Inflation Poised to Strike Shopping Center REITs

Summary

- Shopping center REITs roared higher in 2021. The impressive rally has made prices less attractive compared to other REITs.

- Few analysts are willing to take a simple bearish view on a subsector. It isn’t popular with readers. It goes against their incentives.

- While retail isn’t dead, it is becoming less relevant. Ordering online with in-person pickup helps, but there are other challenges coming.

- Valuations don’t leave much margin for safety. Pressure from rising wages has the potential to severely impact traditional retail tenants, which could weaken leasing spreads over the next several years.

- Rising wages are driving a material shift in our expectations for inflations. Beware of jumping to conclusions about Treasuries or REIT values though.

Shopping center REITs have enjoyed a resurgence in 2021. Many analysts appear to be forecasting the great revival of shopping centers. I’m going to take a less sanguine view. However, I want to begin by acknowledging the optimistic case. Shopping centers have benefitted from adjustments within their parking lots to enable rapid pickup. The ability for consumers to order online and pick up at the store shortly thereafter has been important to the tenant’s ability to maintain profitability (or reduce losses). Shopping centers are involved in this because they need to make it possible, yet putting up a few “Online Only” signs for spaces next to handicap parking is a pretty simple task.

Bulls Hate This View

When I write about how the sector is becoming more fully valued, it isn’t good for customer retention. Even a spectacular article on the topic has a clear negative impact. Many investors think “well, this sector is fully valued so I’ll buy a different sector where the analysts are very bullish”. Think about that for a bit. We’re not going to simply argue that shopping center REITs are near a fully valued level, we’re seeing that for the overall market.

There are still small pockets of value, but perpetually bullish analysts are just prioritizing revenue over taking care of their customers. Those analysts may quietly believe that investors come to them for reassurance and excitement, rather than returns. If they don’t have solid performance on their investments, they can simply hide some of the data or come up with “creative” ways to calculate returns. This is why we added such extensive data on portfolio value over time to our Google Sheets. This transparency removes any uncertainty about the process.

Note: Seeking Alpha will usually prohibit such frank discussion of returns and incentives in public releases.

I premise the rest of the article with that commentary because it provides context. It speaks to our conviction about the long-term fundamentals and our motivation (protecting investors) in highlighting these issues.

Is Retail Dead?

Absolutely not. It isn’t healthy either. We may see stronger performance in the near-term since companies on the verge of bankruptcy had a great opportunity to file already. Further, REITs which adjusted their lease accounting for potential defaults that don’t occur may report stronger values (artificially strong, as 2020 was artificially weak). This can be a tricky situation since it requires quite a bit of digging into the accounting. Since relatively few investors are looking for opportunities to short, this type of digging is most useful when we think we might uncover a buying opportunity.

Two Challenges

There are two issues facing retail today, in my view:

- Retail is becoming less relevant.

- Valuations are high.

Relevance

Because consumers can order so many things online and have it shipped to their door, physical retail is becoming less relevant. This is one of the reasons I’ve tended to prefer net lease REITs which own restaurants and industrial properties over the more generic retail property. While restaurants were hammered during the pandemic, hot food isn’t coming from an Amazon warehouse. The consumer may decide to order through DoorDash, but the order still needs to be routed to a local restaurant. That keeps restaurant real estate relevant. However, big box retail is becoming far less relevant and that means an abundance of space. When a big box store shuts down, the landlord often needs to split up the box and lease it out to several smaller retailers. Consequently, investors can’t simply look at the number of closures relative to openings in a year. On average, the new locations opening will tend to be smaller.

Based on a long-term view, we’re expecting retail rents to grow at slower rates than most other property types. In some areas, they may decline. However, slow growth could still put them below the rate of inflation. This produces a long-term challenge. If prices are low enough, investors could be compensated for taking on lower risk. Are prices low enough? No.

Valuations

It usually comes back to valuation. While there are REITs that I wouldn’t buy at any price, these aren’t them. These are REITs with good management teams (some great), some have strong balance sheets, and the “flaw” is just weaker revenue growth. Again, we need to remind investors that looking at year-over-year metrics following the pandemic can be misleading. We won’t emphasize artificially low values for 2020 as proof the sector is struggling or artificially high values for 2021 as proof it overcame the long-term structural challenges.

