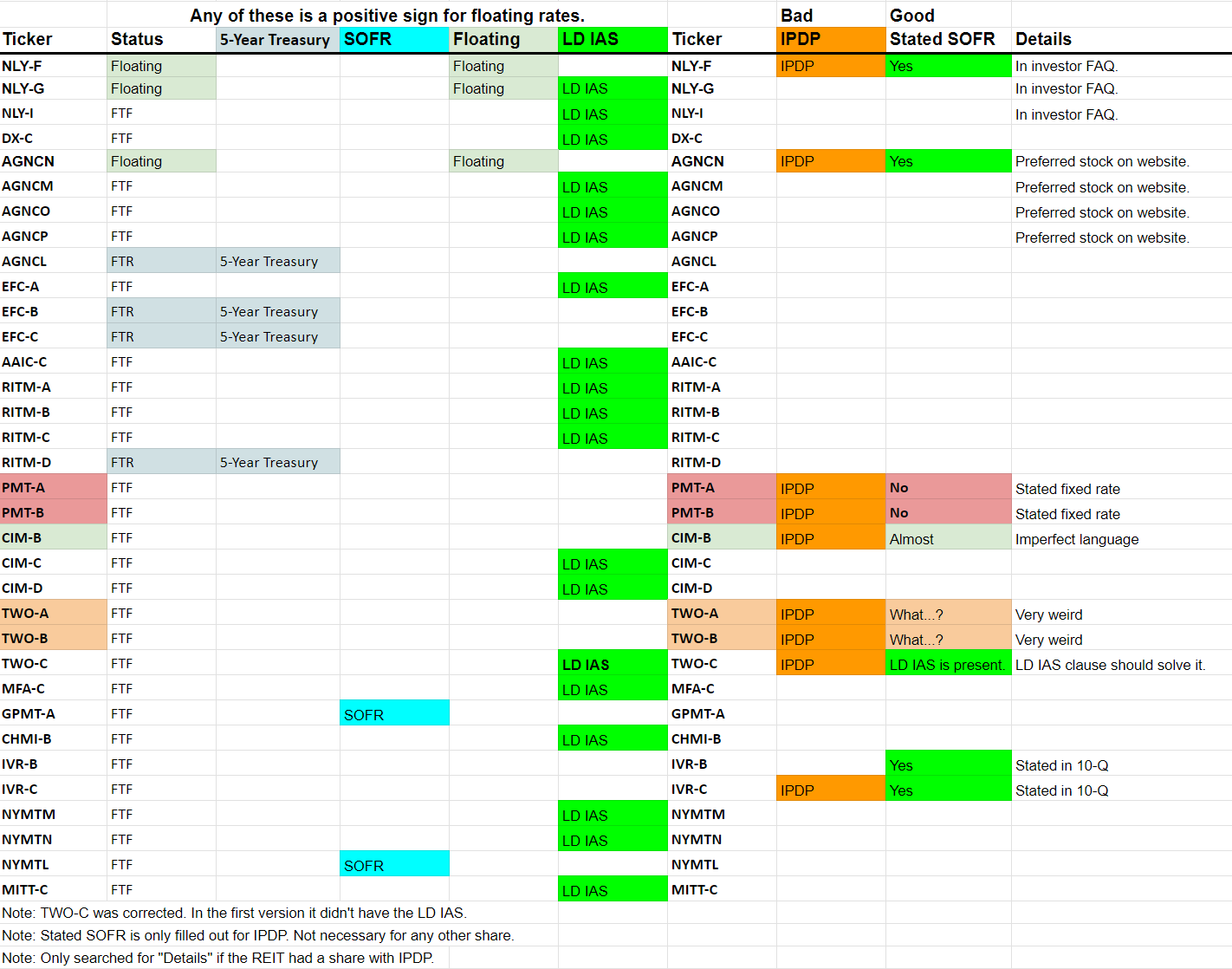

Full Details on NLY-F, AGNCN, IVR-B, IVR-C, CIM-B, TWO-A, TWO-B, TWO-C

After the last update on the preferred share terms, we still needed more information on shares with the IPDP (immediately preceding dividend period) clause. IPDP creates a red flag that a company might attempt to modify the dividend rates.

