PLD: Q4 2023 Solid Quarter, Strong Growth Continues, Expect Vacancy to Spike in 2024

Prologis (PLD) reported Q4 2023 results today. Results were pretty good, though Southern California is called out as a market that saw rents dipping after a few years of massive growth.

That’s negative for Rexford (REXR). On the other hand, their commentary references things improving in California today.

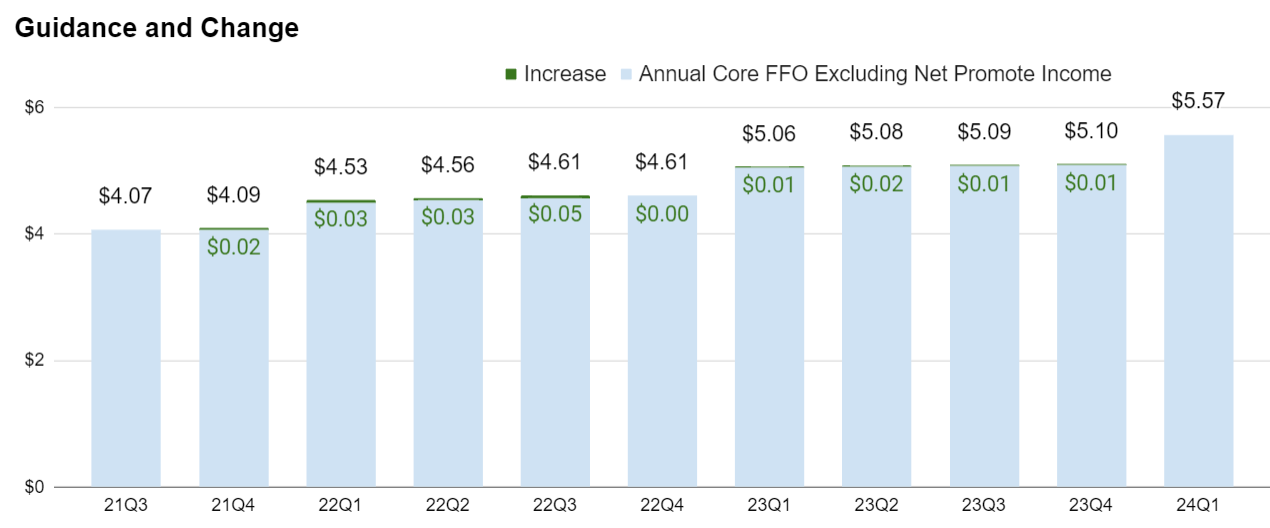

Guidance

The chart below allows us to track the annual guidance for Core FFO excluding net promote income. This is the most relevant FFO metric that PLD provides guidance on.

For Q4, the chart shows the actual Core FFO excluding net promote income for the year.

For 2023, it was $5.10 per share.

We already have a Q1 2024 value because it is the guidance for 2024.

The midpoint of $5.57 implies 9.2% growth year-over-year.

That’s strong. Industrial REITs have lower dividend yields, but much better growth.

Believe it or not, the chart is capable of including values to represent a decrease in guidance. It hasn’t happened in the last few years though.

