Preferred Shares: What To Buy And Sell Amid The Market Disruption

By popular subscriber request, preferred shares were moved to the top of the priority list. We’re going to cover which shares are better values than their peers and which are worse. If you own anything in the list, you’ll be able to see if there is a closely related peer offering a better value.

We’re going to cover preferred shares from Chimera Investment Corporation (CIM), New Residential (NRZ), Two Harbors (TWO). We are long common shares of NRZ, along with preferred shares NRZ-D and CIM-A.

Prices in the charts and discussion are from Friday’s close (paid release over the weekend). The conclusion section updates our outlook to use prices from the close on Wednesday, 2/16/2022 (about 30 minutes ago).

CIM

CIM-B (CIM.PB) vs CIM-C (CIM.PC) and CIM-D (CIM.PD) is the real debate here. We favor CIM-B. Easily. All 3 shares carry at least a moderate discount to call value (plus quite a bit of dividend accrual). When each of these shares has switched over to a floating rate, CIM-B’s spread is the largest and the margin is wide enough to matter. Investors in CIM-C ($24.44) or CIM-D ($24.92) should be looking to swap for CIM-B ($24.87).

CIM-A (CIM.PA) trades above $25.00, but it’s actually quite a bit below call value when we adjust for dividend accrual. The coupon rate is 8% (paying $.50 per quarter), so with the dividend accrual the stripped yield is 8.07%. That’s high enough to leave me unconcerned about increasing Treasury rates. However, CIM-A is still materially different from the other CIM preferred shares. CIM-A is also exposed to call risk as the REIT could call shares and force investors to eat the capital gain.

Since CIM-A is in a different boat, we’re just contrasting CIM-B, CIM-C, and CIM-D with CIM-B as the clear winner at current prices.