The shares with the IPDP clause were:

NLY-F (NLY.PF), AGNCN (AGNCN), IVR-C (IVR.PC), PMT-A (PMT.PA), PMT-B (PMT.PB), CIM-B (CIM.PB), TWO-A (TWO.PA), TWO-B (TWO.PB), TWO-C (TWO.PC)

In this article, you’ll find:

- Sections for each share with exact details and my interpretation.

- An updated chart to compare those findings.

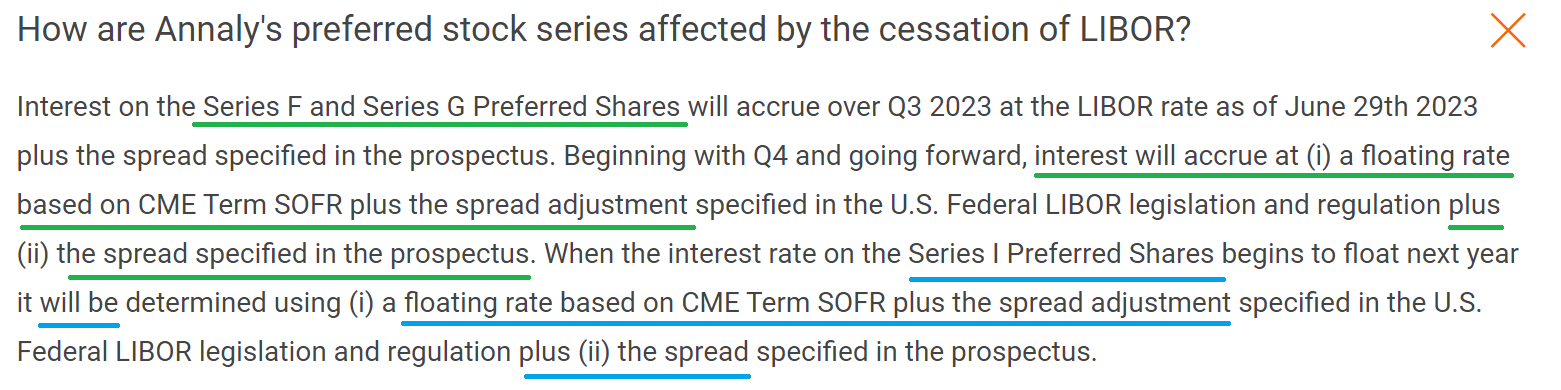

NLY-F

All good. Shares were already floating, so we expected no issue.

Evidence is in the NLY investor FAQ:

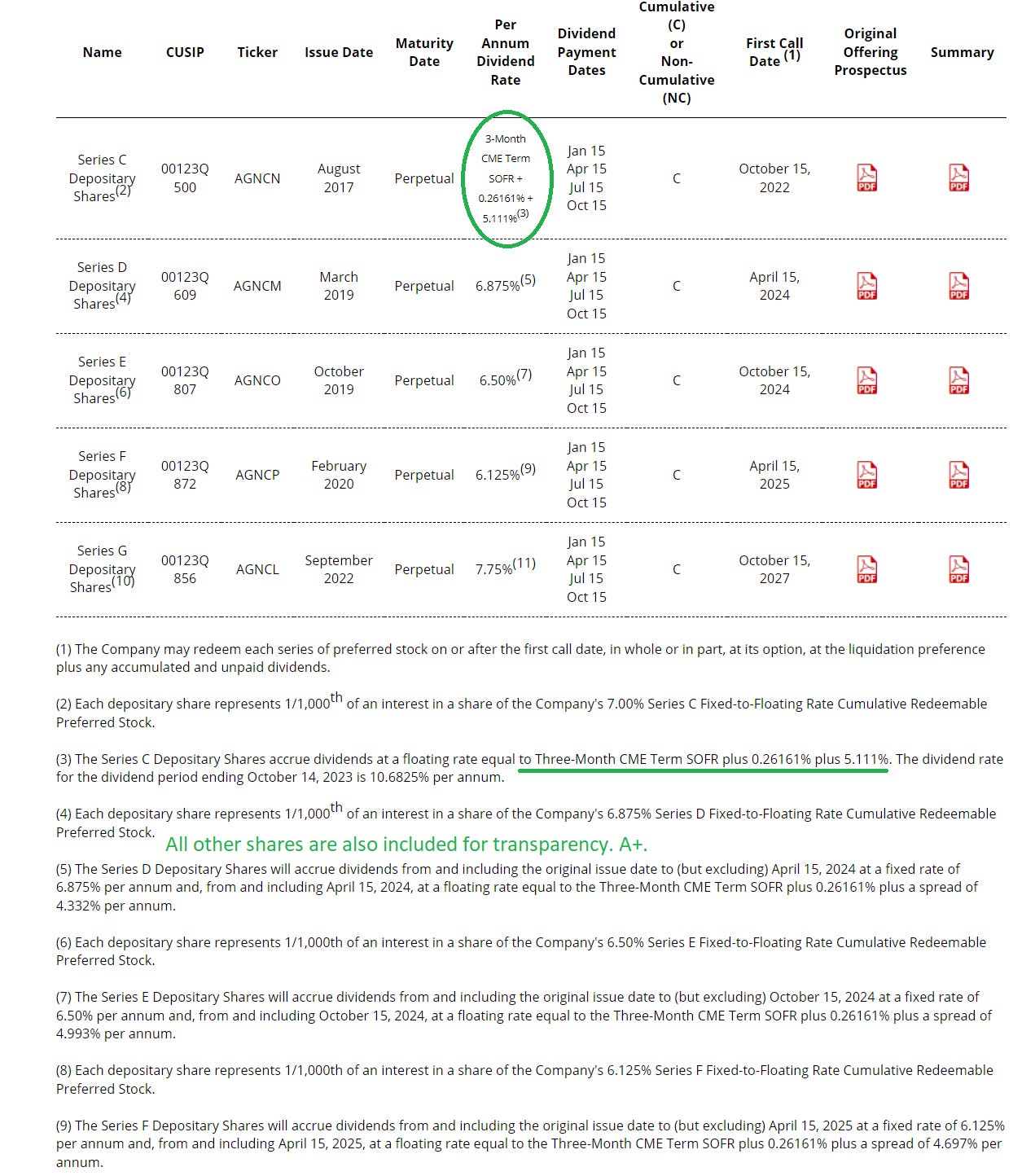

AGNCN

No issue here either. Shares are already floating and AGNC is explicitly using SOFR + 26.161 basis points on each fixed-to-floating LIBOR share. This comes from AGNC’s preferred stock page:

IVR-C

IVR-C was in danger because it had the IPDP language. IVR-B (IVR.PB) was strange as it didn’t contain any of the language we were searching for on either side.

However, IVR settled it definitively by explicitly adopting SOFR for both shares with the following section from IVR’s Q2 2023 10-Q:

Now we’re going to get into the stranger scenarios.

