Realty (ADC) and National Retail Properties (NNN).

O has the edge on price though, especially relative to NNN.

I think the AFFO multiple comparison here is pretty relevant. O fell harder. ADC fell, though not quite as hard. NNN fell materially less.

One part of the smaller decline for Essential Properties Realty Trust (EPRT) is the smaller 5-year average. They were a smaller net lease REIT and their multiple got smashed during the pandemic. You can look back at the TIKR chart and you’ll notice the mustard-colored line clearly runs at the bottom during the shutdowns.

- Is their purported size and WACC (Weighted Average Cost of Capital) advantage truly an advantage ?

Yes and no. The size can be a potential challenge to achieving the same growth rate. However, it hasn’t been a big challenge so far.

The WACC is definitely an advantage. Realty Income has an outstanding balance sheet and access to international markets for raising debt and finding acquisitions. Cheaper debt is really nice. This isn’t so much about the rate on existing debt as the rate available for issuing new debt. O can raise debt at a lower interest rate. That makes it easier for acquisitions to be accretive.

- What would it take for O to grow AFFO by 5%?

I’m assuming this is based on AFFO per share. Growing total AFFO is really easy. Just acquire properties.

To get AFFO per share up by 5%? Time. AFFO per share should still be growing, despite the higher rates (vs. the last two decades).

I expect it to be growing quite a bit slower though.

What O really wants to is to be in negotiations for properties, then get a chance where interest rates dip and the price bumps higher. If they could get that scenario for raising a few billion in capital with acquisitions already lined up, that would be great for them.

- If you had 10 grand to invest in either O or ADC which would you choose and why?

I was going to punt on this one, at least until we get the next set of target updates done. The difference in discounts (to our targets) between O and ADC is only 6% (favoring O). I checked the recent price history and it also favors O by a small margin. So I’ll pick O by a small margin.

Current prices for future reference:

- O: $52.70

- ADC: $60.17

- Prefer O or WPC or neither?

I’m going to punt on this one. WPC’s decision to slash the dividend and do a spin off no one wanted (all without including shareholders) was stupid. I slashed WPC targets immediately and called for a “dumb management discount”.

Since then, WPC has underperformed so thoroughly that they ended up with the largest discount to our targets.

I wrote about the decision immediately and I recently removed the paywall:

Management predicted that the market would “rerate” them after the transaction.

Technically, I agreed. They earned a “rerating”. They just didn’t understand the market would “rerate” them as a REIT with stupid management. They were just hitting dividend champion status (25 years of consecutive increases) when they wasted it.

Let's assume that:

The inflation is higher than stated by PPI and CPI

The US cannot tax away the ballooning debt

It CAN pay off the debt by inflating the dollar away or we might not have a choice if countries dump dollar and stop using it for oil trades so the dollar devalues.

Are NNN companies well positioned for such a move, or are they a terrible idea if their long term leases have fixed increasing prices?

Well, let’s run it point by point:

A. I used to think the gap was tiny. I was wrong. The gap is material. I don’t agree with the invisible “quality” adjustments.

B. Seems like a given. The middle class can’t afford to pay it off. Noone substantially raises taxes on donors without creating loopholes.

C. Inflation is the only way we have left to handle the debt.

Rant Interlude

If we (the United States) don’t inflate away the debt, debt service costs will strangle GDP growth. The government will just keep taxing the middle class to pay compound interest on money that was wasted years ago. I thought the government figured this out. Negative real rates are the only way to control the debt. I’m all for reducing spending, but you still can’t get the budget balanced. Not unless you’re willing to slash Social Security (world’s biggest Ponzi scheme), Medicare, and Medicaid. Political suicide.

Want to completely eliminate the military? No thanks. Peace through strength is cheaper than war.

Back to the question.

Are triple net lease REITs in a good position to handle that scenario?

No. Long-term leases contain either fixed-rate escalators or CPI escalators. They may also contain a mix. However, the CPI increase is often capped. No, you can’t carry the CPI increase into future years for higher increases. It would be nice, but that typically is not in the contracts (per some net lease management commentary while inflation was surging).

So if you assume actual prices will increase at a significant rate, that’s automatically bad for net lease REITs. Exceeding CPI is also worse.

There are 2 silver linings though:

- Net lease REITs that are actively acquiring properties will be getting them at market rates.

- If the government embraces quiet inflation, it only works if interest rates are reduced substantially.

If real rates (inflation-adjusted interest rates) are positive, especially over 2%, then inflating debt doesn’t work at all because the interest compounds faster.

Conclusion

Well, 13 questions seems like a lucky number. Oh well.

If it turns out reader questions are a popular feature, I may do them more often.

Let me know what you think of having the occasional article for covering reader questions on a stock.

This article is free.

You can share it:

Or at least hit the like, comment, or restack buttons. Pound all 3 for bonus coolness points. We’re just trying to teach Substack to pump up visibility for our service.

Member discussion