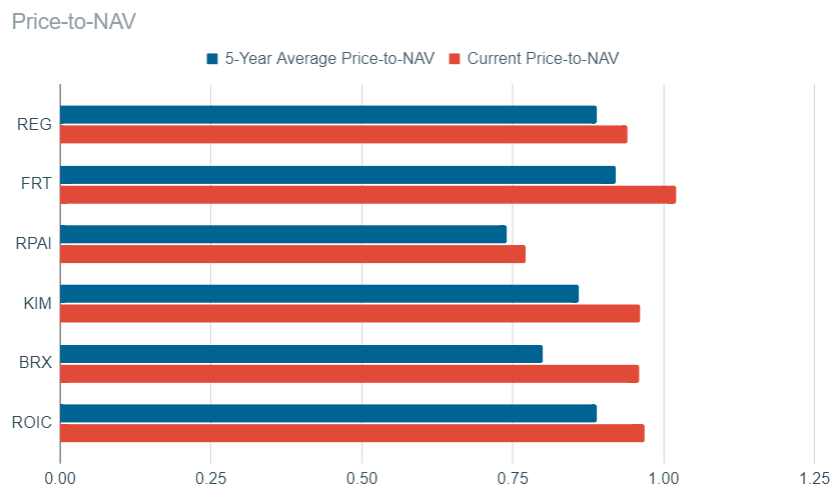

We will start by using “Price-to-NAV”. The NAV (Net Asset Value) used in these calculations comes from the consensus analyst estimate. If we believe the consensus estimate is absurd, we would disclose that. We don’t have any reason to believe the consensus NAV estimates for these shopping center REITs are significantly flawed.

