Portfolio Update - January: Another Winning Year Complete

- Performance for 2023 came in at 20%. The sector ETF average was 12.2%, leading to alpha of 7.8%.

- We beat the average for the ETFs 7 times in 8 years. Cumulative return over 157% vs. just over 30% for the average of the 4 ETFs we compete with.

- We had a few trades in December to adjust our exposure within sectors.

- We also closed our largest preferred share position. I’ll be looking to redeploy that cash. Brief notes article coming soon.

- We modified the order of sections to improve experience across platforms.

Note: If you enjoy the series, please consider tapping the heart icon. It helps to improve our visibility on Substack.

Article Starts

One of the series we provide on our premium service is the monthly portfolio update.

There’s often a public preview that contains a significant preview. Older editions are often unlocked for everyone.

You can find prior installments of the Portfolio Updates on the Portfolio tab of our website:

This kind of filtering system doesn’t exist on Seeking Alpha, so it is only available through our website (which currently runs on Substack).

Layout - Modified Order

To keep things simple for our investors, the portfolio update is divided into several segments. We run the same segments (with new content) each week. We usually maintain the same order from month to month, but I’ve revised the order to work better with free previews.

- Returns on Total Portfolio

- Outlook (we skip it some months)

- Foreshadowing Potential Trades

- Trade Alerts (links to trades)

- Returns on Recently Closed Positions

- Returns to Date on Open Positions

- CWMF’s Portfolio Images

- Sector Allocation

- Conclusion (we may skip it if we had an outlook section)

- Reminder About Cash

- Strategy (Repeated) - This explains how we invest. It helps investors understand why we place the trades we do.

Returns on Total Portfolio

The chart below shows our performance since we began preparing for The REIT Forum at the start of 2016 through the end of the month:

There are four major index ETFs we use for evaluating performance. They are:

- MORT - Major mortgage REIT ETF

- PFF - The largest preferred share ETF

- VNQ - The largest equity REIT ETF

- KBWY - The high-yield equity REIT ETF most retail investors follow

Annual comparison vs. each ETF:

Another solid year. I still hear investors saying we should just be sitting in cash until Powell tells us it is time to buy REITs. I’m happy with 20% on the year. I think 20% is much better than the 4% to 5% we would’ve had from sitting in cash. However, I tend to like bigger numbers.

My goal wasn’t to do 20% for the year. It just turned out that way. My goal was to pick the stocks with the best risk/reward profiles in the sector. That worked. Our portfolio generally went up and down in the same months as the sector ETFs. Despite the correlation, we still outperformed. We didn’t do it by taking on extra risk. In 2022, we outperformed the sector as it declined. This isn’t one of those “higher beta” strategies.

Every new investor should be conditioned to buy index ETFs and hold them indefinitely. That should be the standard strategy for a new investor. Simply put, the majority of active investors underperform. If you have a friend who doesn’t know stocks, the first thing they should do is dollar cost average into a low-fee index fund with their retirement accounts. Just max out contributions that way. That’s the first step.

We could do that, but we are not the majority of active investors. We have a clear record of delivering better returns than our sector. Will we beat the index ETFs next year? I do not know. But we’ve smashed them since inception. The total returns demonstrate that clearly. Looking at individual years, we won in 7 out of 8 years. I like to think we’ve got a good chance to do it again in 2024, but future performance is never certain.

The next chart shows the change in the value of our portfolio from month to month. We strip out the impact from contributions made during the month because, obviously, contributions are not returns.

The prior year is included as well to help investors see how the calculations work.

Outlook

We have moderate recession risk, and interest rates continue to produce macroeconomic risks. Lower rates would be better for business conditions and would be better for the insane level of federal debt. If rates continue to go down, that would be very positive for equity REITs. It would probably be seen as positive for mortgage REITs, though the rate of change is still important.

However, we have to wonder how far the Federal Reserve will actually lower rates without a recession in progress. They have generally been waiting until the evidence is clearly visible in the rearview mirror. It seems unlikely that we will see rates fall as quickly as the forward curve has been predicting without a recession.

Of course, the term “recession” has been defined to mean when a government agency retroactively declares a recession. Perhaps we need a new word to refer to the concept?

I increased cash in December, but I’ll probably put the cash to work in January. Recession risks are present, but we’ve made quite a bit of money trading preferred shares through different environments.

Foreshadowing Potential Trades (Exclusive Portion Begins)

This image will get more epic each month. This is level 2:

Note on target updates:

- Net lease, residential (housing) REITs, and tower REITs are already done. Because they were done while Treasury yields were higher, those sectors could see modest increases.

- Industrial adjustments were just completed last week. Other REITs should be biased toward negative adjustments.

- Preferred share target updates were also completed in December. That is in addition to the ex-dividend adjustments, which are automatic for preferred shares.