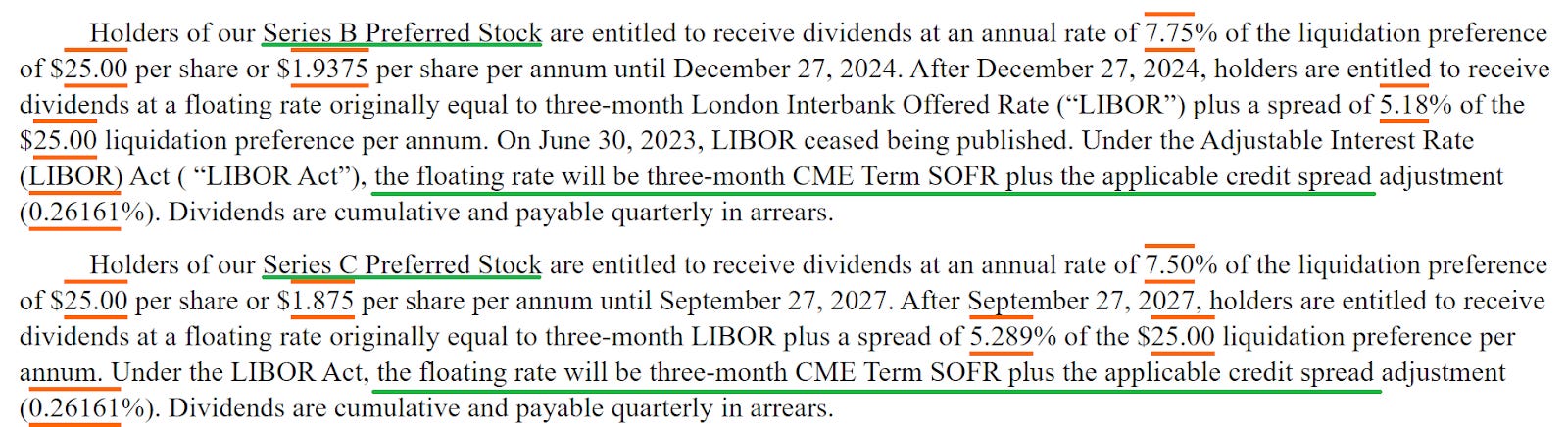

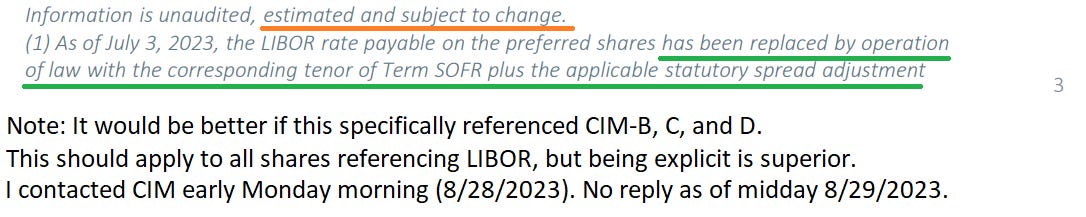

CIM-B

CIM-B should be able to land in the “all clear” pile, but they fell a tiny bit short. If we take “the spirit” of what they said, it would clearly be that they are going to use SOFR. However, the spirit of the contracts and the spirit of the law clearly hasn’t been enough. Consequently, I can’t give this an “all clear”. I e-mailed CIM on Monday morning (8/28/2023) and they haven’t replied yet (as of 8/30/2023 around noon Eastern).

The first source is the CIM Q2 2023 Earnings Presentation:

That’s pretty good. It’s almost complete. It should reference each series individually, but it’s close. This is about 90%.

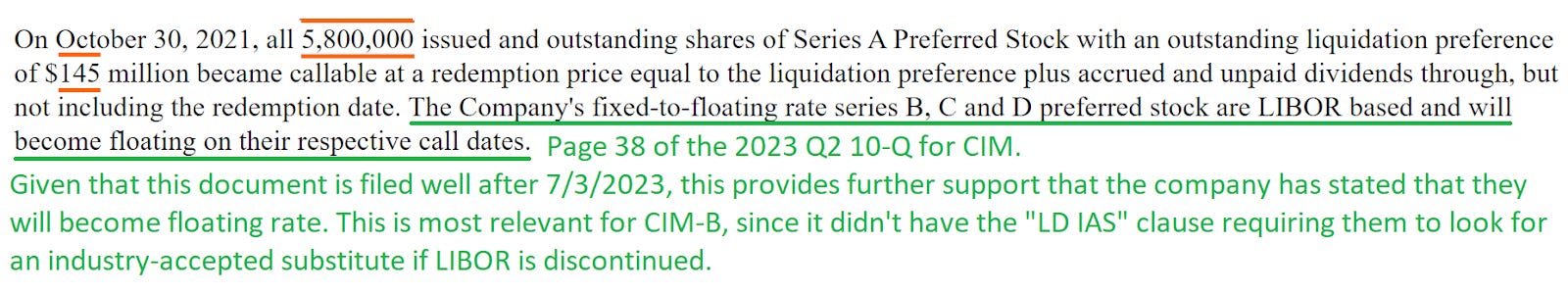

Using CIM’s Q2 2023 10-Q, we have further support:

I think that brings it up to about 95%. Publishing that and then declaring that “will become floating” actually means “CIM-B will be fixed rate” would be indefensible.

PMT-A and PMT-B

As we know, PennyMac Mortgage Trust (PMT) already declared these shares would become fixed-rate shares. I don’t agree with their interpretation of the waterfall, but that’s their plan for now. If someone sues them, it might change. If not, they won’t be pressured to change.

