Guest Post by Yield Hunting (Alpha Gen Capital): December 2023 Newsletter | 'A November to Remember'

Foreword by CWMF: The entire article below is copied from Yield Hunting. Yield Hunting is a newsletter service by Alpha Gen Capital, a popular author on Seeking Alpha. Yield Hunting covers CEFs (Closed End Funds). It’s a sector I thought about covering a few years ago. After reviewing Alpha Gen Capital’s method, I particularly appreciated the emphasis on comparing NAV (net asset values) with share prices. As many of you know, for mortgage REITs and BDCs, we place a major emphasis on NAV (or book value) and the ratio between share prices and book value.

The rest of the article is from Yielding Hunting.

Summary

- November is one of the best months in the last decade, driven by the cooling economy and the market's preference for bad news.

- Higher interest rates lead to lower valuations in the market, impacting future cash flows from equities.

- The market is currently dominated by a handful of stocks, known as the "Mag7," which are seen as a safe haven for investors.

- In the Core I removed Western Asset Diversified Income (WDI) to add further to preferreds and munis, while I also swapped PIMCO Income Strat II (PFN) for PIMCO Access Income (PAXS).

- In mini core, I added DCF, a term fund, and PFN for PAXS.

“Nothing like price to change sentiment.”

-Helene Meisler

Introduction | A November to Remember, But Why?

Core Trades:

- Sell PIMCO Access Income (PAXS)

- Buy PIMCO Income Strategy II (PFN) at 9.0%

- Add to Nuveen Taxable Muni (NBB) by 2% to 15%

- Add to Flah & Crum Pref Income Opp (PFO) by 3% to 16%

- Sell Western Asset Diversified Income (WDI)

Mini Core Trades:

- Buy BNY Mellon Alcentra Global Cr 2024 (DCF) to 6.0%

- Buy PIMCO Income Strategy II (PFN) to 6.0%

- Sell Western Asset Div Income (WDI)

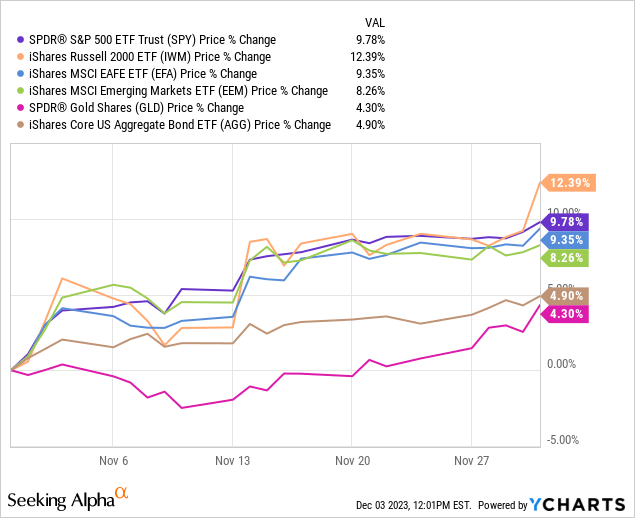

- S&P 500: +9.1%

- TLT: +9.9%

What a great 60/40 portfolio return!

Here are some equity stats for the month, plus the US agg bond index:

Data by YCharts

November was one of the best months of the last decade but it's not because of spectacular future prospects. The economy is cooling which caught the market on fire. The proverbial bad news is good news.

But as long as it isn't too bad. It's definitely a fine line.

Why is this dynamic at play? Essentially, the market hates higher interest rates. Interest rates are the ultimate level for valuations. Higher rates = lower valuations and vice versa.

As interest rates move up, the future cash flows from equities are worth less.

One could argue that in the last year, rates have moved up but so have stocks. This is true and I think it speaks to the market fleshing out the fact that these rates would not stay up forever.

The last several years have been a series of alternating positive and negative returns. I would expect 2024 to be no different in that trend with a reversion back to a negative year.