This section is usually prepared shortly before publishing. The goal is to quickly cover ideas for trades. We aim to foreshadow our trades here, though the market may move in surprising ways. While the article takes days to prepare and documents prices and performance from the end of the month, the potential trades section is written last to provide the most up-to-date pricing.

Based on the change in relative prices as of 01/02/2024 (during market hours), here are some of the trades on my radar.

Foreshadowing potential equity REIT trades

I’m not expecting to increase my weight here materially in January unless we see some dips. It isn’t out of the question, but it isn’t a priority. Our equity REIT allocation is pretty heavy already. Over 49%.

Housing REITs: I mentioned Mid-America Apartment Communities (MAA) $MAA last month. It jumped a bit shortly thereafter. However, it’s still on my radar. I might wait until after Q4 results and guidance come out. If I have enough time, I may also do some comparisons on consensus forecasts in the sector. I want to see how guidance matches up with those forecasts. Remember that apartment REITs are going to be dealing with a massive flood of new supply. That should persist into 2025.

In an efficient market, that would be priced in years in advance. However, we’ve found the market cares much more about the next 3 to 12 months than it does about the next 5 years.

We’re expecting apartment leasing spreads in 2025 to be pretty bad. This should also cause a headwind for growth in AFFO and FFO per share. However, forecasting can be a bit tricky.

Apartment REITs are often developers.

To keep it really simple, new developments can have a temporary negative impact on FFO and AFFO per share depending on how quickly properties are leased and how the financing is structured. This was less noticeable in years with fewer completions and lower interest rates.

Towers: During December, we moved part of our tower REIT investment from Crown Castle International (CCI) $CCI to SBA Communications (SBAC) $SBA. I think Elliott’s success bodes well for CCI because I believe Elliott’s strategy for the REIT is superior to the strategy management was pursuing. I wrote a few articles about this in December. I don’t currently anticipate any changes to our positions in CCI, SBA, or American Tower (AMT) $AMT.

Industrial: In our prior update, I mentioned how Terrno (TRNO) $TRNO was becoming more attractive relative to Rexford (REXR) $REXR and Prologis (PLD) $PLD because TRNO had rallied far less. I followed up on that several days later by swapping part of my position in PLD for more TRNO. I don’t anticipate further changes. However, I should mention that TRNO is at $62.79. That’s about $.20 below the price from our latest purchase (12/19/2023). It very slightly underperformed PLD (up about $.32) during that period. Therefore, the idea of swapping from PLD to TRNO is still viable.

We still own some PLD. Nothing wrong with the REIT. I simply found TRNO’s valuation a bit more enticing.

Other: Alexandria (ARE) was on my radar. Then it popped from about $117 during the prior update to $130.48. That’s up 11.5%. Add in the December dividend to reach 12.6%. Still on my radar. Still undervalued. However, not as compelling after it returns 12.6% in about 3 weeks. Yes, interest rates were falling. Sure, that’s nice. However, ARE has exceptionally long debt maturities and almost all debt is fixed-rate. Consequently, they are less exposed to fluctuations in interest rates. Therefore, lower interest rates shouldn’t be as important to them as it would be to some other REITs.

Foreshadowing potential BDC trades

Probably not entering any trades here in the immediate future.

Foreshadowing potential mortgage REIT trades:

Still considering Ready Capital (RC) $RC. The dividend cut a few weeks ago was disappointing though.

The sector has been wild lately. Too hard to try to predict potential moves over the next month. See the weekly updates for more insight.

Foreshadowing potential preferred share trades:

We closed out our CIM-B (CIM.PR.B) (CIM.PB) position in December. Since CIM-B was our largest preferred share position, that resulted in having quite a bit of cash. I’ll probably be hunting for opportunities to put that cash to work in preferred shares again. For the last few weeks, it was just sitting in a Treasury bill ETF. It earned a bit of interest, but trading preferred shares is often a big factor powering our total returns. While cash can be really nice if the market declines, we don’t want to be sitting in cash for long.

Trade Alerts

There are links to each of my trades below.

I used to swap the links depending on which platform I was publishing to. However, that created a risk of me forgetting. Now, I’m simply including both.

Please use the link that matches your platform.

Our website (Substack) links:

Seeking Alpha links:

Note: On Substack we’ve been able to segment our articles based on themes. The “home” tab includes everything.

However, the other tabs are like a filter that only includes that kind of article.

I’ll probably add a few more segments. For instance, we can create a section for earnings updates. I may also want to create a section for price target updates. The mREIT and BDC targets are all covered in the weekly series, but I don’t have a grouping yet for equity REITs and / or preferred share target updates.

Returns on Recently Closed Positions

These are the positions closed since the last portfolio update. If you want to see positions that were closed before that, you can see the prior portfolio updates or use the Google Sheets. If we didn’t close any positions for the sector during the month, then the image will be blank. Note: By loading the Google Sheets, you can still see all of our closed positions. To reduce the size of the huge article, we’re only highlighting the recent changes.

