Digital Realty: Priced for Excellence, Built of Mediocrity

Digital Realty (DLR) reported their Q2 2024 results. Once again, they would like to make their results look good.

Unfortunately, there was nothing particularly impressive about the results.

They were not bad, but they were not good. They were simply average.

Average shouldn’t be good enough when DLR trades at one the highest AFFO multiples among all REITs listed in the United States.

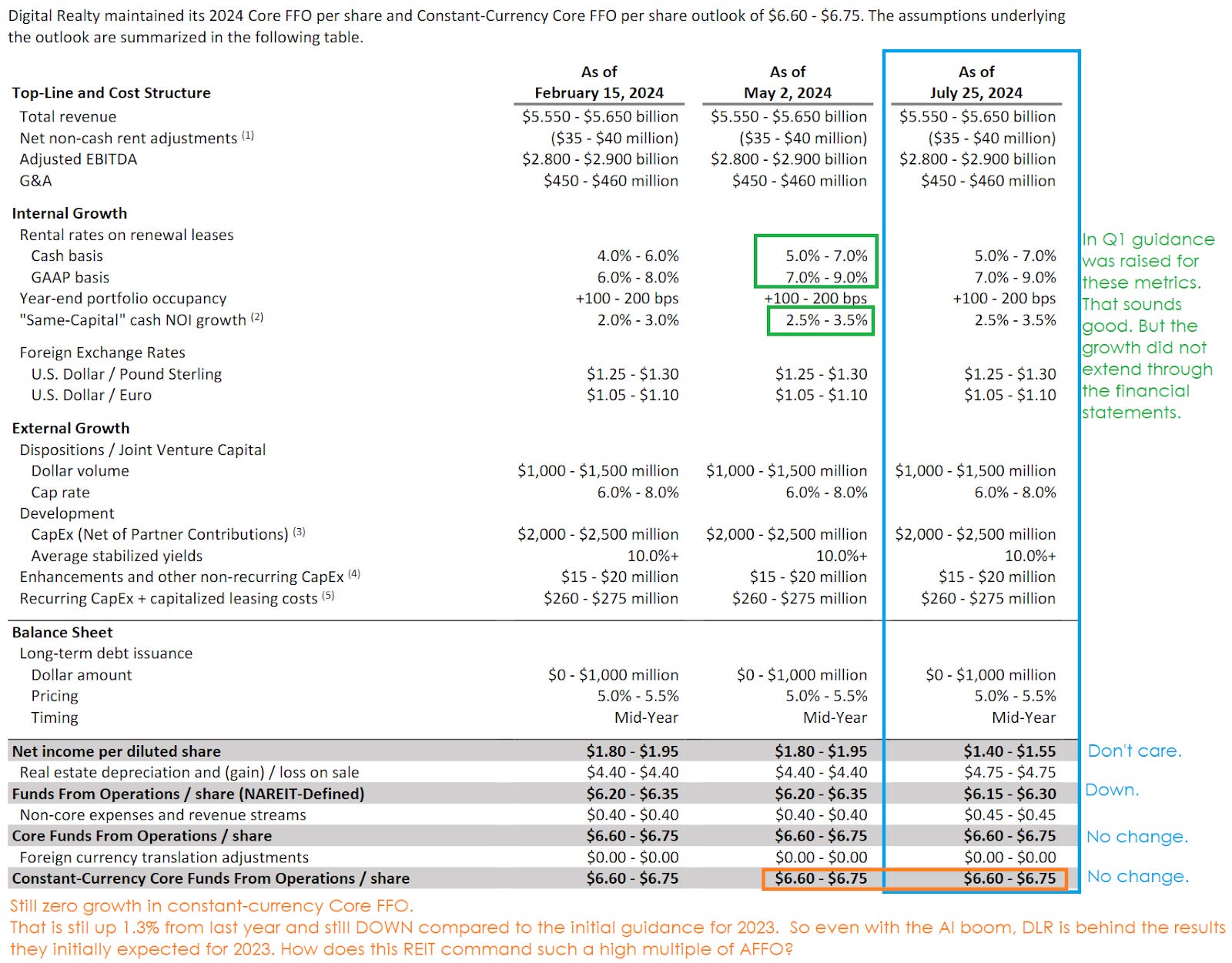

Here’s the comparison of how DLR’s guidance evolved so far this year:

Who wants to pay a premium for that?

