How PennyMac Mortgage Tried to Screw Preferred Shareholders

Disclosure: I am not a lawyer or a judge. My expertise is researching stocks. I have not passed the bar exam. I have never studied law in a formal setting.

This is a long article. If you are reading through e-mail, you’ll need to hit the “view all” button.

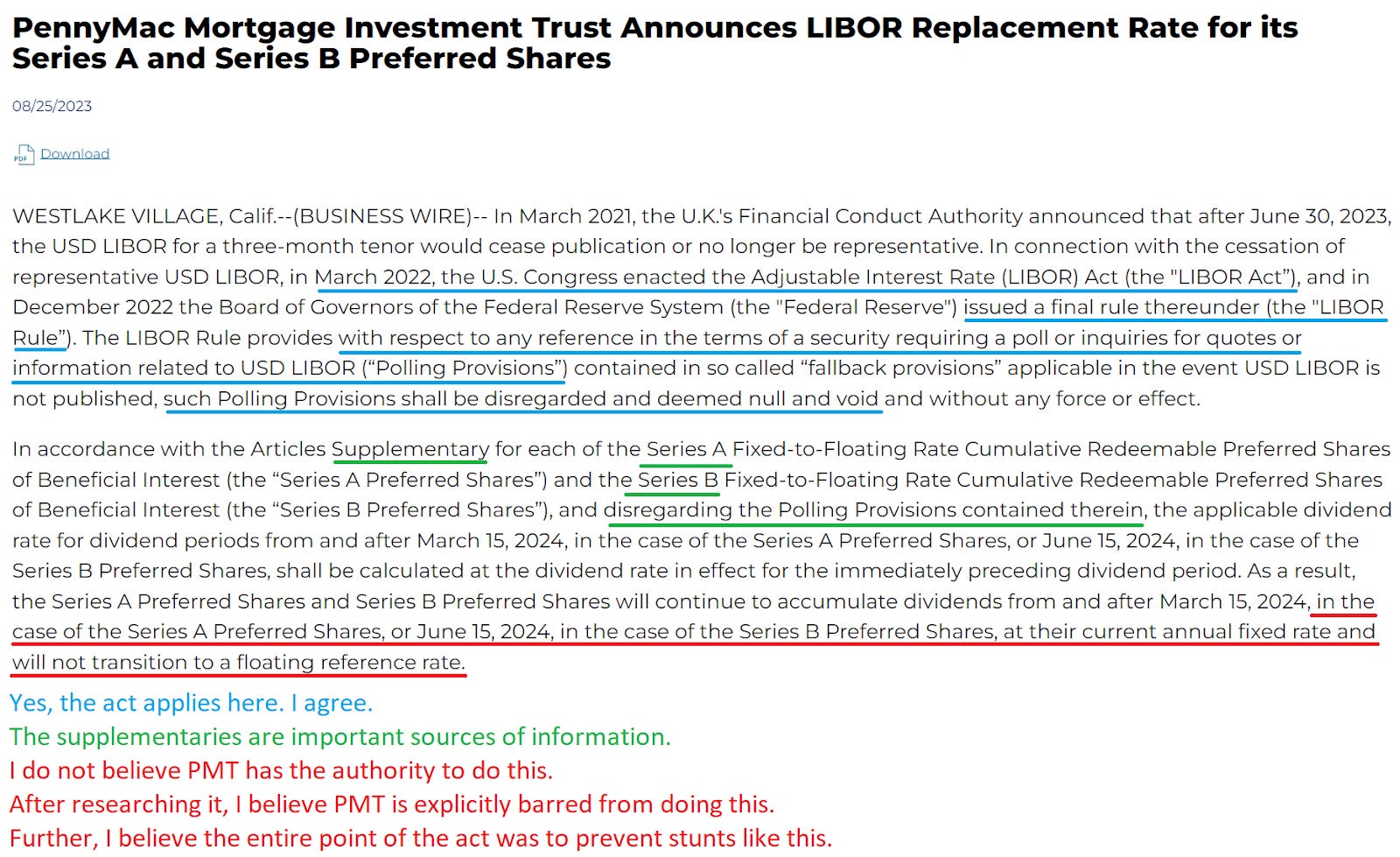

PennyMac Mortgage Trust (PMT) posted an absurd press release today. That press release may stir up quite a bit of panic, but I strongly doubt PMT will be permitted to follow through on their plan.

Here are the relevant bits with some color-coded commentary from yours truly:

Let’s review the claims:

- Congress enacted the LIBOR Act. True.

- The Federal Reserve issued a final rule. True.

- Under that rule, terms for a poll or inquiries for quotes shall be disregarded. True (based on my understanding, which I will share in greater detail).

- Therefore, PMT will just use a fixed-rate dividend. False. I believe PMT’s counsel made a huge mistake.

So, how did I reach my assessment that PMT cannot do this?

Well, I went to the prospectus. It turns out that the prospectus was actually the wrong starting spot, but it still works for laying the article out logically. I’ll focus on what PMT wanted to do, then demonstrate why I believe they cannot do that.

PMT Series A Prospectus

We started with the prospectus for PMT-A.