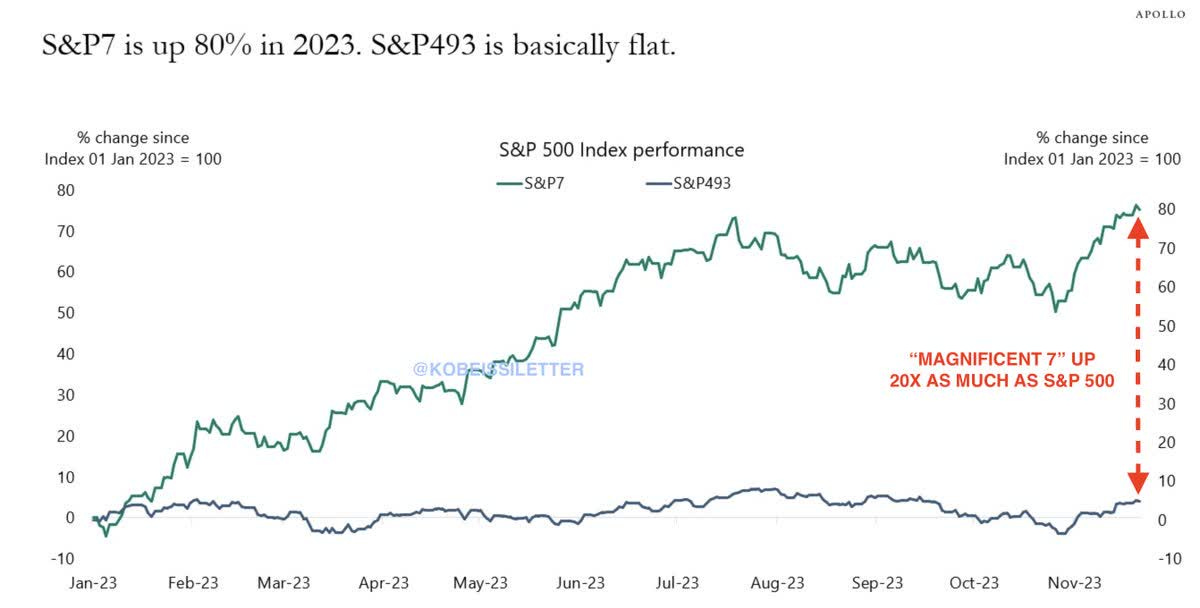

I'm typically not a pessimist. I do think the market will likely be down because of the Magnificent 7 ("Mag7"), the group of 7 which include: MSFT, AAPL, AMZN, META, GOOGL, NVDA, and TSLA.

You're getting paid 5% to "wait and see" if there's a recession.

Down 25%, the market was discounting a recession. Rallying all this way back, the market is no longer discounting a recession.

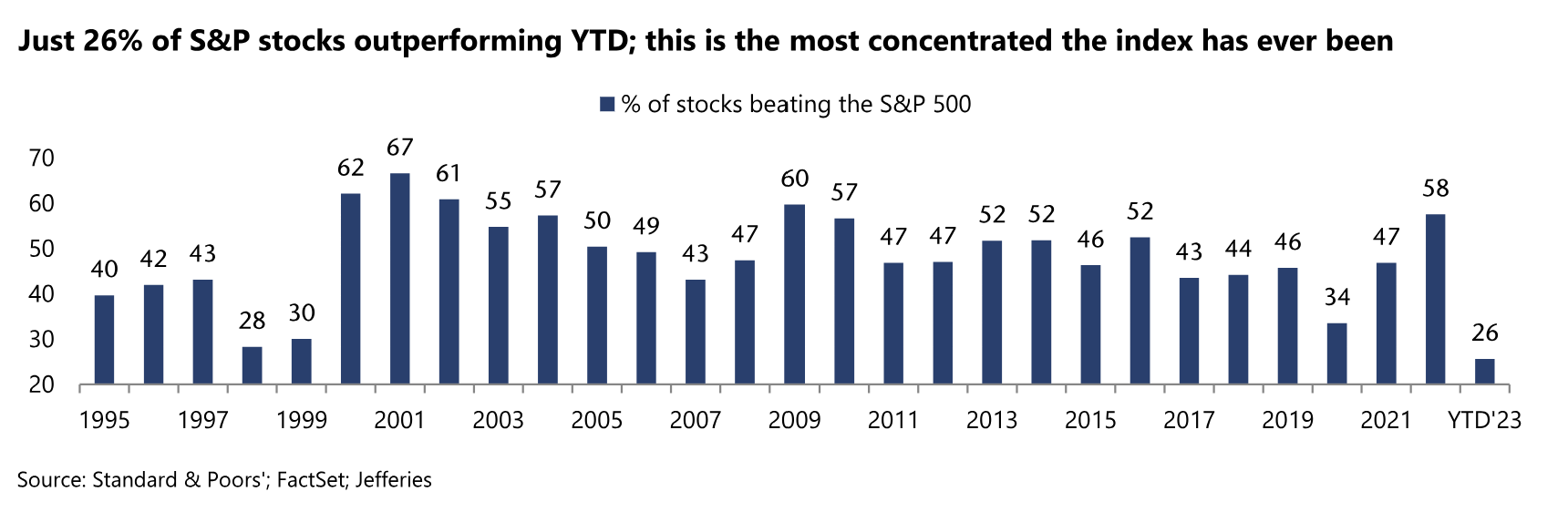

Only 26% of the stocks in the S&P are surpassing the return of the S&P 500 return- around 20.5% YTD. That is because of those Mag7 stocks which are so immense in size that they pull up the index return.

In fact, the Mag7 is up a massive ~80% this year. Meanwhile, the rest of the index is only up 3.5%. Just a handful of stocks, with Nvidia being the biggest driver, are becoming the market. They are what the market does.

This is being driven by investors believing they are the new safe haven. As treasuries and utilities have seen significant declines in the last two years, investors who want to go safe outside of cash are piling into Apple, Google, Microsoft, Nvidia, etc. This is likely to work until it doesn't.

