Crown Castle: Give Boots Capital The Boot - Proxy Voting Guide

Crown Castle International (CCI) has two “activists”:

- Elliott

- Boots Capital

The two activists are not working together.

Both agree that CCI should divest the fiber assets, but they have some significant differences.

- CCI is working with Elliott.

- Boots Capital launched a proxy contest.

Which activist is right?

- We support Elliott’s plan.

In short: We think investors should vote FOR CCI’s existing board nominees. We will not support Boots Capital. We believe Elliott’s motives are better aligned with shareholders.

If that’s all you want to know, you’re all set. The rest of the article is for people who want to go deeper.

Timeline

We could establish a long timeline, but I don’t think it’s necessary. The recent events are enough.

Backstory: Boots Capital and Elliott both encouraged CCI to divest their fiber segment. Elliott previously made this case several years ago. Elliott was right then and they are right now. CCI agreed to work with Elliott instead of trying to fight them.

I’ll be providing a few dates with links to the relevant documents. This timeline isn’t exhaustive, but it covers some major events. Readers can check out those sources, but it certainly isn’t necessary.

- Date unknown: Boots publishes a full presentation. No date stamp.

- 2/28/2024: Boots files suit against CCI over deal with Elliot that names two directors to the board.

- 3/13/2024: Boots publishes an open letter.

- 3/28/2024: Boots announces preliminary proxy materials.

- 4/11/2024: CCI fires back at Boots.

- 4/22/2024: Boots letter to CCI shareholders from April 22nd, 2024.

- 4/25/2024: CCI exposes Boots.

We’re going to focus on the last three items in this list.

My Questions Going in

We already know Elliott has a massive position in CCI. The position is worth a few billion USD. That helps to align them with other shareholders.

We also knew the Boots plan would involve:

- Assigning some NDAs (non-disclosure agreements) to CCI.

- Having CCI reimburse Boots for costs already incurred.

The second item clearly raises some flags. Any time I see an activist wanting to be reimbursed, it triggers additional skepticism.

Two of my biggest questions going into this were:

- How much did Boots invest in CCI?

- How much does Boots want CCI to pay them?

The letters from Boots don’t reveal these points. However, CCI’s response on 4/25/2024 did.

Here are the answers:

- Boots owned about 0.18% of CCI common stock. At a recent price of $95.32 per share, that would be about $73.2 million.

- Boots was seeking payment for “approximately $5 million” of already-incurred costs.

- The majority of the position owned by Boots was purchased after Elliott’s disclosure in November 2023.

That’s not a great look. That $5 million is material relative to the size of the investment by Boots. It’s not remotely material relative to the total value of CCI, but it casts a very negative light on the motives for Boots.

If Boots could get CCI to pay them, it would be an incentive to incur additional “costs” where they could have a margin built in. When an “activist” seeks compensation from the company rather than just seeking a higher share price, it becomes very difficult for me to trust them.

Brief Observation from CCI’s announcement on 4/11/2024

Some of the nominees by Boots Capital are ineligible to serve on the board. CCI’s guidelines make 72 a mandatory retirement age. Boots had 4 nominees. The 3 oldest nominees were 77, 72, and 71.

Other Observations from Boots letter on 4/22/2024

The layout here will go:

- Quote from the letter.

- My observation.

Note: When part of the text is bolded, that is because it was bolded in the letter by Boots.

Here we go:

“In connection with Elliott's first campaign in 2020, the Company appointed three new directors while facing pressure to institute ROIC-pegged compensation and a strategic review of fiber – neither of those things happened. The Company's performance continued to deteriorate, as demonstrated by the Company's TSR since then – negative 542% compared to AMT and negative 153% compared to SBAC. Nonetheless, these directors, as well as many of the directors that oversaw a decade-plus of value destruction, remain on the Board today.”

TSR = Total shareholder return = change in share price + dividends.

