PLD: Q3 2023 & The Global Industrial Outlook

Executive Summary

Prologis (PLD) combined a solid quarter with some negative commentary about the macro environment. Leasing spreads were outstanding yet again. Projected value creation on development looks surprisingly attractive.

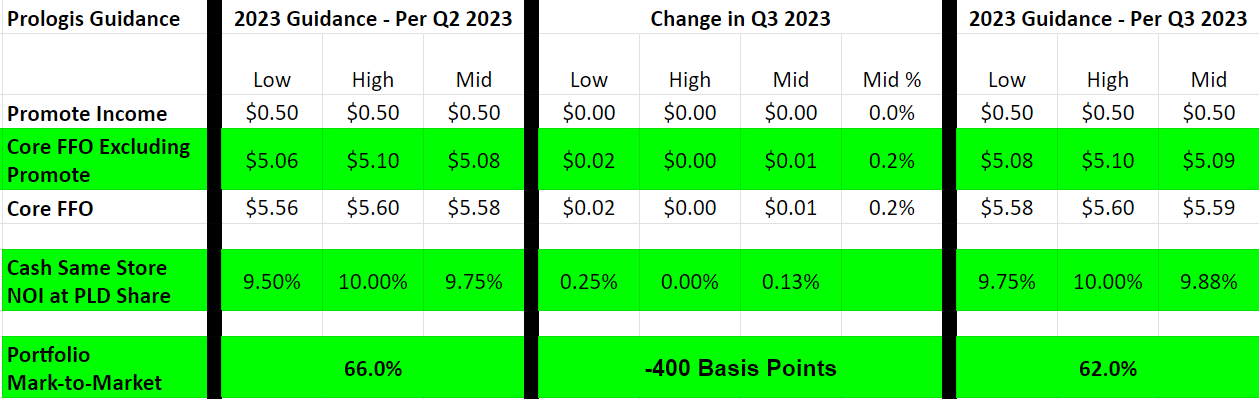

Guidance

I prepared a table to summarize key guidance factors. The ones we’re watching closest are highlighted in green:

Guidance was increased by a hair. Not much, but it’s still the right direction.

Portfolio mark-to-market is down, but that comes with a big caveat. PLD was renewing a bunch of tenants that were way below market. Leasing spreads were huge.

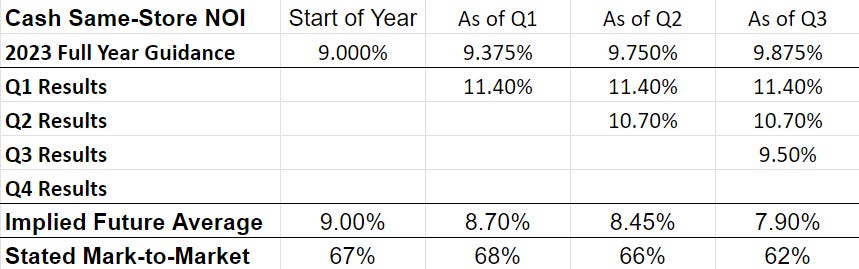

Guidance for Same-Store NOI

I also track the guidance for cash same-store NOI:

Cash same-store NOI growth rates were declining, but still strong. Guidance continued to increase as the company beat expectations regularly.

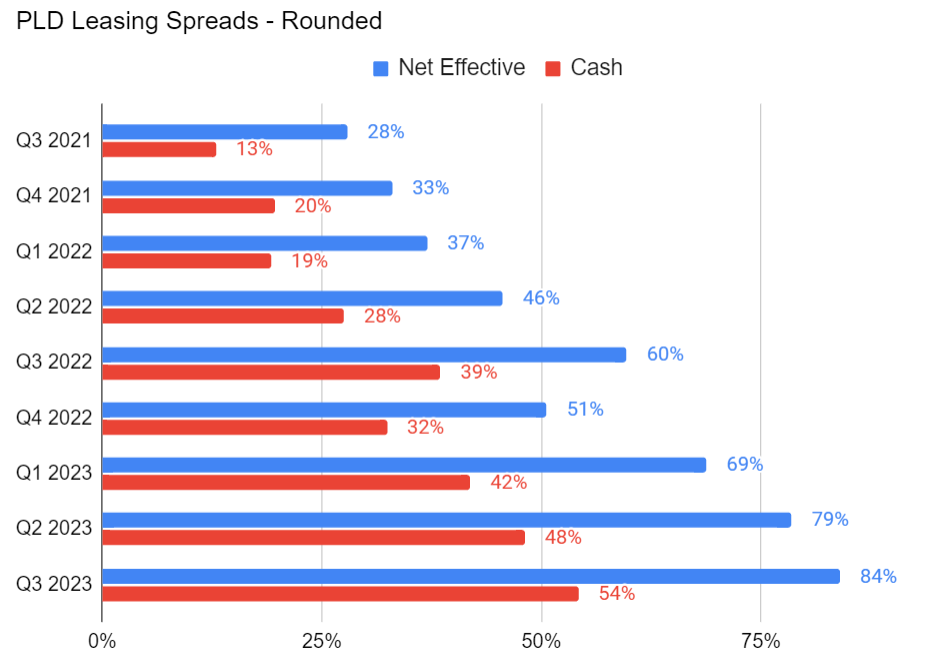

Leasing Spreads

New all-time records set for PLD’s leasing spreads:

On the earnings call, management referenced some locations driving the extremely high leasing spreads:

Net effective rent change was a record 84% of our share, with notable contributions from Northern New Jersey at 200%, Toronto at 187% and Southern California at 165%.