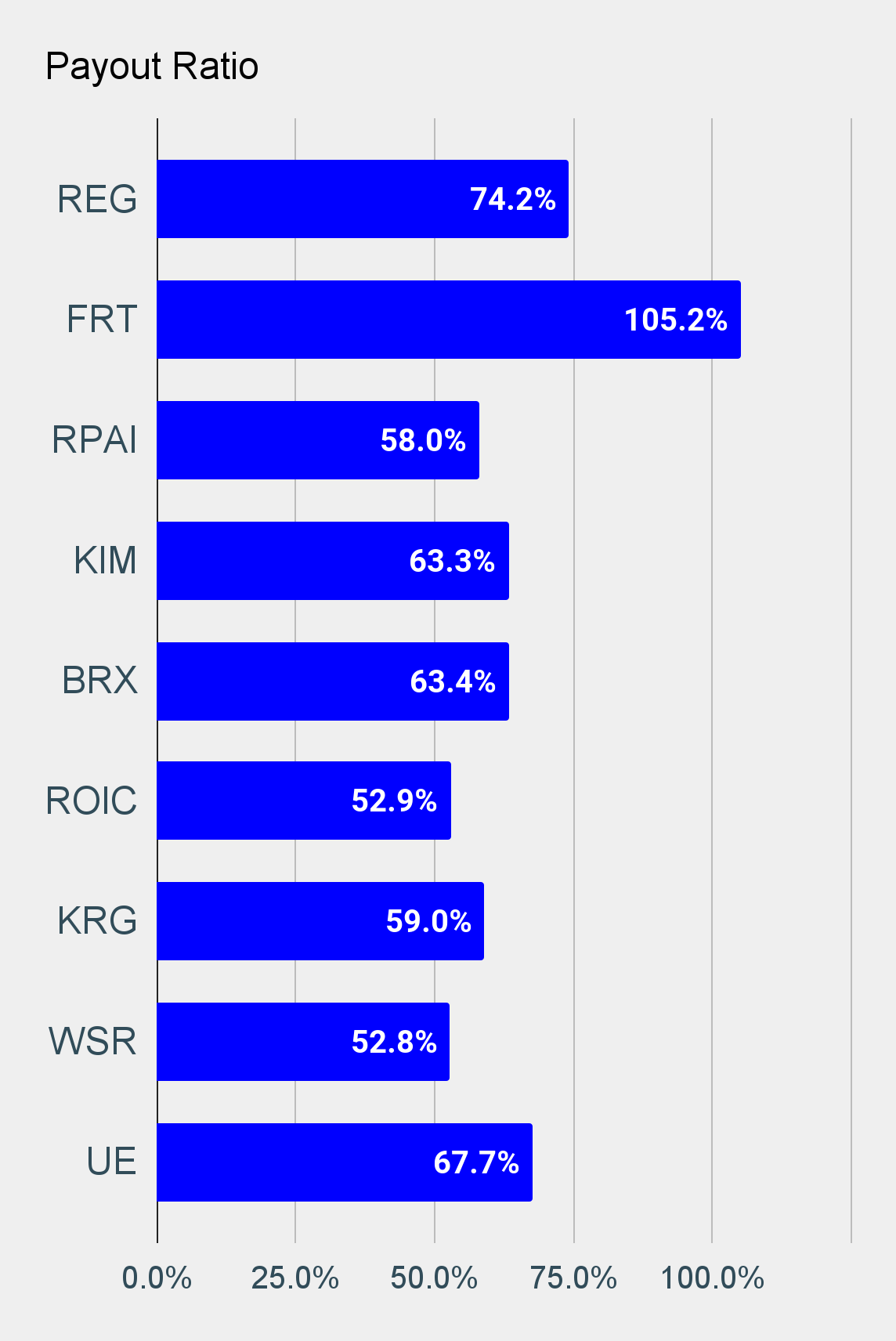

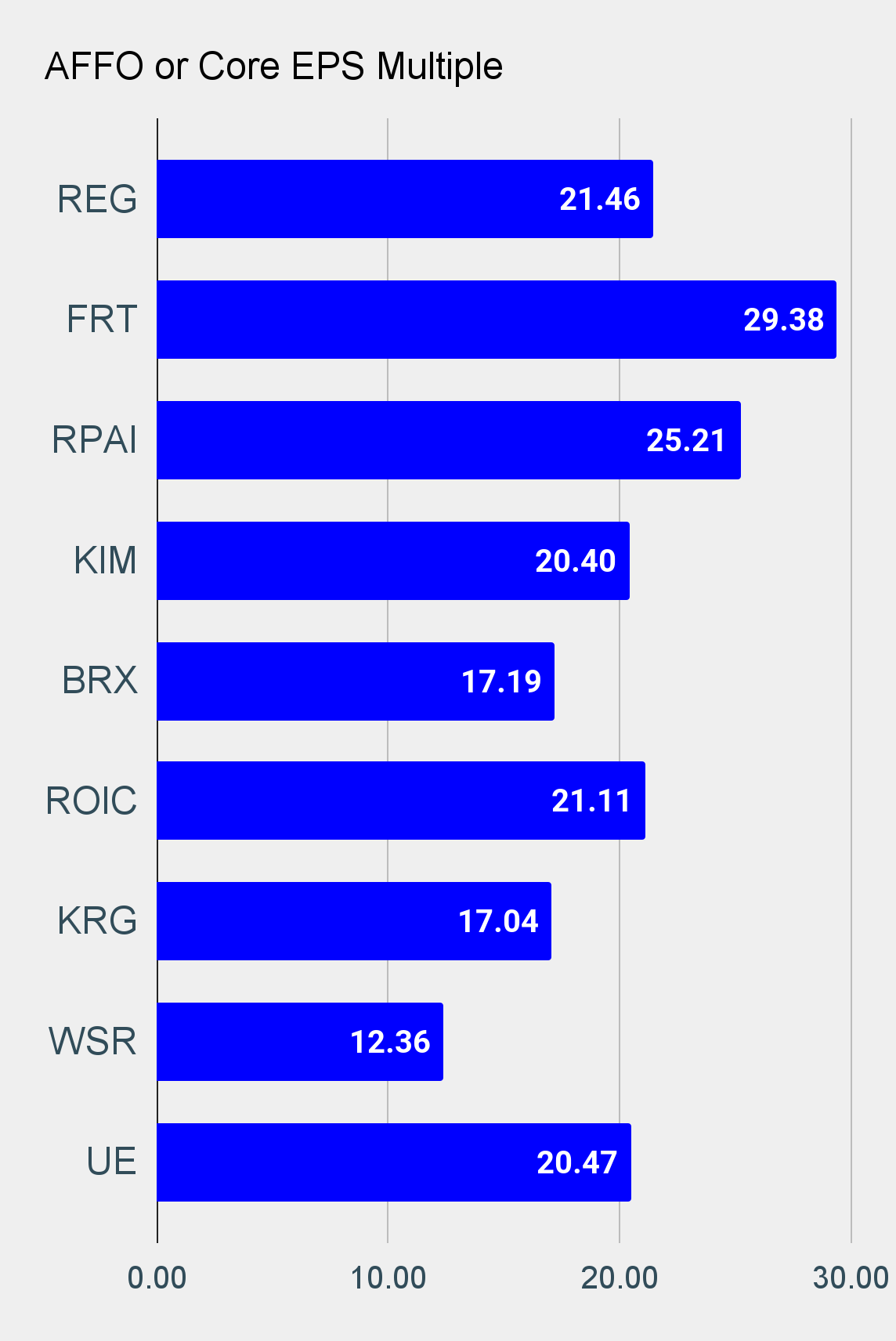

