Digital Realty: Soaring Price, Stagnating Fundamentals, and Magic

Snark alert!

We recently published a huge article on Equinix (EQIX) .

In that article, I determined Hindenburg’s accusations regarding maintenance capital expenditures were mostly on point.

As part of my research, I ran a review of maintenance capital expenditures across several types of equity REITs.

Based on that review, I determined that Digital Realty (DLR) is probably structuring some of their “maintenance capex” to run through “expansion / growth capex”.

I believe it is significantly less for DLR than for EQIX, but I’m inclined to think it is probably happening in both cases. This does NOT mean they are violating any accounting rules.

However, it is a negative indicator in my opinion.

Further adjustments for DLR might be warranted, but we already made substantial adjustments. I’m happy with our current rating (overpriced). That’s a bearish view, incase anyone thinks “overpriced” is positive. I guess we could be a bit more descriptive: “Significantly overpriced”. Better?

Prior Target Adjustment

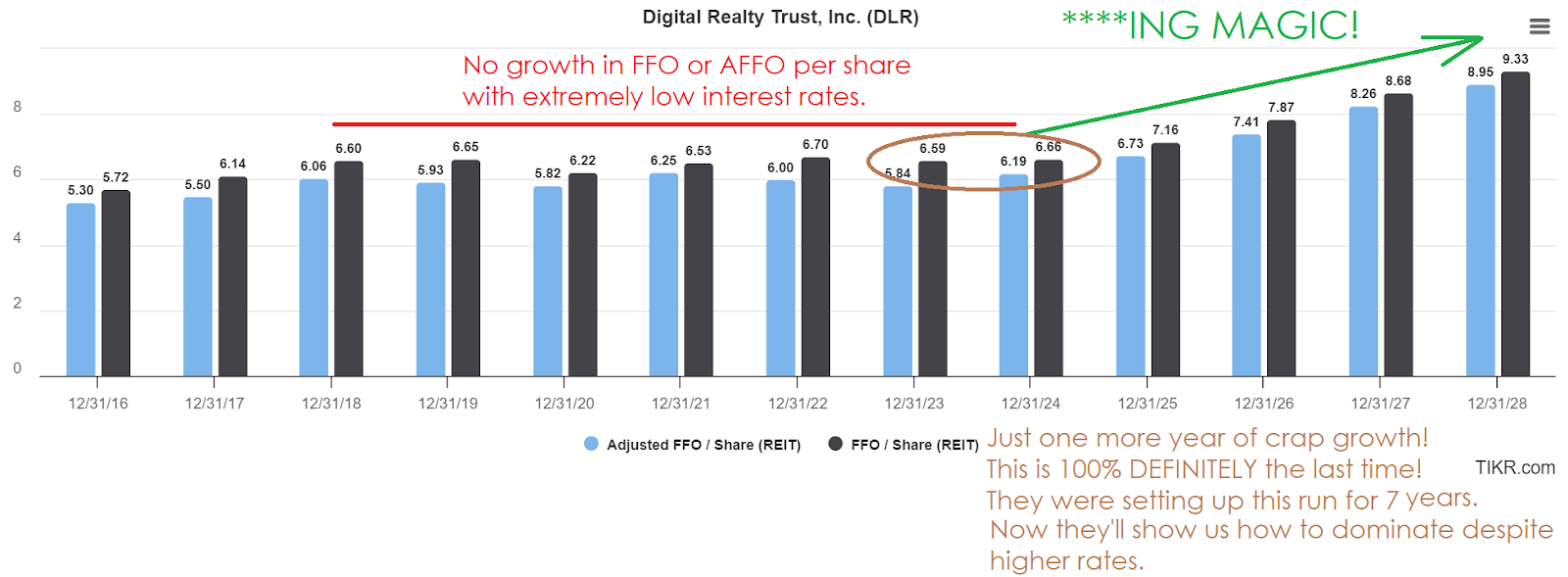

We dropped DLR’s targets significantly in a prior update after years of falling short on AFFO per share.