This presentation of “relative TSR” that leads to severely negative numbers is inherently strange. Absolutely zero supporting math. With no math, how can I or any other investor evaluate the claim?

“The closing stock price of Crown Castle on December 19, 2023, the day the Company entered into the cooperation agreement with Elliott, was $113.99. The closing stock price on April 19, 2023, was down to $95.20.”

Note: Typo by Boots on the year. That should be April 19, 2024.

In other periods, Boots references relative returns. Why didn’t they do it here? Since they provided dates, I’ll check relative returns.

The relative returns for CCI from 12/19/2023 to 4/19/2024 (their measurement period, though they listed 4/19/2023) were actually better than SBAC and AMT.

Saying that CCI outperformed during that period would’ve hurt their argument, so they changed which metric they were listing. This is clearly not trying to give investors an accurate picture.

“Then, in a March 8 hearing, the Delaware Chancery Court requested Crown Castle's Board give notice to Boots if there were to be any major corporate developments6. We believe shareholders would find this to be highly important information, but the Company never disclosed it. Crown Castle has still never informed shareholders of the court's direction, nor did it respect the Chancery Court's instruction in our view when expanding the Board to 13 members later in April, during the critical, late-stages of a proxy contest.”

It seems to me that CCI should’ve disclosed this information. However, if CCI simply discloses all major corporate developments to everyone, then this order would be irrelevant. If the board intended to not comply and simply pay any small fines, then that would also make it irrelevant.

“In mid-March, Mr. Miller flew to meet Board chairman Rob Bartolo at a Peet’s Coffee shop near Mr. Bartolo’s home. There, Mr. Miller proposed significant concessions to end the proxy fight, including eliminating Executive Chairman from our proposal. Notably, the Company continued to highlight this point in its latest press release, with full knowledge that we have revised our proposal.”

That’s interesting. I hope CCI explains the decision to reference the Executive Chairman position after Boots dropped it.

“There are 25 prospective buyers and financing sources who signed our NDA. This includes 3 strategic acquirors, 14 infrastructure/private equity firms and 8 financing sources. These buyers and financing sources represent blue chip, highly qualified market participants capable of executing a $10+ billion carveout transaction. We told this to the Board directly in our meeting.

These entities are not precluded from working with the Company. They are precluded from disclosing the nature of their relationship with Boots. Therefore, the Company is in no position to allege that these buyers and financing sources have not reached out to them as a result of these restrictions. Moreover, it is plausible that these parties have not reached out to the Company because they do not believe in the existing Board’s conviction or ability to execute a fiber sale.”

Why are the companies that spoke with Boots precluded from disclosing the nature of their relationship with Boots?

Is the nature of their relationship concerning?

If it wasn’t, why would they be prevented from discussing it? Alarm bells are blaring for me.

“This consideration is likely a component of what led these buyers and financing sources to engage with us and not the Company in the first place. We have offered to sign a separate NDA with the Company so we could begin the process of gaining the relevant permissions in order for us to share all of this information with the Board. But the Company has refused to take this step.”

That separate NDA with Boots doesn’t even give CCI immediate access to the information?

If the company signed that NDA, they couldn’t provide transparency to the rest of their shareholders. That seems absolutely stupid. As a shareholder, I would be upset if CCI signed that trash. Hard pass. Absolute no. Boots made themselves look bad here.

Other Observations from CCI Exposing Boots on 4/25/2024

I’m using a different layout for these notes because I think it is easier to read this way.

CCI explains why they still referenced Boots wanting an Executive Chairman position.

Note: The existence of an Executive Chairman is a violation of best practices for corporate governance.

Boots would only ditch the Executive Chairman request under the following conditions:

- CCI appoints Mr. Miller (head of Boots) to be Chair or Co-Chair. That would be inappropriate.

- CCI would terminate their cooperation agreement with Elliott (which sent share prices higher). CCI does not have the authority to terminate the agreement with no consent from Elliott. Therefore, CCI couldn’t comply even if they wanted to.

