Rexford Deletes Information, Angers Analysts, TRNO Keeps Rolling

The Rexford (REXR) earnings call was a mess. I was on it live, but there was enough material that it needs to be reviewed. In prior quarters, REXR was relatively easy to cover because they provided so much transparent data.

There’s a transcript for the call, but it’s terrible. The transcript is so inaccurate it can only be used while listening to the call.

I’ll keep the notes brief for now. I’ll have more to say after having more time to review the math.

Focus of the Article

Most of this article will be about REXR, though Terreno (TRNO) also reported their fourth-quarter results.

Looking at the fundamental results for the fourth quarters, they weren’t all that different from each other. However, REXR’s guidance was weak. TRNO doesn’t provide much guidance, but the underlying trends were better.

This update has a negative tone to it.

Price Target Adjustments

Expect REXR targets to be revised in the range of -1% to -9%.

Expect TRNO target revisions in the range of +4% to -2%.

Expect the TRNO revision to be more favorable than the REXR revision.

The weak guidance from REXR and the reduction in transparency are hurting their relative standing.

Presentation Change

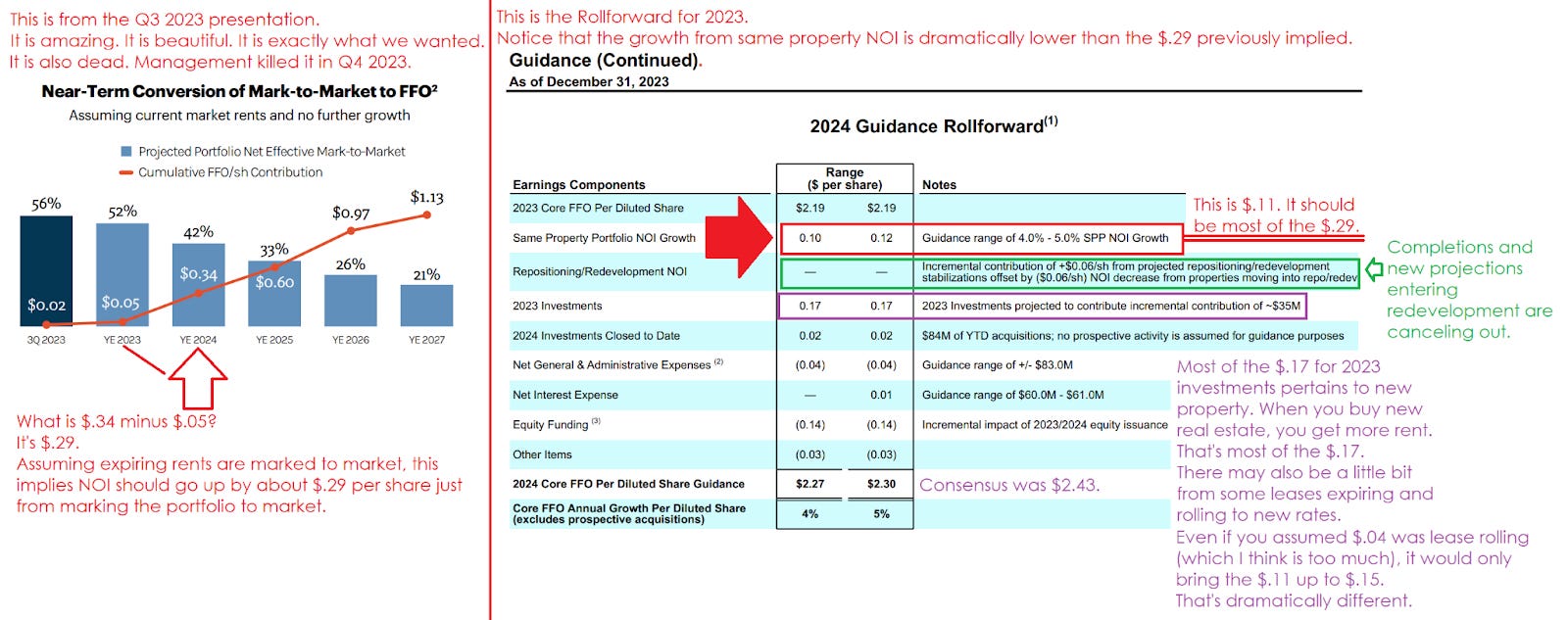

REXR’s prior investor presentation layout was pretty good.

It included some best-in-class practices for sharing information with investors.

Rather than continue using that system, they overhauled the presentation and deleted some of the most useful information.

As you might imagine, analysts had some questions about the data they relied on. Every analyst whose forecasting system used these values as a key input just got hammered. Expect many analysts to be very angry. By withdrawing this information, REXR effectively told every analyst to rebuild their models based on not having access to that transparency.

Transparency got murdered.