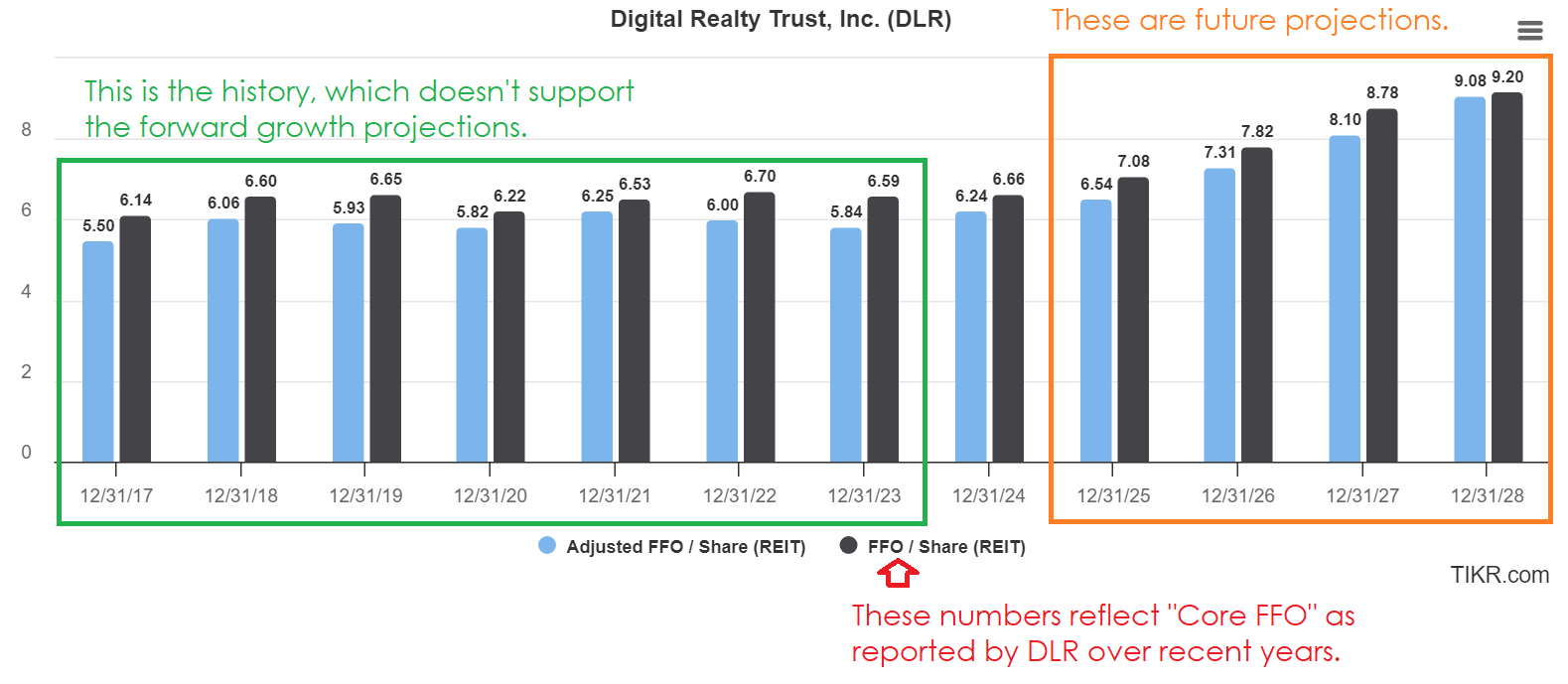

Even if we use DLR’s “Core FFO” metric rather than AFFO (so we can just ignore maintenance capital expenditures”, the Core FFO yield (Core FFO / share price) is low.

The company issued shares at $144.63 and at $148.99. Both lower than their price at the end of the quarter ($152.05).

The Core FFO yield at $144.63 would still only be 4.6%. That’s cheaper than market rate yield on debt.

Therefore, issuing shares is more favorable for Core FFO per share than refinancing expiring debts.

In most cases, investors would be concerned about the impact on growth.

The Core FFO yield may only be 4.6% at that point, but what about in future years when Core FFO per share is higher?

Well, there has hardly been any growth in Core FFO per share for about 6 years. So maybe we should stop believing that the big growth is right around the corner?

