Cell Tower Target Updates and CCI’s Great Announcement

Crown Castle International (CCI) delivered great news on 3 fronts:

- Operational change

- Raised guidance for AFFO per share

- Slashed their full-year misallocation of capital

Note: The misallocation of capital is also referred to as fiber capital expenditures, or fiber capex for short.

While there are positives and negatives, the positives are substantially larger. CCI is moving in the right direction.

The main changes:

- Reduce capital misallocation in 2024 by $275 to $325 million.

- Reduce interest expense because there is less misallocation to finance.

- Reduce annualized operating expenses by $100 million as they eliminate jobs and office space that were supporting the misallocation of capital.

- Increase AFFO per share because of savings on interest and overhead.

Show me someone who doesn’t like these changes and I’ll show you someone who is either shorting the stock or getting laid off.

What is Crown Castle International?

CCI is a tower REIT. They own cell towers, fiber, and small cells. The cell towers are by far the best part of the company. The massive investment in fiber over the last decade produced very poor returns.

The company should have spent that cash on buying more cell towers, repurchasing shares, or reducing debt. Management was very optimistic about small cells, before the prior CEO was sent packing.

The Misallocation of Capital

For readers who aren’t familiar with CCI’s plans, I’ll include a quick background.

CCI spends a ton of cash each year on development.

There are three major uses for development capital expenditures:

- Cell towers. Good. They provide a solid long-term return. Decent escalators + colocation potential.

- Fiber. Mostly bad. Bad. Poor long-term return. No escalators. “Organic” growth driven by capital expenditures.

- Small cells. Mixed. Difficult to separate from fiber because they rely on the fiber network.

The fiber and small cells are so intermingled that some parts of the company statements simply refer to the “fiber segment”, which includes small cells.

Fortunately, some parts of the supplemental presentation separate the two assets.

How Small Cells Work

You can imagine small cells as a tiny cell tower that is located on a fiber network. Small cells cover a very small area at a very high speed. They can be extremely useful for reducing congestion on the network by serving small pockets with high data demand. Essentially, you want them where a bunch of people are going to stream videos. Sending those customers through the small cell gives them high speeds and reduces the amount of traffic on the tower. The reduction in traffic on the tower allows everyone else in the area to get higher speeds.

Small cells are a great tool for a very specific purpose. However, they have two flaws:

- Carriers have been less excited to lease them.

- They generally need to be directly on a fiber network.

