ELS Q3 2023 Earnings Update

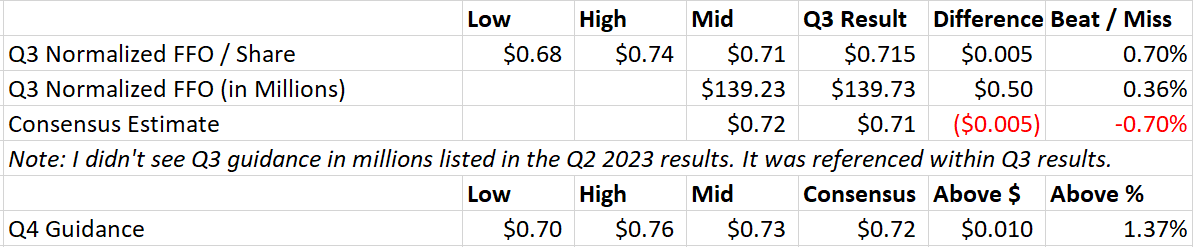

Equity Lifestyle (ELS) announced Q3 2023 results:

They were largely in line with guidance and consensus estimates.

Normalized FFO

However, rounding errors are present. I removed rounding from the results for the tables here.

Source: Company documents, author’s calculations, author’s spreadsheet

Consensus estimates only round to the nearest penny anyway. So rounding errors will be present.

Because of rounding errors (and historical databases), I find stock splits annoying. If ELS didn’t have a stock split several years ago, the per-share figures would be twice as high. That would reduce rounding errors. Unfortunately, the market likes stock splits and REITs can benefit from issuing equity at higher prices.

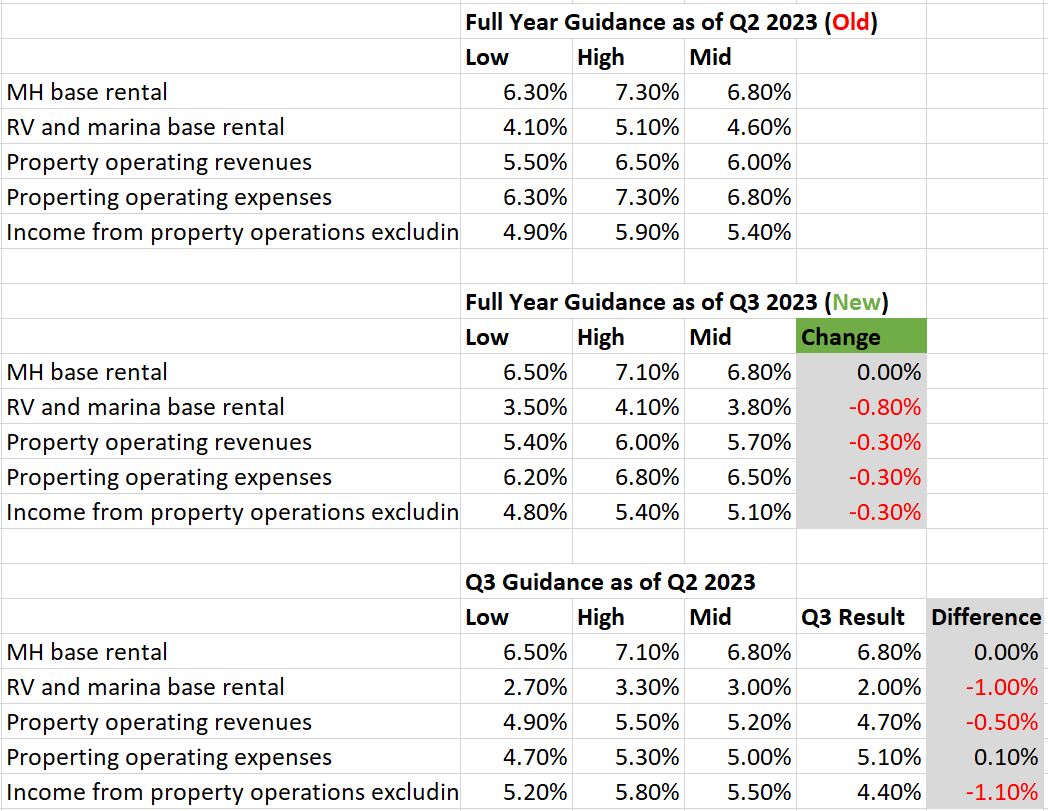

Same Property Growth Rates

The same property figures for Q3 2023 were slightly disappointing. The lower results in Q3 2023 had a negative impact on full-year guidance.