These shares don’t get in the headline because this isn’t new information. However, they did fall into the IPDP category so they were included in the article.

TWO-C

TWO-C is probably okay, but the language isn’t great. It was the share that had a clause for IPDP (which is bad) and a clause for LD IAS (Libor Discontinued, Industry Accepted Substitute). The LD IAS part is good.

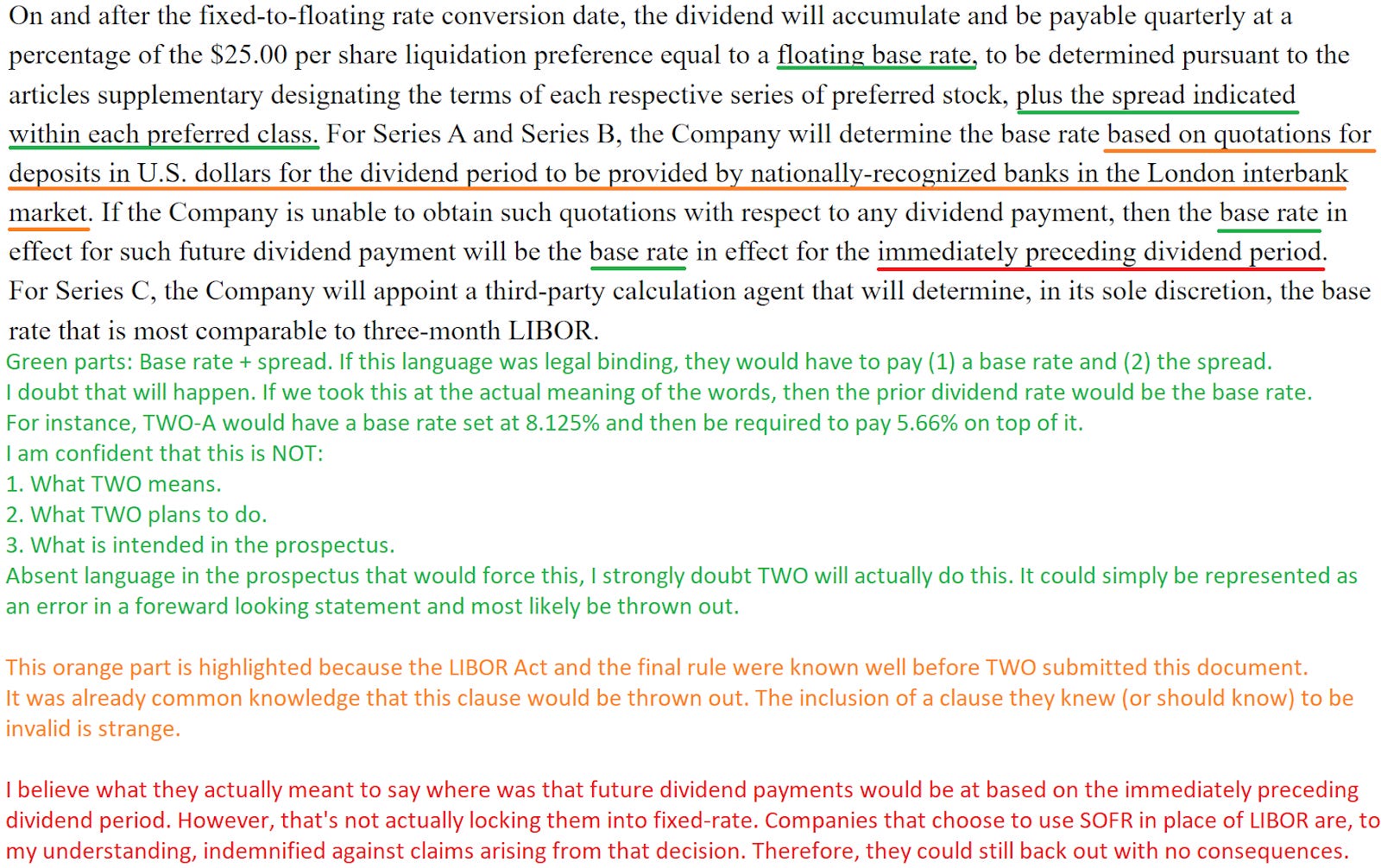

The language in TWO’s comments has failed to commit. For instance:

“For Series C, the Company will appoint a third-party calculation agent that will determine, in its sole discretion, the base rate that is most comparable to three-month LIBOR.”

