A Risk-Free Return On Cash: Guide On Why And How To Buy Ibonds - Part 1

As we’ve been looking for opportunities to optimize our risk/reward profile, we decided it was time to consider the Series I Savings Bonds (or “ibonds” for short). After reviewing the key traits, we decided to invest. This article will explain our decision and guide investors through the process of making their first investment in ibonds.

What Are Ibonds?

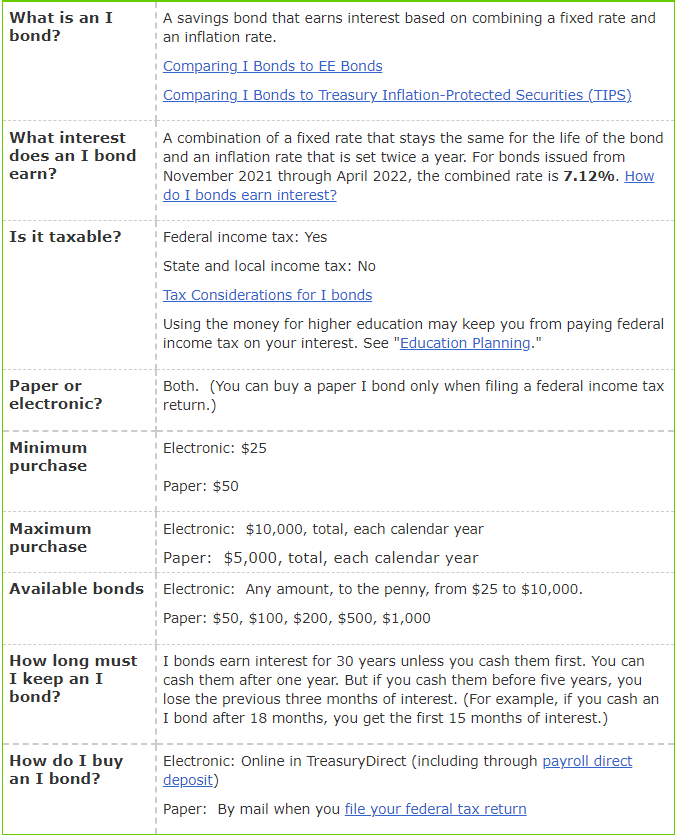

They are bonds you buy directly from the Treasury. They pay a combination of a fixed-rate and an inflation rate. Additional details are shown below:

Source: Treasurydirect

It is important for investors to understand that inflation is an important factor in the total returns. The combined rate of 7.12% is higher than it would be if we were seeing slower growth in the CPI (consumer price index). The rate on the ibonds can increase OR decrease and investors should expect it to change twice each year. Therefore, it could be earning a lower interest rate 6 months from now.

How Do ibonds Fit Our Strategy?

We usually have extra cash in our portfolio. However, we also have accounts for checking and savings. Those accounts are not part of our portfolio. Since the interest rate paid on those accounts is terrible, we aren’t earning any returns on them and inflation leads to negative returns. What do we want? We want a tool where we could earn a respectable rate of return with no risk of our investment decreasing in value. That’s where the ibonds come into play. The cash will be locked up for the first year, but after that it becomes accessible at any point. The downside of cashing it out is that the purchases are limited by the $10,000 annual cap per person. Cashing out in the first 5 years also costs the investor the last 3 months of interest, but that’s not a huge penalty when the other option for cash is earning almost nothing in a savings account.

Using ibonds sounds ideal for anyone who has enough cash on hand to feel comfortable locking some of it up for that first year. We have the option of continuing to hold the bonds for up to 30 years, if we don’t need the cash for anything. Ideally, we can simply build up our position year after year. By using ibonds we have the option of having a smaller emergency reserve in cash. If we needed capital for the next few years we could start cashing in the bonds. Theoretically, we could access stock accounts but we don’t like the prospect of ever “needing” to sell a position.

