Preferred Share Target Updates: A Few Risk Rating Corrections

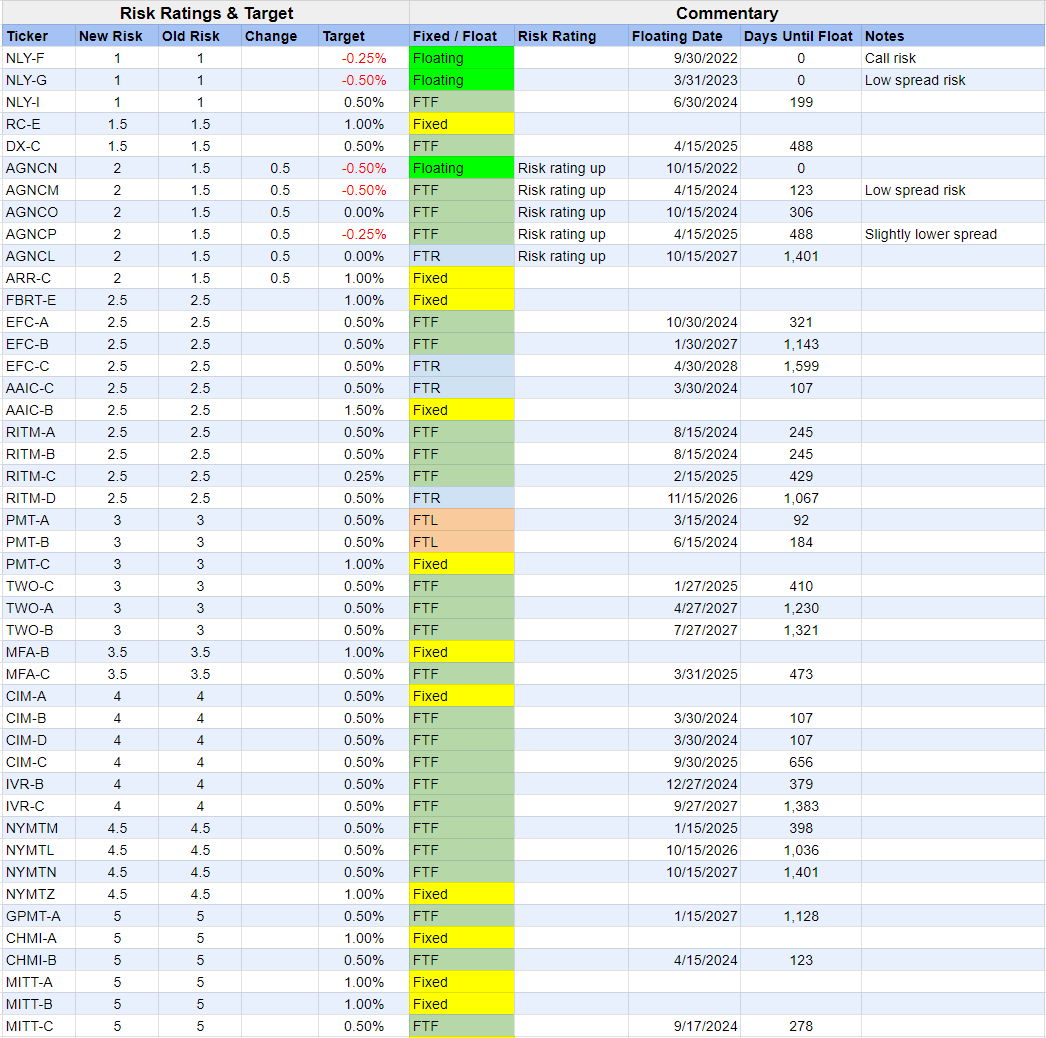

In today’s article, we had an image with the risk ratings of several preferred shares.

There was an error in some of the risk ratings. Thankfully, it was quickly pointed out to me by some of our readers who recognized the missing updates.

