Demolishing an Awful Article on AGNC

Some years ago, rebuttals were my favorite articles.

There’s nothing so motivating as the opportunity to highlight someone being wrong on the internet.

Unfortunately, feelings get hurt. Even if I’m careful to only attack ideas, someone takes it personally when their stupid idea is called out.

You’ll notice how I respectfully called the idea stupid, not the person. Manners are important!

What Happened

After feelings were hurt, complaints were made. Eventually, new policies were created that essentially banned all rebuttal articles.

They are allowed technically, but they have more content restrictions than a Florida library.

An Awful Article

Of course, this is all stimulated by seeing a dreadful article.

I can reply to such an article to point out the flaws, but spending more than a couple of minutes is a waste.

Frankly, I’m not compensated for replies. The compensation went to the author who produced more errors than the San Francisco Giants.

If you don’t get our articles in your inbox, use the button below.

The Birth of Bad Research

Awful research usually comes from analysts who don’t understand accounting.

At one point, I could contest such articles on the basis of dramatically inaccurate facts, gross negligence, or an analyst not understanding what words mean.

That’s no longer the case.

Now bad articles are produced frequently and rarely challenged unless the author gets unlucky enough to face an editor who knows this particular niche.

Are You Going to Link it?

Nope. Not giving the author additional page views.

Instead, we’re just going to annihilate his work like a volcano taking out a sand castle:

To be fair, the author probably knows as much about mortgage REITs as the typical preschooler knows about architecture.

Things That Were Wrong

Here are some of the grievous errors in the article about AGNC:

- Believes AGNC locked in cheap funding. No consideration of the hedge portfolio running out.

- Article attributes economic return to interest spreads. Economic return is the change in BV + the dividend. If a REIT had no dividend, it would just be the change in BV. The change in BV is primarily driven by changes in interest rates and the relative change in MBS values relative to hedges.

- Cherry picking individual quarters for calculating economic returns. The article completely ignores other recent periods with vastly different performance.

- Indicating “profitability” is likely to remain lumpy until 2026 or 2027 while failing to define “profitability” for a mortgage REIT.

- Believing all issuance of stock is dilutive, even when it is actually accretive. Zero concept of how stock issuance works.

- Calculated a dividend payout ratio using a single quarter.

- Attempted to value AGNC using a P/E ratio that is distorted by accounting rules. Compared P/E multiples across “peers” who structured positions differently.

- In 2 out of 3 cases, the selected “peer” also had substantially different assets. In one case, the assets had no comparability beyond technically being mortgages. That makes the “peer” term dubious at best.

- References “bottom line” projections for the group through 2026. I can’t even tell what the author meant. Did he mean the change in earnings using consensus estimates? If so, the numbers were vastly off. If not, what does he think the term means?

- Compares AGNC’s dividend to the “sector median” of 3.62%, which is simply not remotely close to the sector median.

- Declares the stock speculative based on “stock market volatility from the ongoing US election and geopolitical issues”.Sure, AGNC is speculative, but those aren’t the reasons.

- Labels the stock as a “buy” while uploading the article, but then claims “this is a very hard question to answer”.