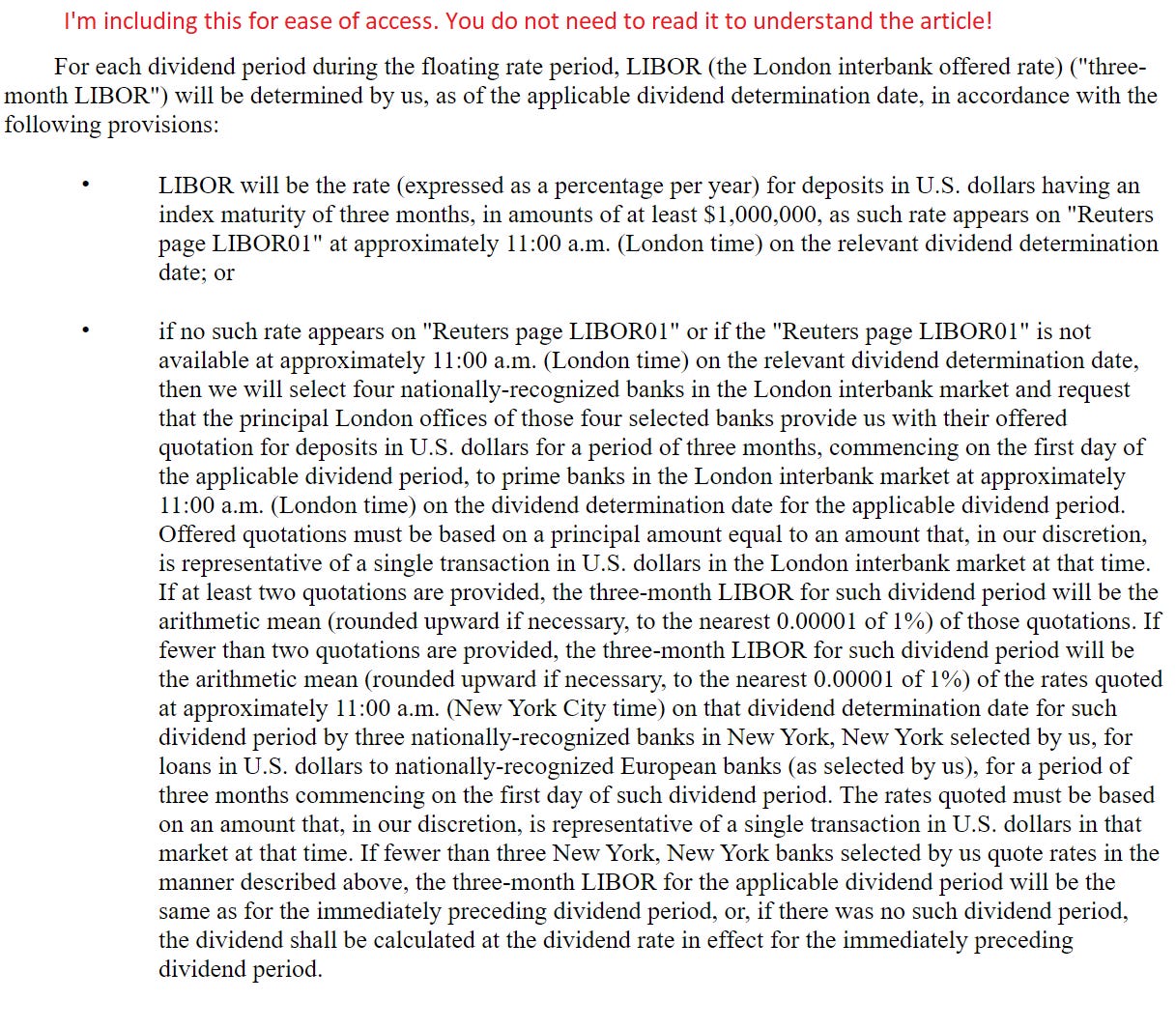

We go to page S-19, and we pull the following section (which you don’t have to read, but you're welcome to):