EQIX escaped the big punishment at that time as they were delivering strong growth in AFFO per share (partially fueled by aggressive use of debt).

Recent Price Action

Over the last 12 months, DLR performed exceptionally on one metric:

- The share price.

Other core metrics were not nearly so great. Not even close.

Further, this strong performance on share price only pertains to the last 12 months. If we were to use a longer period such as 5 years, the results are far less impressive.

Fundamentals

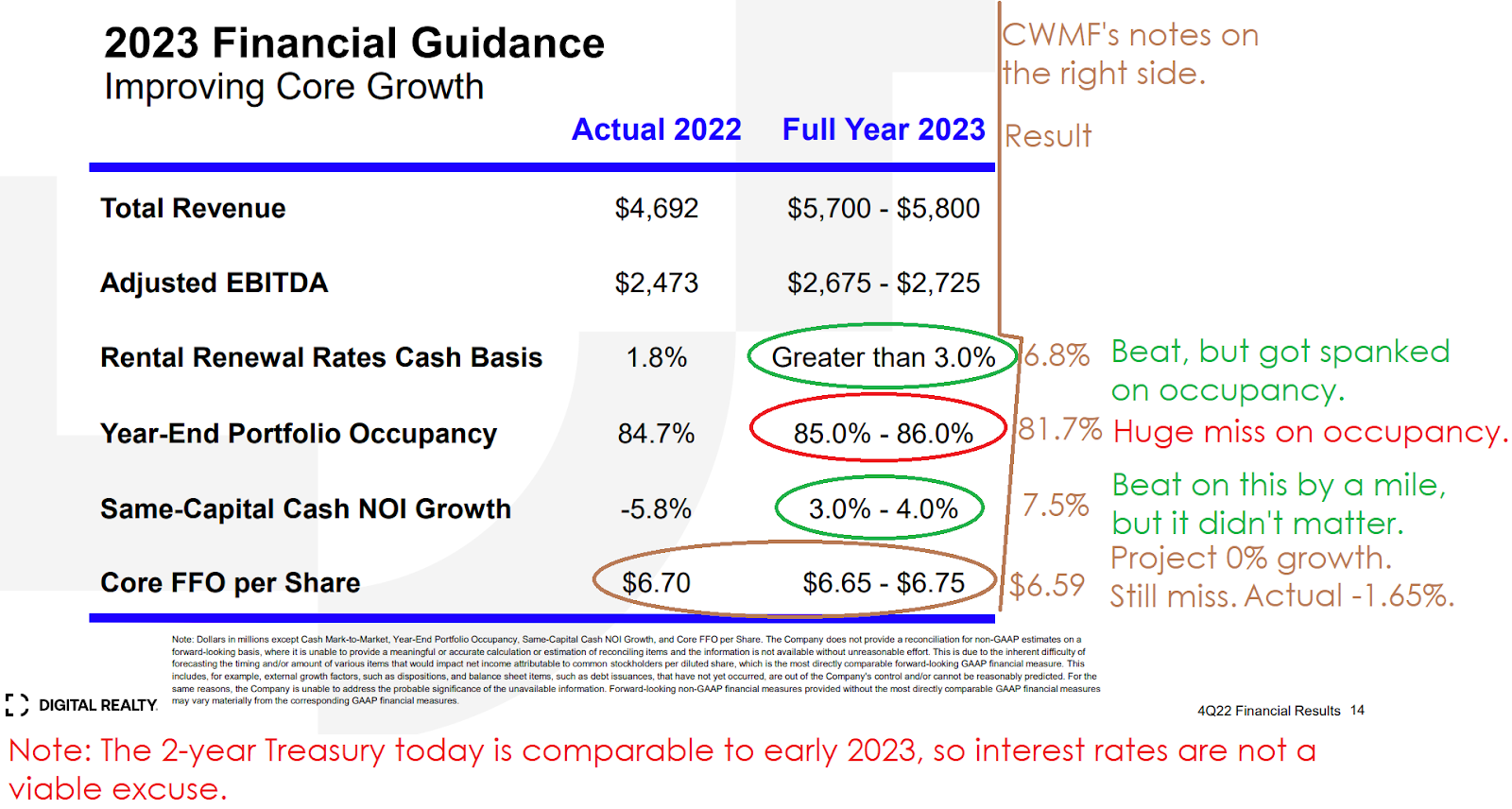

Let’s take a look at how DLR performed in 2023 relative to their initial guidance (from Q4 2022):