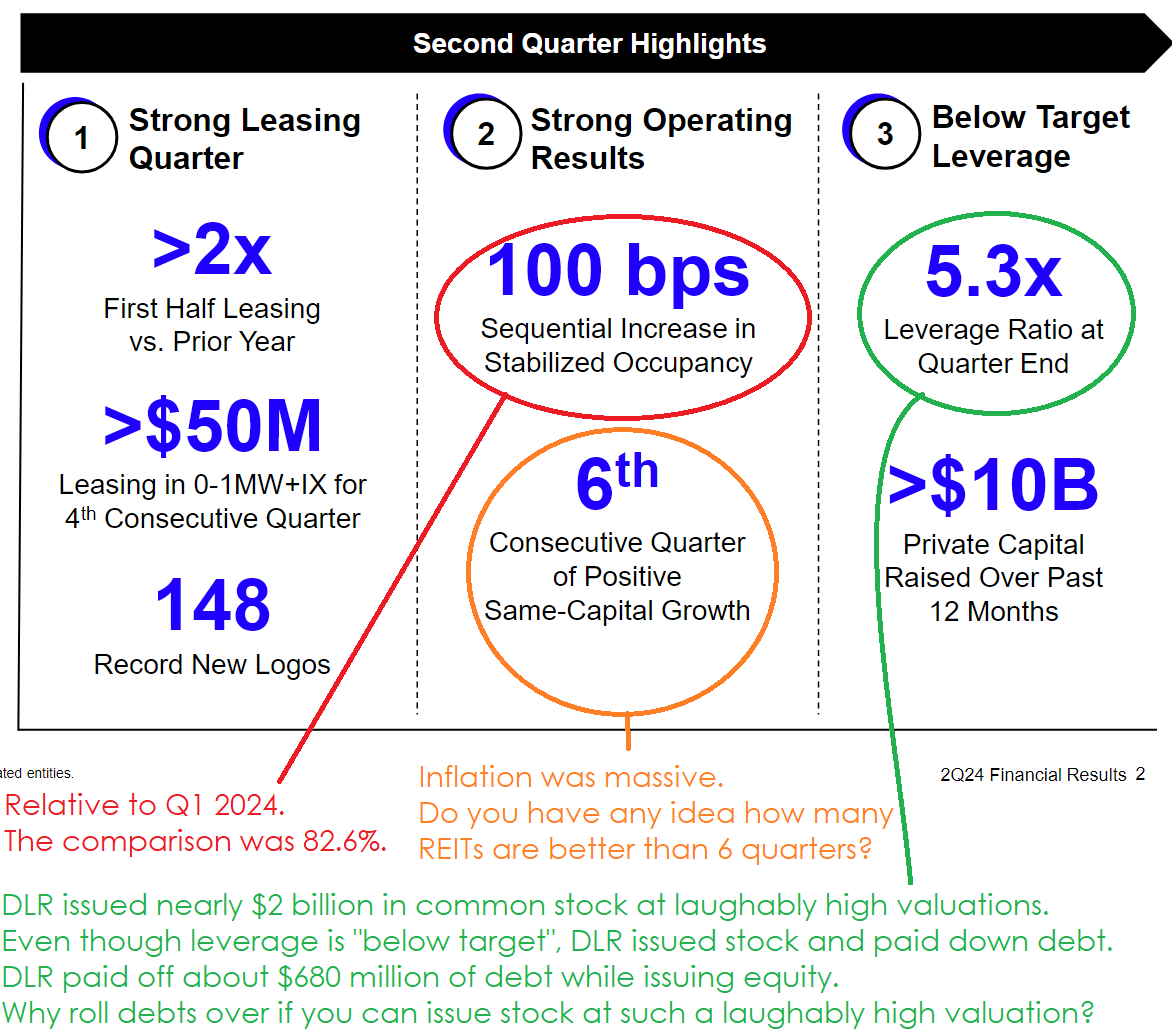

Issuing Equity

When DLR is issuing billions of equity, that means they believe they can invest the equity at a higher return than the cost of equity.

Issuing equity naturally results in deleveraging, since it allows the REIT to buy more real estate.

However, DLR also issued equity and simply used the proceeds to pay down debt. Despite having quite reasonable leverage, DLR recognizes that these prices are simply too favorable not to issue equity. Even if the only use for that cash is to pay down debt, it’s still the right choice.