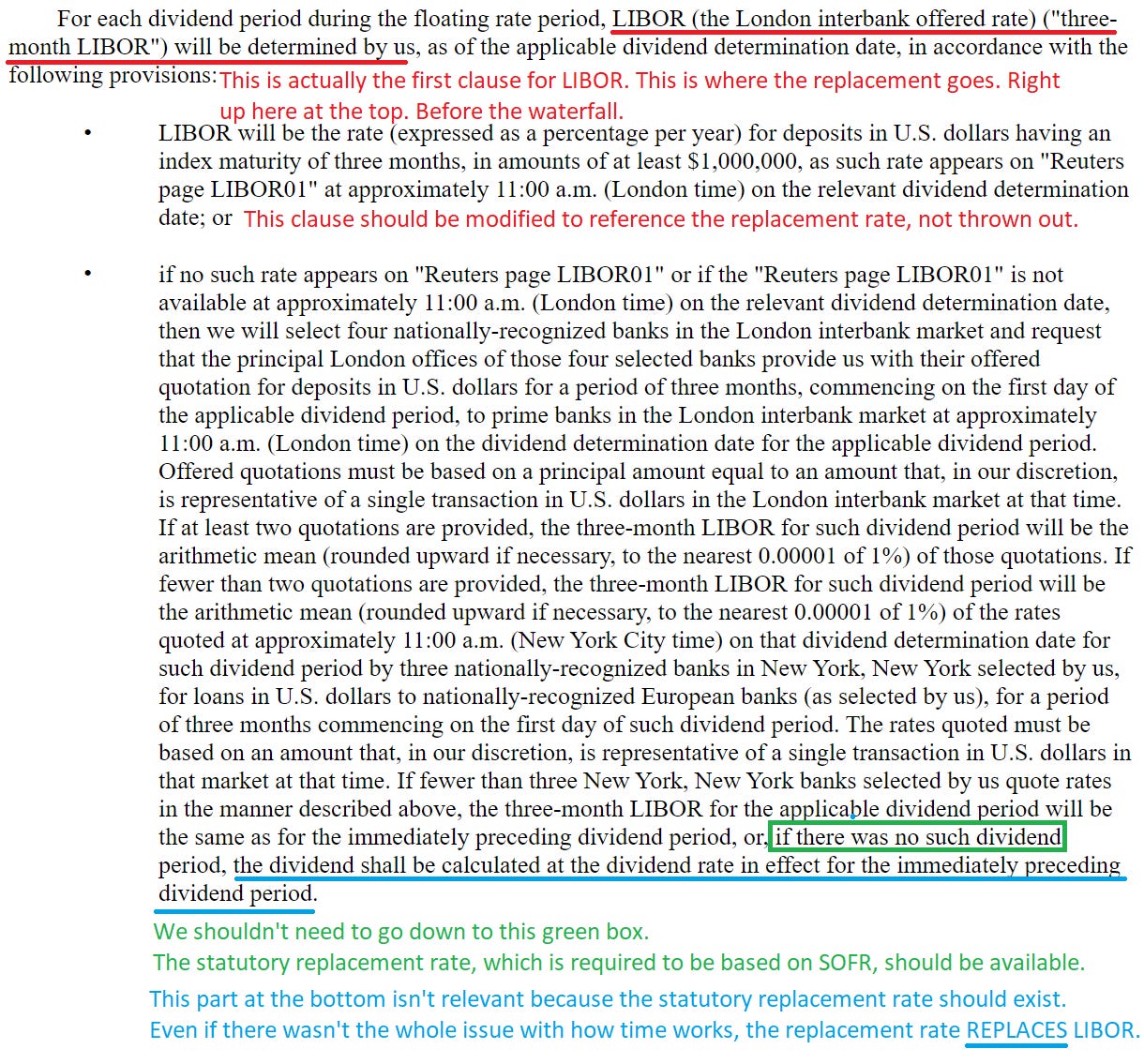

If we agree with PMT that the LIBOR Rule calls for certain provisions referencing LIBOR to be void, then we change the “waterfall” provisions for determining the relevant interest rate by removing dependence on LIBOR.

That would make it look like this:

That’s a much shorter waterfall to read.

It appears PMT wants to read the shortened section starting with the blue part. However, the part in green doesn’t reference LIBOR. If we skip the parts about LIBOR, then we reach the green portion.

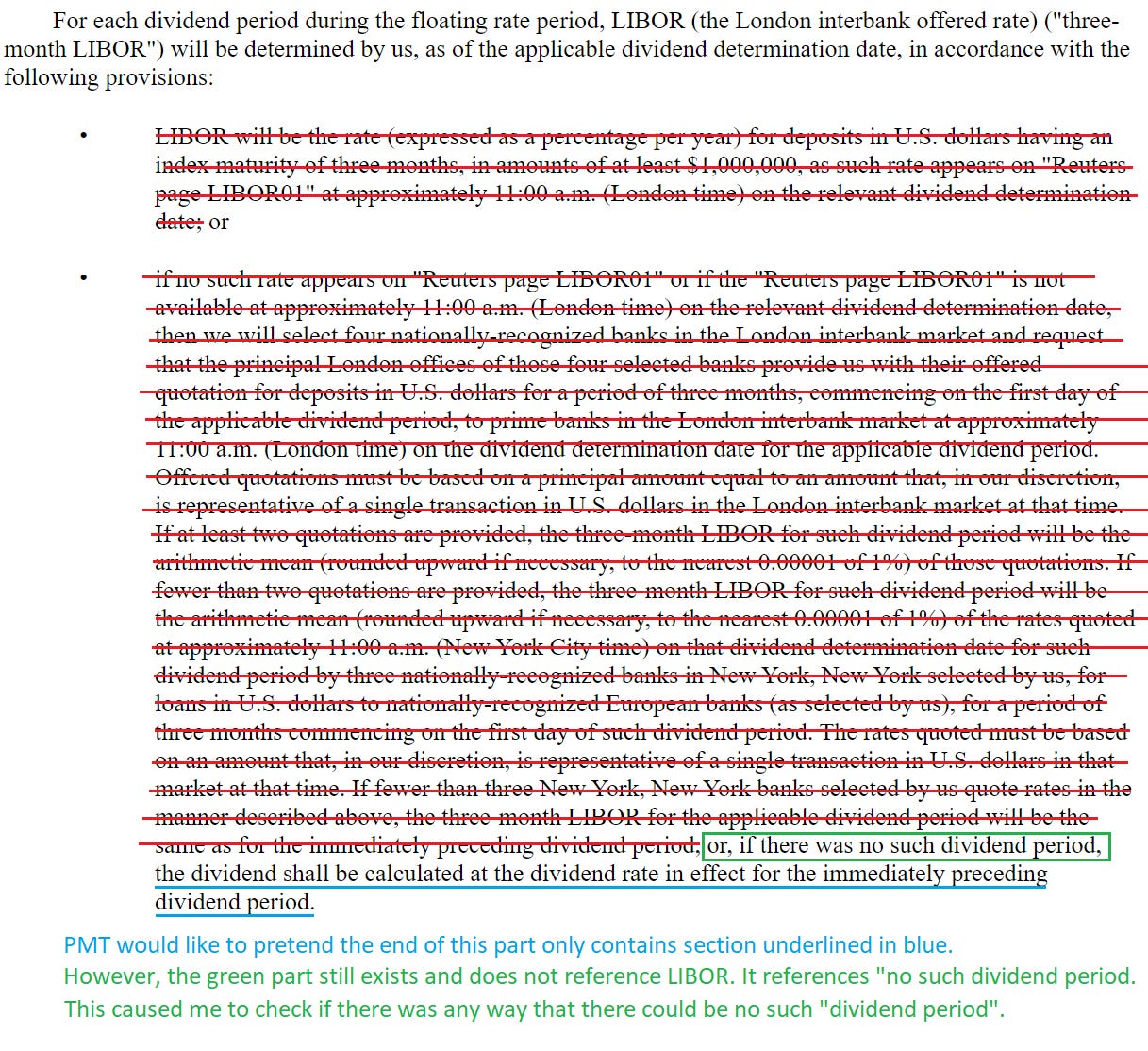

Therefore, I went to check on the definition of a “dividend period” to see if it was possible that no such dividend period would exist.

