Alexandria Real Estate Q2 2024 Update

This update needs to be brief and it needs to be posted quickly.

Alexandria Real Estate (ARE) reported Q2 2024 results yesterday after the market closed.

Today, interest rates are down slightly (about 2 to 3 basis points).

The largest REIT index ETF, Vanguard Real Estate Index ETF (VNQ), is precisely flat on the day. It was up a little earlier, but flat at the moment.

ARE is down 3.34%, which is clearly underperforming.

Sometimes ARE moves on correlation to “office” REITs, but the average performance among office REITs is up nearly 1% on the day.

Therefore, it’s clear that this is a negative reaction specifically to ARE.

Note: Numbers as of a bit earlier today when I began compiling the research into this article.

Second Note: This is a rapid update. Small grammar errors will probably exist.

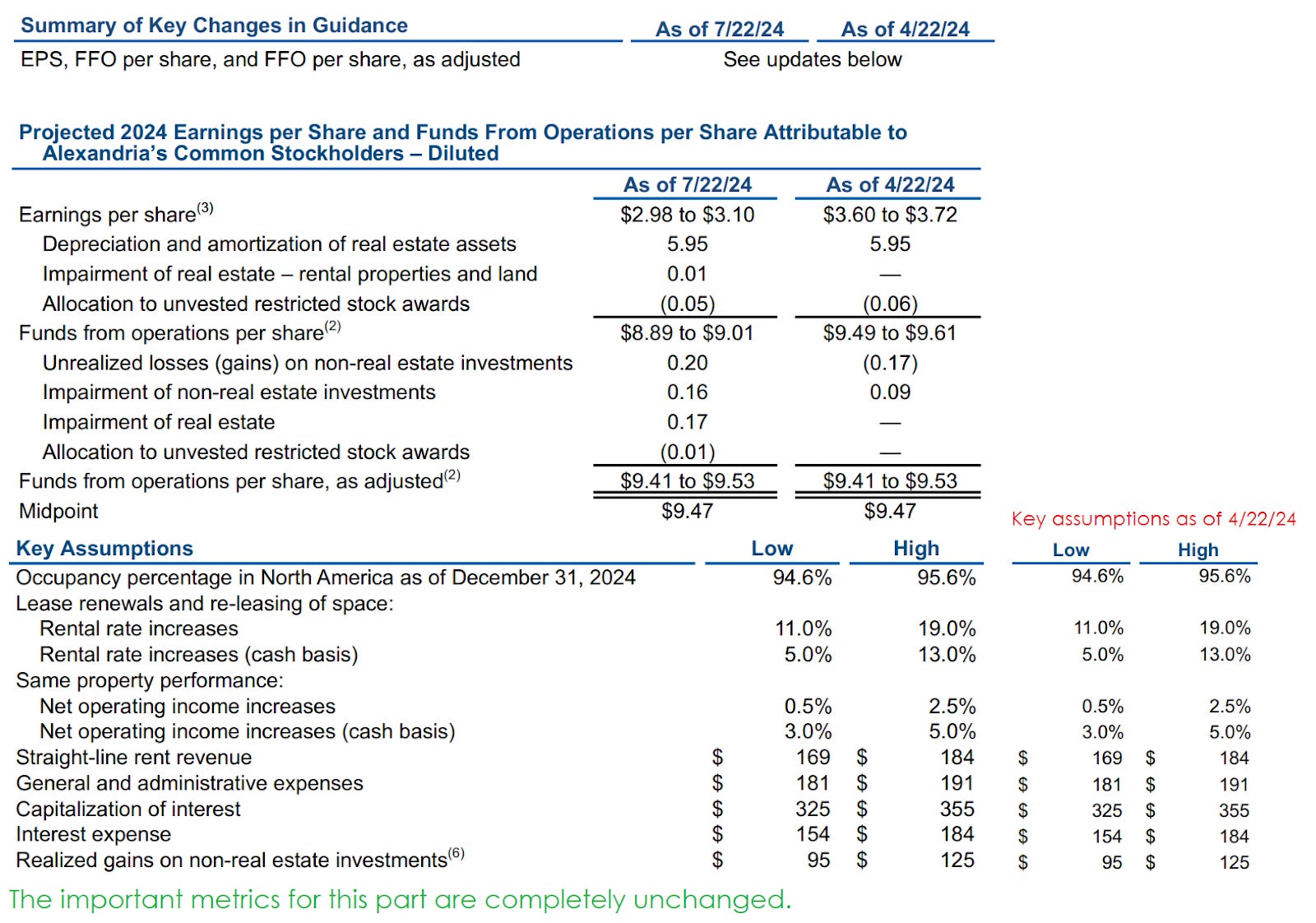

Guidance

Guidance was unchanged on most metrics, including all the important metrics in the first chart:

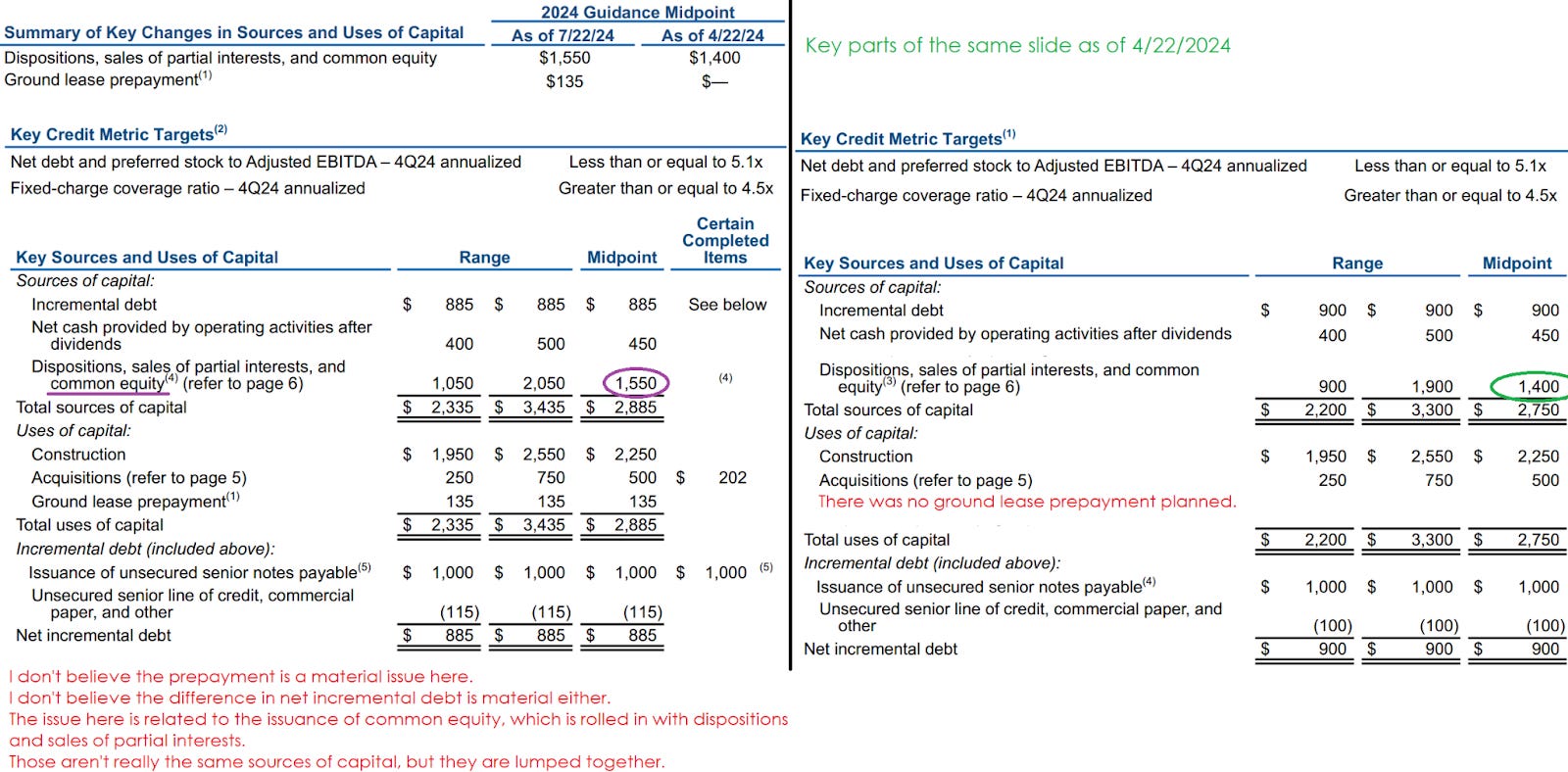

However, there are some changes in the second chart:

The prepayment isn’t a big deal, but the financing could be. ARE has some real estate under a ground lease. They extended their rights for another 24 years (from January 1, 2016 through December 31, 2088). That amendment involved a prepayment and ARE is determining how to fund that prepayment.