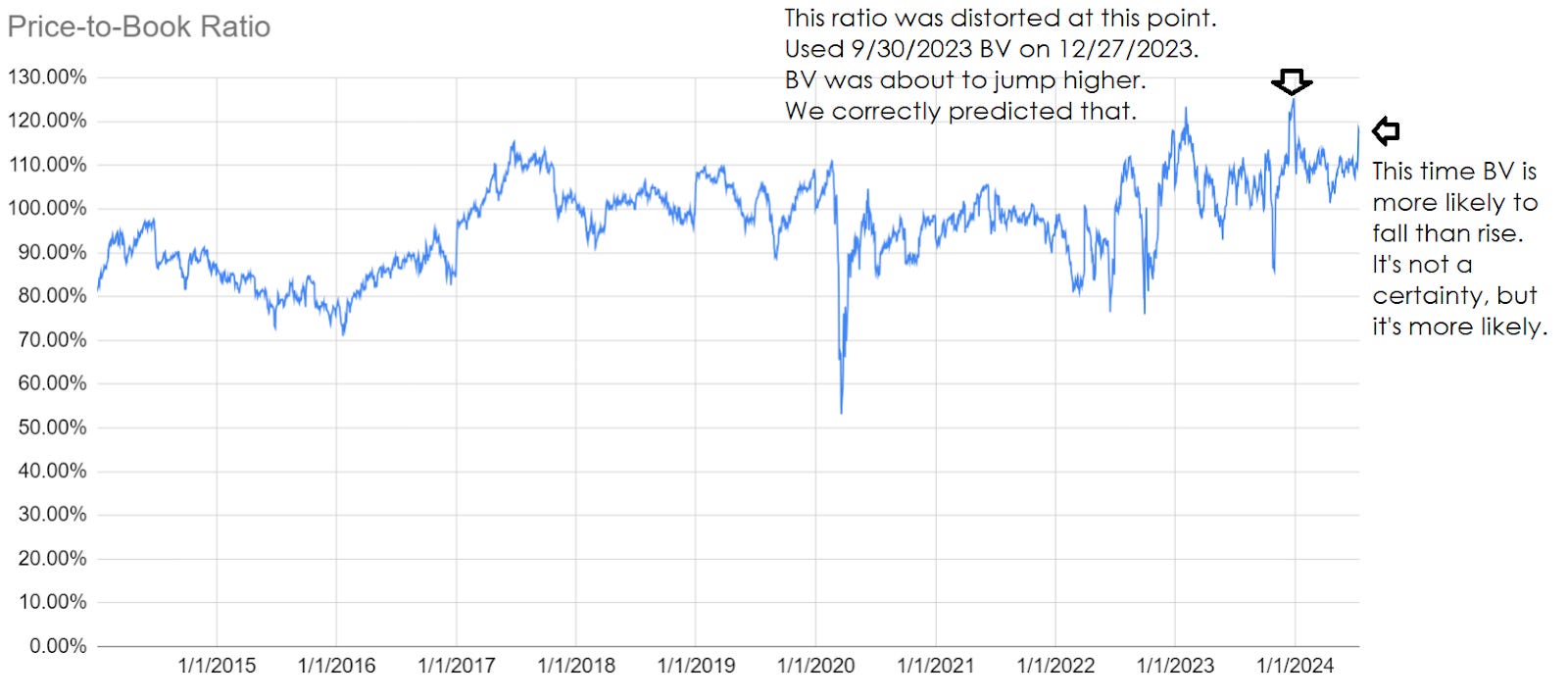

- Uses stock price history to determine if the shares have bottomed, with absolutely no regard for price-to-book. Price-to-book is not referenced at any point in the article. It’s the single most important metric and it wasn’t even mentioned.

Even Wronger

That was pretty polite. Now I want to get to the errors that are so bad I think the author’s compensation should be clawed back.

Big Mistake 1: This sentence: “Assuming that the management continues to deliver QoQ/ YoY improvements in its economic return on tangible common equity and tangible net book value per common share in the upcoming FQ2'24 earnings call on July 22, 2024, we may see sentiments improve from these bottom levels indeed, supporting its recovery momentum ahead.”

Competent Financial Fact 1: Book value is already net. There is no “net book value”. There is “net asset value”. The reason we have “net asset value” as a term is because we have to “net” the liabilities against asset values. By definition, book value does that.

Sorry, that seems pedantic. That’s not the real issue. The issue is that the article says “tangible common equity and tangible net book value” per common share. Those are the same metric. Tangible common equity = tangible book value = tangible net asset value.

Perhaps the article meant to separate the concept of total tangible common equity from the “per common share”. However, that wouldn’t make sense either.

- The economic return on tangible common equity (total value) is a percentage.

- The economic return on tangible common equity per share is a percentage.

By definition, these two percentages are the same.

When you switch to “per share”, you’re just dividing both parts of the equation by the number of shares outstanding.

That has no impact on the final value. This is known as “cross cancellation” and is typically learned around 4th to 5th grade in the United States.

Big Mistake 2: The second part of the sentence we just highlighted: “sentiment may improve from these bottom levels indeed”.

Competent Financial Fact 2: AGNC is trading close to the highest price-to-trailing-book ratio of the last decade. The highest level was at the end of Q4 2023, which was right before many mortgage REITs reported a significant gain to book value. That was a different environment and such a gain is extremely unlikely in the Q2 2024 report. We know that it is unlikely because we know how bond and hedge valuation works. A few quarters ago, I decided to post Scott Kennedy’s projections for AGNC publicly before they reported. The projections were so accurate AGNC panicked and immediately pre-released their earnings. I’m not saying we’re the best at predicting how the portfolio performed (before management releases results), but the evidence sure points to that conclusion.

