Trade Alert: AGNCO, AGNCP

I’m sharing an article we recently sent to our paid members on Seeking Alpha. I’m considering offering the same paid service here because this platform offers greater flexibility. Of course, I would still provide free articles as well. It’s important to blend both types of content.

Trades Placed

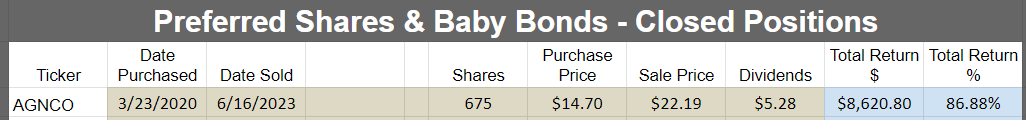

- Sold 675 (AGNCO) at $22.19 per share.

- Purchased 738 (AGNCP) at $20.30 per share.

Commentary

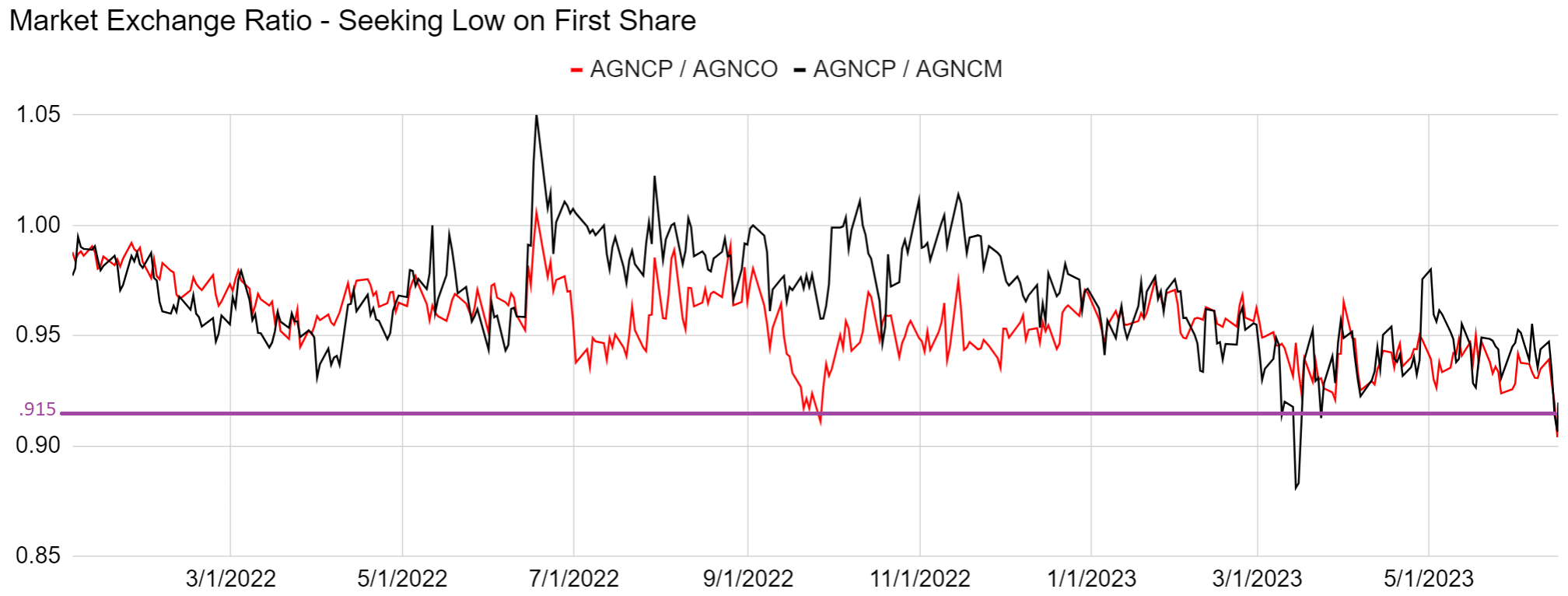

We foreshadowed this trade 3 times in yesterday's article on the AGNC preferred shares (sorry, paywalled article). Here's one of them:

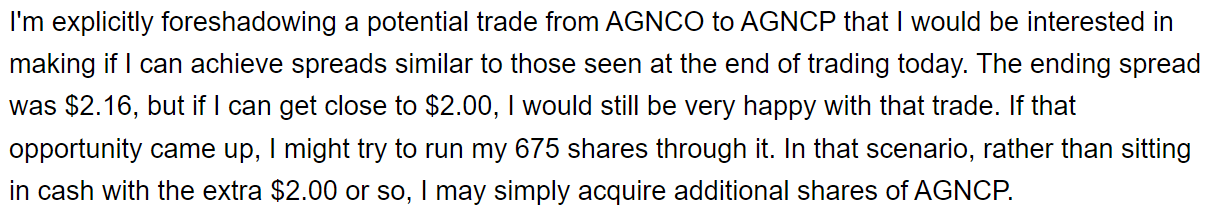

We ended up with a spread of $1.89. Not as good as $2.00, the $2.16 some investors could get yesterday. However, that's still a great spread. I drew it on the chart showing the spread in share prices:

The purple line shows the spread for my transaction and the red line shows the historical spread between AGNCP and AGNCO. Aside from yesterday, it was only larger in the late September 2022 pricing failure.

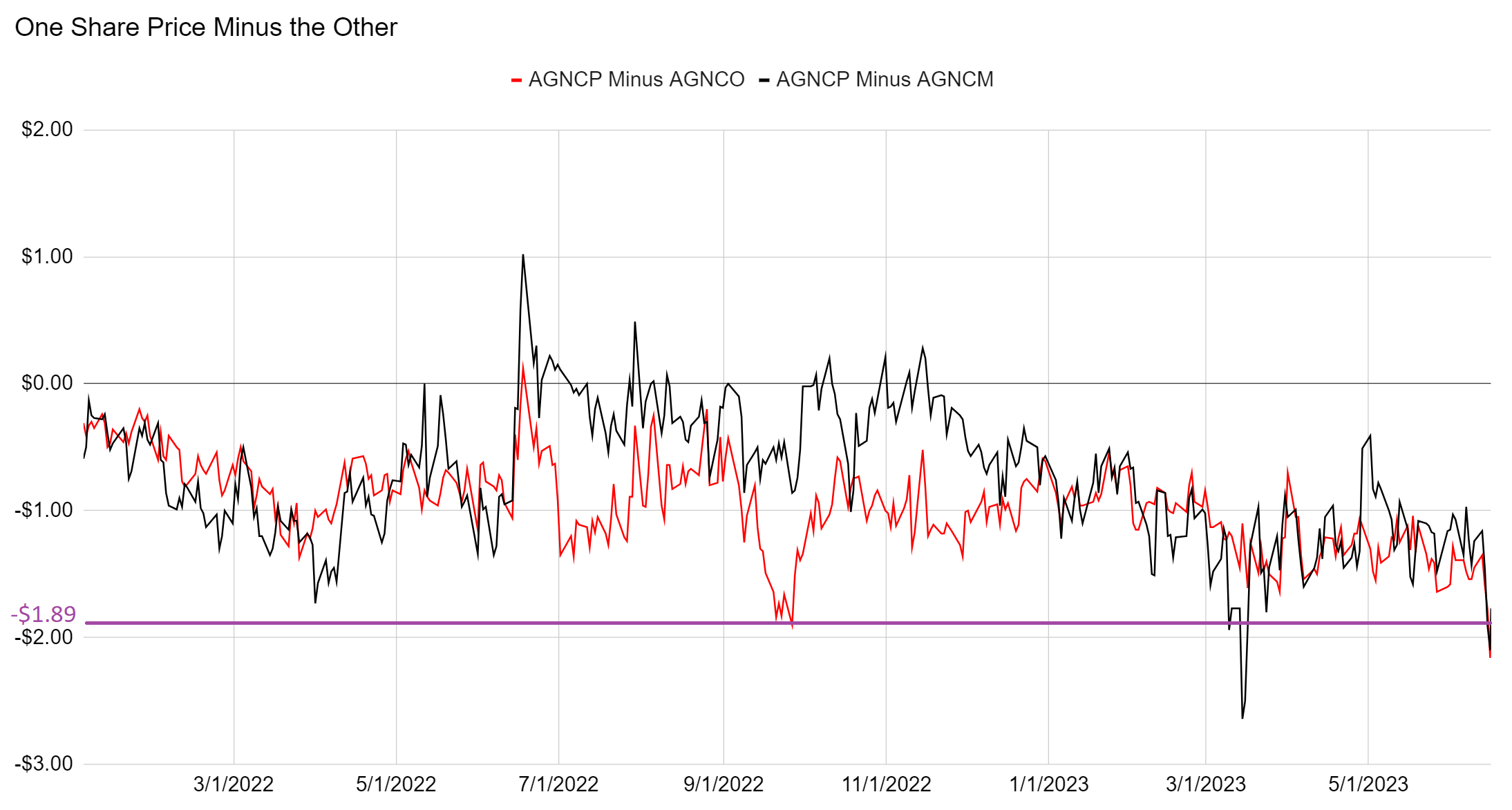

We were getting 1.093 shares of AGNCP per share of AGNCO. Alternatively, you could say we were sacrificing 0.915 shares of AGNCO per share of AGNCP. This chart demonstrates the historical ratio:

It looks very similar to the prior chart because we're still measuring the gap in valuation between the shares. We're just doing it with a ratio this time.

The shares we sold were purchased back in March 2020, so they were carrying a huge gain. The total return on that position came in at 86.88%.

Account

Tax-advantaged account. Actively trading back and forth between similar shares. When prices favor trading out of this position, we're fine making that trade also. I think it is more likely for AGNCM and AGNCO to be overvalued in the near term, so if price-to-buy ratios are extremely similar, I'll tend to favor them.

This morning the price-to-buy ratios favored AGNCP over AGNCO by about 4% (91.23% vs. 87.27%) and AGNCP over AGNCM by about 6% (93.24% vs. 87.27%). At that spread, it is a pretty easy decision to move into AGNCP.

Prices at the time of trade:

- AGNCM: $22.10

- AGNCO: $22.19

- AGNCP: $20.30

That gap is a bit tighter than it was earlier this morning, but I wanted to give members time to use our new article before placing my own trade.