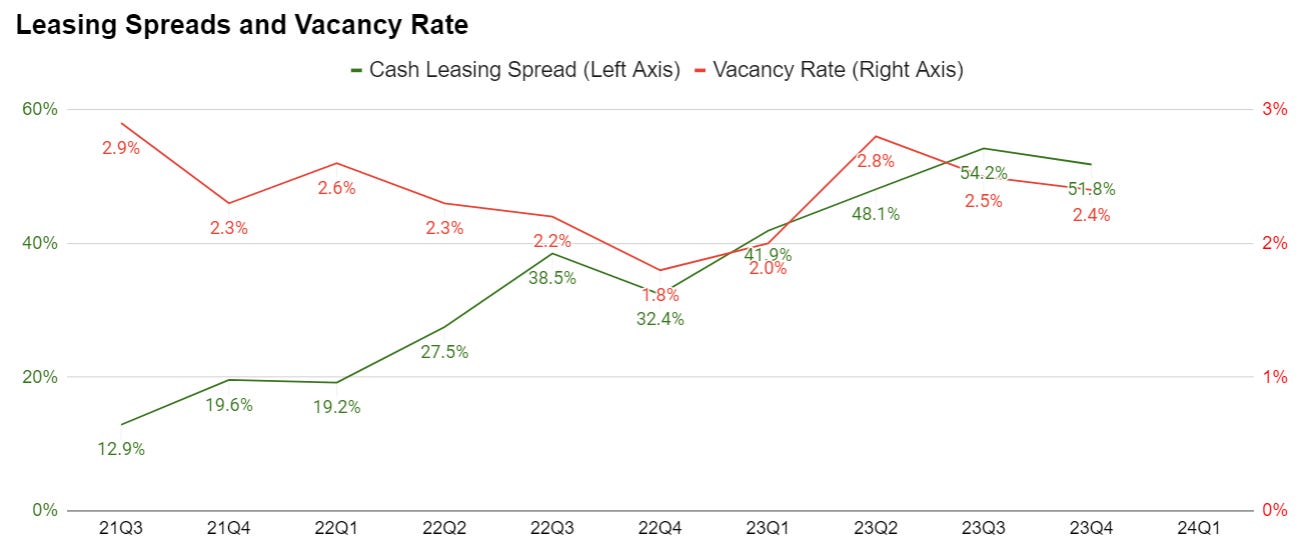

Leasing Spread and Vacancy Rate

The leasing spread and vacancy are inversely related. When vacancy is low, landlords can push for larger leasing spreads. We want to watch both values to keep an eye on the portfolio.

Most analysts would present this as occupancy. However, using the vacancy rate (1 minus occupancy) creates a much better chart because we can still use a 0% zero bound.

Nothing too surprising with vacancy rates. Leasing spreads still remain strong. Management has been guiding for vacancy to tick up slightly as new supply hits the market in 2024. That trend should die off around 2025 (less supply) while demand should continue to grow.

That’s good for shareholders.

PLD’s management is guiding for occupancy between 96.5% and 97.5%. In other words, vacancy between 2.5% and 3.5%.

I need to emphasize that vacancy will spike during 2024 due to the timing of deliveries. PLD’s commentary on the earnings call suggested vacancy spiking as high as 6% or 6.1%. That seems really high based on the last few years, but it’s actually pretty normal by historical standards.

This is a good time to point out that PLD’s vacancy figure includes projects that were just completed. While PLD’s development activity is down moderately, they will have quite a few projects finished during the year. Those completions create a temporary spike in vacancy.

