Rapid Preferred Share Updates

- We still own CMO-E, but the company is in the process of being bought out. We expect to close the position in the next 1 to 2 months.

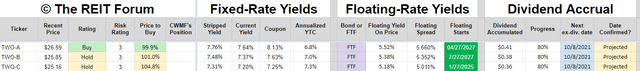

- TWO-A has quite a premium to call value, but still looks pretty good. Yield-to-call remains attractive. Exceptional yield may be partially offset by a gradual dip.

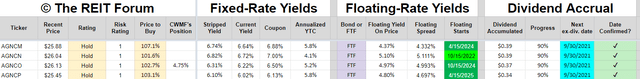

- AGNCN was materially less attractive than peers over the last year, but that’s changed. Now AGNCN is slightly ahead of AGNCO. On the other hand, AGNCM is still inferior to peers.

- NLY-G still looks expensive compared to NLY-F. Investors may hope NLY won’t call NLY-G, but their attitude could change when that low floating spread kicks in.

If you’re new to seeing our content on Substack, we encourage you to subscribe to our e-mail list. It’s free and it means articles like this get delivered directly into your inbox.

To be clear, we’re not just talking about a link to the article. The entire article is sent to you so you can read it on any device you want. No ads. No spam. The e-mails look just like this webpage.

How can it be free?

We have a paid service that covers the cost to produce our research. We don’t need to make money off the public release. Some of the people who enjoy our free content decide to purchase full access to all of our research. That’s the model. That’s why we don’t need advertisers in our articles or e-mails.

Article Starts

We’ve adjusted preferred share targets. The average change is an increase of 1.3% with the range running from 0% to a high of 5%. The largest increases were for higher-risk shares that are still well outside our target ranges. We want to focus on highlighting a few opportunities.

NRZ-D

You’ve probably already seen our report on NRZ-D (NRZ.PD) and the subsequent alert for our purchase. That’s been discussed enough, so we’ll move to other topics.

CMO-E

Capstead (CMO) is in the process of a buyout. We won’t have coverage on the common shares afterward and will probably cut the coverage on the preferred share. However, we still own CMO-E (CMO.PE) presently and expect to own it through the next ex-dividend date, which is expected to be 9/29/2021.

After that, we may look to close it out if we can get a moderate premium to call value. Some investors may want to use it for a potential dividend capture if we see any weakness in the price. Others may opt to close out positions since they like to trade ahead of us. This is the advance notice that I’ll probably close this position in the next month or two, so long as prices are at a modest premium to “call value + dividend accrual”.

If the market gets a bit wild with equity indexes falling, then I might accept a slight discount to call value to free up the cash.

TWO-A

Two Harbors (TWO) still has 3 series of preferred shares. TWO-A (TWO.PA) is the best deal currently with TWO-B (TWO.PB) slightly behind. TWO-C (TWO.PC) is behind by about 3.8%. What do investors like about TWO-C? The premium to call value is materially smaller. Adjusted for dividend accrual, the stripped price (that’s the regular price minus the dividend accrual) is below $25.00. That’s $25.16 minus $.36 of accrual implying a $24.80 stripped price.

A smaller premium to call value is nice, but the dividend rates on TWO-A and TWO-B are materially higher, they have more call protection for longer, and when call protection ends TWO-A and TWO-B get better floating spreads. Those factors combine to be attractive enough to make TWO-A and TWO-B more appealing than TWO-C at current prices.

Source: The REIT Forum

Investors who favor the higher yield to call may prefer TWO-C or at least see the race as being a bit closer. We can’t say whether shares will be called or not, so we set our price targets to reflect the potential that a call might happen or might not happen. If a call was certain, it would favor TWO-C. We would expect the price of TWO-a to gradually decline over the next few years to partially offset the exceptionally high coupon rate.

AGNCN

Looking at the preferred shares from AGNC (AGNC), we are turning our attention to AGNCN (AGNCN). That’s currently the most attractive share, though the margin isn’t huge.

Source: The REIT Forum

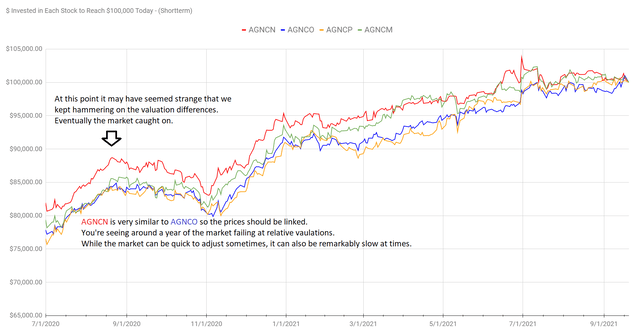

So how did AGNCN become more attractive than peers? It underperformed materially. Over the last year, AGNCN underperformed by peers by about 5%. The easiest way to visualize that is with the $100k chart to see how much needed to be invested on any prior day to reach $100k today:

Source: The REIT Forum

That was a long period for the market to be failing. If you find that crazy, AGNCM (AGNCM) is still overvalued relative to AGNCO (AGNCO) and AGNCP (AGNCP). If we’re right (as we usually are on these issues since they are primarily just a math equation) AGNCM’s price should underperform. When that happens, a dip in the current price pulls the line upwards across the history of the chart to demonstrate the underperformance.

How can we be so confident? Would you rather have a floating spread of 4.332%, 4.697%, 4.993%, or 5.111%? You probably didn’t pick 4.332% because more money is better than less money. So why is AGNCM’s price still so similar to AGNCN and AGNCO? Why is it still $.41 higher than AGNCP? Investors who don’t think about the eventual floating rate are overpaying for current yield. They did that with AGNCN also. As the floating date (same as the callable date, 10/15/2022) approaches some of the investors began to catch on and the price began to underperform. AGNCM’s floating rate won’t kick in until 4/15/2024, but the same basic scenario should play out.

Investors who own AGNCM could still look at selling the shares to buy an alternative like AGNCN or AGNCP. It's still a reasonable trade, though it's less of a home run than it was for the months we kept hammering on the idea.

NLY-F vs NLY-G

NLY-F (NLY.PF) will be the first share (among those we cover) to hit the floating rate on 9/30/2022. Shares are trading at $25.52. NLY-G (NLY.PG) is trading at $25.50 and hits their floating rate about 6 months later on 3/31/2023. For NLY-F the spread will be 4.993%. For NLY-G the spread will be 4.172%. What sounds better? Paying $25.52 and getting a spread of 4.993% or paying $25.50 and getting a spread of 4.172%? That difference will equate to about $.20 per share per year when both shares are floating. Maybe NLY-F gets called and NLY-G doesn’t? I’m not convinced shareholders of NLY-G would be happy about not getting called when that 4.172% spread kicks in. If short-term rates were 25 basis points (that’s 0.25%) investors would have an annualized dividend of $1.1055, down from the current annualized rate of $1.6875. That would be a dividend reduction of more than 34%. Think NLY-G shareholders will still want those shares? I’m not convinced. If they want to sell NLY-G, they get the market price which could be less than $25.00.

Thank You For Reading

If you enjoyed this article, please feel free to forward it to friends.

Got feedback? You can hit the reply button on the e-mail and your letter goes straight to me. If something wasn’t formatted correctly in your inbox, please let me know. The ability to send the entire article out via e-mail, without advertisements, was a major part of my decision to use this platform.

Member discussion