- CCI intended to disclose the terms of Mr. Miller’s proposal, but the lawyers for Boots Capital said the proposal was confidential.

This is also the letter where CCI revealed the Boots Capital:

- Only owns 0.18% of the company’s stock.

- Had estimated already-incurred costs of $5 million they wanted CCI to reimburse.

Those were the two points I was searching for from my “questions going in”. It was great to have CCI announce those details. I believe this should be mandatory disclosure for activists.

CCI harps on the fact that Boots Capital attempted to delay CCI’s ability to pursue a fiber sale through the legal system. That is clearly against the best interest of shareholders and would serve only to assist Boots in trying to force CCI to pay for the research performed by Boots.

Boots insisted on being able to bring in their own advisors for the fiber review process and have shareholders in CCI eat that cost as well.

A number of the “prospective buyers and financing sources” that Boots had under NDA’s were actually potential investors in funds owned by Boots. They were not explicitly interested in pursuing a transaction with CCI.

Remember how I was concerned that these potential buyers were “precluded from disclosing the nature of their relationship with Boots”?

Now we know why those investors were not allowed to disclose it. Because they were not actually serious bidders for CCI’s assets.

Other Notes

Boots Capital also proposes cutting the dividend as part of their plan to adjust financing.

That wouldn’t help the share price.

While CCI could reduce their dividend (particularly if the fiber sale can’t achieve strong pricing), it shouldn’t be one of their first options.

The valuation on the sale of the fiber assets could have a material impact here. We may end up doing some articles on potential scenarios for the fiber sale and the impact it would have. The range of potential sale prices for the fiber assets is significant. We don’t have great comparable transactions for such a large fiber portfolio. Therefore, we would need to model for a fairly diverse range of outcomes. Clearly, some are more favorable than others.

Conclusion

Boots Capital looks awful in our review.

Their incentives are not properly aligned with common shareholders.

CCI did a strong job of exposing Boots and demonstrating why shareholders should not support Boots.

I intend to vote my shares in favor of management (also known as “the white card”).

CCI is working with the right activist, Elliott.

How To Vote

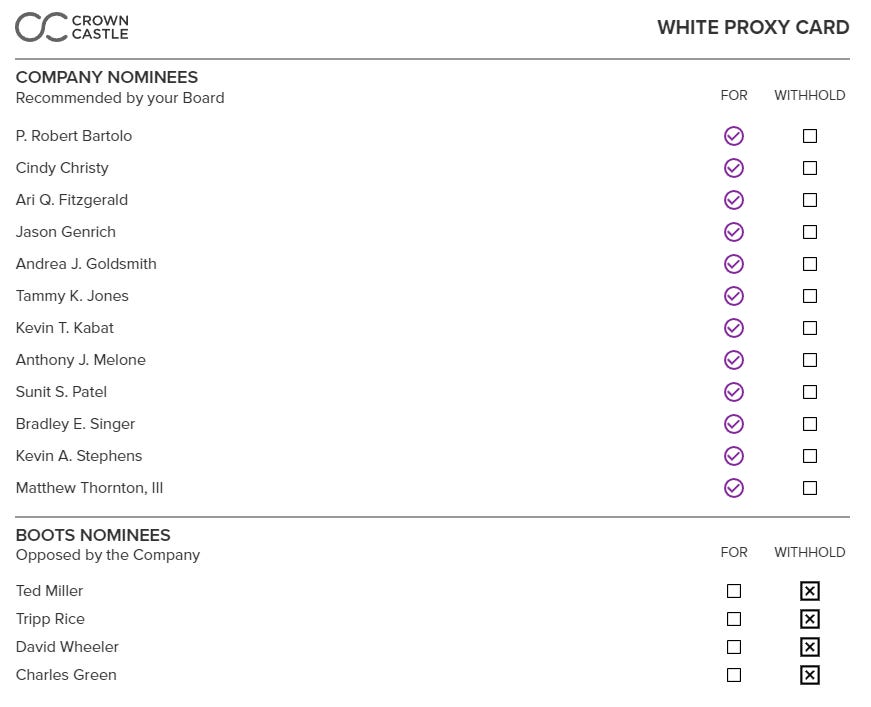

My voting for nominees will look like this:

Source: Crown Castle guide on how to vote.