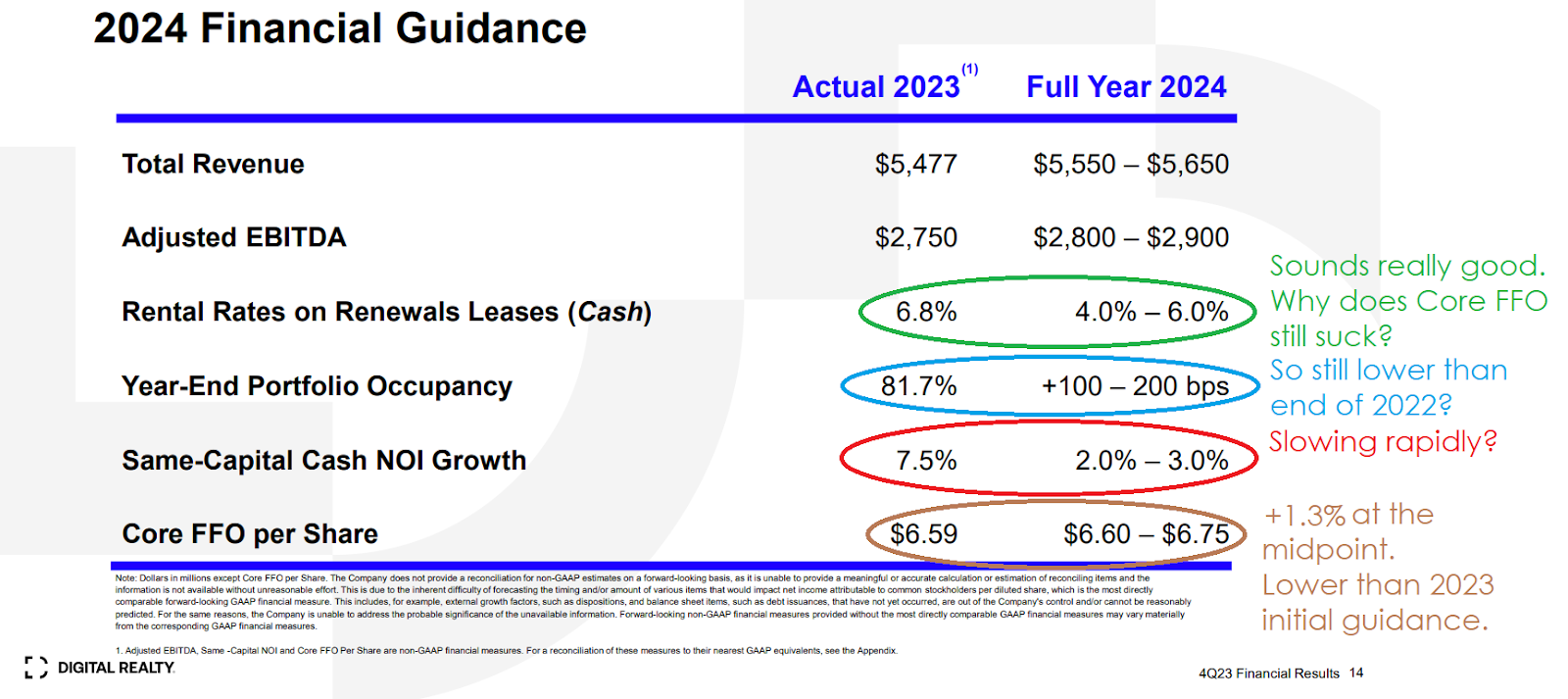

Now that we have that historical context, let’s take a look at their new guidance for 2024 (from Q4 2023):

What is Digital Realty calling “Same-Capital Cash NOI”? How can they achieve 7.5% growth while Core FFO per share declines 1.65%? That’s impressive, in a bad way.