Returns for Closed Positions

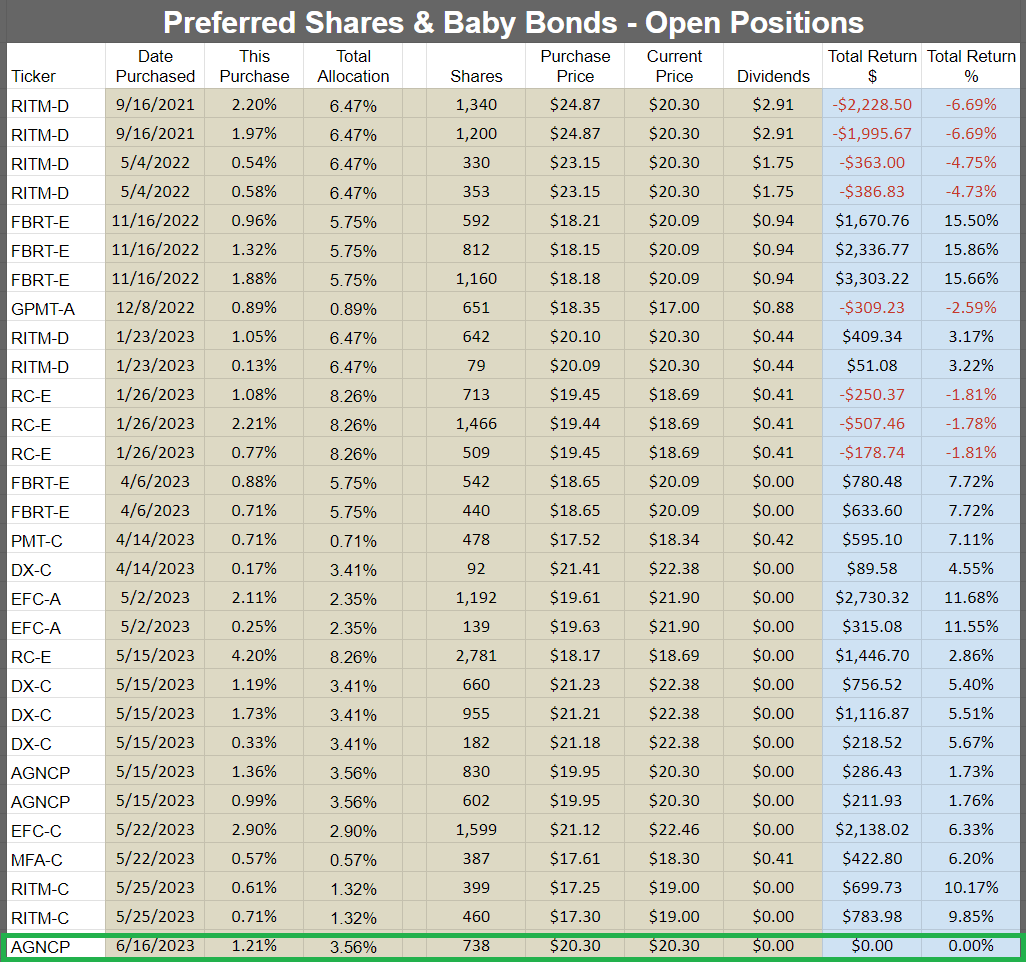

Returns for Open Positions

Conclusion

This is an opportunity to swap 1 share of AGNCO for 1.093 shares of AGNCP. I think that's a favorable ratio. Before yesterday, it would've been shocking.

This trading opportunity could dry up. It opened up substantially yesterday. I waited a bit into the morning to leave more time for members to utilize yesterday's article on the pricing disparity. As it stands, the volume on AGNCP quickly surpassed 100,000 shares. Many days the volume comes in closer to 20,000 shares, so I believe many members have taken advantage of the pricing disparity.

We also saw a surge in the volume on AGNCO, reinforcing my belief that investors are going for this swap.

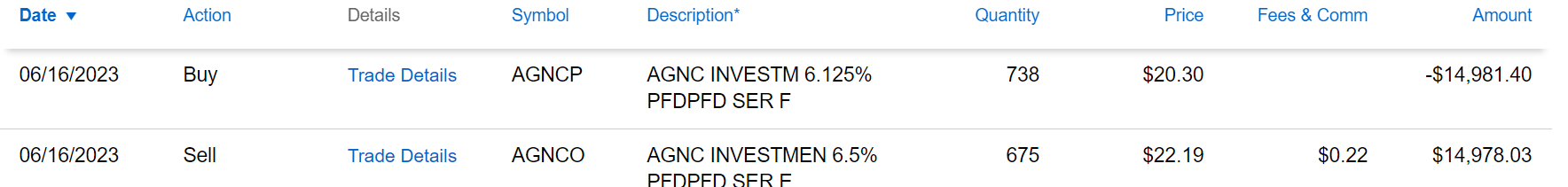

Execution Screenshots

Since the main purpose of adding these screenshots is to guarantee transparency, I think it makes sense to include them after all the discussion.

Note: Schwab's new layout for trade tickets and order history leaves something to be desired. I'm screenshotting from the "History" tab because it provides a vastly better summary of transactions:

I’ll send the other part public on Seeking Alpha soon, but this part is only available on my website and to our paid members.

Like our work? You can subscribe to see more:

Already subscribed? You can share this report:

Member discussion