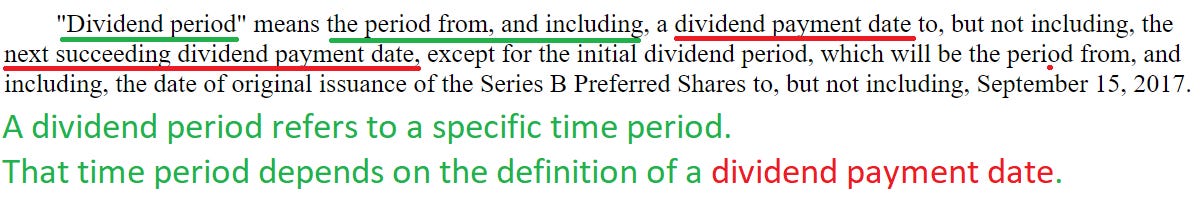

Definitions

On page S-19, that’s the same page we were already on, we get this definition:

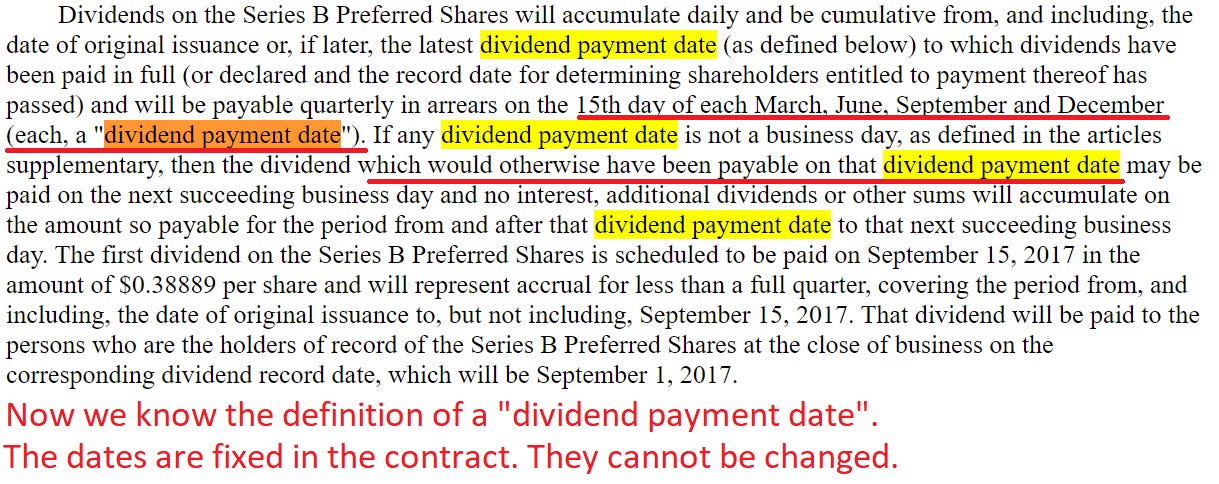

To get our definition, we must find out what a “dividend payment date” means. That answer is only one page higher (on S-18):

The dividend payment date is a specific date.

Now I ask myself, is it possible that this time period between specified dates might not exist? If so, it would break our understanding of how time works. I’m confident in saying that those dates will happen each year and that there will be time in between those dates each year. Therefore, it is not possible that there is “no such dividend period”. Even if PMT didn’t pay a dividend, the dividend payment date doesn’t depend on them paying the dividend. It is simply a fixed date.

Because Time Still Happens

Based on my reading, I could not find any scenario where it would be possible for that time period not to exist. However, I wasn’t done. That was the warm-up. At this point, it probably seems like the removal of LIBOR is a massive, complicated mess and there’s no way to figure it out.

Where I Should Have Started

Remember how I said the prospectus was the wrong starting point? I should’ve started with reviewing the laws. Upon reviewing them, I don’t believe we ever reach “the green box” I highlighted before.

There are two relevant things we needed to consider before the prospectus:

- The LIBOR Act

- The LIBOR Rule

The LIBOR Act

We begin with the LIBOR Act.

Thankfully, Reuters put together an outstanding summary of the LIBOR Act.