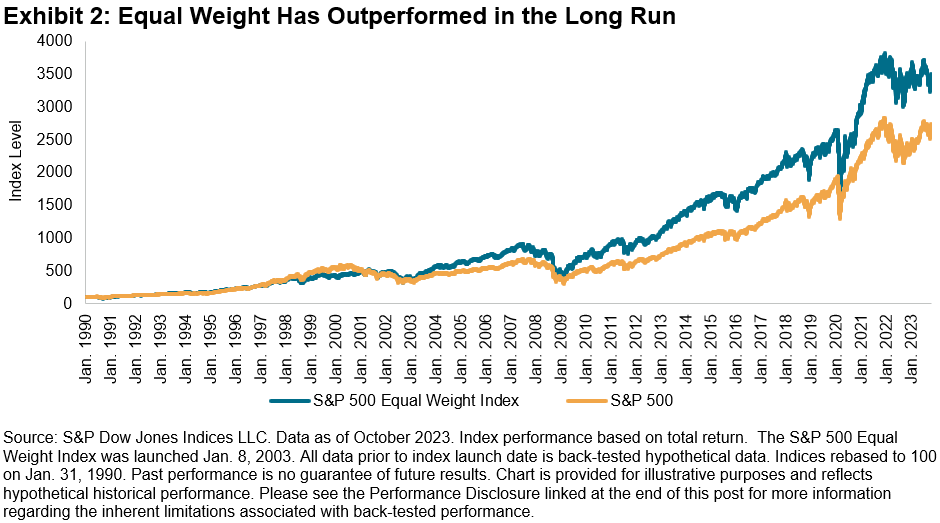

Over time, these things tend to mean revert. In fact, over long periods of time, the equal weight S&P 500 tends to outperform the market cap weighted S&P Index. Traditionally, there is the small company effect that states smaller firms are more risky and tend to contain more upside.

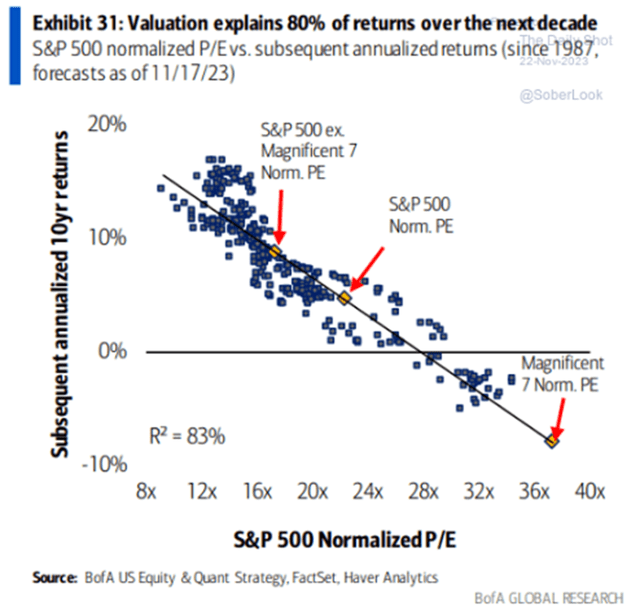

This chart from BofA out recently is a good one. It uses a regression model to calculate future returns. Basically, the S&P 500, as it is constituted, is trading around a 22x normalized P/E which implies around 4.8% annual returns for the next ten years.

This is something we highlighted in our September letter "Are We Out Of The Woods Yet?" where we discussed capital asset market assumptions. A regression to the mean suggests a long-term P/E and average EPS growth.

I would argue that on a nominal basis, revenue growth should do well thanks to the company's being able to pass along inflation. However, that could be offset by corporate margin compression as we see reshoring and higher labor costs.

It remains a question whether future EPS growth can match the last 30 years - many say it would need a productivity breakthrough to do so.

It remains a question whether future EPS growth can match the last 30 years - many say it would need a productivity breakthrough to do so.

Just investing in the Mag7, you can see that the ten year returns are implied to be negative. If you take out the Mag7 and invest in a market cap weighted S&P 493 ETF (doesn't exist), then your future returns look a heck of a lot better.

So what does 2024 look like?