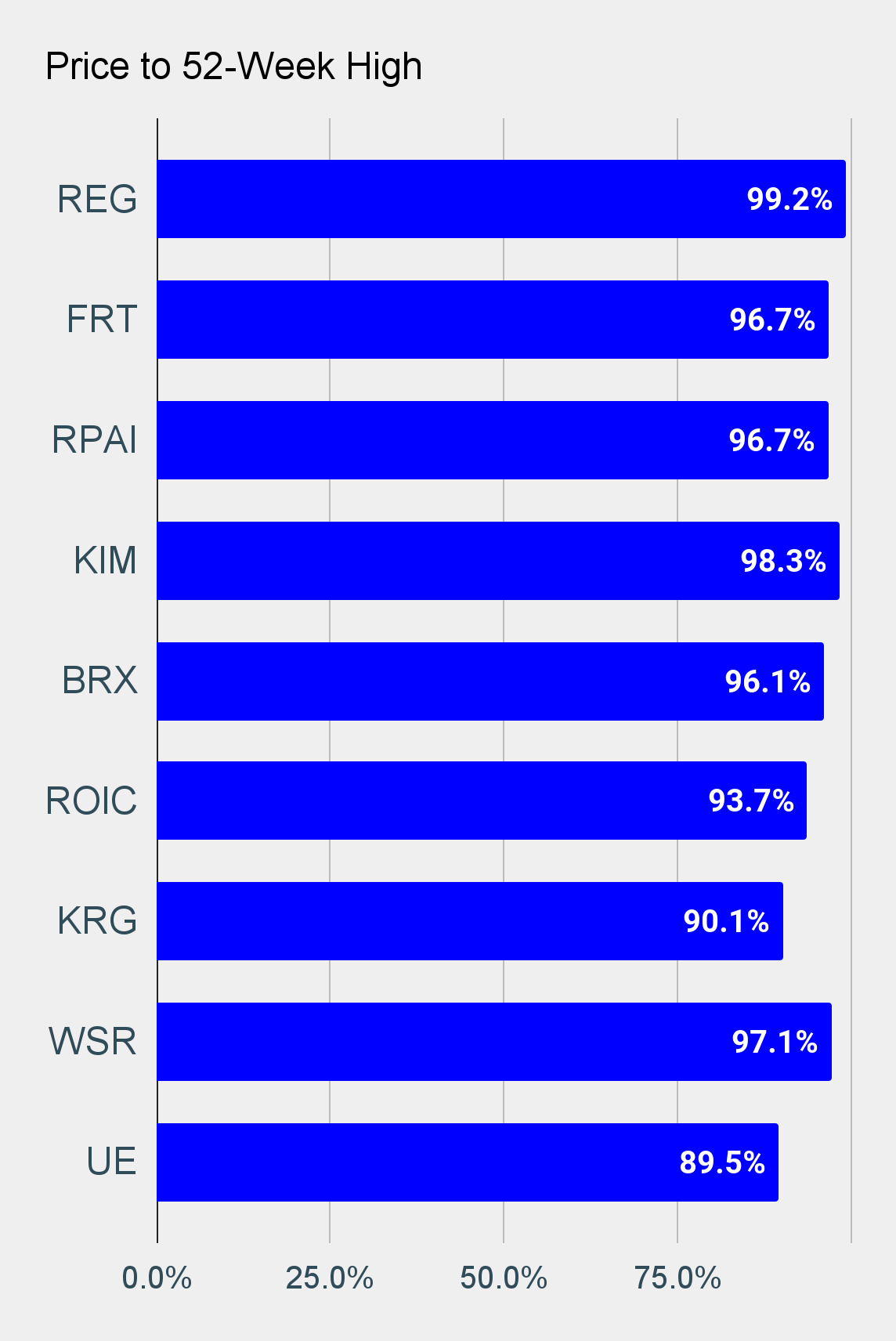