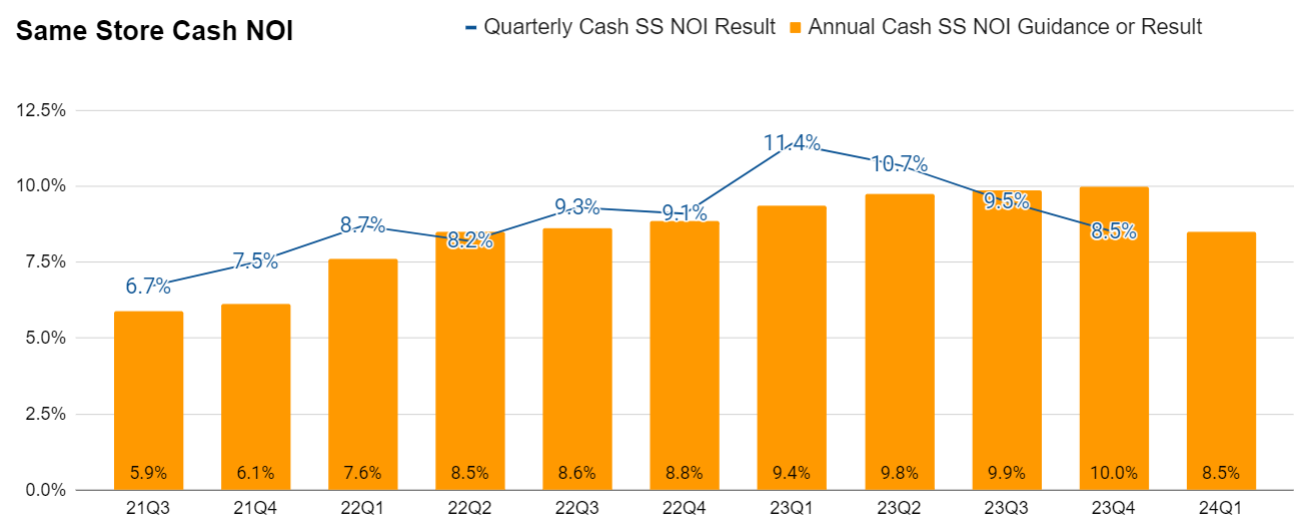

Same Store Net Operating Income

The reason Prologis has been so successful in growing “Core FFO excluding net promote income” (1st chart) is because they delivered massive growth in same-store NOI (net operating income).

In the following chart, we have a line for quarterly same-store NOI values and bars to show the latest annual guidance:

Just like the first chart, we’re able to include a value for 2024 because it is the 2024 guidance.

Note: Same-store and same-property can be used interchangeably when discussing REITs.

Tying Them Together

These charts all work together to demonstrate the health of the underlying portfolio.

For industrial real estate, the huge discount to market rates gives the REITs significant room to raise rental rates even if market rents were flat for a few years.

Southern California generally had outstanding leasing spreads, but market rents came down moderately after the enormous growth in prior periods.

Rather than bemoaning that, PLD management indicates that it is actually the East Coast they are watching more.

Earnings Call

There was a quote from the earnings call I find particularly relevant:

Our global view is that rents declined this quarter by 90 basis points but predominantly impacted by an estimated 7% decline in Southern California. Our full-year view is that global market rents grew by 6%, just below our expectations, ultimately driving our lease mark-to-market to end the quarter at 57% after capturing approximately $100 million in realized NOI growth from leases rolling up to market. The outlier on rent growth is clearly Southern California. While our portfolio was only 2.6% vacant at year-end, growing availability has made leasing very competitive.

Combined with a 110% increase in rent since 2020, the rent retracement is understandable. Historically, there has never been a market where the delta between expiring and market rents has been so large that it provides ample room for property owners to deviate for market in order to attract customers. So, looking ahead, the positive news is that we are watching two trends reverse. The first is that the supply pipeline is clearly emptying with little in the way of new starts.

And the second is that the escalating issues in both the Suez and Panama Canals, together with the resolution of the West Coast labor negotiations, are moving shipment volumes back to the West. While this bodes well for SoCal and still early, we are watching East Coast port markets more closely. In any event, all of these disruptions are reiterating the underlying need for resiliency and the just-in-case approach to inventories.

Remember the inflation and shortages we saw in recent years? Part of that was related to companies running out of stock because they were too focused on “just in time” instead of “just in case”.

The “just in case” philosophy is a sturdier approach to managing supply chains rather than hoping everything comes through smoothly.

Overall, management highlighted that while things were a bit choppy in Southern California today, they expect the market to rebound nicely.

Market Rent Growth

Prologis talks quite a bit about “market rent” growth. That’s a broad assessment of the change in fair market rents over time. Their commentary is very helpful for evaluating the state of the industry.

Prologis projects market rent growth to average between 4% and 6% over the next few years. This is an imprecise value because there is not one exact dollar amount for “fair market” rents.

They forecast that 2024 will probably be a little bit weaker. For reference, the full-year results for 2023 were around 6%.

Rents take time to catch up to market rent. But surely investors would be pretty happy in most sectors if rental rates were rising 4% to 6% on average over several years. That leads to consistently strong leasing spreads.

Conclusion

It was a pretty good earnings release overall.

PLD trades at a dividend yield of 2.8%, so we’re clearly pricing in significant growth. If they can grow Core FFO excluding net promote income at about 9%, that’s a strong growth rate. I’m generally expecting to see this growth rate range from 5% (a really bad year for growth) to 15% (a great year).

PLD continues to deliver on our investment thesis, so I’m happy with the results.

I’m going to rate the quarter as an 8. Remember, our rating scale is like an IMDB rating scale for shows. 8 is considered quite solid.

No projected change to targets so far. That may change as we get reports from the rest of the REITs and evaluate how the market (and interest rates) are developing. A big swing in Treasury rates (up or down) could push targets. Higher rates would be negative. Lower rates would be positive.

Disclosures: Long PLD, REXR, TRNO

Member discussion