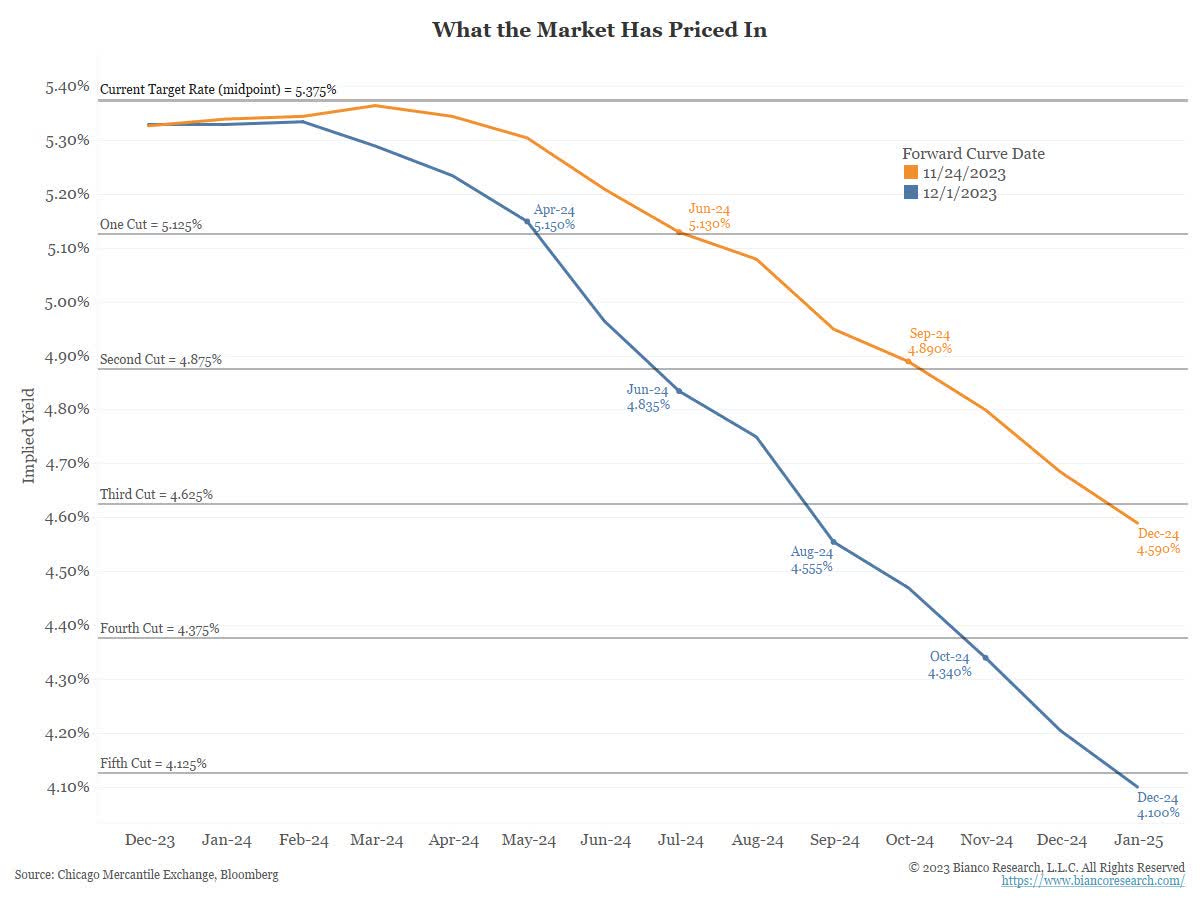

I wouldn't expect too many cuts- at least not what the market is thinking. That is, unless we see something break or some exogenous shock. I've been saying this for some time.

Fed Funds futures now predict the first cut in May but I am thinking the back half of the year. Some of the futurecast CPI models I follow and subscribe to suggest a CPI of around 3.4% by the end of the first quarter and 3.1% by the end of the second. That won't be enough progress for the Fed to lower rates.

So higher for longer is likely the case.

By the back half of next year, CPI should be in the 2s, which would likely help make the case for the Fed to cut rates back a bit.

My thesis remains that the consumer is likely to be the source of the next slowdown. This typically means that the slowdown/recession will be shallow.

As Jamie Dimon said recently, the American public is addicted to debt. The Black Friday reports on spending detail that. Americans spent a record online and also a record using 'buy now, pay later' ("BNPL") services.

BNPL is essentially a form of credit card usage.

This underscores how consumers are still trying to buy gifts while managing their debt obligations amid persisting inflation, high interest rates and resumed student loan repayments. For example, Americans are holding a record amount of credit card debt at about $1.08 trillion

I highlighted an article in the Wall Street Journal recently about the consumer nearing the breaking point. The cost of everyday goods has risen significantly since the pandemic which is causing the average person to have to fight to make ends meet. Wages have risen to keep pace but if you're a retiree, you don't have that income increase offset.

The only saving grace is the Federal Reserve is giving you an opportunity to actually earn income - and somewhat decent income- from fixed income as they attempt to quell inflation.

This will be the drag over the next six months. On a real basis (after inflation) retail sales are down. It is only through inflationary price increases that total sales are up.

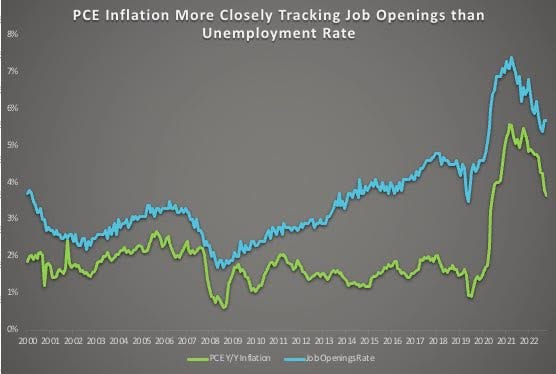

I commented recently in my daily note that I watch the labor markets very closely. The soft landing narrative is predicated on employment more so than inflation. Look how correlated job openings are with the PCE inflation rate.