If Same-Capital Cash NOI is ripping higher, then we should see improvements, right?

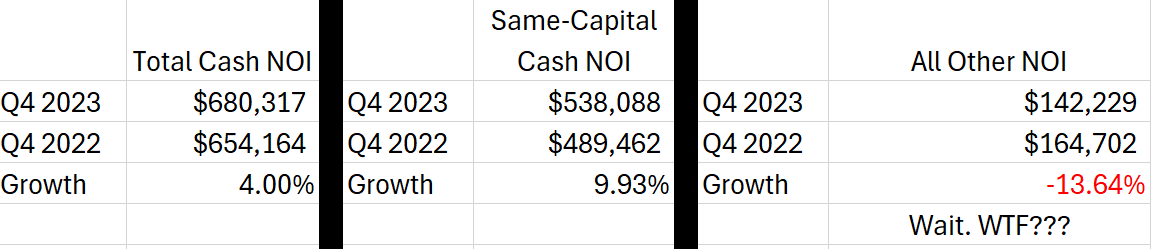

Let’s just check the Q4 2023 figures.

In Q4 2023, same-capital cash NOI was even hotter:

Same-capital cash NOI was hot, but total NOI was not. Why? Because other NOI was falling.

Well, how did that happen? Was DLR selling off their real estate assets?

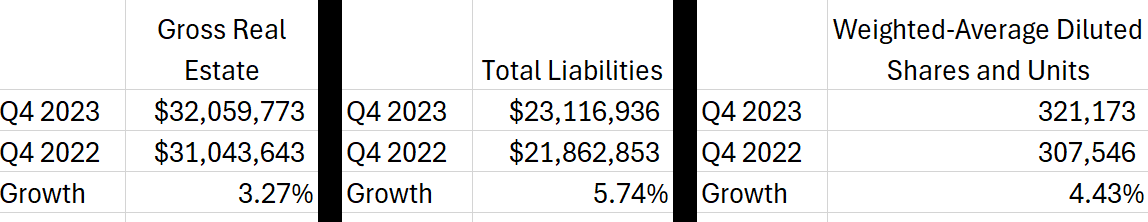

No. Real estate assets were increasing.

How did they pay for that?

- Total liabilities increased.

- Shares outstanding increased.

Here’s the math:

I’ll make it simple:

Properties that look bad were excluded from the pool.

Here’s DLR’s description:

“The “Same-Capital” pool includes properties owned as of December 31, 2022 with less than 5% of total rentable square feet under development. It excludes properties that were undergoing, or were expected to undergo, development activities in 2023-2024, properties classified as held for sale, and properties sold or contributed to joint ventures for all periods presented.”

Sorry, let me format that statement for you. Sentences should be shorter than tweets. Just saying. Here’s a version designed to be useful:

The “Same-Capital” pool requires properties were:

- Owned as of 12/31/2022 with less than 5% of total space under redevelopment.

Except for properties that meet any of the following:

- Undergoing development.

- Expected to undergo development in 2023 or 2024.

- Properties labeled as “held for sale”.

- Properties that are sold.

- Properties that are stuffed inside joint ventures where transparency is much weaker because GAAP rules for joint ventures are trash.

In other words, there are many ways to remove problem properties from the pool.

Based on Fundamentals

Our call to drop targets on DLR was based on the fundamentals.

Those huge cash increases in rental rates on renewals look really good, but GAAP increases were only modestly higher. They were about 10.7%.

When your cash spread is 6.8% and the GAAP spread is about 10.7%, it means the GAAP spread is only about 4% higher than the cash spread.

Why does that matter? It implies that lease escalators are pretty small. So tenants are paying a healthy cash spread today, but they are not locked into big escalators.