Vacancy

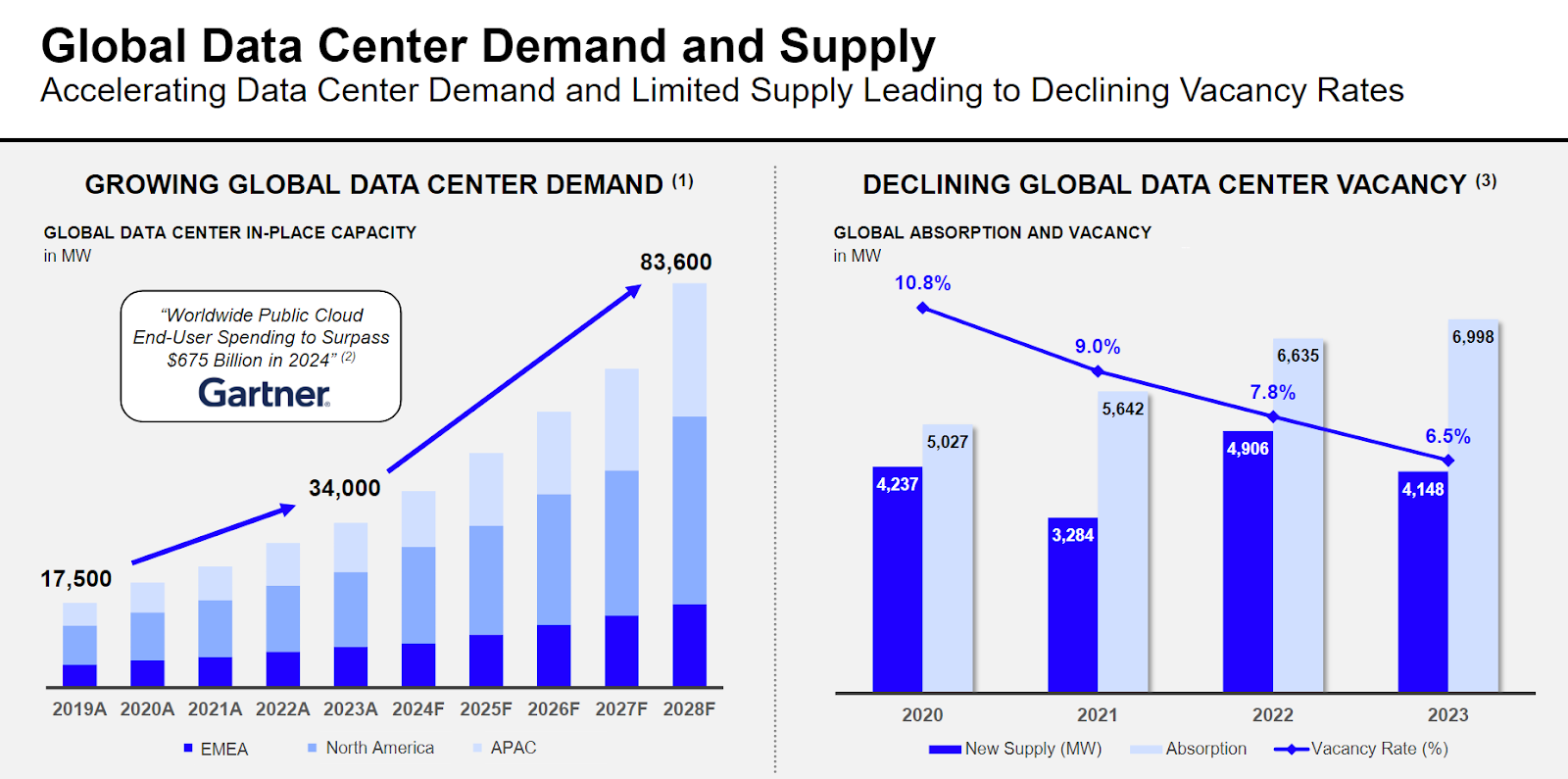

The demand for artificial intelligence is pushing data center occupancy higher around the world. Despite rapid construction, vacancy is trending down:

Sounds great, right?

We have rapid investment in data centers because data centers can be built at much higher yields than the cap rates they command. In other words, there is a solid profit margin in the construction of data centers.

That’s great for an investment vehicle like a REIT where there is a simple path to issue equity and build new data centers.

The booming demand for data centers is outpacing even the rapid construction, so surely DLR is rocking. Right?

If only that chart on the right for global vacancy rates also included the DLR vacancy rate!