The slowdown in the economy (and some would argue there has been no slowdown) has simply been flushing out the slack in the labor market. This has reduced the overall velocity of labor with job openings falling back. But we've also seen quits and those planning to change jobs come back to normalized levels.

Within employment, construction employment within the housing market is a key indicator and variable to watch. It has been said that seven out of the last 11 recessions were started in the housing market. Thus, watching this variable is critical to assessing the potential for recession.

The ultra-low supply of housing inventory along with fewer workers to build new homes in this country could alter this trend as this new environment may mean, this time is truly different. However, it could also means that it is unlikely to be a recessionary catalyst in the near-future.

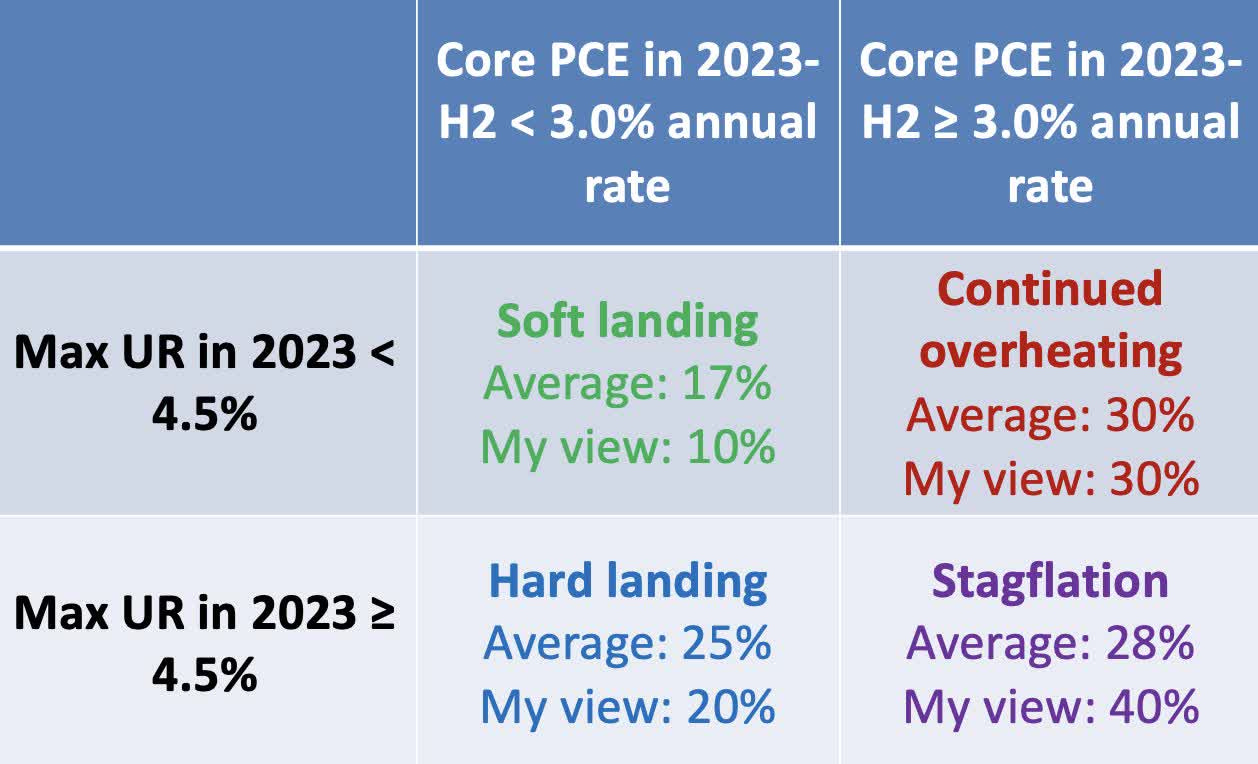

I still think a recession is base case scenario at 50% with stagflationary outcome at 20% and soft landing at 30%. I don't see overheating as much of a probability since the Fed wants to avoid that at all costs and will increase rates to the point of breaking the economy's back.

Here is the economic outcome matrix from Jason Furman late last year. By this matrix, we hit the soft landing zone (6-month Core PCE was 2.5% and unemployment remains at 3.9% as of this writing. That could change before year -end).

But a soft landing is a soft landing until its not. The cycle seems to have been drawn out with reactions to policy moves and new data not moving economic data points all that much. So what people thought could happen in 2023 may just be delayed to 2024. Or even 2025.

I believe the unemployment rate will rise above 4.5% in 2024 and that inflation will continue to decline but at a slower rate. This would be more of a stagflationary outcome morphing into a hard landing at some point.