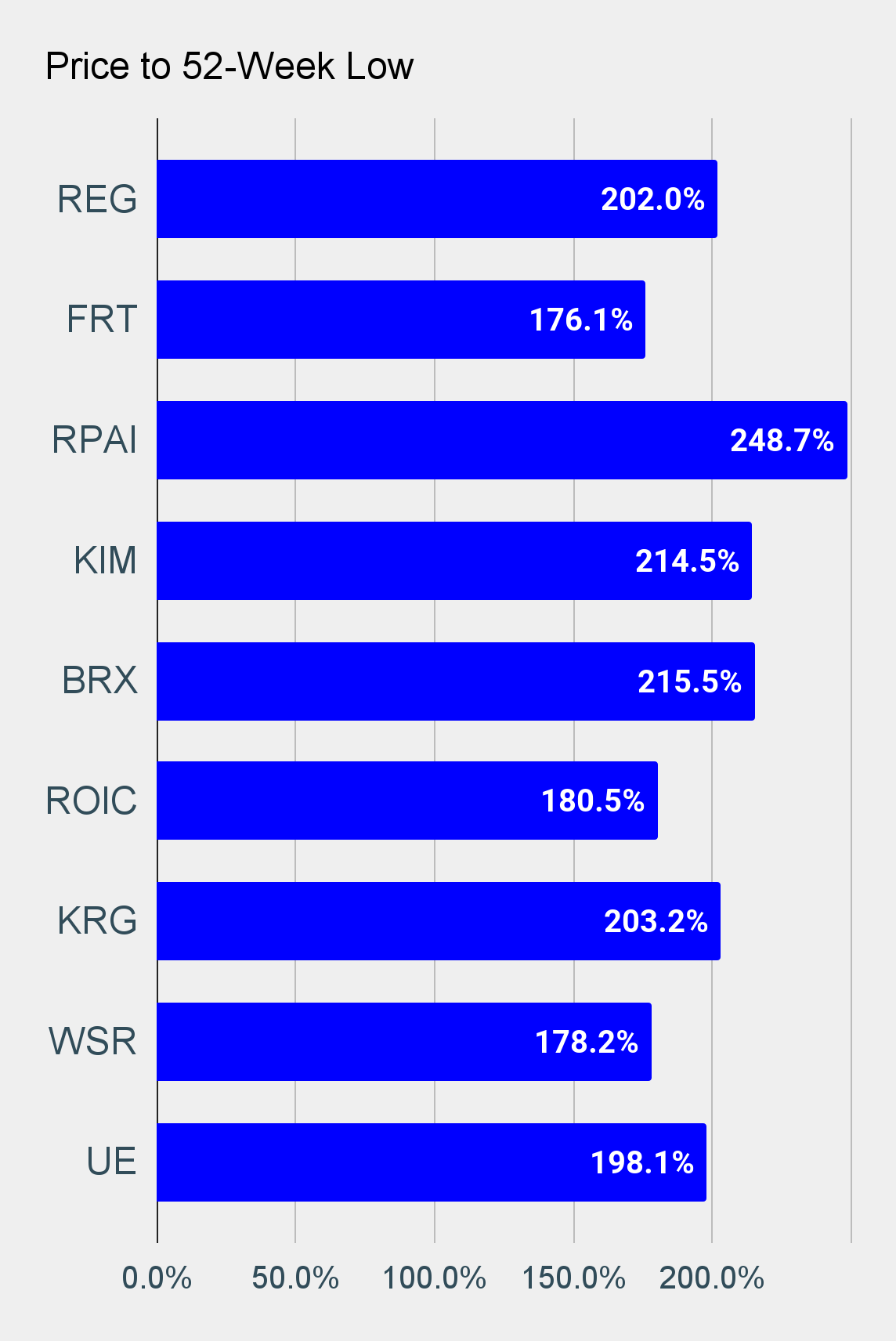

These charts cover:

- Regency Centers (REG)

- Federal Realty (FRT)

- Retail Properties of America (RPAI)

- Kimco (KIM)

- Brixmor Property Group (BRX)

- Retail Opportunity Investments Corp. (ROIC)

Source: Author’s chart, data from TIKR.com

You may notice that in each case the current price-to-NAV is higher than the 5-year average. It is true that price-to-NAV ratios were absurdly low during the pandemic, but the last few months have been dragging the averages higher. Seeing the higher-than-normal price-to-NAV ratios, investors could start asking themselves “do I believe the future performance of this real estate will be substantially superior to prior levels”? Remember, this period covers far more than just the pandemic. We can enhance this analysis by also comparing current values with the historical levels for AFFO multiples:

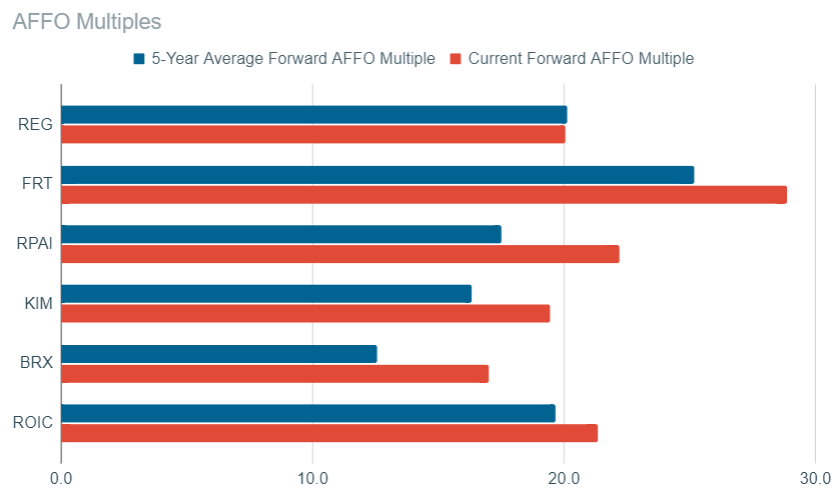

Source: Author’s chart, data from TIKR.com

The only case where the AFFO multiple is lower than average is Regency Centers (REG). In that case, it is only slightly lower. In some cases it is quite materially higher. The most notable cases are Retail Properties of America (RPAI) and Brixmor Property Group (BRX). Despite our overall pessimistic view for the property type, we think BRX deserves to trade at or above the historical average AFFO multiple because a population shift is favoring their real estate. On the other hand, shopping centers in higher cost areas may struggle more to maintain rent levels as tenants grapple with consumers migrating away from those areas.

First Conclusion

Valuations across the shopping center REITs recovered dramatically. The current valuations leave far less margin for weakness in leasing results over the next several years. That feels like a pretty high bar given some of the long-term macroeconomic headwinds. Despite solid management teams and a resurgence in retail real estate, tenants are still facing several issues. The lingering difficulty of competing with e-commerce may be compounded by other factors such as the requirement for higher wages to attract employees. Staffing retail locations may become materially more expensive. The additional cost reduces the attractiveness of opening new retail locations. A reduction in new store openings would drive difficulties in leasing spreads or occupancy over the next several years. Current valuations imply continued solid growth in AFFO per share year-over-year. If that growth stalls out, then existing multiples and price-to-NAV ratios would provide room for a material decline. That doesn’t fit our risk/reward profile.