Those are properties that were on old leases at vastly below market rates.

Market Rents

PLD’s “mark-to-market” is management’s estimate of the difference between rents on current contracts and the rents if they could negotiate new leases on every property today. Industrial rents increased dramatically for several years. Consequently, many older leases are far below market.

While PLD’s mark-to-market decreased by 400 basis points, that was all driven by the spreads on new leases. Because those tenants are now experiencing market rents, the average lease isn’t so far below market.

Market rents (as estimated by PLD, with the best industrial demand data in the world) increased by 0.6% during the quarter across the entire portfolio. That’s about in line with the CPI.

There was a bit of weakness in Southern California. That is particularly relevant to Rexford (REXR). However, market rents declined a mere 2%. Relevant, but not that big of a deal. That’s occupancy dipping from extremely high to very high.

Looking for other markets where rents are weaker, PLD highlighted:

- Houston

- Indianapolis

- Poland

- China

Net Asset Values

PLD is the largest investor in industrial real estate. They know rents, occupancy, and asset values across the world. I consider them the most accurate source for high-quality data about private party values for industrial real estate.

There were four regions provided:

- United States: Down 3%

- Europe: Flat to up by a hair.

- Mexico: Up 8.5%

- China: Down 6.5%

This was the first meaningful dip in China, but PLD projects that those values may dip a bit more.

2024: Vacancy and Duke

Due to higher levels of deliveries (new supply) hitting the market in 2024, PLD expects average occupancy levels to decrease slightly. Due to reduced supply in the years after 2025, occupancy should trend higher again. For reference, occupancy is at 97.5%. That’s pretty good. Where else do you see that level of occupancy?

PLD forecasts that market rent growth in 2024 will be low, but remain positive throughout the year despite the increase in supply.

The other factor to consider for 2024 is the impact of adding Duke to the same-store pool. Duke had an extensive industrial portfolio prior to being acquired by PLD. When Duke joins the same-store pool, it may throw off some metrics. That’s something we’ll want to monitor going into 2024.

Press Release

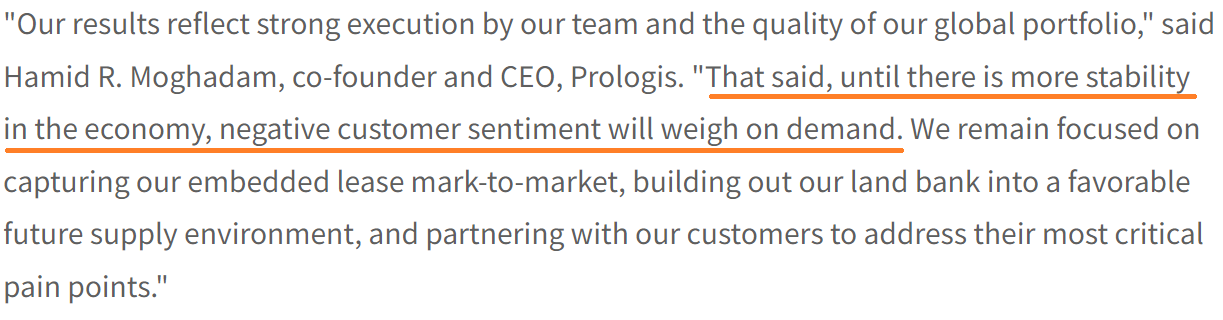

The press release had great numbers, but a quote from management was initially concerning:

That seemed negative at first, but not so much in the context of the earnings call. As management reiterated their expectations for mild market rent growth in 2024, it sounds like industrial real estate is succeeding despite the “negative customer sentiment”.

Interest Rates

As I’ll cover in an upcoming article, interest rates are the big factor impacting REIT share prices. They are hitting share prices much harder than fundamentals.

PLD issued some debt. Combined with their “co-investment ventures” (because PLD’s accounting is more complex), they issued $1.4 billion of debt at 3.2% with an average term of 5.9 years. For reference, that’s lower than 5-year Treasury rates at any point during Q3 2023. It is even lower than 5-year Treasury rates at any point this year.

When reviewing the press release, I thought it may have been related to hedging activity. However, the answer is “yen”. Interest rates on Japanese Yen are materially lower. Part of the debt was in Japanese Yen, which lowers the average rate on debt.

That seems like a smart move for a global company.

I’ll be covering inflation and interest rates in another article.