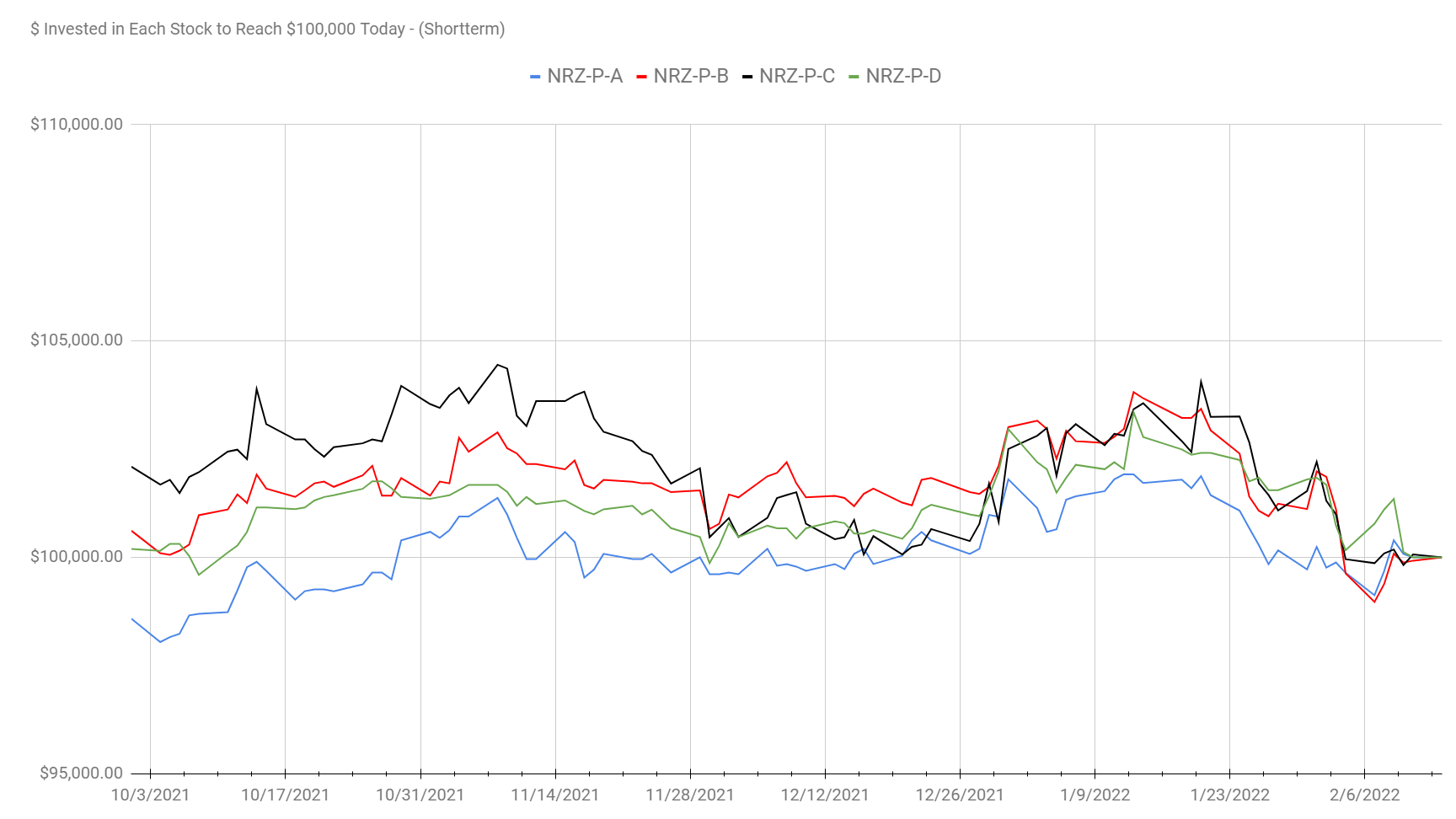

NRZ

Contrasting NRZ-A (NRZ.PA), NRZ-B (NRZ.PB), NRZ-C (NRZ.PC), and NRZ-D (NRZ.PD) gives us a few observations. NRZ-A offers less value than any of its peers. While valuations have been comparable at times, NRZ-A simply didn’t dip as much as peers.

We aren’t labeling NRZ-A as less appealing simply because it dipped less though. For several months we felt the relative pricing between NRZ-A and NRZ-B was very reasonable. It’s only the recent shift around early February that throws the valuations out of alignment. Investors in NRZ-A would be better served by changing shares. We would favor NRZ-C or NRZ-D as the target.