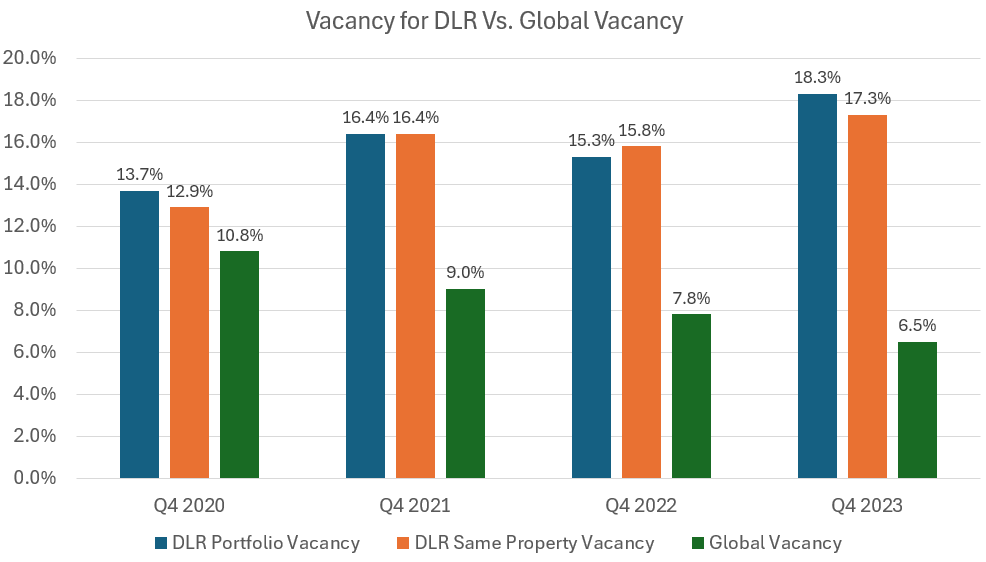

Fear not, good reader. I prepared a chart comparing DLR’s portfolio vacancy (all properties) and same property vacancy to the global vacancy rate:

Wow, that’s really special. Global vacancy keeps going down, yet DLR often found a way to increase vacancy.

Not to worry though! DLR’s vacancy is down to 17.1% for the total portfolio and 16.4% for the same property portfolio.

Note: DLR doesn’t provide a vacancy statistic. They provide “occupancy”. Since the opposite of occupied is vacant, the math was pretty easy.

There is an interesting theory here though. If demand grows faster than new data centers are built, global vacancy trends towards zero.

Even if DLR’s competitors get market share first, eventually tenants have fewer non-DLR choices available.

We Demand A Highlight

Issuing equity at high prices wasn’t good enough?

Alright, fine.

On the earnings call, the CEO (Andrew Power) referenced “hitting” on questions 3 times.

“But Matt, why don't you hit on the question?”

“Matt, why don't you hit the dividend question first and Colin, and I can hit a little bit on what we're seeing in the enterprise demand piece of the puzzle?”

Is that lingo cool?

Sorry, I like to hear things like “dividend growth backed by AFFO per share growth”.

The AI Wave

Investment in AI is booming, right?

That’s why some company called Nvidia (NVDA) keeps going up?

Occupancy is up globally, but remains weak for DLR. It “improved” by virtue of the low bar.

A bar that kept drifting lower over several years as occupancy trended lower in DLR’s properties.

Who else would be bragging about reaching 83.6% occupancy?

Maybe investors don’t have a frame of reference for that occupancy level.

You know how malls are (not) booming?

Simon Property Group (SPG) had 95.5% occupancy in their US malls and premium outlets at the end of Q1 2024.

Macerich (MAC) had 93.4% occupancy at the end of Q1 2024.

Core FFO Per Share Growth

For those who aren’t familiar with DLR, I’m including the chart again:

Investors, and Wall Street, are really counting on DLR delivering impressive growth.

They haven’t been able to do it so far.

This isn’t the first quarter where AI technology exists.

Interest rates are still high enough that DLR is better off issuing equity and using the proceeds to handle debt maturities.

New Slogan

Perhaps DLR can get a new slogan:

- Like investing in artificial intelligence, without the intelligence.

In a Nutshell

DLR is operating in an industry with booming demand.

The yield on new data center construction is very attractive.

REITs from other sectors are even getting involved because of the attractive development yields.

Yet somehow, DLR still hasn’t delivered on fundamentals.

DLR’s vacancy increased for years even as global vacancy was falling.

I suppose DLR does have quite a few empty properties, which could really enhance revenue if someone would rent them.

That would be a nice boost to Core FFO per share. It wouldn’t be enough to make the historical growth trend “good” compared to REITs in most other sectors. But it would be a nice bump.

In my opinion, DLR is unattractive as an investment. They failed to capitalize on prior tailwinds and so far haven’t shown success capitalizing on this one.

This is beyond that whole issue I had previously talking about DLR’s suspiciously low maintenance capital expenditures.

Member discussion