TRNO: Brief Update

Terreno (TRNO) is one of my favorite REITs.

They offer investors dramatic growth in AFFO per share and do it with extremely low leverage. Great combo.

Today, TRNO announced its Q4 2023 operating portfolio results. That’s different from releasing the entire financial statements. TRNO regularly gives investors a quick update on how the underlying real estate portfolio. I appreciate that because we should remember that equity REIT performance over the long term is a combination of real estate performance and management quality. TRNO has performed well on both criteria.

The News

The main things investors are looking for:

- Leasing Spreads

- Occupancy Rates

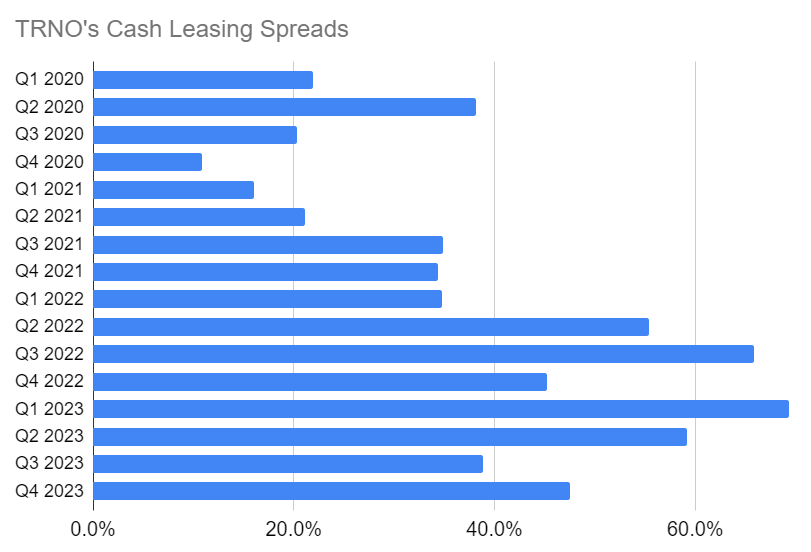

Both are still high. Leasing spreads came in a bit from all-time records, but they remain solid.

Occupancy ended at:

- 98.5% for the total portfolio.

- 98.5% for the same-store portfolio.

It's not a typo; both were 98.5%.

That represents a slight increase in the total portfolio and a slight decrease in the same-store portfolio.

Issuing Shares

TRNO issues shares and uses the proceeds to fund acquisitions and redevelopment. These are accretive to AFFO per share and leverage management’s expertise in identifying opportunities to add value.

While I would love to see TRNO getting a higher price on issuing shares, they are still trading around NAV (Net Asset Value). Consequently, shareholders still gain from management’s expertise in investing the capital. They’re still getting a respectable yield on their cash investments and finding opportunities to further enhance that yield through improvements to the real estate. This is leveraging one of TRNO’s core competencies. If TRNO never issued equity, they would have generated less growth in AFFO per share. We’re interested in TRNO’s ability to deliver long-term growth in cash flow, and AFFO is our preferred method of measuring that cash flow.

We use AFFO for equity REITS rather than other metrics like operating cash flows because we want to gain some of the benefits from accrual accounting. Simply put, AFFO tends to be a superior way to measure recurring cash flow because it strips out some of the noise. However, there is no AFFO announcement in TRNO’s brief updates right after the quarter ends. We only get the data on the real estate portfolio.

Conclusion

The quarter looks pretty good. There were no big surprises, either positive or negative. Nothing in this update is likely to change our opinion on TRNO.

Disclosure: Long TRNO, REXR, PLD

Member discussion