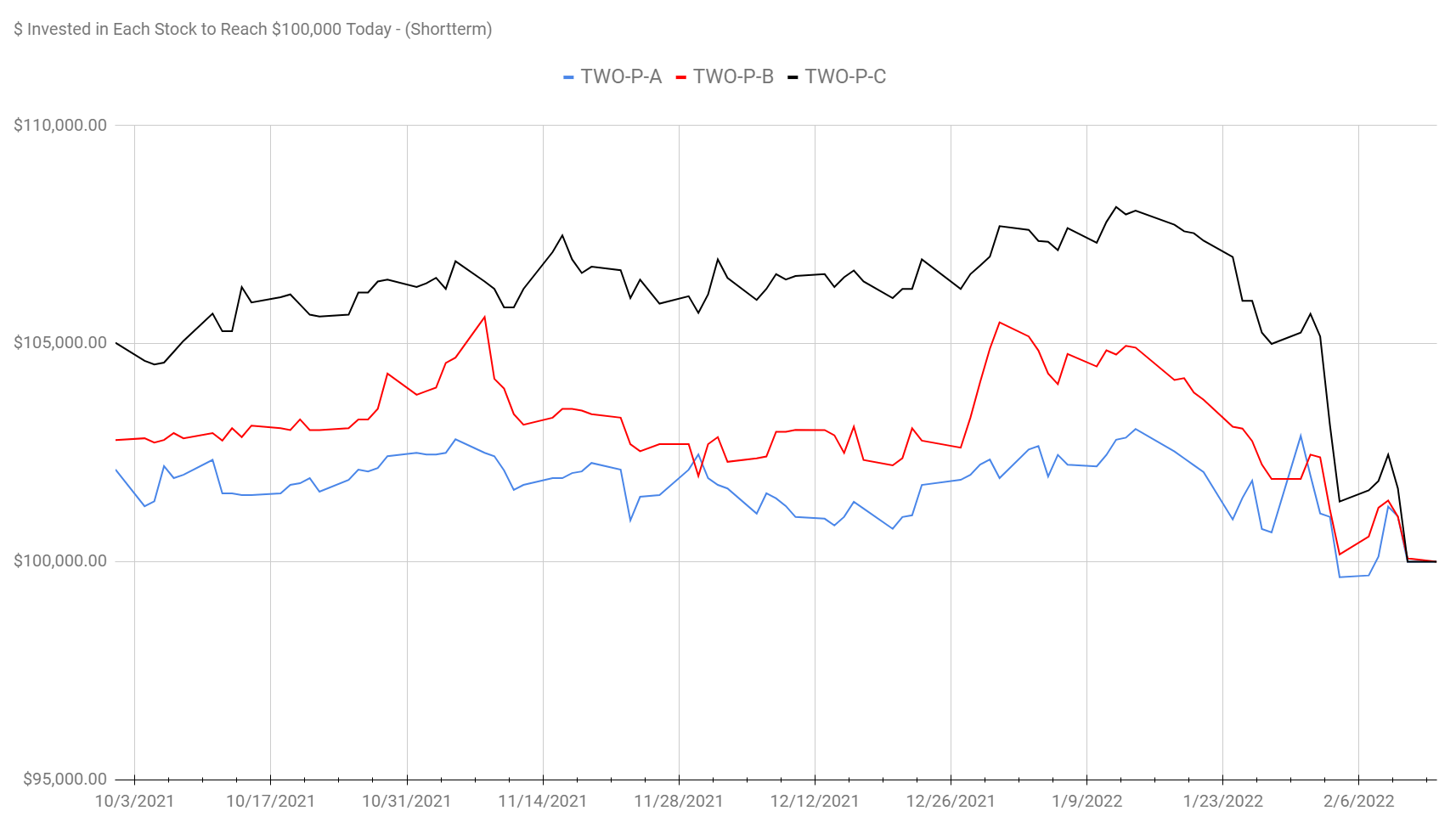

TWO

TWO-A (TWO.PA), TWO-B (TWO.PB), and TWO-C (TWO.PC) are trading pretty close to each other. On a fundamental basis, you could pick any of the three. However, for technical reasons, you should pick TWO-C at $23.25 over TWO-A at $25.34 or TWO-B at $24.26. When the sector recovers, TWO-C should see significantly more upside as the market regularly awarded shares a valuation that was a bit too high compared to peers:

Conclusion

Using updated prices for Wednesday’s close:

CIM-A is down slightly, further improving the call protection granted from shares trading at a discount to call value (when adjusted for accrual).

CIM-B is up $.10. Compare that to CIM-C up $.21 and CIM-D down $.21. Since we favored CIM-B over CIM-C before the latest changes, swapping out of CIM-C to buy CIM-B is an even stronger call.

NRZ-B and NRZ-C are up about $.30. NRZ-A is up $.04. Yet NRZ-D is down slightly. Investors in NRZ-A would be well served by switching to NRZ-D. Swapping for NRZ-C became slightly more difficult due to the shift in prices.

TWO-A and TWO-B are down slightly, while TWO-C rallied by $.66. That makes TWO-C less appealing as a core part of our thesis for TWO-C over TWO-A and TWO-B already played out.

So what do we think of mortgage REIT preferred shares overall in this environment? We’re seeing vastly more bargains in the sector than we’ve seen in a long time. This is a group opportunity for investors to begin building positions again.

Thank you for getting our letter and reading it.

If you’re reading this on the website, you can get the entire article e-mailed to you by subscribing here:

This is a free release of part of our research that doesn’t make its way onto Seeking Alpha’s public side.

If you also follow us on Seeking Alpha, we’ll be releasing an article on the tower REITs soon.

Member discussion