Carrier Reluctance

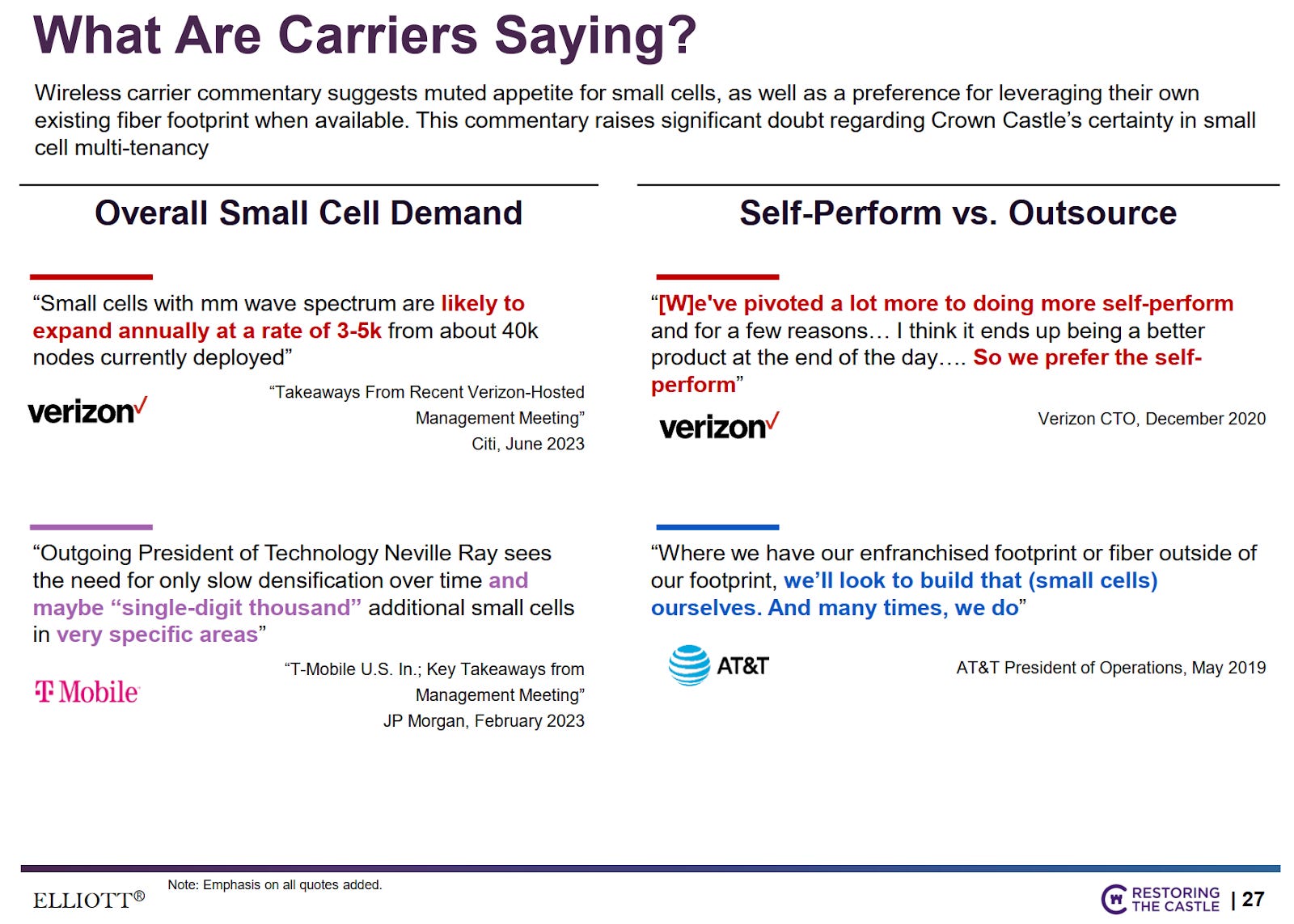

As part of Elliot Capital’s campaign to fix CCI, they highlighted key quotes from executives at each of the major carriers:

At some point, small cell demand may ramp up. Presently, it just isn’t there. The carriers have generally opted against using it. It can significantly improve speeds, but carriers are not focused on actual speeds delivered to customers. Switching carriers is hard. Since carriers made the switching process so awful, they created their own perverse incentives:

- Advertising a high speed network is good. Tell potential and current customers how great things are.

- Delivering a high speed network is bad. That costs money. Since customers have a hard time switching, the carriers are not punished for a clogged network.

Consequently, carriers tend to use big towers to cover the widest possible area with the slowest (and longest range) network that can technically be classified as “5G”. Even if that network is clogged and slow, they will still claim to have a huge 5G network.