Investors on retirement plans would do well to take advantage of the sweet spot for bonds here where we are in a disinflationary environment and no further Fed hikes likely.

What To Do 2024

I've noted that investing in bonds post-last hike has typically been a good trade. Once cuts arrive from the Fed, equities have typically done very poorly. However, that is often a reaction to economic slowdowns and the Fed reacting to it by cutting rates.

This time is different in that the Fed is attempting to slow the economy via higher rates- even to the point of a soft recession in order to achieve their price stability goals. So the old dynamic of cuts occurring and markets declining may not hold here.

So what's the risk-reward trade for the first quarter of 2024?

It continues to be a shift towards higher-quality and defensive positioning.

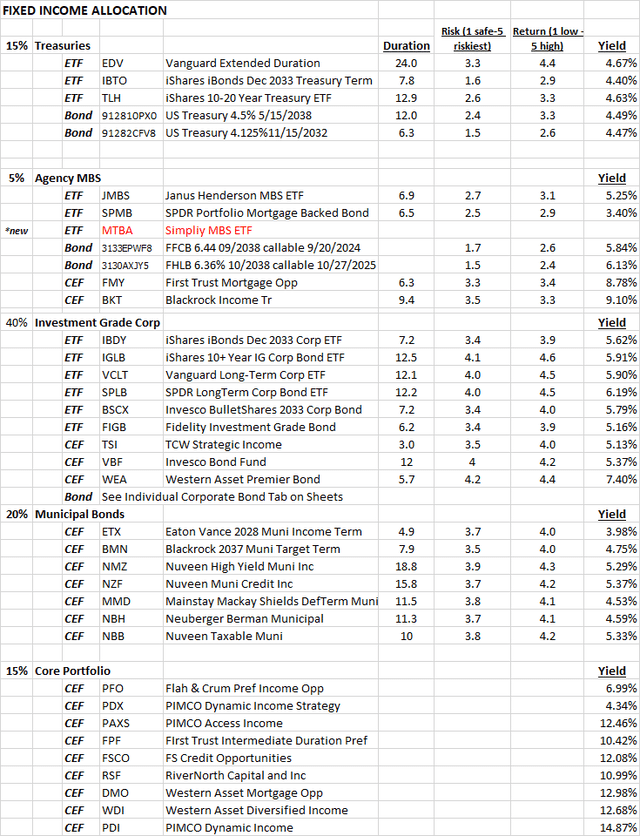

The overall asset allocation for the more passive, buy-and-hold, less "hands on" member of our service should focus on an asset allocation similar to what we laid out a week ago in our Commentary.

- Treasuries: 15%

- Agency MBS: 5%

- Invest Grade Corps (individuals mostly): 40%

- Munis: 20%

- Core Portfolio 15%

I would say each of these components of your fixed income allocation could be "massaged" by 5%-7% on each side. In other words, treasuries could be a bit larger, especially if you're more risk averse, moving to 20%-22% of the allocation or lower to 10%-12% for the more aggressive investor.

Within each of these categories of fixed income, there are various subcomponents.

This is purely a model example but one I had implemented for a few people who have asked me to help them build a 'safer' fixed income portfolio that they won't have to touch more than monthly (at the most).

Core Portfolio

The Core Income Portfolio did spectacularly in the month of November, just like most risk assets. The total return was +8.7% for the month on price (+5.4% on NAV) as we captured some discount tightening.

The weighted average discount of the portfolio is now back to single digits at -9.2%, from -11.9% at the start of the month.

I like the Core and the way it is setup currently. With long rates coming down and the yield curve un-inverting, banks should be in better shape. If banks are in better shape (not great shape by any means), their preferreds should be a better investment.

I like the overweight to preferreds as it has been a great trade for the last several months. That combined with the muni positions (tax-free and taxable) provides that safety/high-quality that I want in the portfolio.

I did take out Western Asset Diversified Income (WDI) to add further to preferreds and munis, while I also swapped PIMCO Income Strat II (PFN) for PIMCO Access Income (PAXS).

We added to Flah & Crum Pref Income Opp (PFO) and brought the position to a big 16% weight. I also added 2% to Nuveen Taxable Muni (NBB) to bring that to the second largest position at 15%.

In the mini core, I like the term fund, BNY Mellon Alcentra 2024 (DCF) thanks to it terminating in a year. The yield is a bit lower as the fund reduces its risk and net investment income but it is trading at a -5.4% discount. In aggregate, the return looks like it could be low double digits for a 12-month holding period. The portfolio is mostly BB and B high yielding junk.