Ratings:

- None

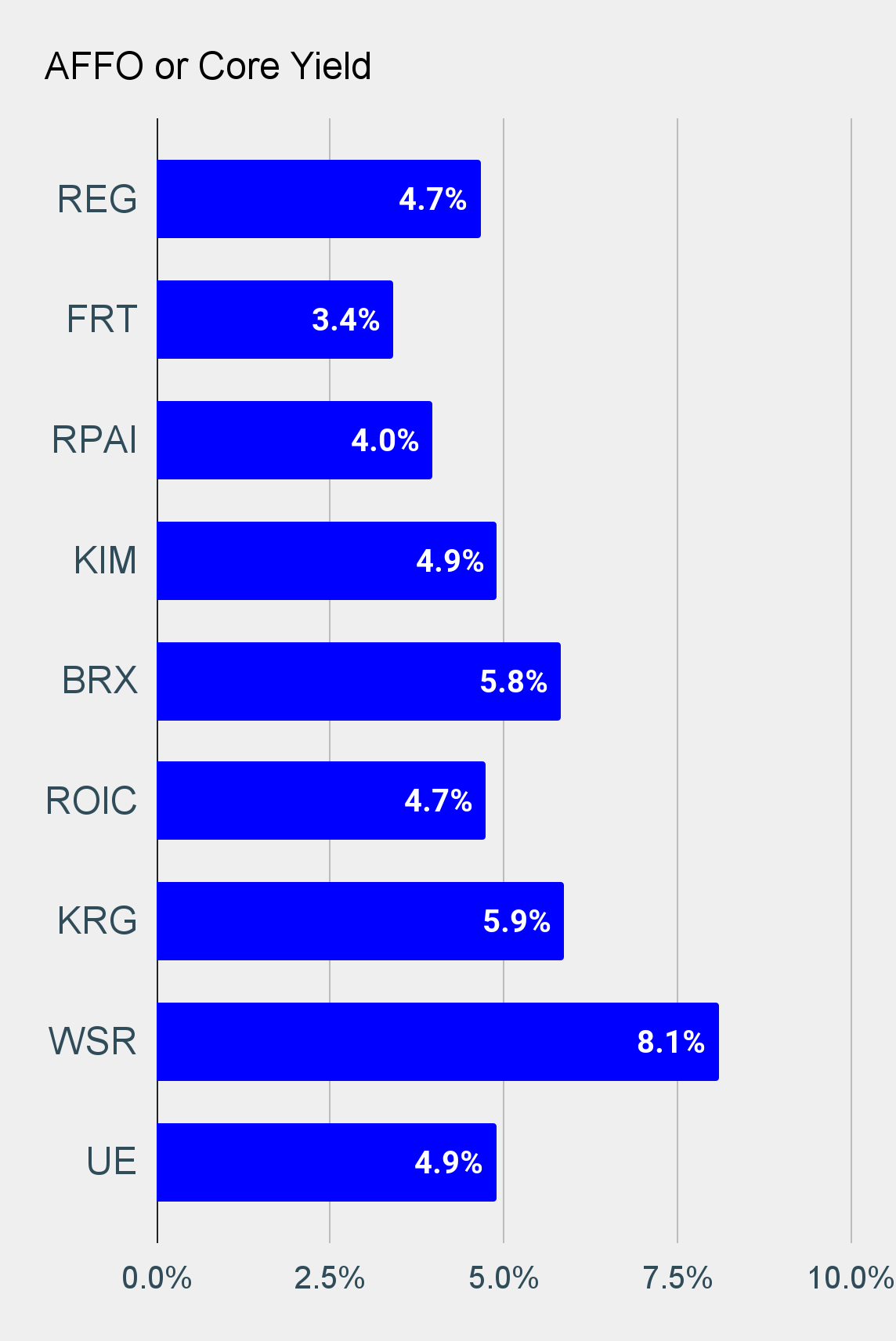

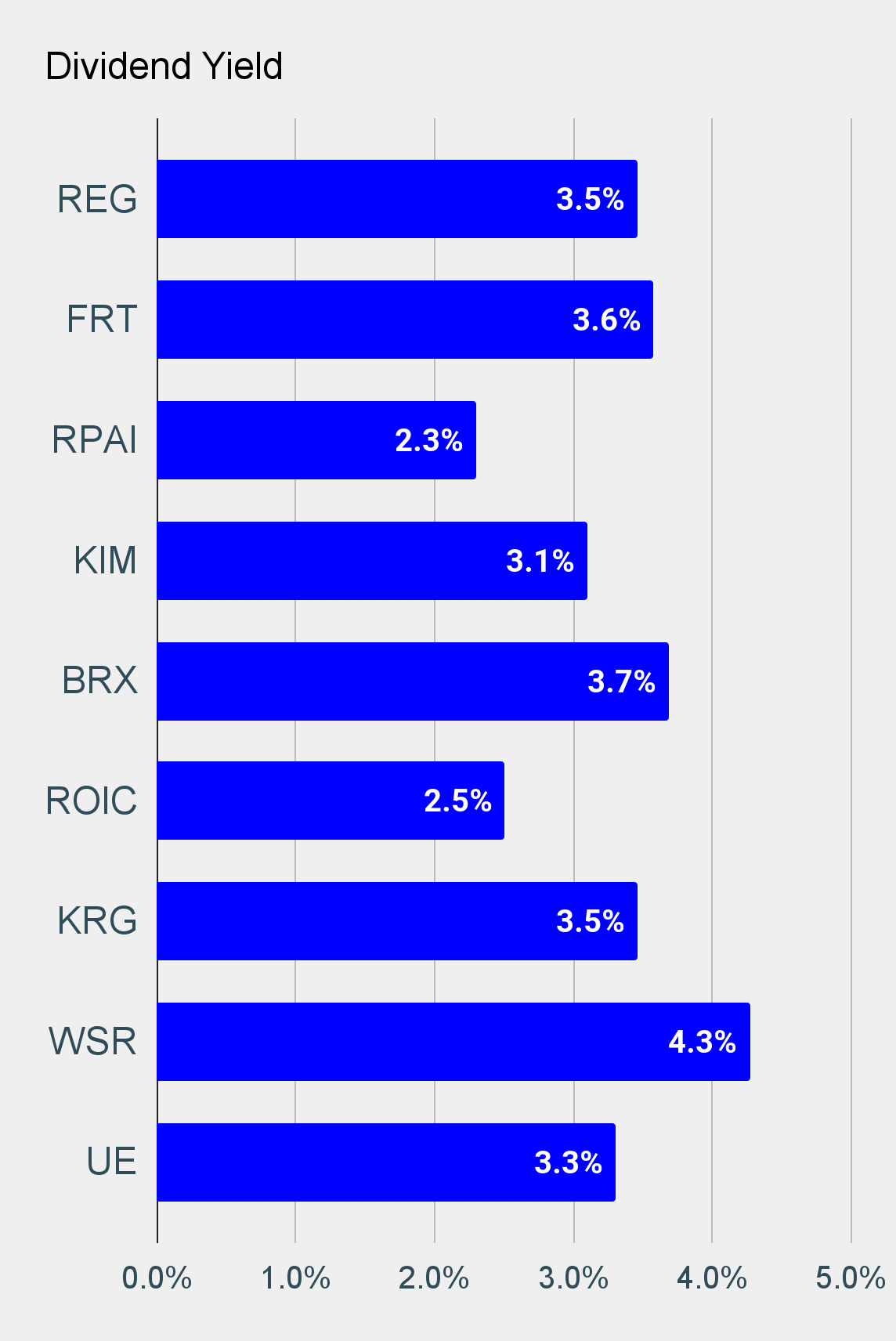

The charts in this section will still be updated for each new article, but the rest of the text for the public version will be mostly repeated from piece to piece. We structure the article this way because the repeated sections are extremely important to understanding REIT investing, yet we find people rarely click links to access additional information. Therefore, it needs to be in the body of the article so any reader can easily refer to it.

Note: The following charts are absurdly large, but we’re working on ways to mitigate that while retaining the ability to zoom.

If you enjoyed this article, please feel free to forward it to friends.

If you’re reading this on the web, you can get this entire article delivered to your inbox:

Got feedback? You can hit the reply button on the e-mail and your letter goes straight to me. If something wasn’t formatted correctly in your inbox, please let me know. The ability to send the entire article out via e-mail, without advertisements, was a major part of my decision to use this platform.

Member discussion