In theory, they could just have inflation-based escalators. I couldn’t find an exact number for how many of their leases included inflation adjustments, but their financial documents did state:

“In addition, many of the leases provide for fixed base rent increases.”

Further, if their leases contained escalators based on CPI, we probably wouldn’t have seen “Same-Capital Cash NOI Growth” at negative 5.8% for 2022 (before it surged to 7.5% in 2023).

Negative Core FFO Per Share Growth

Despite recording outstanding growth in “same-capital cash NOI” and achieving the “highest cash renewal spreads since 2015”, they achieved negative 1.65% growth in core FFO per share.

They are guiding for 1.1% growth in Core FFO per share for 2024.

In other words, 2024 Core FFO per share guidance is still:

- Below results from 2022.

- Below the initial guidance for 2023.

So what do analysts think?

I don’t think DLR is going to achieve that growth in the chart.

They failed to deliver growth in AFFO per share when they had:

- Cheap debt for many years.

- The best cash leasing spreads since 2015.

- 7.5% same-capital cash NOI growth.

So how the heck are they going to do it now?

They won’t. Magic isn’t real.

Now we can understand why Core FFO per share guidance is so weak. Based on guidance, Core FFO per share would only be up about 1.1% relative to 2018. Not a 1.1% compound annual growth rate. Just a 1.1% increase for 6 years.