That would bring the portfolio to the following sector breakdown:

Core Trades:

- Sell PIMCO Access Income (PAXS)

- Buy PIMCO Income Strat II (PFN) at 9.0%

- Add to Nuveen Taxable Muni (NBB) by 2% to 15%

- Add to Flah & Crum Pref Income Opp (PFO) by 3% to 16%

- Sell Western Asset Diversified Income (WDI)

Mini Core Trades:

- Buy BNY Mellon Alcentra Global Cr 2024 (DCF) to 6.0%

- Buy PIMCO Income Strategy II (PFN) to 6.0%

- Sell Western Asset Div Income (WDI)

Fun With Charts

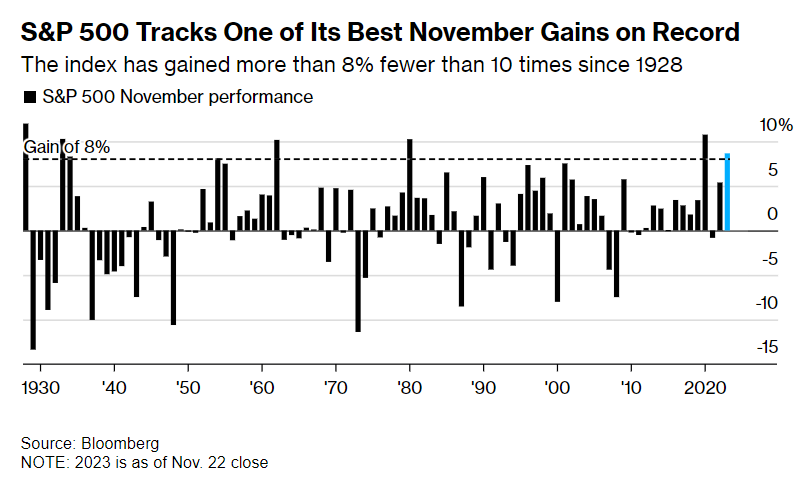

(1) The S&P recorded one of its best month's ever on the back of the market thinking the Fed is set to pivot.

(2) For hedgers, S&P 500 put options are dirt cheap. You can insure for little money today.

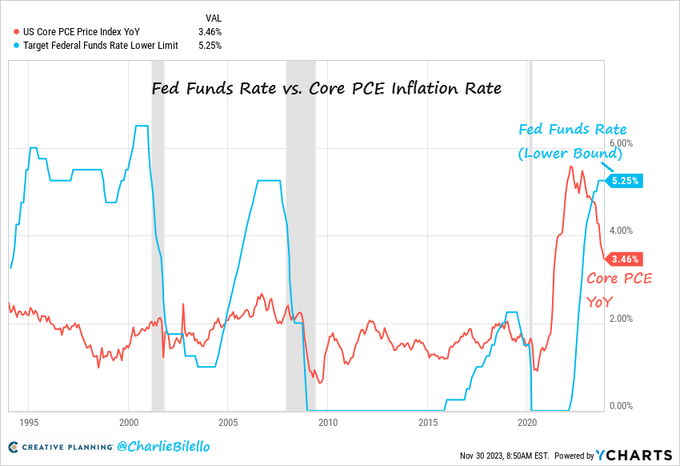

(3) Bilello: "The Fed's preferred measure of inflation (Core PCE) moved down to 3.5% in October, the lowest since April 2021. The Fed Funds Rate is now 1.8% above Core PCE, the most restrictive monetary policy we've seen since 2007."

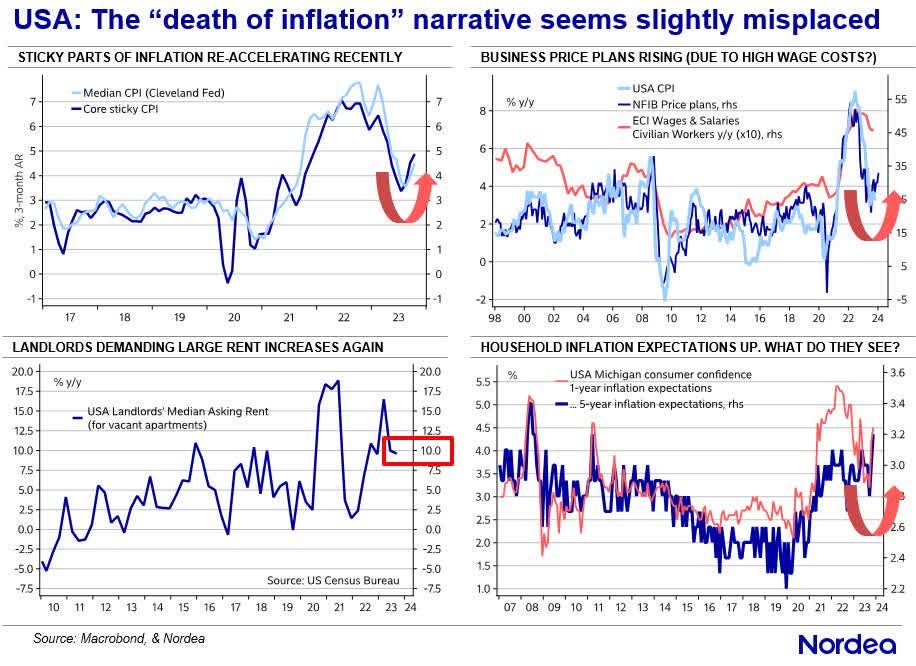

(4) Could the death of inflation be a bit too soon? Watch that narrative shift!