Development

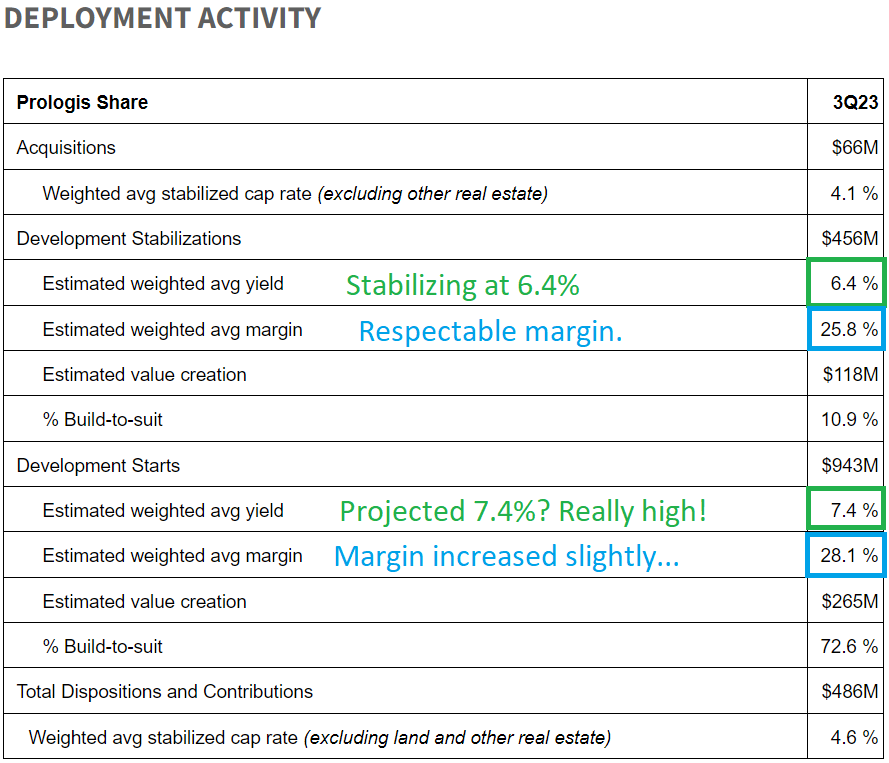

PLD deployed some capital during the quarter. A significant amount of development starts are underway. However, the estimated yield on development starts looked really high, while the margin on development only increased modestly:

Due to the higher interest rates and lower share prices, REITs should be demanding additional yield to start developments. However, it seemed strange that the yield would be so much higher on the new projects.

The answer is that more than half of the development start is related to a data center. PLD has some real estate that it believes will be more valuable as a data center, so it is building a data center. Development yields on data centers are higher, with much weaker rental growth.

So what’s the goal? PLD hasn’t needed to issue equity for about a decade. But they are funding growth. It isn’t all done with debt. They have a great balance sheet. Instead, they’ve used profits from development as a source of cash.

When discussing the data center business, management specifically said:

We are not, at the moment, interested in being in that business in terms of long-term ownership. It's more of a development and harvest strategy. And that capital that comes out of the margins of those deals will be a substantial contributor to our growth going forward.

Further details on the big data center they are developing won’t be available because of confidentiality agreements. That’s fine. We got enough to be comfortable with their decision. Expanding into data centers would’ve been undesirable. Using their development expertise and land portfolio to develop some data centers for sale is perfectly fine.

Conclusion

Good quarter for PLD. Minor concerns in the commentary about negative sentiment from customers. However, management is still forecasting for market rent growth in 2024 despite elevated new supply. We are seeing a trend lower in same-store cash NOI, but it’s a trend lower from a very high starting point. Market rent (on a global average) continues to push higher. It’s not growing quickly at the moment, but the average lease is far below market. Simply rolling over expiring leases to market rents still offers a substantial amount of growth.

I’m rating this quarter as 8/10. We had a tiny increase in guidance. New record leasing spreads (partially offset by having some of the most underpriced leases rolling over). Same-store cash NOI was still good, though decelerating. Without deceleration, it would’ve been at least a 9/10.

Most of the debt is fixed-rate. Some of the debt is denominated in other currencies like the Japanese Yen. Using data centers as development projects may drive some other benefits down the road. They still generate development profits, but part of those profits don’t involve creating more industrial supply.

Along with most equity REITs, targets will be revised modestly lower to reflect higher Treasury yields pressuring valuation. There will not be any negative impact from fundamentals, as those remain good. If Treasury yields were falling, targets would be flat or increasing.

I still think $104.38 is a great bargain. Shares are trading well under consensus NAV and continue to offer rapid growth in FFO and AFFO per share. The strong balance sheet is a great tool to weather this storm. The biggest issue hitting PLD’s share price isn’t a fundamental factor. It is Treasury yields hitting the entire REIT sector.

PLD’s CEO referenced the biggest risk to the economy as “the Fed overdoing it”. I couldn’t agree more. Industrial fundamentals are good, even in the face of increased supply in 2024. The risk is coming from the Federal Reserve. It’s a good reminder to only own equity REITs with strong balance sheets.

Disclosure: Long PLD, REXR, and TRNO in the industrial sector.

Member discussion