Debt

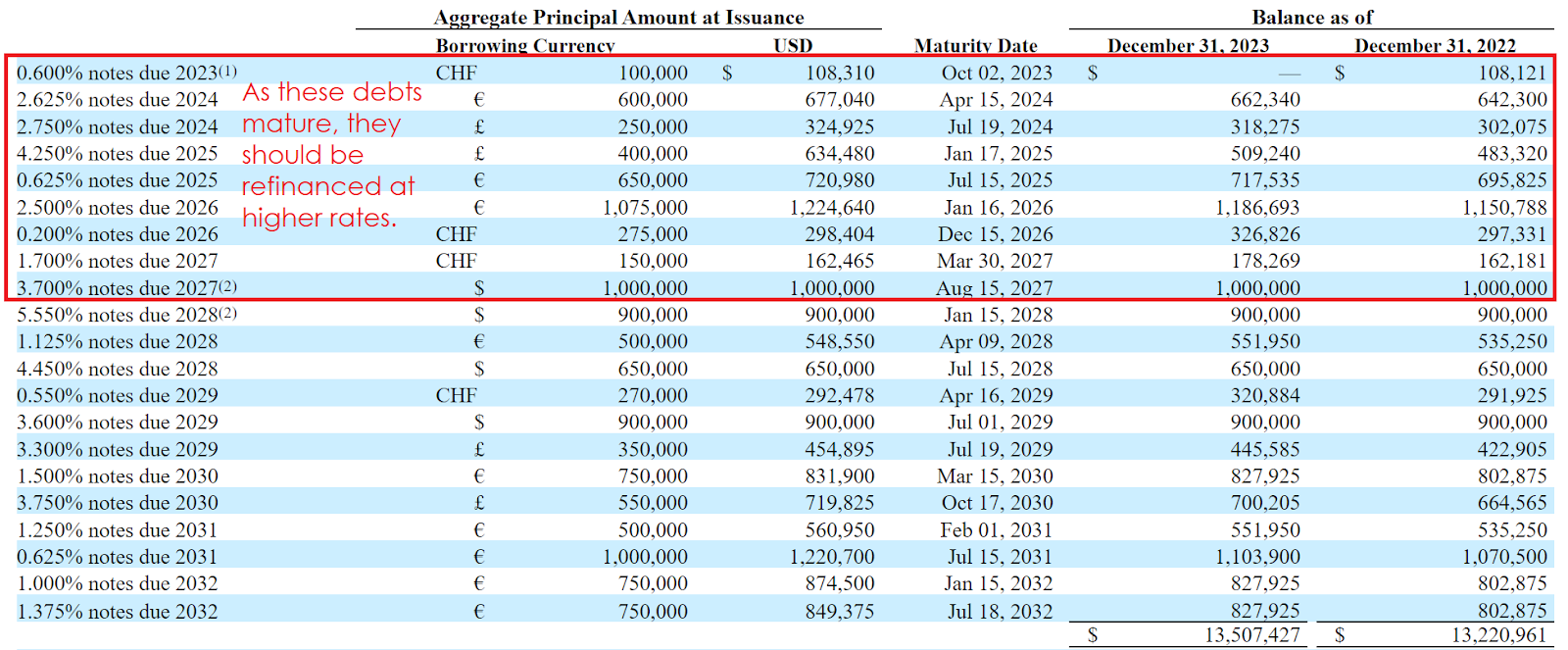

DLR had access to cheaper debt during the last several years.

Now maturing debts will need to be refinanced at higher rates.

I went and pulled the table for debts from DLR’s 2023 10-K:

We’re simply going to focus on the debts maturing through 2027.

If you think DLR can perfectly predict which currencies will perform better or worse, you’re giving them too much credit.

They can try to use cheaper currencies to borrow, but the other currencies are not dramatically cheaper. They won’t be getting rates under 1.0%. Not even close.

Therefore, we can simplify this by assuming DLR simply refinances all expiring debts to 5-year debts denominated in USDs.

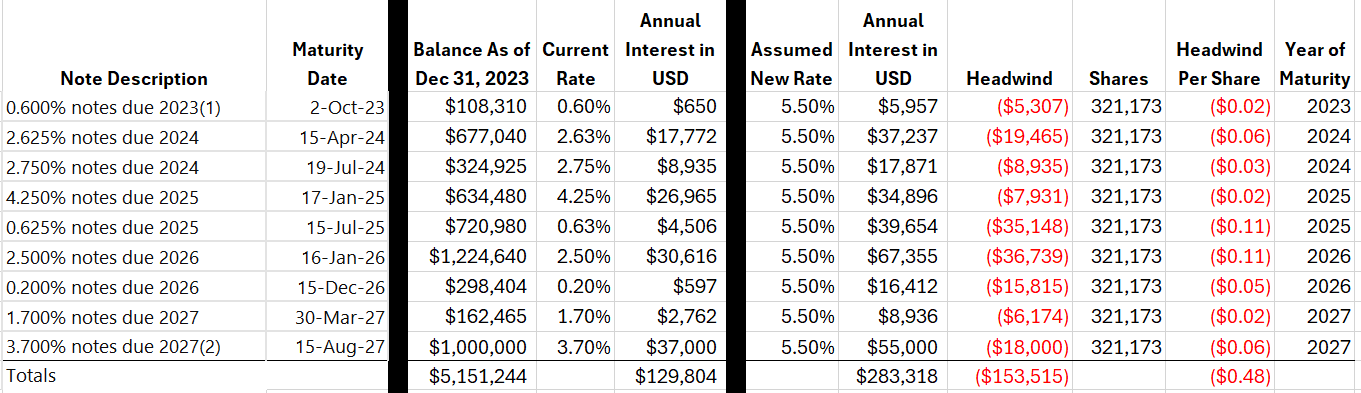

The Refinancing Headwind

We need to assign an interest rate. I’m going to assign 5.5%.

Why? The 5-year Treasury rate is 4.375%. A spread of 1.125% over 5-year Treasury rates would be pretty reasonable. Perhaps even favorable.

So what happens if DLR borrows dollars at 5.5% to pay off those maturities?

We get the following headwinds (values in thousands except “Per Share” figures):

By the end of 2027, the run-rate for the headwind relative to 2023 would be about $.48 per share.

That’s a material headwind for a REIT with 1.1% cumulative AFFO growth per share across 6 years.

The $.48 per share is equal to 7.2% of management’s guidance for AFFO per share for 2024.

Can DLR generate enough new EBITDA per share to cover the additional interest and match the market’s optimistic projections for growth? I doubt it, but you decide what you think.

What if DLR Issues Equity?