Selling common shares is not a great way to do it.

The big emphasis here is the potential change related to common equity.

ARE has an ATM (at the market) program and they may use that program to issue equity immediately or through “forward sale agreements”.

ARE having an ATM program was not concerning. It’s good practice for a REIT to have an active ATM program so they can go to it opportunistically without any big announcements.

The real concern is that ARE used a tiny bit of their ATM program during Q2 2024.

Further, I think investors want some clarity on how ARE is considering using that program moving forward.

The ATM Program

ARE only issued 230,000 shares under the program. That is a 0.13% increase. That isn’t material by itself.

However, the average price on those shares was $122.32 before underwriting discounts.

The problem is that this sends a very negative message to the market. Consensus NAV estimates for ARE were still around $145.

Consequently, management choosing to issue even one share at $122.32 looks bad.

In our case, it leads to an adjustment to our targets.

When management agrees to issue shares at a low price, I have to adjust targets accordingly. Generally, even if I believe in a REIT, I won’t let the strong buy price be substantially higher than the recent equity issuance. It may be modestly higher in some cases (particularly if the issuance was part of an acquisition), but issuing cheap has a negative impact on targets.

Note: The regular “buy under” target can exceed the issuance price by a material amount. That’s perfectly fine in scenarios with accretive acquisitions.

On the other hand, repurchasing stock or huge insider buyers (open market purchases) can encourage higher targets.

The ATM program had a total value of $1.5 billion.

While ARE could use the entire program, I still find that highly unlikely at these valuations.