Preferred shares and baby bonds:

Equity REITs:

Mortgage REITs and BDCs:

Other:

Returns to Date on Open Positions

We will start with the open positions as of the end of the month. It often takes a few days to prepare this article, but the screenshots below are from the end of the prior month.

The cell with the ticker is grey if the position is in a taxable account. This was a request by a few members and there was no drawback to adding the information. All of those positions are in equity REITs.

Preferred shares and baby bonds:

Equity REITs:

Mortgage REITs and BDCs:

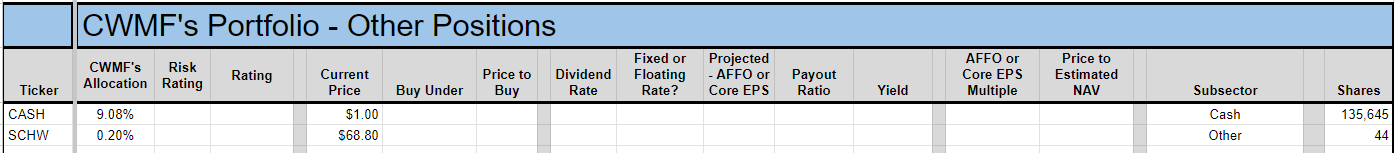

Other:

CWMF’s Portfolio Images

These images use the data from the end of the month. That includes the prior price and prior targets!

Preferred shares and baby bonds:

Equity REITs:

Mortgage REITs and BDCs:

Other:

Sector Allocation Chart

The sector allocation chart helps to explain how we are thinking about risk and seeking returns:

Conclusion

This section was replaced by the Outlook section for this month.

Reminder About Cash (Repeated)

Finally, I would remind investors to make use of short-term Treasury ETFs. These are a perfectly suitable replacement for cash if you expect to know you’ll need it a few days in advance. I would normally keep at least 6 months (often more) of living expenses in cash. If you normally keep around $40k to $50k, the difference between getting paid 5% and 0.2% is around $2k per year. I’m using (SGOV) and (SHV) as my cash substitutes. Another good option is (BIL). When cash is needed, I’ll transfer it from the brokerage account over to regular checking.

Note: I use a separate account for holding this cash. It doesn’t get factored into my portfolio. It is functionally a checking account, but it is technically a brokerage account capable of owning shares. There are some alternatives for money market funds as well. Just beware of leaving significant amounts of cash in a near-0 yield checking account.

Strategy (Repeated)

For new subscribers, we should emphasize that we often treat our positions differently. We have those we consider as being primarily “Trading” positions and those where we prefer to “Buy and Hold”. A simple way to remember it is that anything with a high risk rating is probably going to be a trading position. Most of those high-risk positions are mortgage REITs and BDCs. These are two very challenging sectors where most investors (and “analysts”) simply don’t get it. Analysts who can’t predict the changes in book value for mortgage REITs or NAV for BDCs aren’t in a position to trade them. Analysts who don’t know how to evaluate the probability for dividend cuts (or raises) are in a weaker position for trading them. We have access to a great analyst (Scott Kennedy) who delivers exceptional estimates and price targets. If we only bought and never sold, we couldn’t reallocate to take advantage of the next disparity in valuations.

When we switch over to equity REITs, we usually have a long time horizon for investments. We’re thinking more about growth in AFFO per share and the long-run outlook for the sector. Consequently, we will pick REITs with lower risk ratings. The risk rating on an equity REIT correlates heavily with how much debt the REIT is using. That isn’t the only factor, but the correlation is strong. When debt levels are high, that alone can be a sufficient reason to assign a higher risk rating. Consequently, you’ll see us trading equity REIT positions far less actively. We will mostly wait for opportunities to buy a great REIT at an attractive price. We simply don’t want the mediocre equity REIT, not even at a low price. It doesn’t fit our strategy.

Preferred shares can be used in either way. However, you’ll often see our positions listing a “short” holding period. That’s because we frequently swap between different preferred shares that are at least roughly similar. For instance, we might sell NLY-F to buy NLY-I, then sell NLY-I to buy AGNCO, then sell AGNCO to buy NLY-F again. Why would we do that? They each have a risk rating of 1, trade at roughly similar prices, and will carry similar spreads when they begin floating. So what are we doing? We’re taking advantage of a change in the relative prices. By the time we’re back to the initial share, we are able to have more of them. If each time we traded between those shares we ended up with a 1% increase in the share count, we could end up with 3% more shares of NLY-F at the end of that trade than at the start. That leads to faster growth in the total portfolio. It appears that we’re selling the preferred shares quite often, but frequently it is just a change between two similar shares. We do this when we’ve found the spread in prices is large enough to let us exit one position and enter the next.

This may be different from the methods you’ve seen employed by other analysts. You may have joined us because you became tired of mediocre results. Our better results have been a function of our unique strategy.

Member discussion