Requiring A Higher Rate of Return

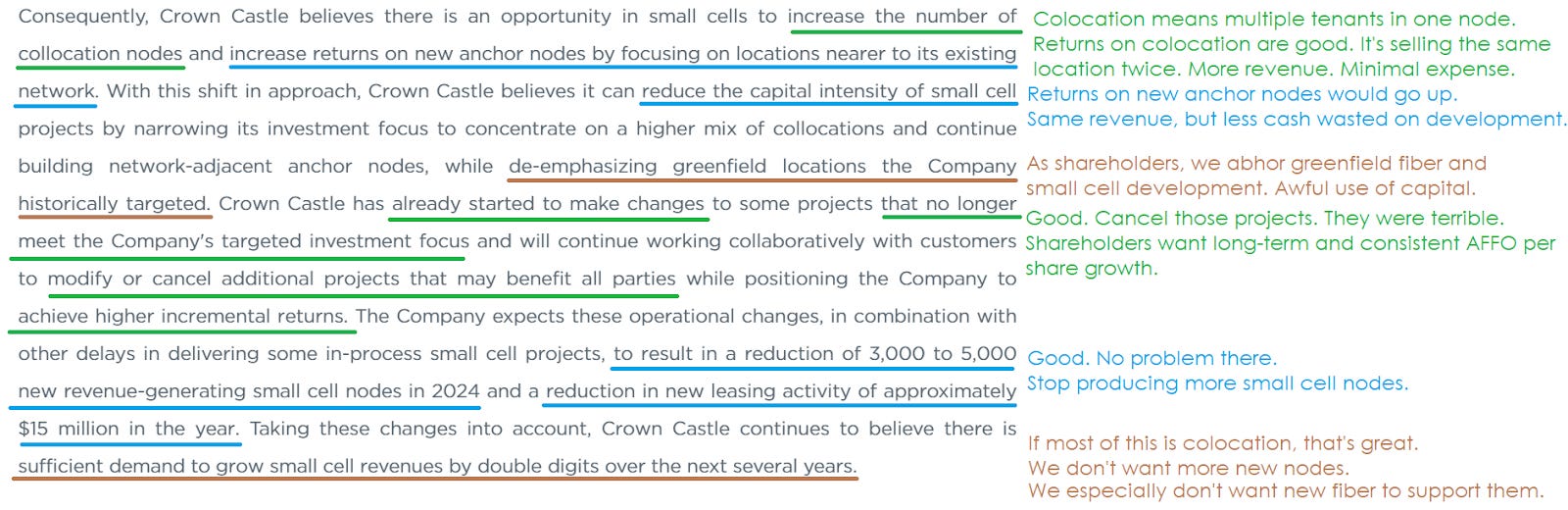

By requiring a higher rate of return on investments, which is completely appropriate, CCI is improving their strategy.

They are reducing the amount of new small cells and slashing “greenfield” projects, which had an awful return on investment.

As per my usual style, I’ve written my notes on the press release:

The ideal solution would probably be selling off their fiber and small cell segments so they can just focus on towers. However, that strategy would still depend on the valuation they could get for the assets.

There’s been substantial inflation. Towers built years ago are generally worth far more than their cost of construction.

However, CCI would most likely need to sell their fiber segment for less than the historical cost. If they can recover their historical cost, it would be very positive.

