Inflation Down, Rates Down, REITs Up

Summary:

- REITs are up 3% to 9% due to a drop in interest rates.

- Rates are down about 20 basis points from the 2-year to the 10-year, which is positive for stock valuations and the deficit.

- Shelter data is unreliable and does not accurately reflect inflation in the rental market.

- When yields fall, REITs rally at the same time. There isn't a big lag period for investors to pile in.

Just a quick note regarding today’s rally.

Many REITs are up 3% to 9%. That’s the impact of a drop in interest rates.

Source: MBSLive

From the 2-year to the 10-year, rates are down about 20 basis points.

That’s positive for pretty much everything. It’s good for stock valuations and it’s good for the deficit. The deficit is still massive, but any reduction in interest rates will reduce the damage.

I wanted to share some quick charts.

Two Charts for Inflation

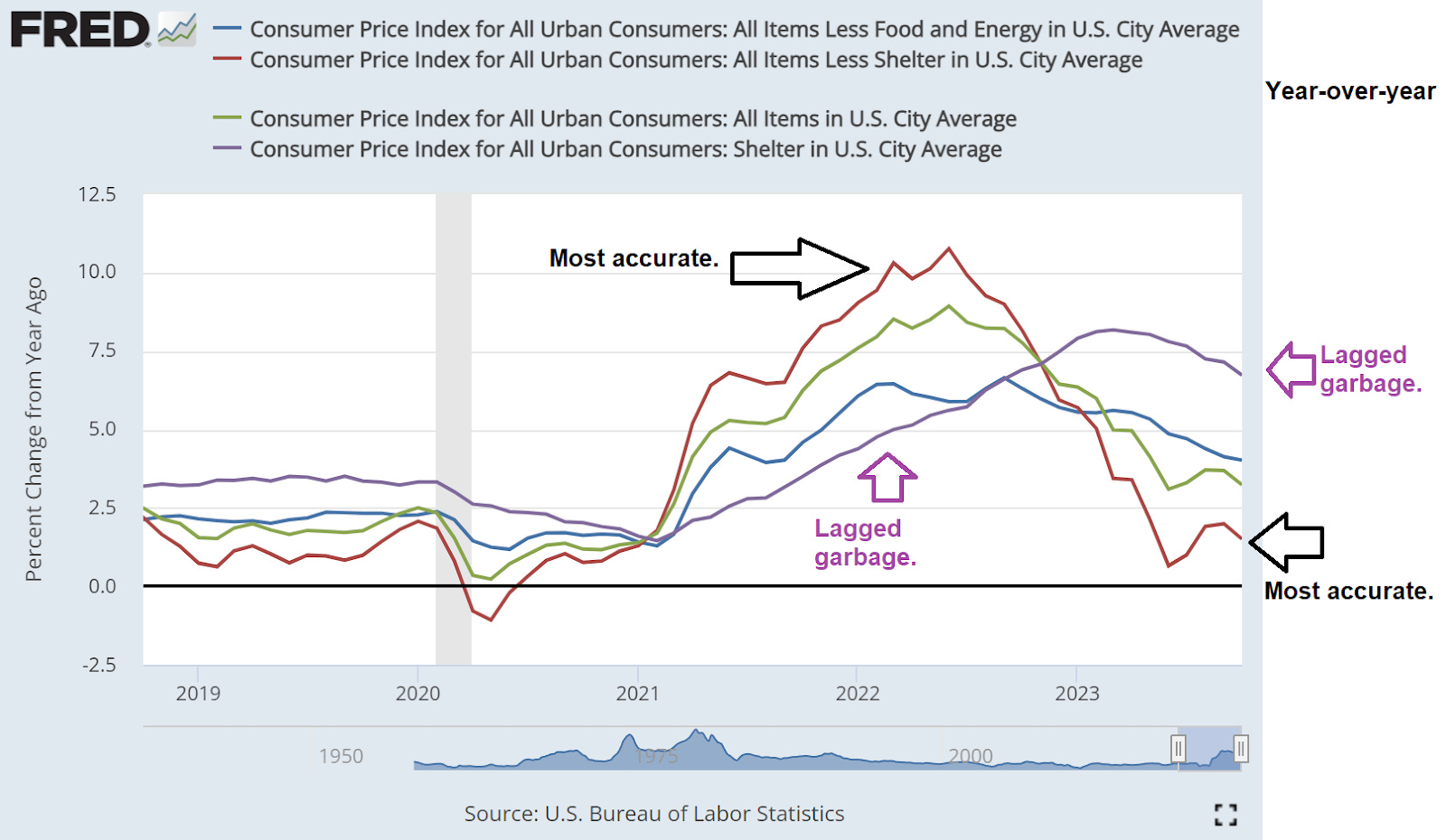

First, here is the year-over-year data for the CPI (consumer price index) using a few variations:

I’ve argued previously, to great extent, that inflation was already dead. That was because the red line (the best leading indicator) was sending a pretty clear signal.

However, just using year-over-year data bothers me because it still emphasizes things that happened nearly a year ago.