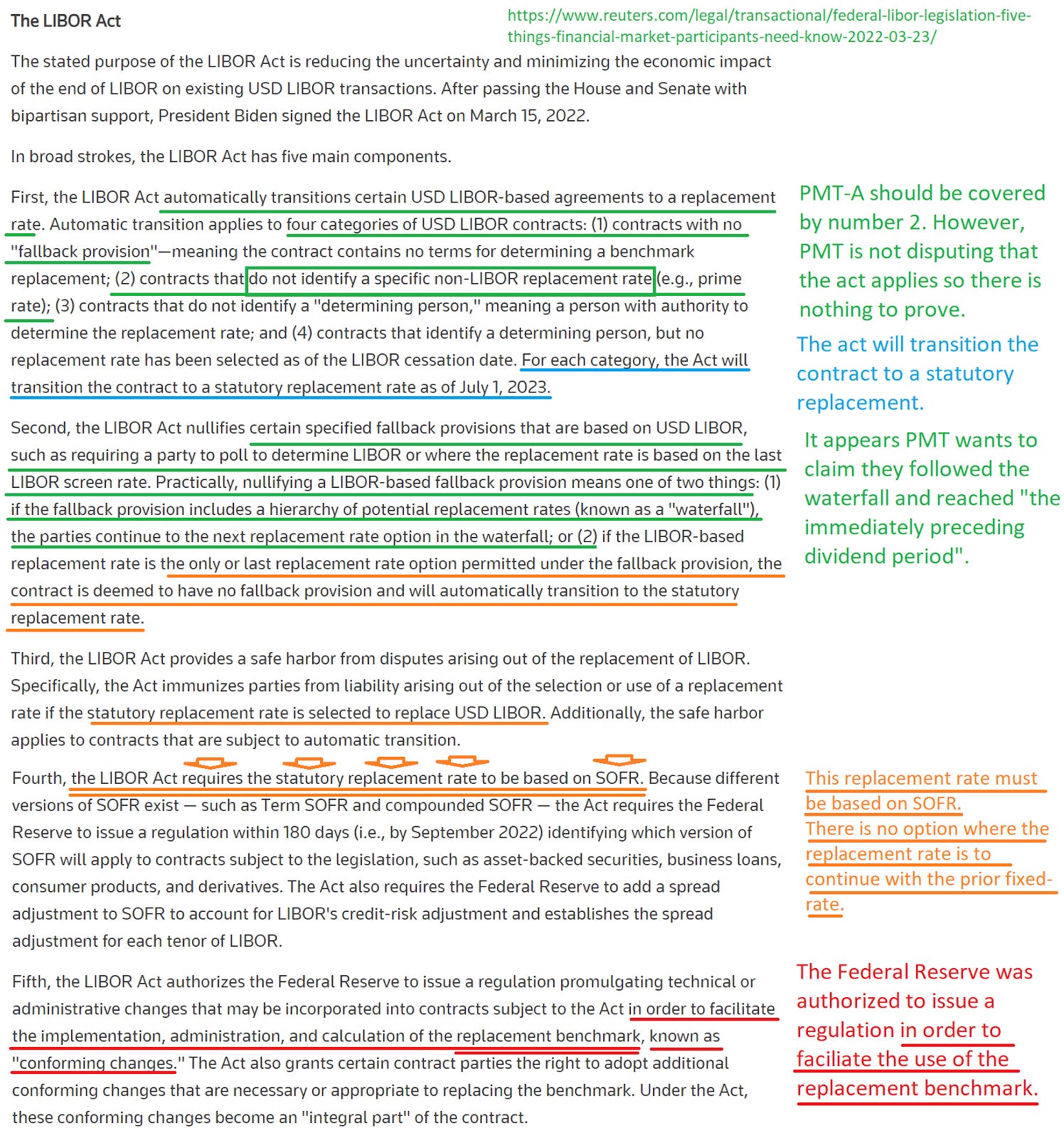

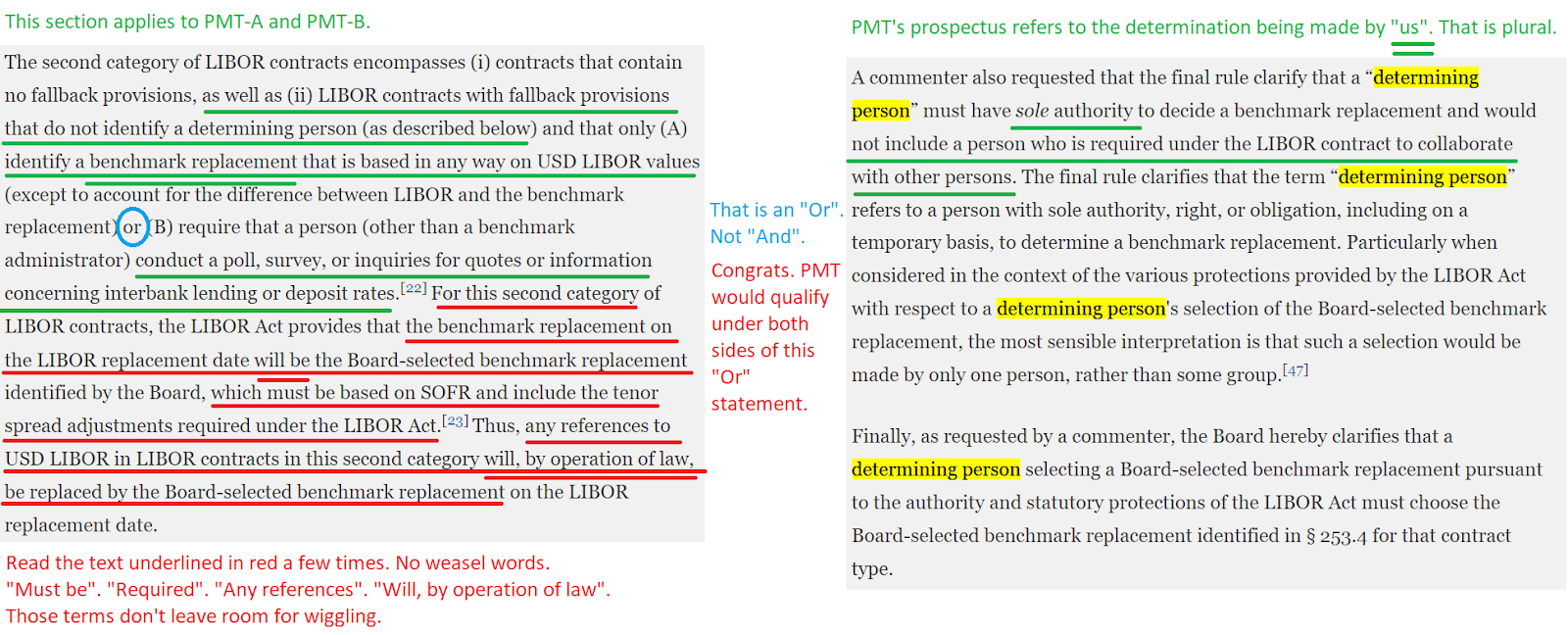

I pulled a portion of the summary to write my notes on. I suggest reading the full image:

We can all agree that PMT’s preferred shares are covered under this act. That isn’t under dispute. PMT already clearly referenced this act in the press release.

Next, we can agree that for each category, the act will transition the contract to a statutory replacement rate. See the blue section.

Next, we can all agree that the LIBOR Act requires the statutory replacement rate to be based on SOFR. There isn’t another option. See the orange arrows? This is extremely important. They can use different versions of SOFR, but it definitively must be based on SOFR.

As many of you know intuitively, the prior dividend rate is not a form of SOFR.

The Waterfall