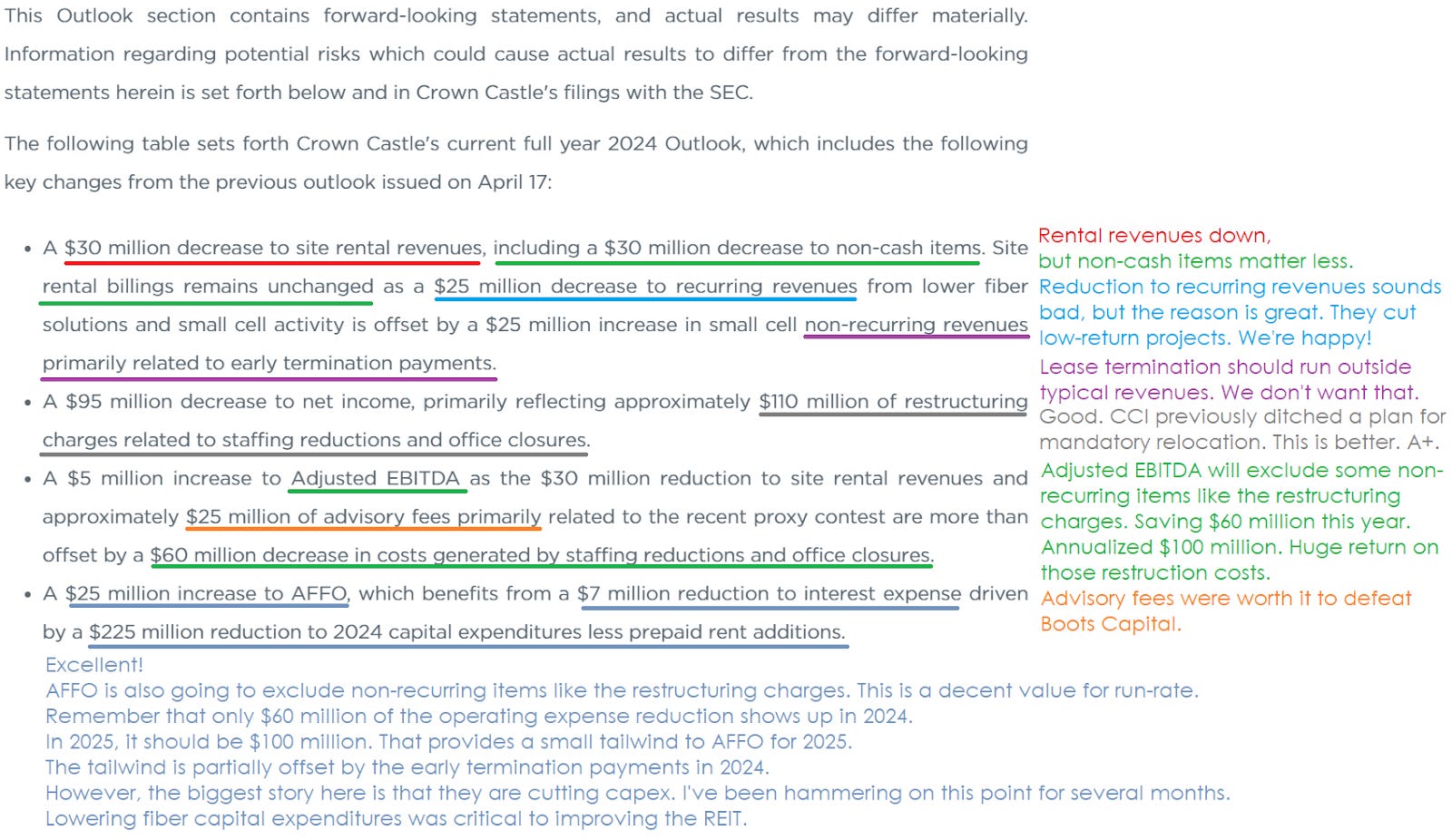

Specific Adjustments

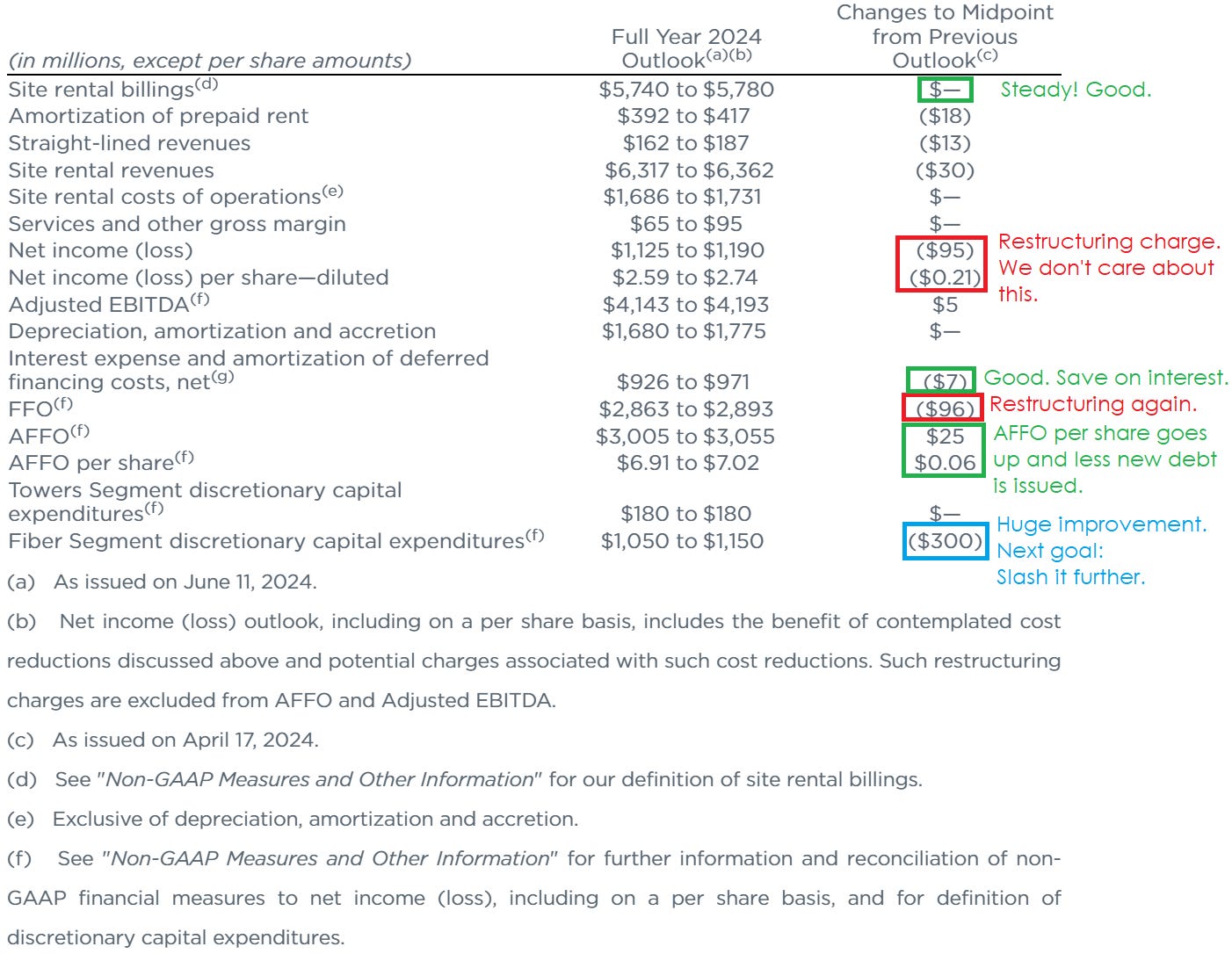

The update in guidance impacts several line items:

Those announcements are great. Big improvements for CCI.

Why are staffing reductions great? No, it isn’t a heart of stone. Staffing reductions should reduce jobs for growing the fiber network. CCI shouldn’t be growing the fiber network, so they should need fewer employees.

Updated Guidance

The result of those changes is a nice improvement to guidance:

Per Share Impacts

There are about 435 million shares outstanding.

- The $300 million reduction in capital expenditures = $.690 per share.

- The $60 million reduction in overhead this year = $.138 per share.

- The $100 reduction in run rate overhead = $.230 per share.

- The $25 million improvement in AFFO = $.057 per share.

The reduction in capital expenditures is excellent.

The implications are uncertain. Specifically, we want to get a better feel for how much capital expenditures will fall in 2025 and 2026.

There are 3 reasons to believe we may see further reduction next year:

- This change was announced in June 2024. They can’t cancel capex from months that already happened.

- Canceling plans for 2024 is more difficult than canceling plans for 2025 or 2026.

- The elimination of greenfield development suggests a fundamental change in perspective.

Target Adjustments

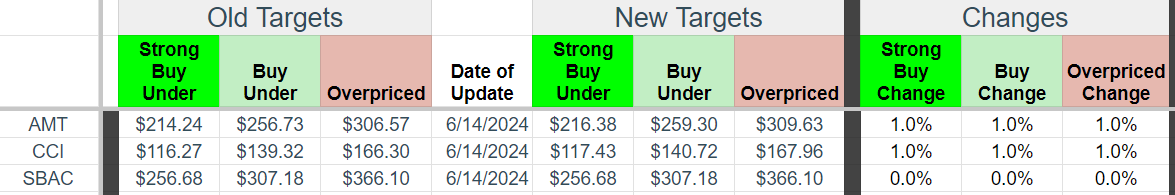

We’re raising targets on CCI by 1%. That comes out to $1.40 (rounded).

We’re raising AMT’s targets by 1% to reflect the high valuations we’ve been seeing in data center REITs. Some investors may end up picking AMT simply as a tower REIT that also owns a data center REIT. AMT’s purchase of a data center REIT has been playing out well, despite the unfortunate timing (financed with adjustable-rate debt just before rates ripped higher).

We’re reaffirming the targets on SBAC.

Shares of all 3 REITs are significantly below our targets.

- AMT: $197.03

- CCI $99.10

- SBAC $195.96

There are a few important factors that could push CCI’s targets further:

- Changes in interest rates can have an important impact. Since our prior update, interest rates are up. That’s bad. However, the technical signals on interest rates are better.