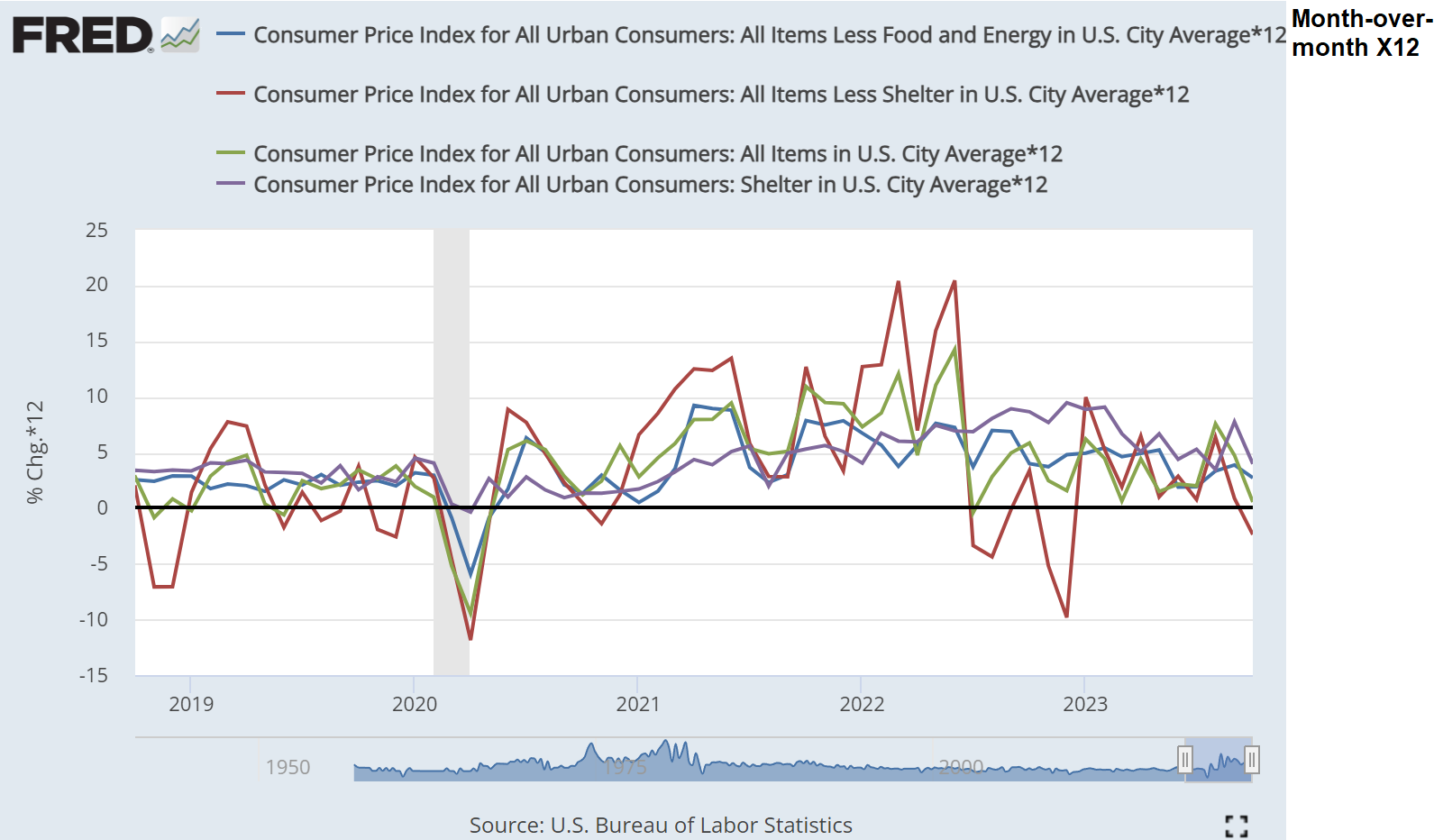

The next chart provides the month-over-month changes:

That looks really good. Every value was dipping.

Shelter Data Stinks

Shelter data is awful. There are two major reasons:

- It uses an average of the prior readings, which inherently lags the indicator.

- The data comes from surveys asking people how much they think the rent would be for their home.

Bad system. Most people have never rented out their own single-family home. Most people are not landlords. Most homeowners don’t have any particular reason to follow the rental market. This is a dreadful system.

Most of the sample pool is people who:

- Have no relevant experience.

- Have minimal reason to care.

- Have nothing better to do than talk to the Census Bureau.

Is it any wonder the data quality is so poor?

Remember, we already have data from the apartment REITs on leasing spreads. Leasing spreads are in the very low single-digit range. In some cases, they turned negative.

CPI: Shelter still indicates that there is “shelter inflation” at about 7% year-over-year.

Rents did increase dramatically, but it happened in 2021 and 2022.

A Little Caution

It’s nice to see the drop in rates. It’s particularly interesting to see rates plunge through the 50-day moving average. They still have a very long way to go, but this is a nice development.

I’m not convinced the Federal Reserve will respond by dropping rates. Prior commentary emphasized that they would rather keep rates too high for too long than lower them too early.

Looking Forward

Investors should remember this day. This is the second time in the last few weeks we’ve seen a big hit to interest rates coincide with REITs surging. The REITs do not simply wait around for investors to evaluate the lower rates and decide if they want to invest in the sector. Rates plunge, and the REITs rally at the same time.

This is part of why we have not simply sat on the sidelines. We’re buying great companies and getting great prices. Those great prices are available because demand for REIT shares sagged under the pressure of higher interest rates.

Interest rates may continue to be a key factor in moving REIT prices. REITs could be up or down 5% in a week. However, we’re looking for strong companies. When the dust settles, our companies should still be generating strong cash flows for shareholders.

Eventually, I expect rates to decline or inflation to rip higher. While higher rates are “deflationary” for the moment, they are quickly compounding the national debt. That’s a topic for a different article.

Member discussion