Per the Treasury Department’s guidance, the ibonds are not subject to state or local taxes. They are subject to federal taxes. The bondholder for the ibond can choose to report interest every year (more work and earlier taxes) or they can defer reporting the interest until the year they take their money out (max 30 years). Theoretically, there could be a situation where a parent buying the security for their child would want the income reported every year. However, that’s getting into a pretty niche situation due to rules for unearned income for children.

Cash Management

You may notice that we aren’t thinking of the ibonds as a traditional “investment”. We’re looking at it as a cash management technique. It isn’t replacing part of our stock portfolio. It is replacing cash that would’ve otherwise sat in checking or savings accounts earning very little. It is allowing us to earn new money using money that otherwise would’ve been slowly eroded by inflation.

The Guide

We’re going to guide investors through the process of creating an account on Treasurydirect.gov, funding that account, and purchasing ibonds. There was only one step in the process that felt a little awkward. Overall, it is pretty straightforward. To prepare this guide, I purchased $10,000 in Series I Savings Bonds. I took screenshots of every single step along the way and highlighted where I clicked to reach the next step. The purchases go through Treasurydirect.gov and the site says it is optimized for internet explorer, so we used Microsoft Edge (close enough).

What to Know Before You Start

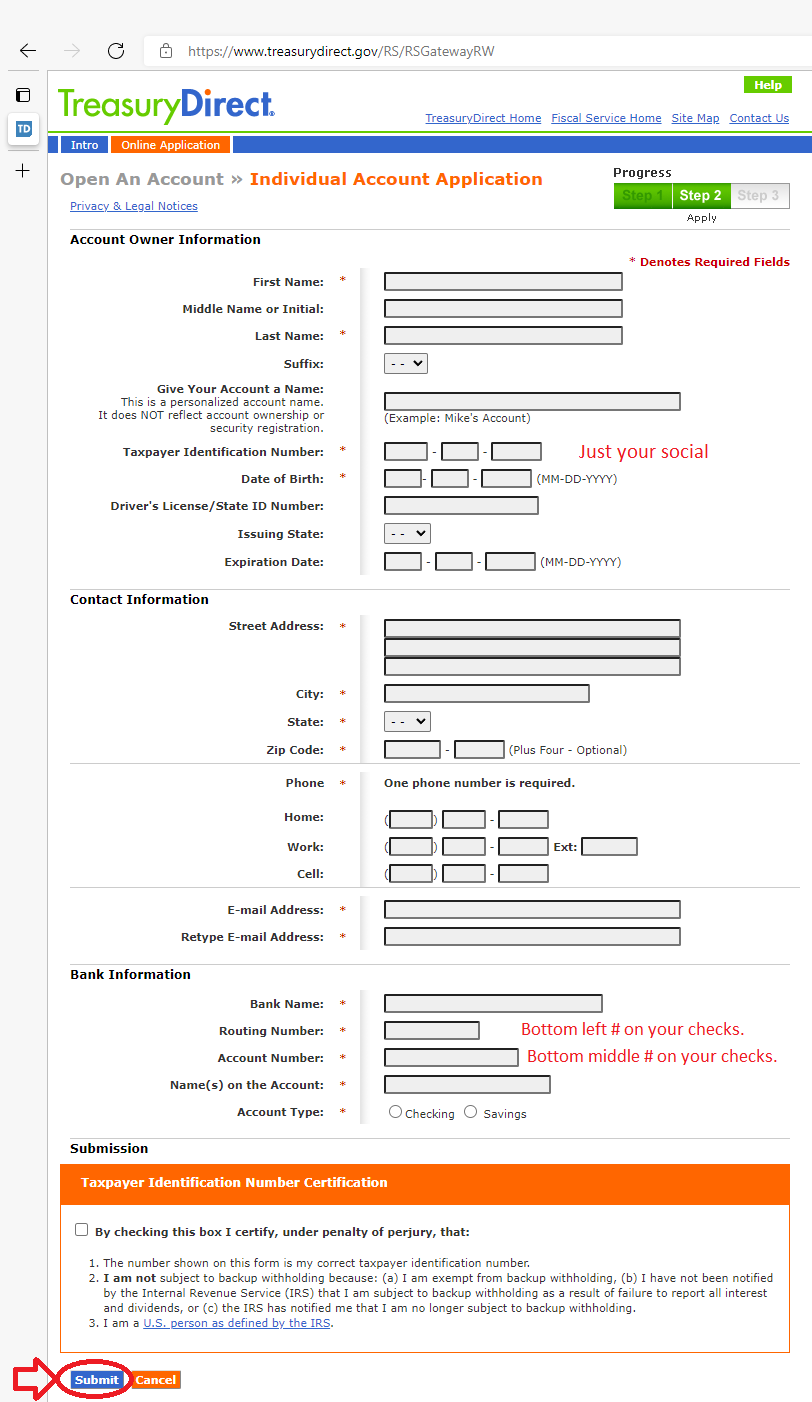

Having your ID card (such as driver’s license) isn’t necessary, but I add that information anyway.

You will need to have:

- Either: A check for the account you intend to use to fund your purchases OR the bank name, routing number and account number.

- Your social security number.

- Access to your e-mail since you must receive two emails for verification codes.

It would be wise to also have enough cash in the bank account to fund the transaction. However, investors can choose to start with a small amount and can choose to do recurring investments if they desire. We’re jumping right in and buying $10,000 of ibonds.