- Management will probably be questioned about future development capital expenditures on the Q2 2024 earnings call. If they indicate further reductions in planned fiber segment (includes fiber and small cell) capital expenditures, that would be a strong positive. This year’s guidance for $1,100 million is a big improvement (from $1,400 million), but I’d still like to see this category fall more than 80%.

The “buy under” target comes in at about 20.2x management’s guidance for 2024 AFFO per share.

If CCI manages to sell off their fiber and small cell assets, I think it would be dilutive to AFFO per share. However, the REIT would warrant a higher multiple because it would significantly improve the growth profile.

If CCI sold all fiber and small cell assets, they would deserve the highest multiple on (the remaining) AFFO per share.

It’s hard to establish how dilutive a sale of the fiber and small cell assets would be because transactions for huge fiber portfolios are rare.

Note: Target adjustments were set in the spreadsheets on Friday (6/14/2024), though this article is published on Sunday (6/16/2024).

All else equal, AMT and SBAC should see faster growth in target prices due to lower payout ratios. They have more cash remaining within the REIT to fuel growth, which should lead to better growth rates. Therefore, if every REIT was performing equally, the difference in retained cash would lead to SBAC and AMT growing faster while CCI would pay out higher dividends.

Interest Rates

The following charts demonstrate the change in rates since our prior target update:

You’ll notice that in both cases rates are higher today (but only slightly for the 10-year Treasury). However, the current interest rates are below the moving averages. Since interest rates can end up trending in one direction or another, it’s nice to see that they are below the moving averages.

Sector Notes

All tower REITs benefit from a reduction in CCI’s capital expenditures. It’s less new space they are trying to lease. Reducing competition is nice.

The magnitude of the impact will depend on how much they reduce capital expenditures for 2025 and beyond. However, it’s a positive sign.

We’re invested in all 3 tower REITs. Besides CCI, we also own positions in American Tower (AMT) and SBA Communications (SBAC).

All 3 have taken a significant hit from the substantial increase in interest rates and carriers aiming to reduce their capital expenditures on network quality.

Carriers

Carriers still emphasize priorities like having 5 stores within easy driving distance of my house.

Has the presence of additional stores (more than 1) ever influenced your decision of carrier?

Leave a comment to explain if you picked your carrier based on 2+ locations. I really want to hear about that process.

When you think about it that way, it’s no wonder AT&T (T) and Verizon (VZ) delivered extremely poor results over the last 20 years.

T-Mobile (TMUS) delivered outstanding results as they grew their customer base. How did they do it?

They had a merger with Sprint where they agreed to not raise prices for several years. It was a regulatory requirement.

That made them the clear winner on price. Meanwhile the acquisition of Sprint gave them more spectrum and a bigger network, which was an improvement to the product.

Customers (or at least intelligent customers) generally want 4 things:

- Reliability

- Speed

- Low price

- Easy to switch (but this is as rare as unicorns)

The agreement not to raise prices expired. TMUS is now free to raise prices. If you’re a TMUS customer, you may have already heard about a substantial rate hike.

As a TMUS customer, my bill is set to increase significantly with no improvement in services.

Sadly, T and VZ remain even worse.

Conclusion

Great announcement by CCI.

It might warrant a bigger boost to targets, but the current environment remains challenging for tower REITs.

The big unknown still hanging over CCI is what will happen with the fiber and small cell assets.

I remain bullish on cell tower REITs. The ability of cell towers to generate revenue growth through colocation is very attractive.

Consumers continue to want connections that are more reliable and capable of handling more traffic.

Top speeds on the network are great. No issue there. The problem is that most consumers often get a small fraction of the top speeds.

While preparing the conclusion, I blew through some data on my plan. The plan includes more than I can reasonably use.

Speedtest results:

- 833 Mbps down

- 81.8 Mbps up

- 19 ping

That is what 5G networks are supposed to do. But most people aren’t having that experience.

Most areas have congested networks with poor speeds because the carriers simply have not installed enough bandwidth on the towers.

Enjoyed the article? Hit the heart icon, leave a comment, or tap the restack button. Those engagement metrics can help convince Substack to increase our visibility.

Member discussion