Guidance Change

Guidance for Core FFO per share growth came in low. It was materially below consensus estimates and those consensus estimates were reached intelligently.

Earnings Call

Given the reduction in transparency and the weak guidance, analysts had several questions. Great questions. Critical questions. Questions that should’ve been answered, rather than going on tangents about metrics that are not directly related to the question the analyst asked.

Specifically, analysts were asking about the change between the metrics implied in the old presentation and the guidance provided today.

What the Duck

I’m not going to be a tease.

I don’t have the answers. At least not yet.

Like a bunch of other analysts, my day is going to rebuilding models.

But I put together an image so you can see what happened:

That’s why analysts are upset. The first chart doesn’t lead to the second chart, unless you assume something like:

- A big increase in vacancy (guidance calls for a small increase)

- A bunch of properties enter redevelopment and stop producing NOI (no, the green text addresses that this isn’t the case).

- Market rents plunged (management says they are flat).

The chart was designed to indicate what happens with flat rents.

I don’t know who screwed up the numbers. I don’t know if they screwed it up for the Q4 2023 release or if it was wrong in the prior releases.

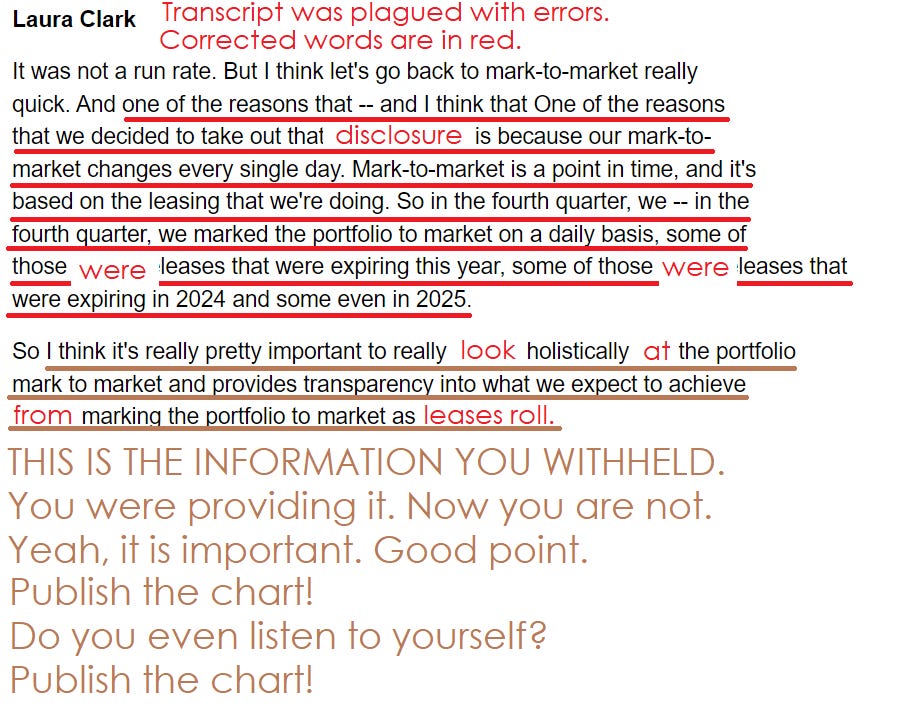

Why Transparency Had to Die

When asked about the death of the chart, the CFO indicated that the data is always changing anyway. That is the single dumbest reason I’ve ever heard for killing transparency.

Try that trash with your spouse:

“Hey Honey, what happened to that calendar of your evening plans?”

“I decided to stop sharing it with you because it changes every single day. Sometimes I have a new class or hobby or affair. There’s no point updating it since it keeps changing.”

Was there noone present in meetings to suggest they come up with a better reason for removing the transparency.

Here’s the comment I’m referencing:

What About TRNO?

Not much to say. I’ll have a very brief update coming up on them. Strong same property NOI. Respectable leasing spreads. Looks good. In line with expectations to slightly above expectations. No concerns.

Conclusion

It’ll take me longer to do an update on REXR because:

- Guidance came in low enough that I still need more time to dig deeper into it.

- Management deleted useful information.

I expect a negative revision to targets based on the guidance for Core FFO (implying weaker AFFO) and on the reduction in transparency.

During the earnings call, management was adamant about being transparent. If only they had kept providing the charts that contained that best-in-class transparency.

I’ll have another update coming out, but I wanted to provide something promptly to our members to indicate why it is taking longer to review the REXR earnings release.

Post Scriptum

It’s late. Please forgive any typos. It’s easy to update the models for REXR to just “put in whatever management says”. That’s not good enough. The gap between the consensus estimates (which were very reasonable for 2024, in my opinion) and the guidance management provided was large enough to warrant further research. When it’s ready, I’ll highlight the most relevant and interesting parts for our members.

Disclosure: Long REXR, TRNO, and PLD.

Member discussion