The link above explains additional ways to vote.

I’ll demonstrate for Schwab and Fidelity, then share a screenshot of my voting form for one account.

The Boots nominees are the bottom 4 on the list of nominees, which makes it much easier to find them.

My Form Filled Out

I had to vote for four different accounts, but the votes were identical.

The form is huge (thanks to white space) and I don’t think it would enlarge perfectly.

Therefore, I uploaded the full-resolution version of my form to an image hosting site.

Item 1: I voted for all of CCI’s nominees and against all of Boots’ nominees (the last 4 on the list)

Item 2: Ratification of accountant choice: For

Item 3: Executive compensation: Against (protest voting because they haven’t canceled 2024 fiber capex yet).

Item 4: Boots wants to repeal amendments to By-laws: Against

Note: Item 3 has no real impact. It is non-binding. It’s just a way for shareholders to let management know they aren’t thrilled.

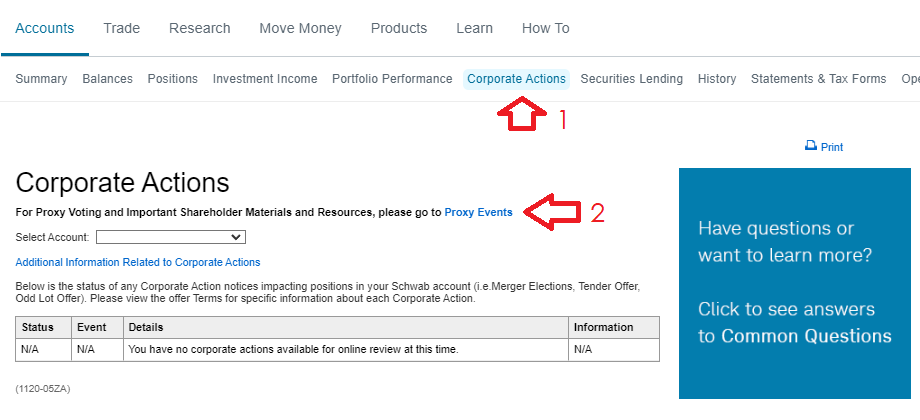

Process on Schwab

After logging into your Schwab account:

- Click “Corporate Actions”

- Click “Proxy Events”

