Prologis Plunging: Quick Notes

Prologis (PLD) $PLD is getting hammered today. Rexford (REXR) $REXR is also down. PLD reduced guidance (that's been extremely rare) in the Q1 2024 update (this morning).

Brief Earnings Call Note

PLD management says demand is being pushed back (delayed) a bit. Expecting leasing slightly later in the year.

Lists higher rent markets as the more challenging. The highest rent market is Southern California (where REXR operates).

Highlights that private party valuations for industrial assets are down (makes acquisitions more attractive).

PLD emphasizes that their expectations 2 to 3 years out are unchanged. They are reducing guidance for this year, but still expect the leasing to happen.

Customers are a bit concerned about signing new leases until they see the all clear from the Federal Reserve. Until then, some tenants are concerned about committing to new leases because of macroeconomic risks (Fed induced recession).

PLD cut guidance for new development starts by $500 million.

Old development guidance: $3.0 to $3.5 billion.

New development guidance: $2.5 to $3.0 billion.

That’s positive for further reducing supply in the upcoming years.

REXR Implications

REXR is scheduled to report today after the close. Based on commentary from PLD, I wouldn't be surprised at all if REXR reduces guidance.

REXR’s decision to issue those shares (at $48.95 a few weeks ago) is suddenly looking much better (shares $42.42 today).

Given the commentary on Southern California, I think the consensus NAV estimates on REXR may have been a bit too high. Expect those to dip.

If REXR drops guidance on Core FFO (in line with the idea of Southern California having slower rent growth and leasing), it could bring prices down.

I’ve been building up our cash allocation, so I may put some of that to work. I was thinking about putting it to work today but decided to wait for the results.

Depending on the magnitude of the change, I might be a buyer in that environment.

Based on sentiment and the swing in rates, we could see a modest reduction in PLD targets. However, even if we apply a small reduction, shares would still be firmly in the bullish range for PLD, REXR, and Terreno (TRNO) $TRNO.

Industrial Sector

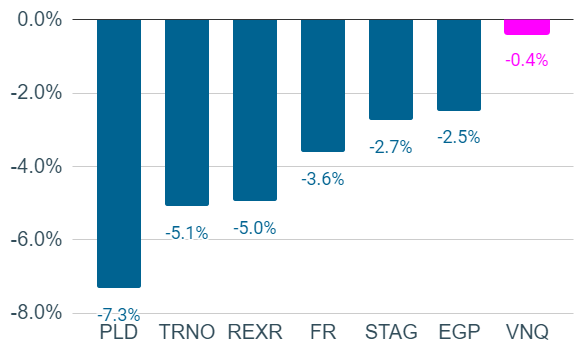

Industrial REITs are all down.

The Vanguard Real Estate ETF (VNQ) is barely down.

Note: It turns out Substack is giving the wrong change in price on the day. VNQ is down about 0.38%, not 1.03%.

Here’s a chart showing the declines by REIT.

Terreno is getting hit hard along with PLD and REXR because TRNO is focused on high-rent markets. It isn’t all Southern California, but they are focused on the high-rent markets. Those markets tend to have massive barriers to new supply, which is driving much faster growth on average.

I would like to have another update out after we see the results.

Thanks for reading!

Member discussion