Here’s the price-to-trailing-book chart:

If we use the current estimated book value, AGNC is toeing the line for the highest ratio in a decade. That means the risk/reward for AGNC is particularly bad at this valuation. AGNC trades at 10.51 today. Horrible risk/reward profile.

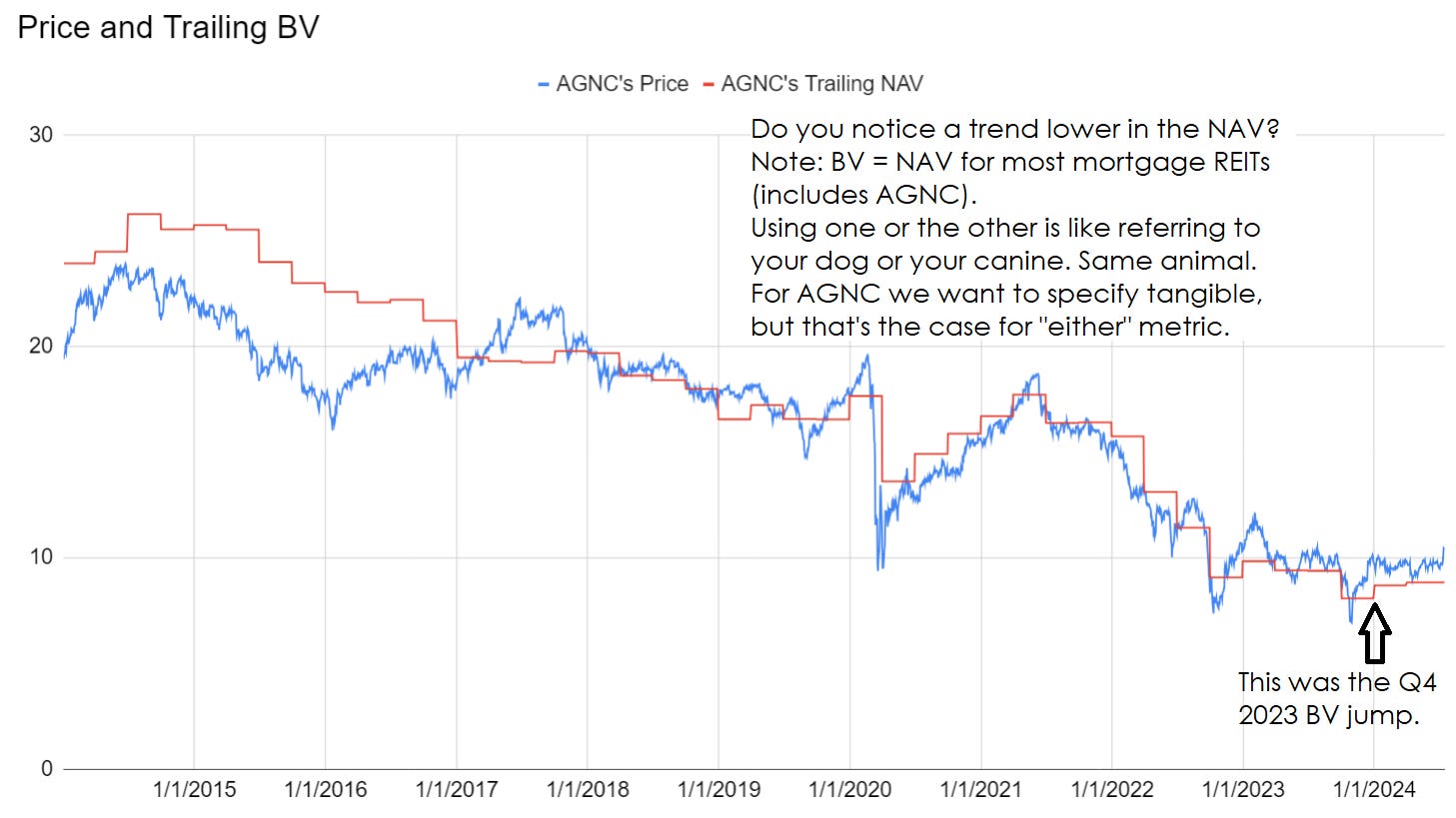

How about one more image?

Notice how the book value plunged in several periods? The author completely ignored those periods.