Creating Your Account

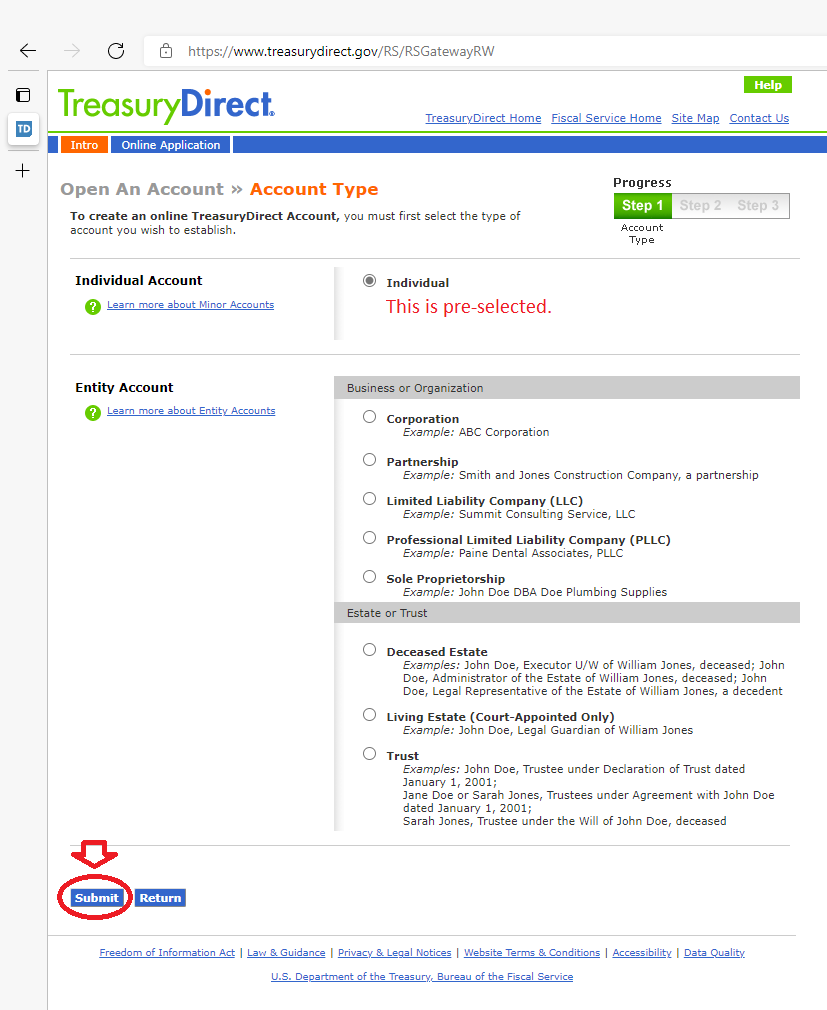

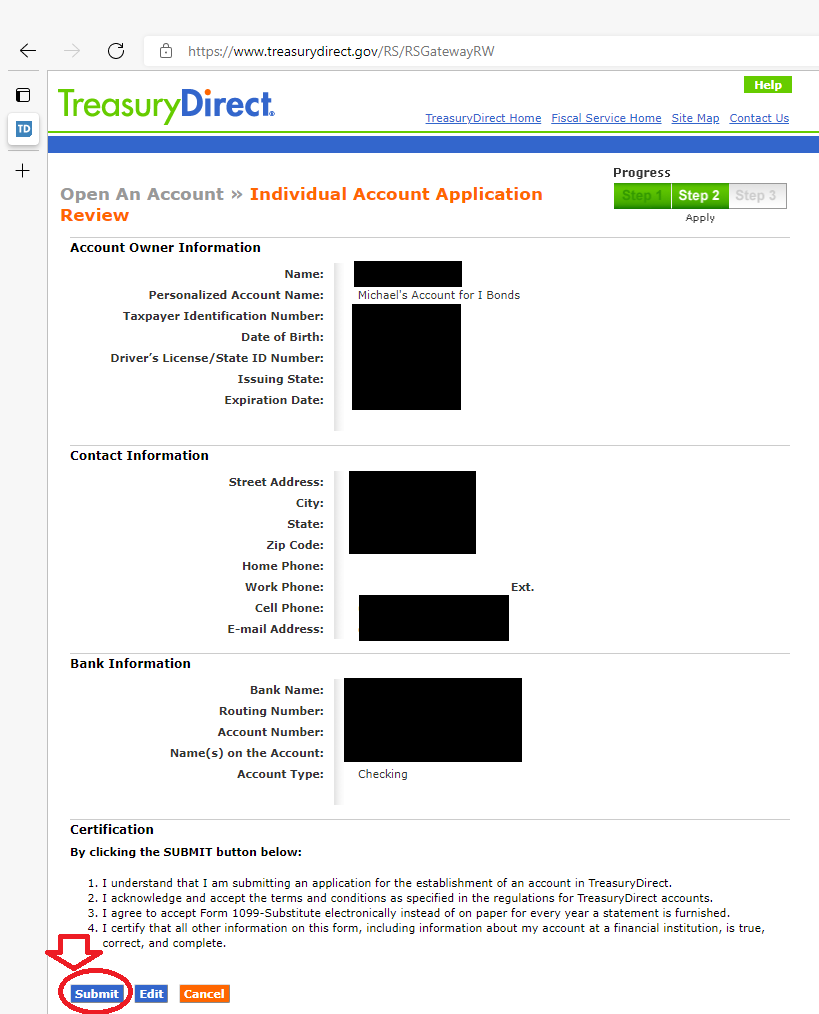

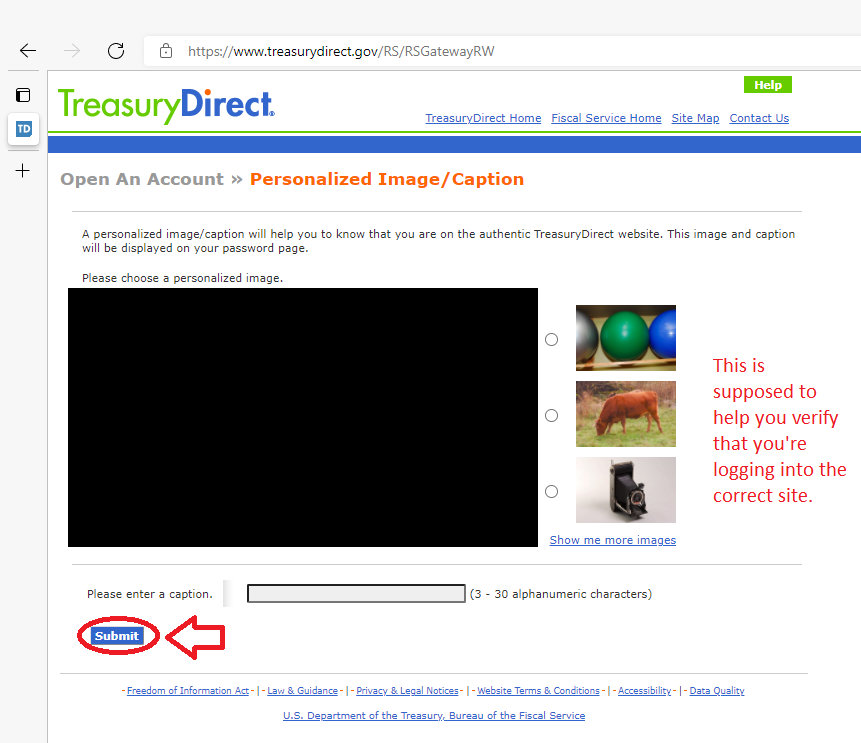

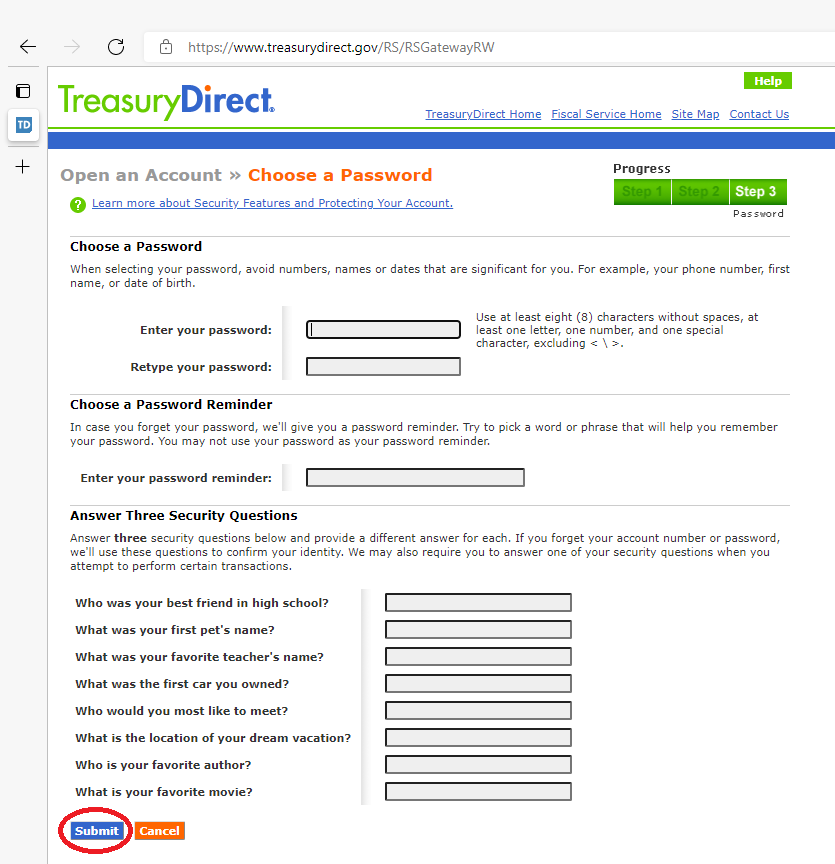