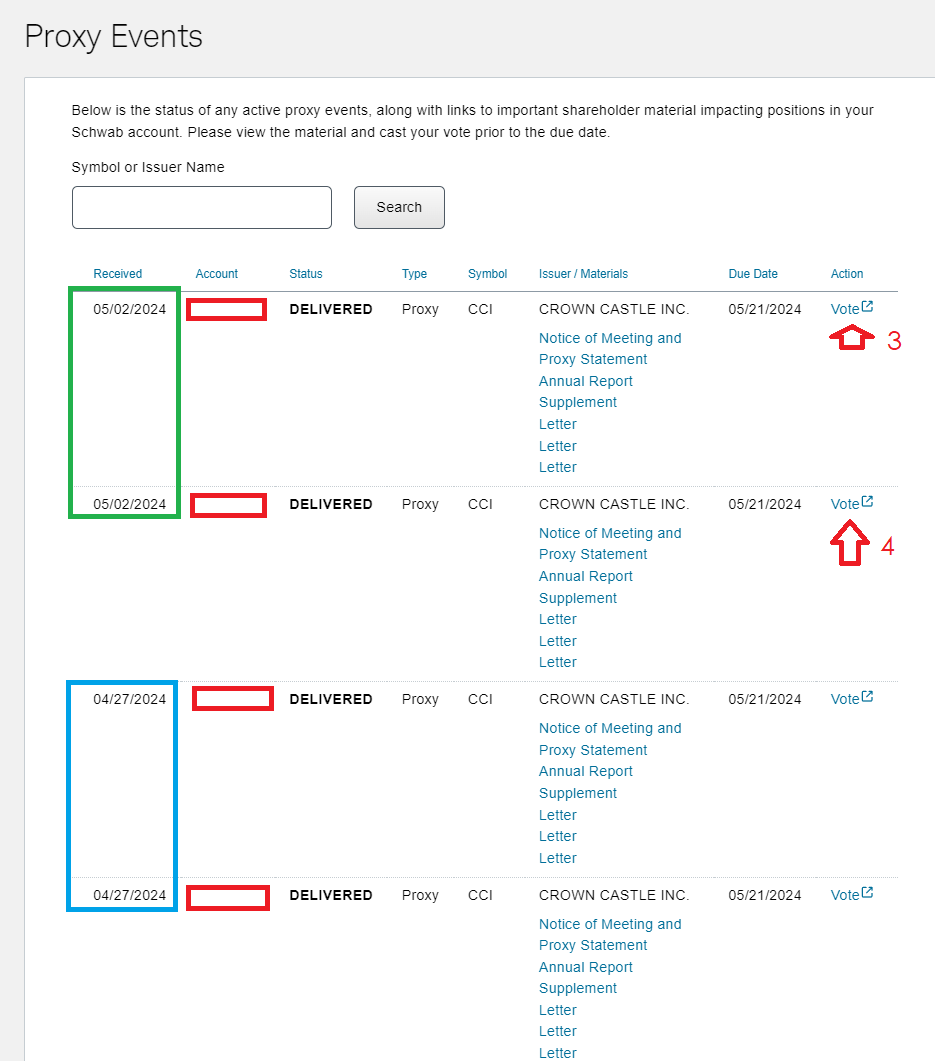

- Go to the CCI proxy and click “Vote”.

- If you have multiple accounts, you’ll need to click “vote” for each account. You’ll see the account numbers on the left.

Here’s what it looks like when you’re clicking through (from a desktop computer).

Steps 1 and 2:

Steps 3 and 4:

Next, I’ll show Fidelity.