I used 321,173 shares based on the weighted-average fully diluted shares and units for Q4 2023 from DLR’s Q4 2023 earnings release.

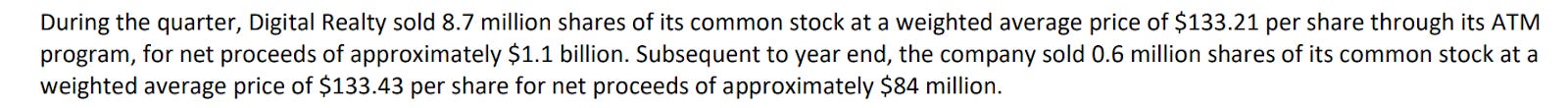

I think DLR should be pumping out equity as fast as they can at these inflated prices, so the actual share count will probably be higher.

Think that reduces the headwind per share?

Only if DLR reduces the amount of debt per share.

If DLR issued new debt to maintain the same amount of debt per share, then the weighted-average interest rate would increase faster (print more debt at 5.5% or higher). Therefore, the headwind from interest expense would be higher. The reason to issue shares is simply that the price is remarkably high. Further, the advantage of cheap debt is going to run out anyway. They might as well use the opportunity to pump out shares at these prices.

Think DLR wouldn’t issue equity?

Weighted average shares and units outstanding increased by 4.4% from Q4 2022 to Q4 2023. They increased shares outstanding even though their price didn’t touch the current level at any point between the start of Q4 2022 and the end of Q4 2023.

Let’s ask DLR just to be sure. DLR, would you issue equity at a price below $146?

Seems pretty clear.

Price Dip

Interest rates jumped higher following the CPI data (slightly higher than expected).

The 2-year Treasury is up about 22 basis points. That means the market is looking at the inflation data and expecting a reduction in the amount of rate cuts for this year. The 5-year is up 23 basis points and the 10-year is up 18 basis points. The market is pretty upset about the higher inflation data.

Most of this article was prepared 04/09/2024, when the latest share price for DLR was $146. I’m not editing those parts, but I’ll comment on the price change.

All REITs are getting pounded on interest rates:

- VNQ: Down 4.14% (at $82.41)

- KBWY: Down 4.24% (at $17.39)

- MORT: Down 4.63% (at $10.70)

Remarkably, DLR is only down about 3.07% (at $141.40). Investors are pretending interest rates matter less to DLR, even though DLR has a significant amount of debt maturing and plans to issue more debt each year to fund their development pipeline. Before you get excited about that pipeline, you should know that they also had it in prior years (yet Core FFO per share growth was still awful).

Conclusion

Artificial Intelligence is great, but is the data center space becoming less competitive?

If it was becoming less competitive, would occupancy be at 81.7% with guidance implying only 1% to 2% growth? For reference, 81.7% is not good. Technically, it does mean DLR has space available that could enhance revenue. That’s really polishing the turd though. Might as well say that a restaurant has extra capacity for customers because it’s never packed.

I believe the market is severely overvaluing DLR at $144.60. I don’t think their fundamentals will get a substantial enough lift from artificial intelligence. They achieved better cash leasing spreads, but vacancy was jumping higher. Sure, higher spreads are nice, but vacancy ripping higher is bad.

The best case scenario for DLR would be if they could convince EQIX to buy them out. Even if they could reach such a deal, regulators would have to be negligent to permit it. I’m not saying that can’t happen, but it shouldn’t be the core thesis.

DLR delivered disappointing results for many years. Occupancy slumped as new supply outpaced demand. After 5 years of flat Core FFO per share (with guidance predicting another flat year), analysts are predicting a dramatic improvement.

Rather than a tailwind from from issuing new debt at cheap ratest, DLR has billions of cheap debt expiring over the next several years. They also have plans to issue even more debt to fund development (while current properties remain at low occupancy). Growth in Core FFO per share will be reduced by the increase in interest expenses. So how is DLR supposed to achieve that growth?

Magic.

Member discussion