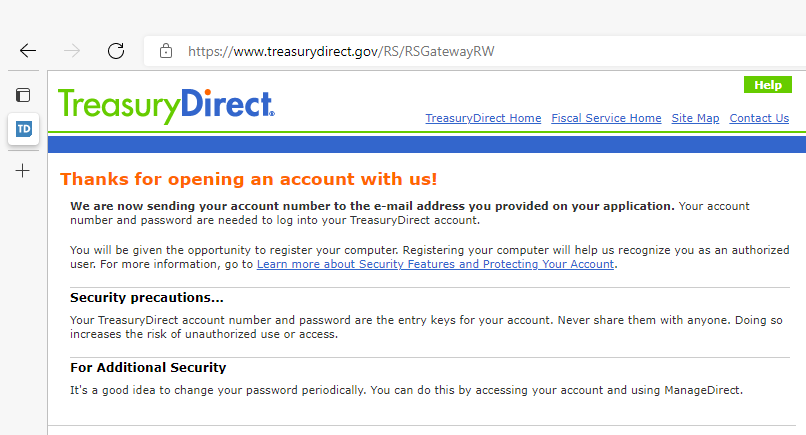

When I’m following a guide for something that is new to me (almost always fixing a setting on my phone), it irks me when even a tiny step is left out. Therefore, I would rather err on the side of being too obvious than risk leaving out one step. The final click on any page is highlighted with a red circle and may also have a red arrow to draw further attention to it.