We already demonstrated that following the waterfall would lead to a clause that could not occur within our understanding of time. However, what if that clause about the dividend payment dates did not exist? Would that permit PMT’s strategy? No, I don’t believe it would. The LIBOR Rule was created to facilitate the use of the replacement benchmark. It was not created to enable companies to create their own rules.

When we look at the waterfall again, we can see where the LIBOR replacement should actually be inserted: Right at the top.

The LIBOR Rule

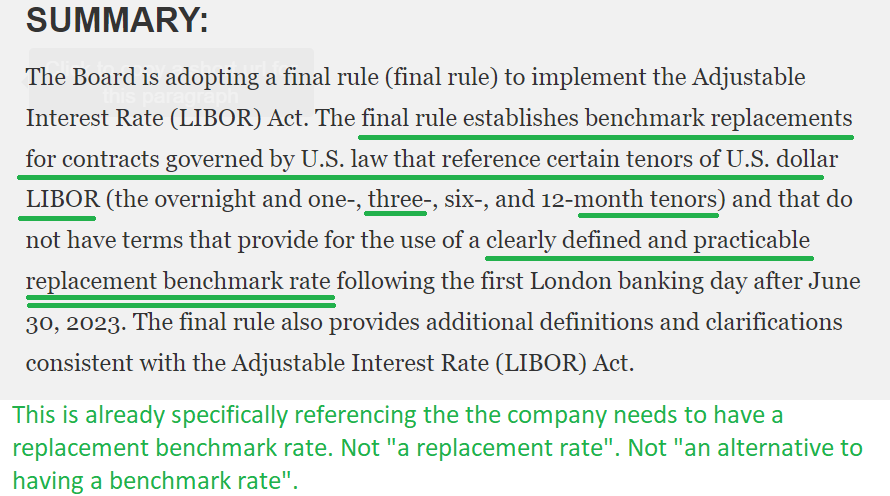

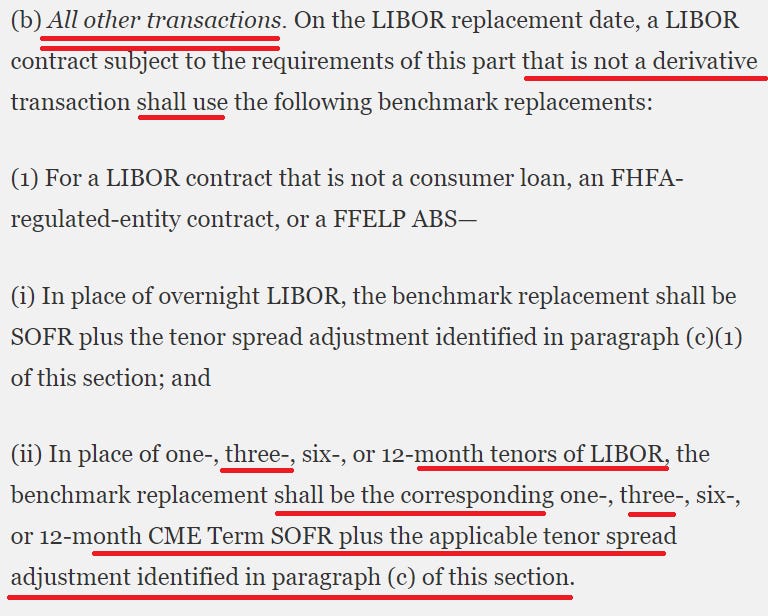

Now we’re pulling directly from the text published by the government.

The Federal Reserve issued a press release when they adopted their final rule.

The actual rule is pretty long.

However, I pulled the parts I felt were most relevant:

From the start, this rule is designed to establish the benchmark replacements.