That agent should be picking SOFR + 26.161 basis points. However, peers with the same language about having an agent picking a substitute have already stated they will use SOFR + 26.161 basis points.

TWO-A and TWO-B

This was the hard part. I take you to page 34 of TWO’s 2023 Q2 10-Q:

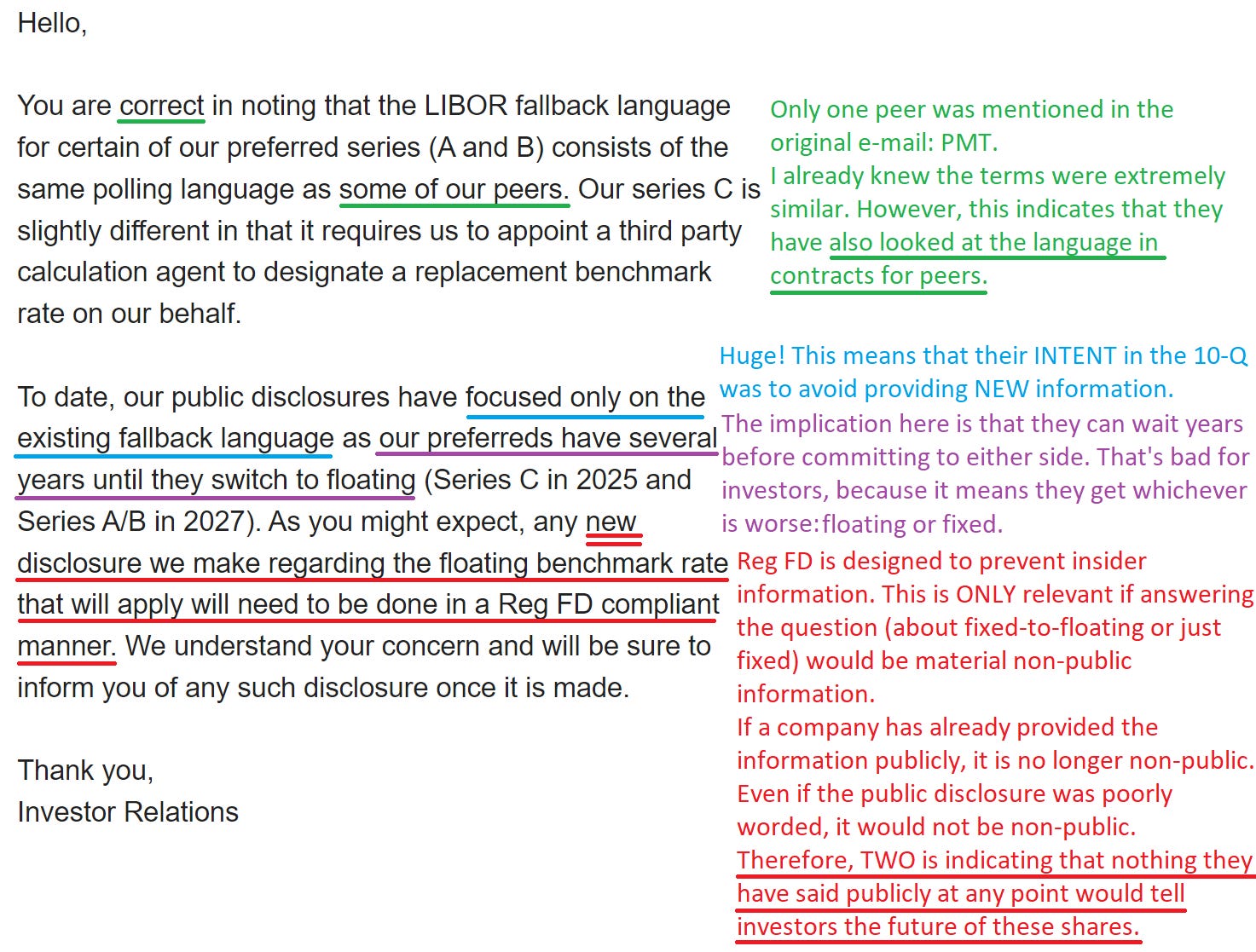

I felt this was pretty good evidence. This had me mostly convinced that TWO was refusing to commit. However, TWO was kind enough to provide the information we needed in an e-mail to a REIT Forum member.