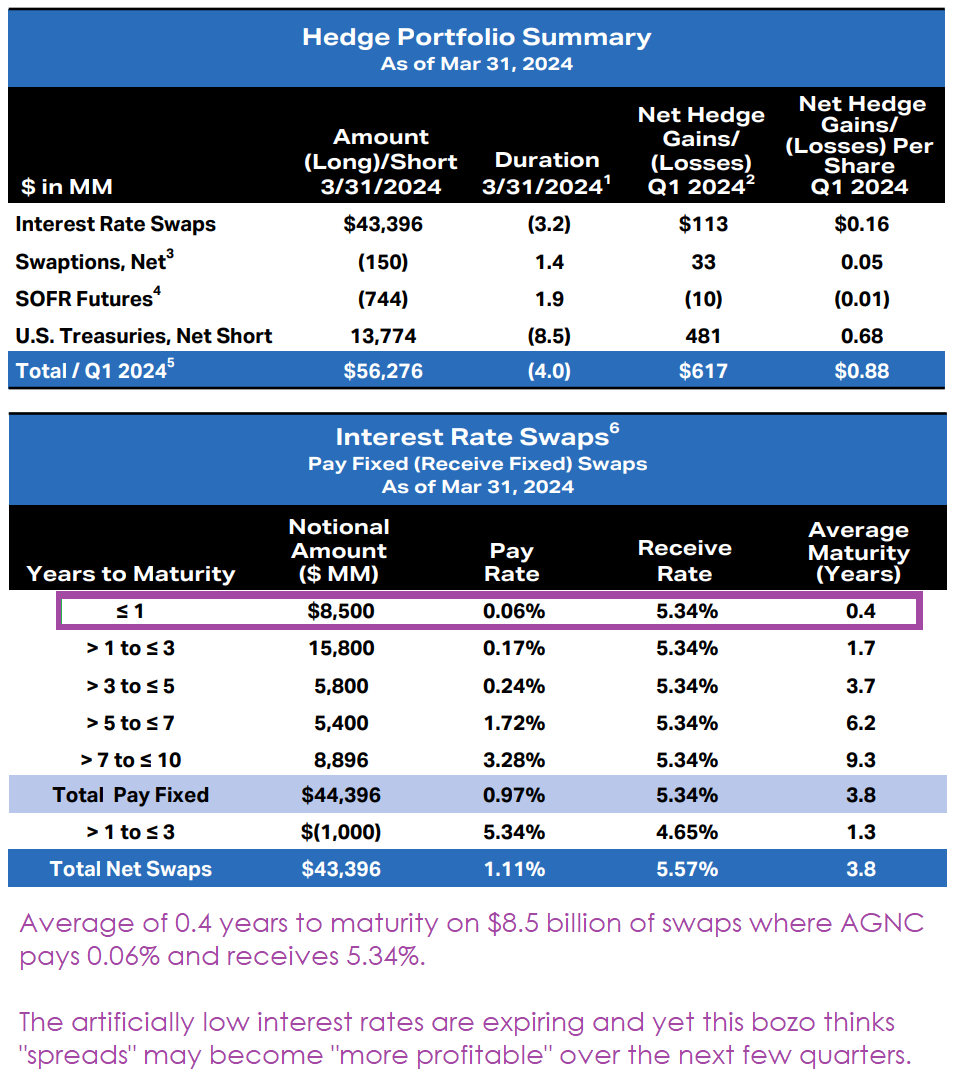

Big Mistake 3: The article says: “The eventual reversion may allow AGNC to similarly report improved performance, once its rate swap hedges are more predictable and spreads more profitable over the next few quarters.”

Competent Financial Fact 3: The economic net interest spread is at historically wide levels. The primary factor is interest rate swaps. As those swaps expire, the spreads should decline because the economic cost of funds (which is the cost of borrowing adjusted for net interest payments on swaps) will go up.