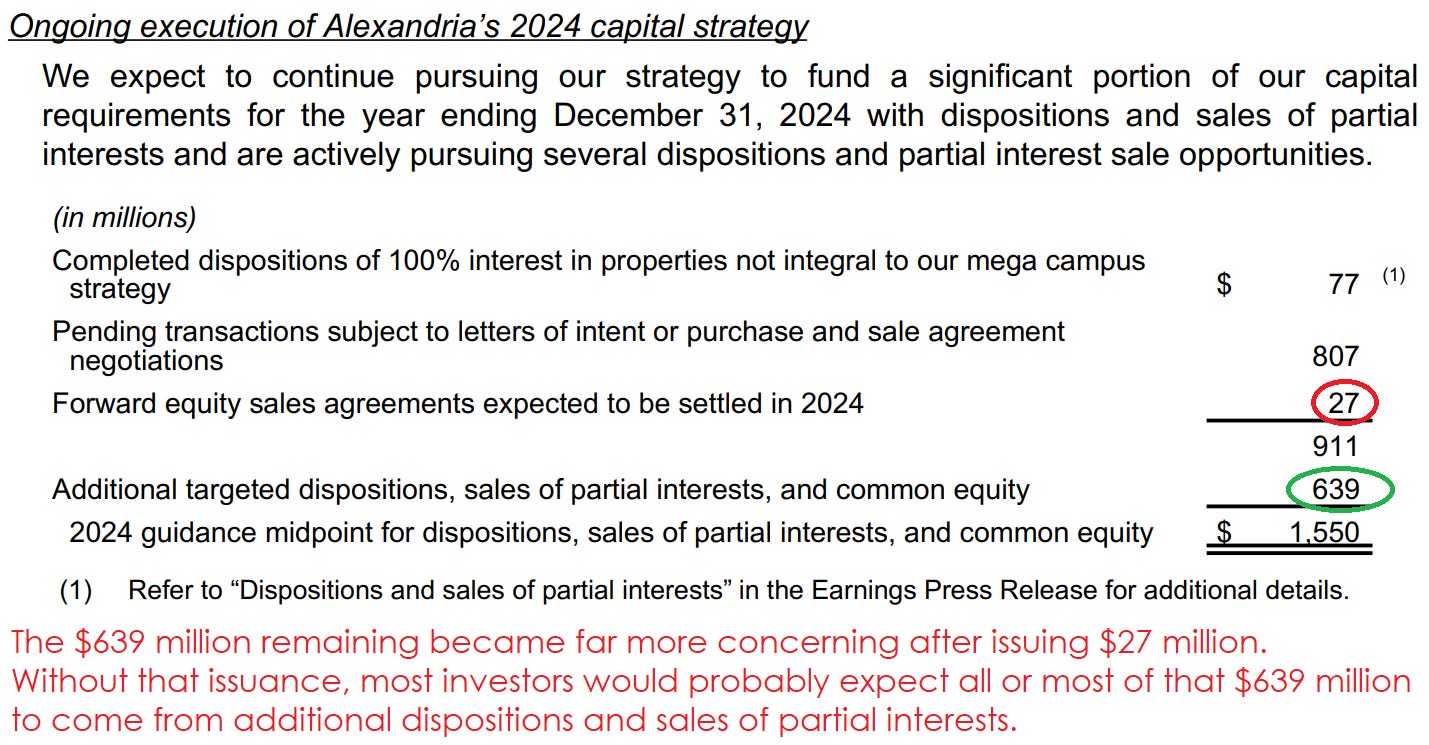

Dispositions, Sales of Partial Interest, and Common Equity

Out of the $1,550 midpoint for this category, there is $639 million left up in the air.

That’s the concern. There’s $639 million left for ARE to figure out.

Now investors are pondering how much common equity ARE might issue and what prices the company might accept.

The issuance of 230,000 shares for $27.8 million was not going to move the needle on fundamental valuation.

However, investors are wondering:

- Will ARE use issuance to cover the rest of the $135 million prepayment?

- What about the $150 million increase in guidance for dispositions, sales, and common equity (which includes the $135)?

- Or in a bear scenario, would they consider using it for a greater portion of the $639 million left to be determined? This seems unlikely at the current valuation, but it’s a greater concern today than it was yesterday.

Leasing Spreads and Same Property NOI

These are important topics so I wanted to touch on them briefly.

Guidance was unchanged for both metrics.

- Cash leasing spreads in Q1 2024 were hot at 19%.

- In Q2 2024 they were much lower at 3.7%.

That sounds much worse, but we already had guidance for the year indicating cash spreads in the 5% to 13% range.

Further, there were a small portion of leases going through in Q2 2024.

Moving on to same property NOI (Net Operating Income):

- Cash same property NOI growth was 4.2% in Q1 2024.

- It cooled slightly to 3.9% in Q2 2024.

It’s a bit lower, but that’s still a solid increase.

My Thoughts

Frankly, I find the decision pretty strange.

Any time a REIT issues a really tiny amount of equity (especially at a discount), I find it strange.

They didn’t bring in enough cash for it to matter, so why do it?

If they felt it was a good enough price to issue shares, then they could have issued more.

I think one of the most important topics on the earnings call (which starts soon) would be how management is thinking about the ATM program and what they are seeing in the market for potential dispositions.

Note: You can listen to the webcast of ARE’s Q2 2024 earnings call if you want to hear it live. They ask for names, email and so on. You can enter junk info. It isn’t verified.

Analysts will want to understand if buyers are present and what cap rates they might expect. They may want to better understand management’s thought process.

Did the market for selling assets dry up a bit?

Management for ARE has generally been pretty bright, so this is a surprising move.

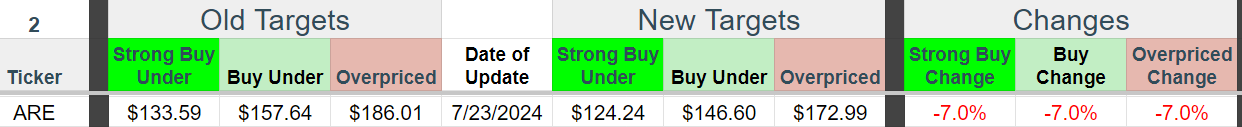

Target Adjustments

Further adjustments MIGHT be necessary after the earnings call.

However, the decision to issue shares at $122.32 is pushing targets lower.

While it wasn’t a large enough issuance to really move the “per share” values, it still reflects negatively on the valuation.

Fundamentals are the primary factor for valuation. Those were not changed.

The negative adjustments to targets is purely to reflect the decision to issue shares at a low price.

The new targets have reduced the strong buy price to slightly over ARE’s recent issuance price.

I believe today’s dip in the share price is primarily reflecting negative sentiment on management’s decision to issue those shares.

Member discussion