Note: The member was kind enough to forward the e-mail chain (original and reply) to me.

This is one reason investor relations may ghost many e-mails, even when they ask a simple question. There is the risk that an analyst gets their hands on the e-mail and dissects it.

For instance, that could look like this:

Given the e-mail, I feel confident in saying that TWO intends to wait before making the determination. For TWO-A and TWO-B, they may be able to wait quite a while. So if we approach 2027 and short-term rates are 6%, TWO-A and TWO-B will get a “fixed-rate” announcement. If we approach 2027 and short-term rates are 0.15%, we will get a “floating-rate” announcement. If short-term rates are about 2% to 2.5%, it will be hard to predict.

Consequently, targets for TWO-A and TWO-B need to reflect a reality where the shares perform poorly in a high-rate environment (become fixed-rate) but also struggle in a low-rate environment (become floating-rate). Investors can only “win” by the situation reversing after TWO makes a decision or by short-term rates running about 2% to 2.5%.

There are no other shares we cover that can get the worst of both worlds (fixed and floating). I believe this is absolutely antithetical to the LIBOR Act, which was created specifically to reduce uncertainty. Instead, it appears TWO wants to use it to create a shield for waiting years to make a decision. Consequently, these shares must trade at a discount to alternatives.

New Table

This is the new table for comparing the shares:

I only did this extra layer of digging for shares with the IPDP clause. In finding the confirmation for NLY and AGNC, I also found the confirmation for their other series of fixed-to-floating shares in the same location.

Conclusion

As the smoke settles, there are four shares that stand out as significant risks to try the “floating rate could mean fixed rate” stunt: PMT-A, PMT-B, TWO-A, and TWO-B.

The situation with PMT-A and PMT-B is severely troubling and represents a foolish decision by management. Even if they manage to avoid legal costs and get away with it, they lost credibility with many income investors. It was a stupid move. Even the “winning” scenario for them wouldn’t be worth the cost.

The situation with TWO-A and TWO-B is actually worse since they can delay their decision for longer. Given this risk, TWO-A and TWO-B will end up with higher risk ratings than TWO-C. However, all 3 should be penalized for management’s refusal to commit. They are preparing to burn investors, but unlike PMT, they didn’t broadcast it as openly yet.

TWO-C should’ve committed to SOFR already, but it would be hard for management to escape it given the language.

There is still some minor risk with CIM-B as well since management has been unwilling to categorically state: “CIM-B will use SOFR + 26.161 basis points”.

That’s not even half of a tweet. If management believed their public commentary had indicated CIM-B would use SOFR + 26.161 basis points, they would’ve been able to reply with one sentence. That leaves CIM-B in a weird place. The public language was almost conclusive, but not quite. This is a huge challenge for assigning targets because it is a low-probability event. Further, If CIM-B were fixed-rate (unlikely), it would be roughly equivalent to CIM-A (same 8% rate). CIM-A is about $.60 to $.70 cheaper presently, which would be less downside than we saw in PMT-A and PMT-B.

Any LIBOR-specific concerns related to any NLY, AGNC, or IVR preferred share should be completely gone. However, IVR preferred shares will also see a risk-rating increase due to the loss of book value over the preceding two years. The ratio of common equity to preferred equity is low enough to require a higher risk rating, but the LIBOR issues are solved.

The next piece I publish on preferred shares should (please, no new developments) cover price target adjustments and risk rating adjustments. Most of the risk rating adjustments are due to changes in the ratio of common to preferred equity.

I’d still like to publish our weekly update on the common shares, though it’ll be pretty short. We’re also quickly coming up on the next Portfolio Update. It’s been a down month for values, but a pretty good month for alpha so far.

Member discussion