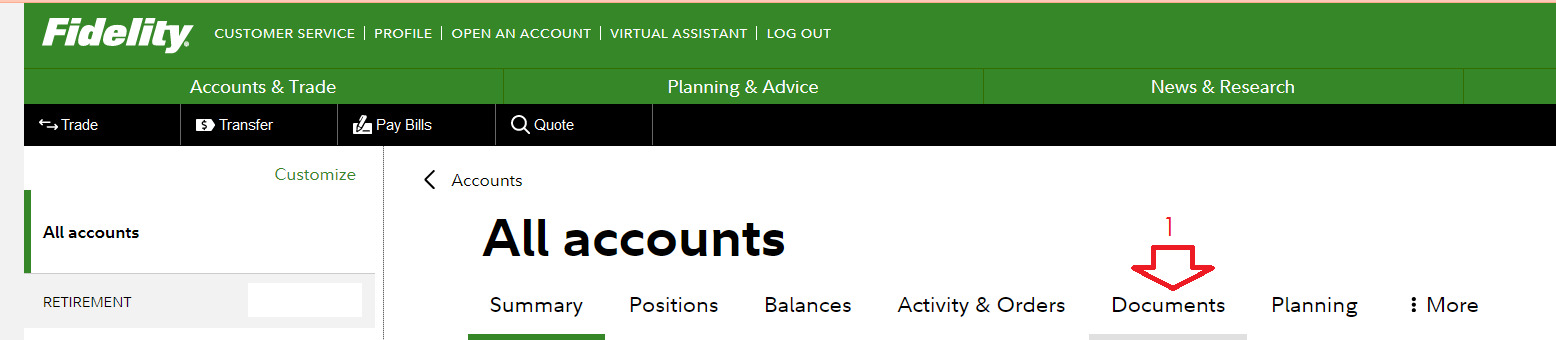

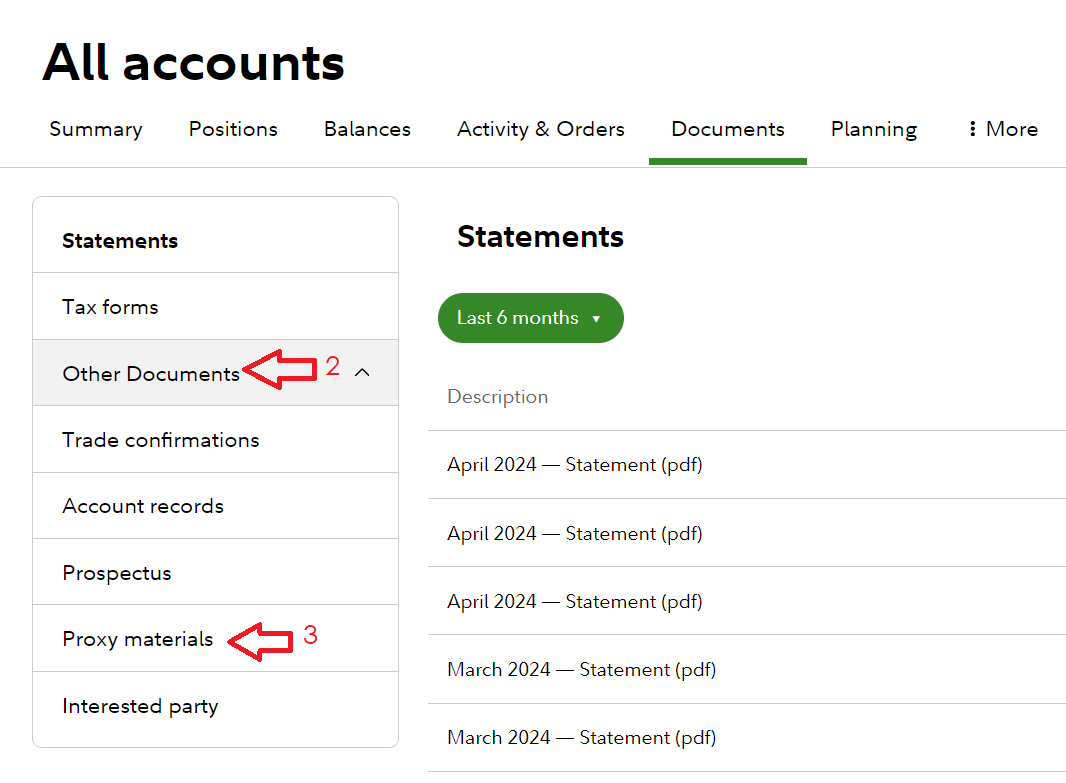

Process on Fidelity

The buttons for Fidelity are in different places.

After logging in you’ll use the following steps:

- Click Documents

- On the next page, click “Other Documents”

- Click “Proxy Materials” in the drop-down menu

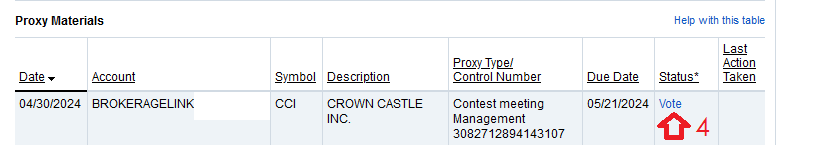

- On the next page, click “Vote”.

The screenshots are below.

Step 1:

Step 2 and 3:

Step 4:

The End

Thanks for reading. I hope this guide helps investors evaluate which potential board members to support.

Member discussion