ESS: Q2 2023 Guidance Up, Setting Up A Q3 Beat

Essex Property Trust (ESS) had a great Q2 2023 earnings release.

Guidance Update

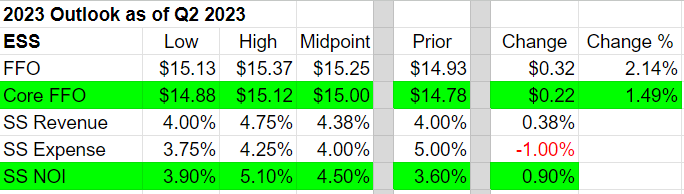

I prepared the following table to highlight key metrics:

Core FFO

That’s a healthy increase to Core FFO guidance. About 1.5% is good for any environment, but it’s especially nice this year.

Same-Store Portfolio

Guidance for revenue is up slightly and expenses are down. The combination is a nice boost to net operating income. We’re getting the same story in same-store NOI and Core FFO. Fundamentals are doing a bit better than expected.

Earnings Call

On the earnings call, Essex’s management said (bolding mine):

Our improved outlook reflects the year-to-date resilience of the economy and labor markets, both surpassing our initial forecast. This dynamic, coupled with slowing apartment deliveries, have contributed to a healthy demand for rental housing in our markets. As a result, we raised our average market rent growth expectations for the West Coast by 50 basis points to 2.5%, with notable increases to San Diego and San Jose.

Demand associated with job growth is a key driver to the revision. We now expect our markets to generate 1.7% job growth for the full year. This is mostly attributable to the growth achieved in the first half of the year, with our markets posting 2.6% job growth on a trailing 3-month average through June.

Additionally, the layoff announcements from the largest technology companies have proven less consequential than headlines suggested with only a fraction occurring within our markets, and the vast majority of those affected quickly finding new employment.

Turning to the supply outlook. Our research forecast a slight reduction in 2023 deliveries as a few delay projects get pushed into 2024. While we have been pleased with the steady job growth achieved on the West Coast to start the year, we remain cognizant of the potential for more interest rate increases given the Fed's focus on inflation reduction. Thus, our job outlook contemplates a moderating economy as we approach year-end. And accordingly, our base case expectation assumes modest market rent growth for the remainder of the year.

I want to emphasize that the “slowing apartment deliveries” are a direct function of delays pushing some projects back. It isn’t less construction; it’s just slightly delayed delivery.

Further, I want to emphasize that guidance still assumes the economy weakens later in the year.

Guidance Vs. Actual

When discussing the Q1 2023 results, I wrote:

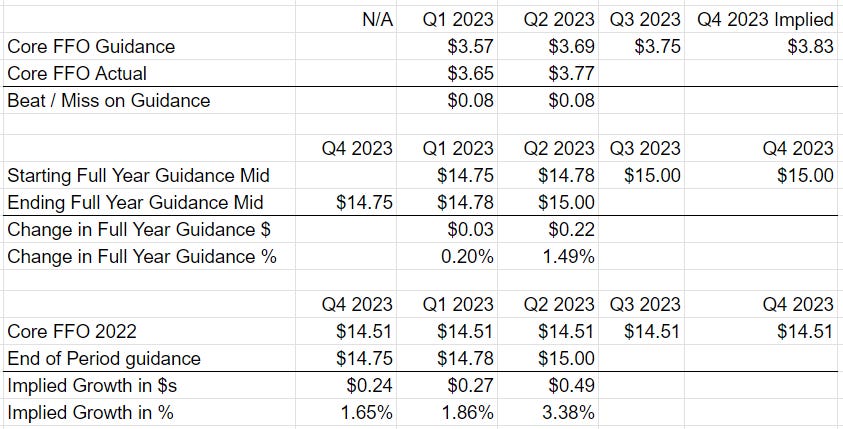

Management has been forecasting a recession all year and that weighs on guidance. We can see that it is still weighing on guidance. Core FFO came in $.08 above the midpoint of management’s expectations. That gain was driven by stronger revenue, it wasn’t a non-recurring expense reduction. Despite the improved revenue, guidance only increased by $.03.

Since management’s base scenario was a recession, the original guidance was biased toward the low end. Consequently, raising expectations was easier than it would’ve been for a REIT that wasn’t forecasting a recession as the base scenario.

Because ESS has been delivering weaker guidance for the year, I decided to add another chart showing the development of guidance throughout the year:

Full-year guidance increased by a cumulative $.25.

In the first half, ESS beat guidance by $.08 twice for a total of $.16.

That means the second-half projections are only up $.07 since the year began. However, the outperformance so far was driven by better-than-expected same-property NOI. That’s good because it tends to persist. If it was driven by the timing of G&A costs, it wouldn’t mean much.

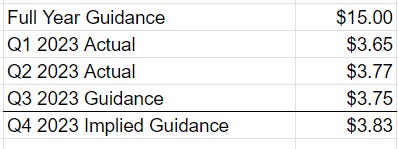

ESS hasn’t given Q4 2023 guidance yet, but we can create an implied value. Rounding errors will be present, but if you have full-year guidance and Q3 2023 guidance, you can create the Q4 2023 implied guidance pretty easily.

Just subtract other values from full-year guidance:

Q3 2023 guidance is $3.75. Q2 2023 just delivered $3.77 while raising rents. The odds are better than 50% for beating $3.75.

Note: Consensus estimates may be above $3.75, which could change the headlines.

Development

ESS has only one project that is in development with cash left to spend. This property is inside a joint venture. ESS has already put in most of the cash they need to invest. The numbers below represent Essex’s share.

- Total expected cost: $52 million

- Cost already paid: $40 million

- Left to fund: $12 million (estimated)

Miniscule. That’s good for this environment. Sometimes we really like development, but this isn’t a great environment. Rates are too high, and there is too much supply coming to market in 2024.

Acquisition

ESS had one acquisition during the quarter. That was a 73-unit apartment community in April 2023. ESS sees value in it because it is within an existing ESS community, and they expect to see improved performance from their collections model. At $23.1 million, that’s not a big commitment for the REIT.

Buybacks / Stock Issued

No stock issued or buybacks in Q2 2023.

During Q1 2023, ESS repurchased 437,026 shares at a weighted-average price of $218.88. The buyback was funded by selling an apartment complex for a similar total value.

That Q1 buyback looks good as shares are trading at $244.64 today.

Conclusion

Great quarter. Guidance up. Most of the guidance update was admitting the outperformance that’s already happened. If guidance had been increased adequately after Q1 2023, the increase after Q2 2023 would’ve been smaller. Consequently, I’m rating this report as a 9. Core FFO guidance up by 1.5% while still forecasting a recession is great.

However, the report gets punished for starting with artificially low guidance. That made it easier to raise guidance. On the other hand, management is still using a mild bear-case scenario. Consequently, I think we will see Core FFO per share come in modestly ahead of Q3 2023 guidance and Q4 2023 implied guidance.

We’ll have to see where the consensus estimates are set. Often consensus estimates run just a hair over guidance.

Disclosure: Long all stocks in CWMF’s Portfolio. That includes ESS.

Like the report? Feel free to share it.

Member discussion