In brief, the most recent round of risk rating updates was not included in the tabs I was using. Consequently, a few shares were shown with outdated risk ratings. That includes:

- PMT preferred shares are a 3.0 (incorrectly shown as 2.5 before)

- CIM preferred shares are a 4 (incorrectly shown as 3 before)

- NYMT preferred shares are a 4.5 (incorrectly shown as 4 before)

- GPMT preferred shares are a 5.0 (incorrectly shown as 4 before)

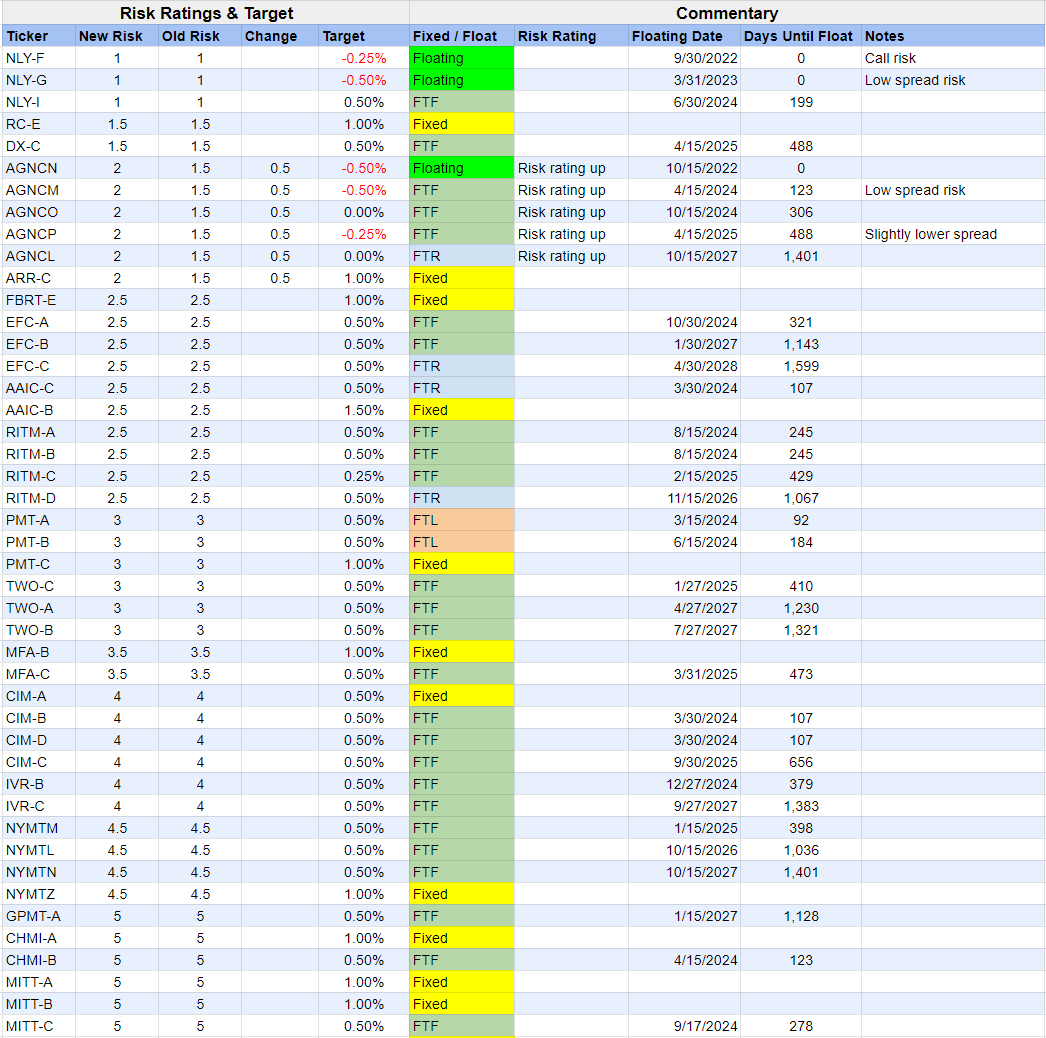

The corrected list is included below:

Remember these two things:

- Preferred shares are graded on a harsher level than common shares.

- Higher numbers indicate higher risk.

The original post (which also has the updated image) is included here:

Preferred Share Target Updates

ColoradoWealthManagementFund • Dec 14, 2023

We’ve got a bunch of preferred share target updates. None are huge, but they will create a bit of a shift in relative rankings. We’re adjusting for a few things. AGNC preferred share risk rating update as previously foreshadowed to members. Adjustment for shares that are already floating. The expected dip in short-term rates may reduce enthusiasm.

Read full story →

Thank you for your patience!

Disclosures: Long RITM-D, GPMT-A, DX-C, EFC-A, RITM-C, EFC-B, PMT-C, PMT-B, CIM-B, AGNCP, CIM-D, RITM-B, RITM, SLRC, GPMT, RC

Member discussion