The following table breaks down the changes in same-store guidance:

Source: Company documents, author’s calculations, author’s spreadsheet

I believe the most important metric to come out in the earnings release is usually the change in the full-year guidance. Consequently, I initially labeled this report as slightly disappointing.

Commentary on New Leases

ELS indicated that they are sending out the 2024 rent increase notices to about 50% of their MH (manufactured home) residents. The average increase is 5.4% for MH. This serves as a bit of a preview for 2024. That’s less than the average increase in 2023, but it’s still very good.

RV annual rates for 2024 have been set for 95% of ELS’s annual sites. The average rate increase is 7.0%. That’s very good. It’s harder to compare that to 2023 because annual revenue is 75.3% of Core RV revenue (rather than 100%) and the RV segment is lumped with Marina for reporting.

Why Slowing Rent Growth is Good

Apartment construction is booming presently. Many deliveries coming in 2024. They should fall off during 2025 and be terribly low by 2026. While landlords always love to see accelerating rent growth, increased supply is putting pressure on apartment rent growth. We expect that trend to get worse (for landlords) before it gets better. Against that backdrop, an average 5.4% increase (for the 50% getting notices soon) is quite favorable.

Price Change

The hottest housing stocks today are ELS (up 4.75%) and Sun Communities (SUI) (up 3.04%). I would attribute all of that to the commentary about rate increases. It’s also noteworthy that they are rallying today, given the jump in interest rates.

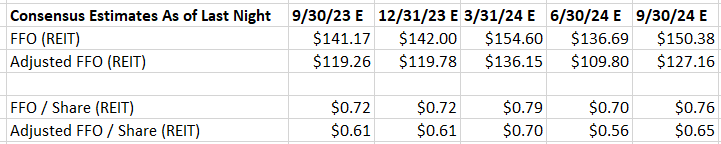

Consensus Estimates as of Last Night

For future reference, here are the quarterly estimates as of last night:

Source: TIKR.com

Earnings Call

No major revelations on the earnings call. Interesting to hear that Western Florida visitors were primarily from the Midwest and Eastern Florida visitors were primarily from the Northeast. I would’ve figured they were traveling far enough that it wouldn’t be a meaningful predictor.

Bonds and Interest Rates

ELS runs low on leverage. The average time to debt maturity is high (which is good). Emphasis on fixed-rate debt. ELS had some borrowing on a line of credit at the end of Q2 2023. That was moved over to long-term financing. The average rate on debt edged up from 3.92% to 3.95%. Not material. Unless ELS takes on some debt for acquisitions, it should be fairly steady.

Interest rates today continue to pound higher. The 10-year Treasury is now at 4.83%. Of course, it might change by the time the market closes. The increased interest rates are bad for equity REITs.

When rates were low, increases didn’t mean as much. Going from .5% to 1.8% wasn’t such a big deal. However, going from 3.5% less than 6 months ago to over 4.8% today is enough to put more pressure on real estate.

See the chart for the trend in 10-year Treasury rates:

Source: MBSLive

If rates remain this high, new apartment construction for 2026 and beyond will remain low. That drives higher growth rates for rental revenues. Likewise, the high cost of mortgages makes single-family home ownership less affordable. It raises interest expense for REITs, but it would support faster revenue growth a few years out.

The market rarely sees that kind of factor coming, so I doubt it would impact pricing before some time in 2025. Just something to keep an eye on.

Pending Target Updates

I expect negative revisions across equity REIT targets to reflect pressure from rates.

The impact will be smaller for REITs that are less exposed to interest rates (like ELS). For ELS, the primary headwind from interest rates is simply that more investors will choose bonds. It hurts valuation, but won’t have a material negative impact on interest expense for many years (unless ELS takes on new debt for acquisitions).

Therefore, ELS should see a smaller negative adjustment than other REITs that are more exposed to interest expense.

Scoring The Quarter

Excluding the commentary about renewals for 2024, this report was slightly disappointing.

Including that commentary about rates for 2024, it was about neutral. I’m scoring this report as about 6.5/10. It would’ve been lower without the commentary about rental rates for 2024.

Scores do not translate to letter grades. They are more comparable to IMDB scores. A 6.5 is about average, which is much better than some investors may think when they see the score.

Disclosure: Long all positions in CWMF’s Portfolio. That includes a 2.2% (at current valuation) allocation to ELS.

Member discussion