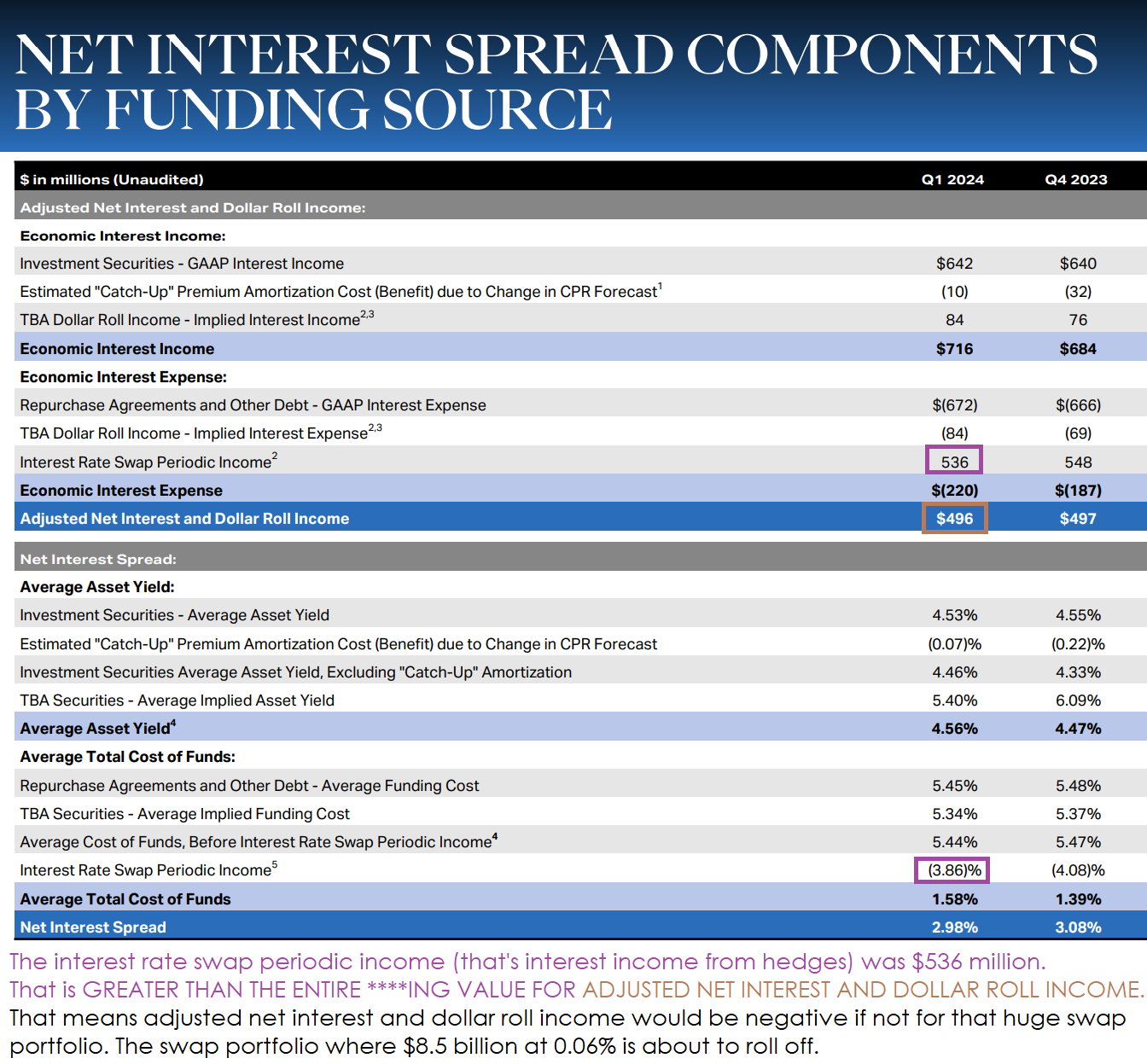

Take a look at the income from swaps with me and see what stands out to you:

This all speaks to the problem. The “analyst” referenced the “rate swap hedges” becoming “more predictable”.

However, these are very predictable for someone who knows how to do it. The fact that the analyst doesn’t have a clue how to predict them doesn’t make them unpredictable.

The Saving Grace

While the analyst was comfortable getting paid to post this garbage, you can rest assured that they won’t lose their money in the investment. They had no position in the stock.

AGNC was only good enough for their readers, not for them.

I have no position in AGNC.

If I had a position in AGNC, I would dump it at this extreme premium to book value.

Some investors will wonder if my view on AGNC preferred shares changed.

My risk rating on the preferred shares did not change.

My price targets on the preferred shares did not change meaningfully beyond the standard adjustment for dividend accrual.

Specifically, AGNCN and AGNCM targets were unchanged in our last review. AGNCO and AGNCP targets were increased by $.19 and $.20 respectively because the shares are closer to their floating dates.

For full members, I discussed the valuation of AGNC preferred shares within today’s Portfolio Update.

Member discussion