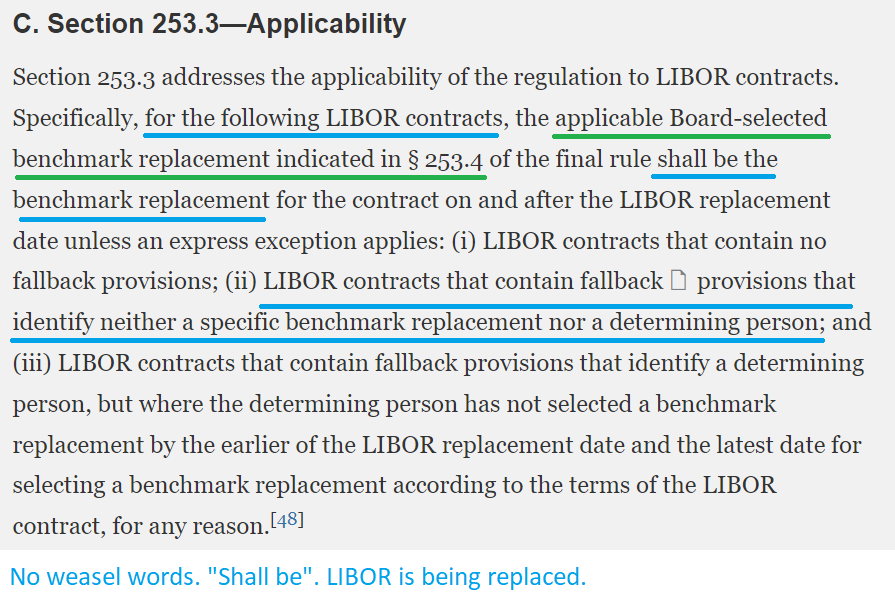

Further, we can see that one of the categories fits these shares perfectly:

That section makes it pretty clear that the LIBOR rate is being replaced with the board-selected benchmark replacement. Consequently, that should happen before sections are voided out. It wouldn’t make much sense to void The thing about a replacement rate is that it replaces the prior rate. When we replace the reference to LIBOR with a reference to the board-selected benchmark replacement.

For clarity, the “board” references the board of governors of the Federal Reserve System. It isn’t the company’s board of directors.

Applicability of LIBOR Rule

To further hammer this point home, the LIBOR rule states specifically that the board-selected benchmark replacement shall be the benchmark replacement:

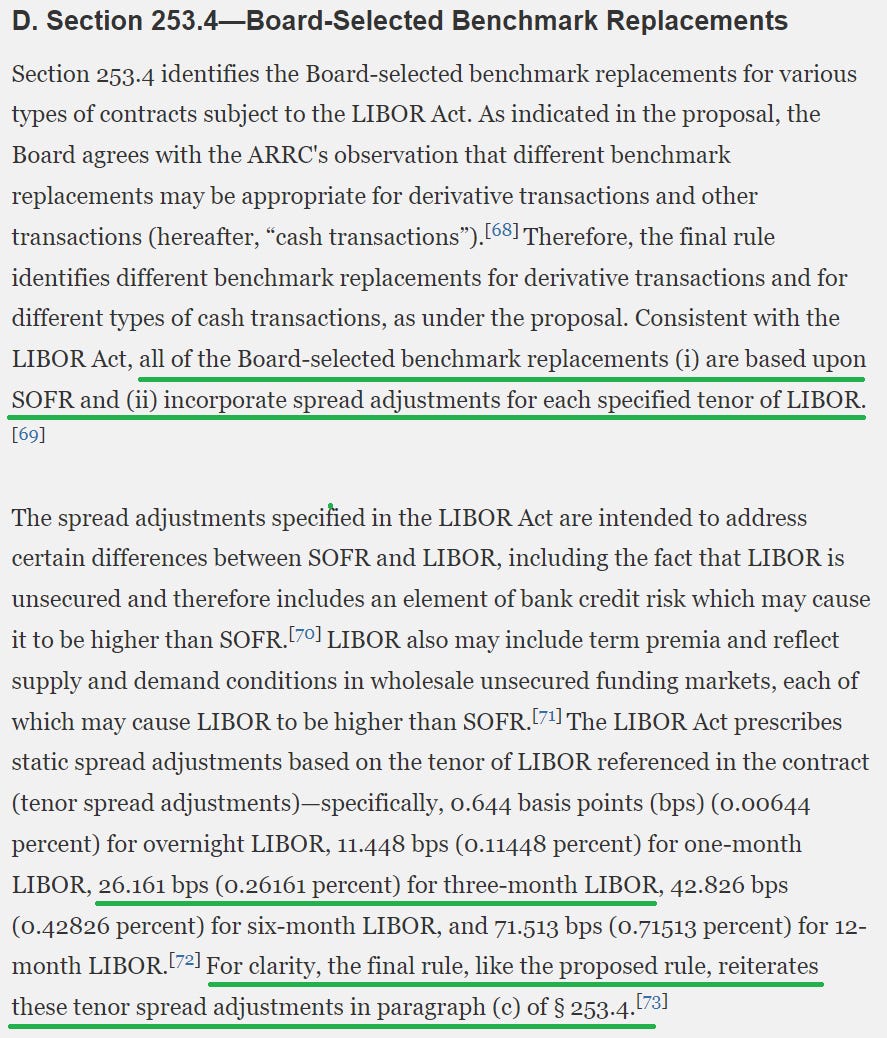

What did the board select?