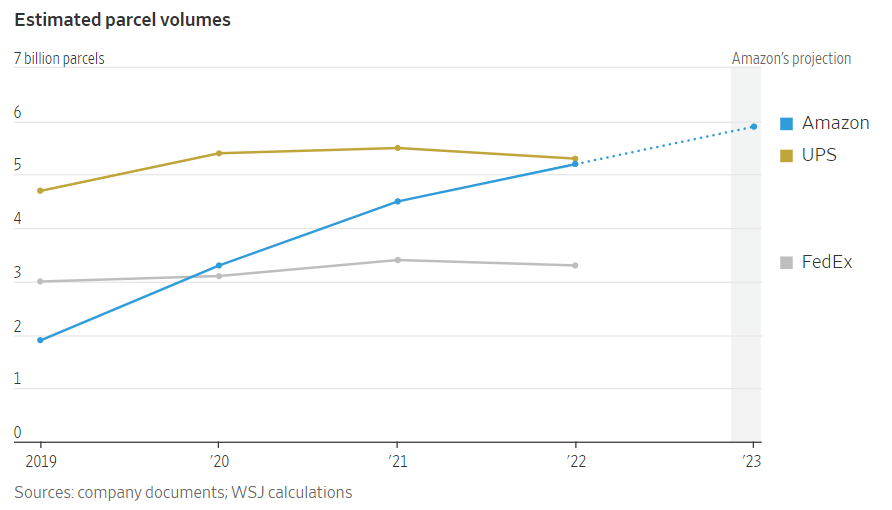

(5) Amazon.com has grabbed the crown of biggest delivery business in the U.S., surpassing both UPS and FedEx in parcel volumes.

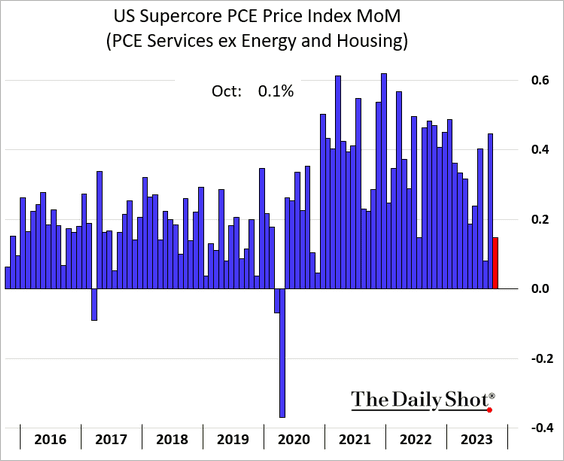

(6) Supercore inflation is on the wane, finally.

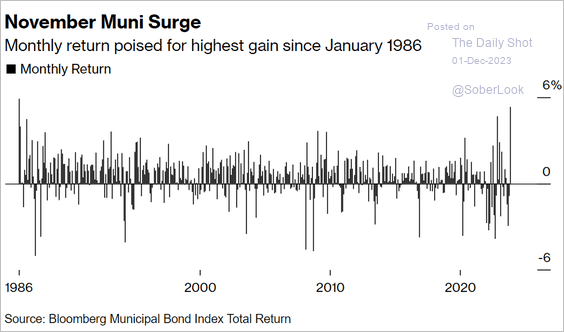

(7) Muni bonds saw their best month since 1986.

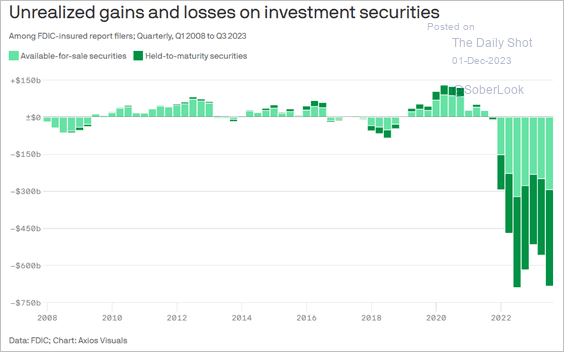

(8) Despite the drop in rates, financial losses at banks remain high.

(9) I agree with Rosie. Markets should zoom into the new year. Recession watch is still on, however.

(10) Bianco: " How much have Fed expectations moved this week? Last Friday (orange, Nov 24) had 3 cuts priced in for 2024, with the first in June. Today (blue, Dec 1) has five cuts priced in for 2024, starting in April (straddling the March 22 and May 1 meetings). ---- This is a massive move for a week that did not have a CPI or Payroll report. But the week did start with Waller and end with Powell. "

Disclosure: Yield Hunting (Alpha Gen Capital) has a beneficial long position in the shares of most positions mentioned either through stock ownership, options, or other derivatives.

Member discussion