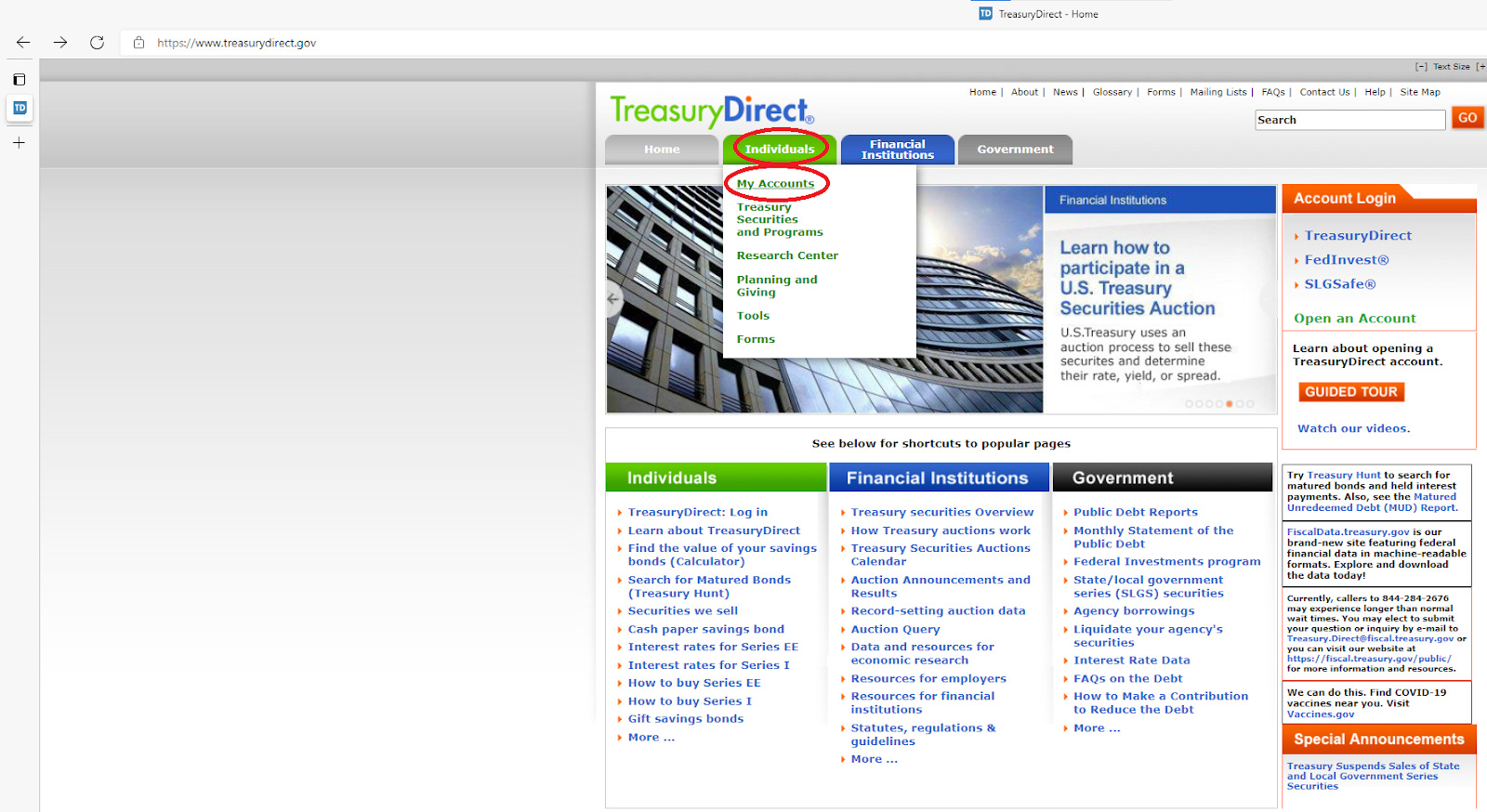

Step 1: Go to

https://www.treasurydirect.gov

and click “Individuals” followed by “My Accounts”

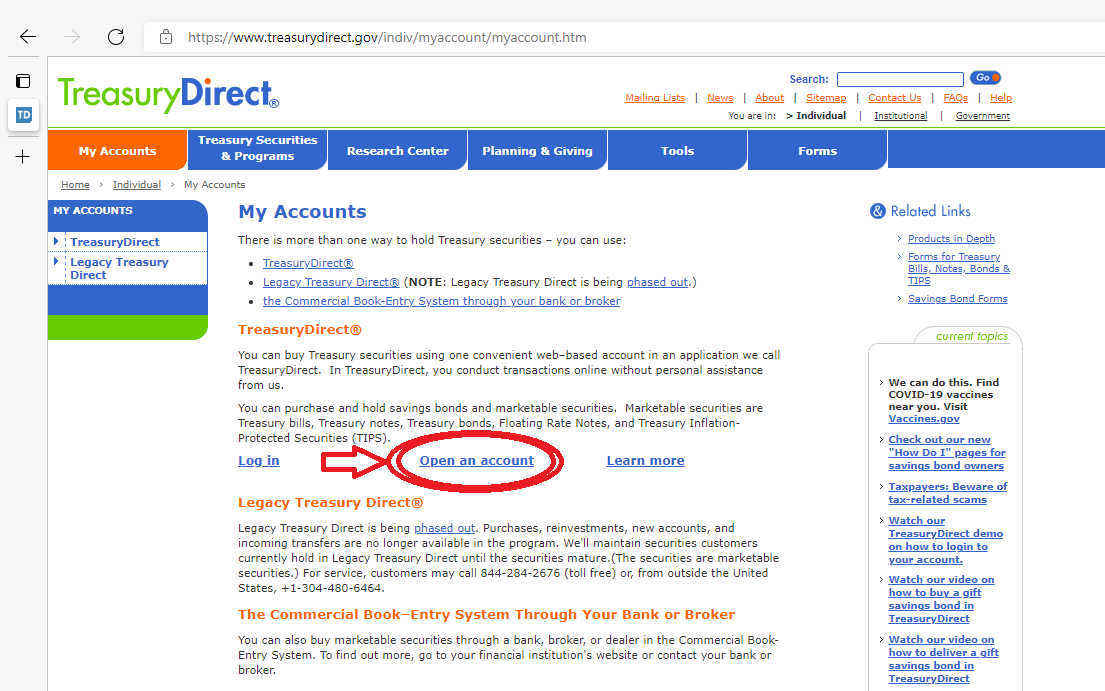

Step 2: Choose “Open an account”:

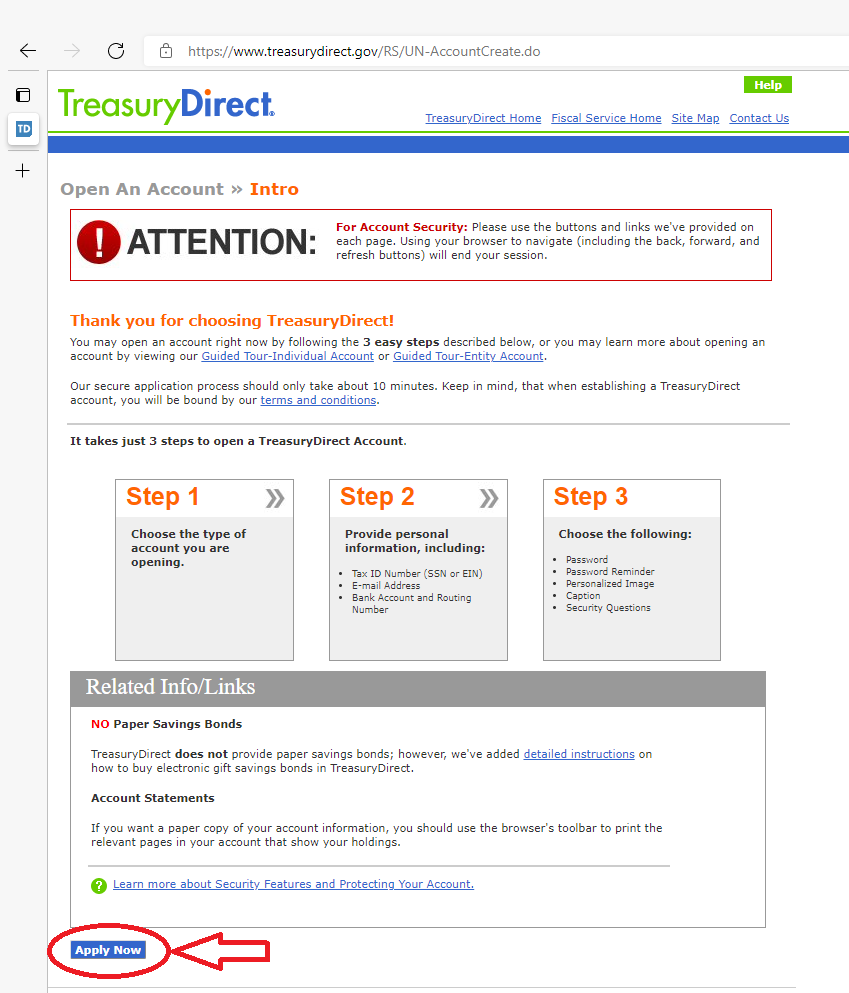

Step 3: Choose Apply Now

Step 4: The “Individual” option will already be selected. Click “Submit”.

Step 5: Enter your personal information and then hit “submit”. Fortunately, you’re entering all of the information on just one page, which is far less annoying than using several pages.

Step 6: Review that you didn’t typo any of your information. If you did, use “edit” rather than trying to press “back”. When you’re happy, hit submit:

Step 7: Pick a personalized image and caption, then hit submit:

Step 8: Choose a password, set a reminder (I like to list the password requirements), and answer three security questions. When you’re done, submit again:

Step 9: Get this nice little “Thank you” page telling you go to go check your email:

This effectively ends the first section for creating your account and there ironically isn’t a direct link to the next step. You’ll be starting fresh after you get the email. In Part 2 of this guide, we’ll demonstrate the rest of the steps.

Next up

We’re organizing the second part of this guide. As you might have guessed, the title will be:

A Risk-Free Return On Cash: Guide On Why And How To Buy Ibonds - Part 2

Member discussion