Equity Lifestyle Dips on Higher Guidance

Equity Lifestyle Properties (ELS) did what investors should want:

- Raised guidance for normalized FFO (Funds From Operations) per share from $2.88 to $2.89.

- Raised guidance for same-property NOI (Net Operating Income) from 5.6% to 5.8%.

Despite that strong performance:

- Most housing REITs are trending higher on the day.

- ELS is trending lower on the day.

Strange, right?

ELS trades at a higher AFFO multiple than other housing REITs.

That isn’t new though. It’s been like that for many years.

The question is why ELS is underperforming today on the back of a strong report.

I listened to the conference call searching for a solid explanation.

There are two things that came up:

- While full-year guidance was raised, a wet April weighed on some properties (worse whether for RV trips). That weather is weighing on guidance for Q2 2024.

Quarterly guidance of $.61 to $.67 per share (midpoint of $.64 per share) looks bad next to the consensus estimate of $.67 per share.

Even though the full-year guidance is up slightly, investors may be looking at the Q2 expectations. That could be weighing on it. - Memberships for “Thousand Trails” continued to slide.

Thousand Trails Memberships

Note: This is a membership program ELS offers to travelers.

Management attributes this to simply returning towards pre-covid levels:

Source: Seeking Alpha

I’m going to cast some doubt on that explanation.

- End of 2019 memberships: 115,680

- End of 2020 memberships: 116,169

- End of 2021 memberships: 125,149

- Q3 2022 peak membership: 132,185

They were growing fast in 2021. I’ll agree with that. But they were also growing very fast in 2022.

Since then, it’s been trending down. That timeline doesn’t match up very well with the explanation. I want to try a different explanation.

Evidence

I want to bring a bit more evidence to the case:

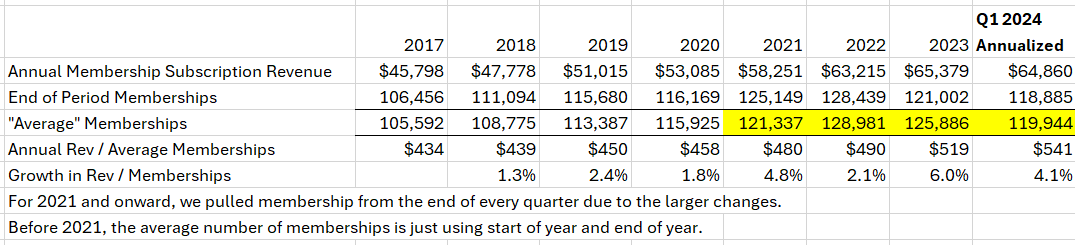

Note: In 2021, 2022, 2023, and 2024, we pulled every quarter to nail in the average values tighter.

Timeline:

- In 2021, the average revenue per member (hint: the price) was climbing. However, it was increasing less than most inflation.

- In 2022 the impact is minimal.

- In 2023 and 2024, we see the average price rising more than inflation.

There’s some discounting going on as well. We’ll just start with the normal price

In 2022:Normal price $630. Add additional zones for $70 per zone.

In 2024: Normal price: $725. Add additional zones for $110 per zone.

Therefore:

- The base price went up 15%.

- The additional zones went up 57%.

Of course, coupons are also present and the discounting means the revenue will regularly be less than the “normal” price.

Other

Also noticed these, but didn’t think they were worth a section:

- Insurance premiums up 9% on new policy. That’s a bit less than previously expected.

- Variable rate debt swapped to 6.05% for 2 years. Not a big deal either way.

Conclusion

It was a solid quarter.

Annual guidance increased for key metrics, despite weaker Q2 2024 guidance.

Membership volume came down a bit as the company pushed prices.

Overall results look good.

We have a modest position in ELS at 1.76% of the portfolio (using today’s closing price of $61.77).

Note: Housing REITs is a group that contains apartment REITs, manufactured home park REITs, and single-family rental REITs.

Member discussion