It selected SOFR plus a spread adjustment based on the tenor (the length of the term):

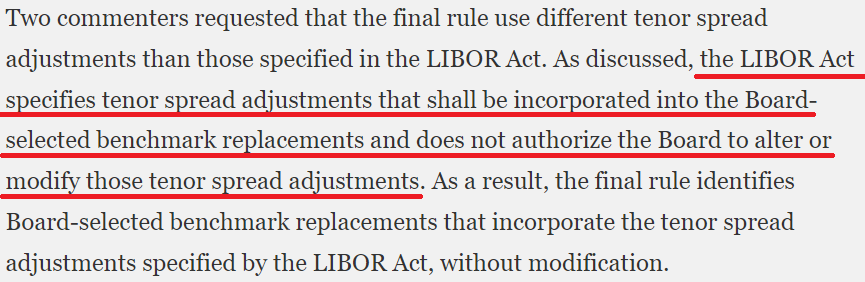

Are those adjustments optional? No. The LIBOR Act set those adjustments into the law and even the Federal Reserve doesn’t have the authority to change them:

So what is the replacement for 3-month LIBOR?

The replacement shall be the 3-month CME Term SOFR plus the applicable tenor spread of 26.161 basis points.

Making It Clear

The waterfall provision shouldn’t even be relevant. Regardless of what any person at PennyMac Mortgage Trust believes, it seems pretty clear that 3-month LIBOR “shall be” replaced by 3-month CME Term SOFR plus 26.161 basis points.

Bank of America

PennyMac Mortgage Trust is far from the only company with contracts referencing LIBOR. Bank of America (BAC) has enough money to pay for a huge team of lawyers. They won’t do something that hurts profits if it is not required by law.

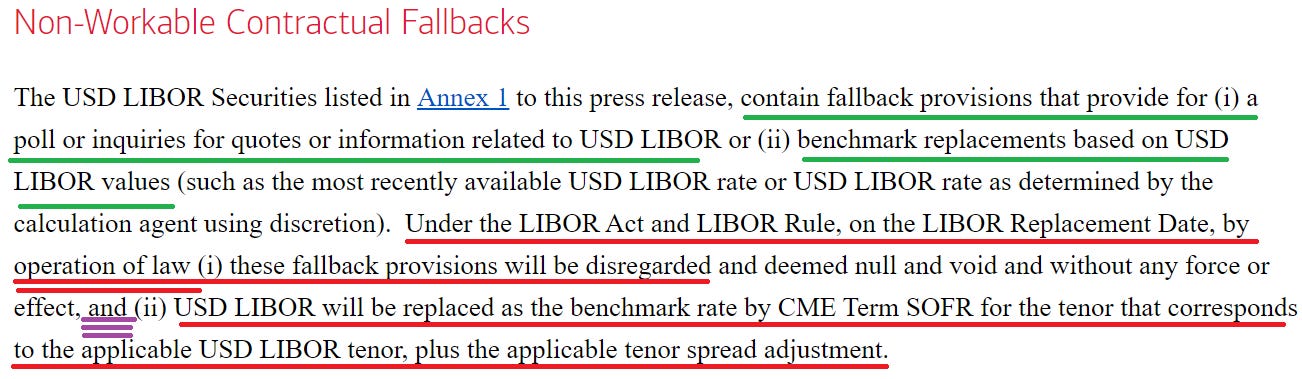

As it happens, Bank of America’s press release explains how they are replacing LIBOR.

It’s convenient that they had securities that could be described the same way as PMT’s Series A (PMT-A) and Series B (PMT-B) preferred shares. This is what BAC wrote:

You may notice that interpretation matches our interpretation. Fallback provisions that don’t work are disregarded, AND the USD LIBOR value is replaced by CME Term SOFR for the same tenor plus the applicable tenor spread adjustments.

In other words, it appears BAC’s lawyers came to the exact same conclusion I did.

Back Down or Get Sued

In my opinion, as someone who is not a lawyer, PMT has two significant options:

- Publish a new press release indicating that they were wrong and stating 3-month LIBOR will be replaced by 3-month Term SOFR + 26.161 basis points.

- Get sued and lose immediately, then field questions from analysts who work at banks. Banks which may have already updated their own contracts in accordance with the law.

Conclusion

I believe the odds of PMT being able to pull off this stunt are extremely low. However, it is possible that we could see a material swing in the share price. Consequently:

If share prices are steady, investors might sell shares to wait and see if they dip.

If share prices dip, investors might buy the dip on the premise that PMT’s case appears laughably weak.

In my opinion, PMT should fire the individual who pushed this idea. If I can dismantle it on a Friday night for my customers, PMT’s lawyers should’ve been able to do the job.

There is one thing I appreciate. PMT posted this on a Friday night. That gave us (and any other analysts willing to sacrifice their Friday night) enough time to dismantle it. It also gives them more time to print a retraction before their blunder hammers the share price.

What If They Could Do It?

If investors believed PMT could pull this off, which I find extremely unlikely, they would expect PMT-A and PMT-B to decline 7% and 6%, respectively, to reach the same yield as PMT-C. However, PMT-C has a lower coupon rate. At equal yields, PMT-C would offer a greater upside. Therefore, PMT-A and PMT-B should have higher yields if they were all fixed-rate shares.

Therefore, if PMT could actually do this, I would expect prices to be about 10% lower for PMT-A and 9% lower for PMT-B.

However, I must reiterate that I very strongly doubt PMT can pull this stunt off. The LIBOR Act was created to prevent this kind of garbage, not to make it easier.

I am embarrassed for the person who came up with this idea and whoever decided to run with it. When they issue a correction, I would like to know if any currently licensed lawyers were consulted before issuing the press release.

I am posting this article publicly so all investors can access it for free.

Disclosure: I am long PMT-C. If PMT-A and/or PMT-B plunge, I may buy shares.

To support my work, please click the heart icon to help people discover it. It helps my rankings on the platform. You can also share this entire article.

New to our work? Hit the subscribe button to get more research:

Member discussion