AGNC Preannounced Huge BV Loss, As We Predicted

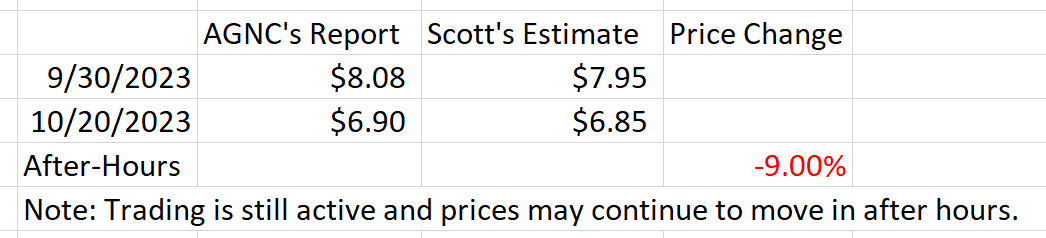

AGNC Investment (AGNC) preannounced results (as I said they should in last night’s article):

This doesn’t mean they must announce a secondary, but I believe it is extremely likely if the market price doesn’t tank far enough. The market is working on getting the price down.

AGNC was scheduled to report earnings on 10/30/2023 after the market close with the call following the next morning. There’s not much reason to announce one week early unless they are hoping to issue shares. Since these results were material information, they needed to provide this data to the market before trying to sell shares.

We didn’t have any non-public information. We simply had vastly better analysis than the market. There’s nothing wrong with better analysis.

It appears the market is either:

- Shocked by these results (which are extremely close to Scott’s projections) or

- the after-hours market recognizes that the reason to preannounce is hoping to issue new shares.

Shares closed at $8.11. They are currently trading at $7.52. They’ve been slapped for over 7% on results that matched Scott’s predictions.

Predicting it:

Yesterday’s article included the following quotes:

Agency: It appears that the market really nailed the adjustments on agency mortgage REITs. It did not. AGNC had the biggest projected loss in BV but the smallest drop in share price. Consequently, AGNC continues to be an absolutely dreadful choice. Price to projected tangible BV as of this weekend is about 1.20.

Later in the same article:

That’s the current environment. It makes estimates less precise, but it also makes them extremely important. There are still some investors who are using book value from 6/30/2023.

AGNC’s tangible book value was $9.39 on 6/30/2023.

Using Scott’s estimates, we believe tangible book value was:

· About $9.40 as of 7/28/2023.

· About $8.95 as of 9/1/2023

· About $7.95 as of 9/30/2023

· About $6.85 as of 10/20/2023

That represents a cumulative 27% decline relative to the end of Q2 2023. About half of the projected decline occurred across the first 3 weeks of October.

Are the preferred shares still okay? I don’t see a problem. AGNC’s book value per share is getting shredded, but the share price represents a huge premium. AGNC would be wise to issue any shares they can at the market. If I were them, I would want to pre-announce the results just to clear the way for a huge secondary. If book value is close to our estimates, then issuing shares is by far the most accretive thing management can do. Even if the price-to-book fell from 1.20 to 1.15, it would still be an amazing opportunity to pump out shares.

If AGNC’s portfolio is only worth $6.85 per share and they can pump out shares over $8.00, that’s a no-brainer. It’s not “dilution”. After issuing shares, the equity per share would increase. That would allow AGNC to buy more assets. If the REIT is fortunate enough to have a large premium to NAV, then issuing shares at that premium is precisely how to drive growth.

Conclusion

Don’t pay around 1.20x tangible book value for a simple agency mortgage REIT whose assets are held at market value.

Props to AGNC for moving so quickly to preannounce their results. They recognized the writing on the wall for that premium and took decisive action. It is better to line up a secondary before the analysts who are nailing your book value proceed to post it for everyone.

Big round of applause for Scott Kennedy. BV fell about 27% since the end of Q2 2023 and Scott’s estimates are still within 1%. Management actually provided a range of $6.80 to $7.00 for 10/20/2023. I took the liberty of using the $6.90 midpoint for the table. That $6.85 estimate was outstanding. That's akin to hitting a full-court shot while someone is shaking the hoop.

Like the article? Hit that share button and tell a friend.

Member discussion