CPT: Q2 2023 Solid performance, As Expected

- Q2 2023 results for Camden Property Trust (CPT) were solid, with no big surprises.

- Guidance has been increased slightly, driven by better-than-expected performance of new developments and a reduction in interest expense.

- Expenses have been driven up in the near term due to evicting deadbeats (non-paying tenants), but this will improve revenue as paying tenants move in.

- From 2024 through early 2025, I’m forecasting a big headwind from new supply. By early 2026 the headwind will turn into a massive tailwind.

- If rates remain elevated, the 2026+ tailwind becomes stronger.

Camden Property Trust (CPT) results for Q2 2023 were good. No big surprises.

Guidance Update

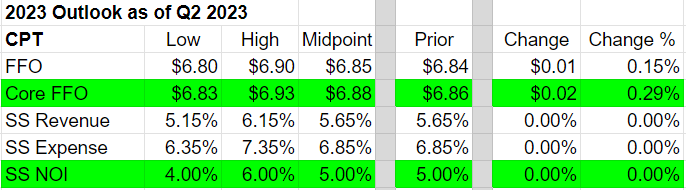

I prepared the following table to highlight key metrics:

Core FFO

A tiny boost to guidance is positive, though not large enough to be material. Two factors:

- Slightly better than expected performance of new developments. Not in the same-store pool.

- A slight reduction in interest expense from prepaying variable rate debts.

Same-Store Portfolio

Guidance is flat. The composition of expenses changed a bit. Favorable tax appeals, but higher repair costs on some tenant moveouts. That’s a very slight positive for future projections.

Elevated repairs are driven by deadbeats (non-payers) being evicted. They recorded $0 in revenue from non-payers. Any future recovery is a bonus. As CPT works through evicting those people, it enables them to bring in new tenants who pay rent as agreed. Replacing deadbeats with paying tenants improves same-property NOI after the new tenant moves in.

Why is this beneficial for future estimates? Because the elevated expenses should decline as the percentage of non-payers declines. To be clear, this was always a very small percentage. We’re still modeling the elevated repairs as part of recurring expenses, but a small portion of repairs are effectively non-recurring.

That’s positive, but it’s still a very slight impact. I want readers to know about it so they are inoculated against any reports that misrepresent the situation.

Revenue Expectations

On the earnings call, CPT’s management said:

“Last night, we reaffirmed our same-store revenue, expense, and NOI midpoints at 5.65%, 6.85%, and 5%, respectively. Our revenue growth midpoint of 5.65% is based upon an anticipated 1.5% average increase in new leases and a 5% average increase in renewables for the remainder of the year for a blend of approximately 3.25%. We are anticipating that our occupancy for the remainder of the year will average 95.6%.”

As it stands, CPT is actually doing a bit better than that on leasing metrics year-to-date. Average same-store occupancy:

- 95.35% for the first half of the year.

- 95.6% as of July 2023. This matches management’s forecast for the second half.

Development

CPT developed some properties to take advantage of stronger rents and favorable spreads between their cost of capital and the yield on construction in late 2021 to early 2022. Due to the massive increase in interest rates, development became far less favorable.

CPT has 5 projects that are still in development.

- Total expected cost: $546 million

- Cost already paid: $333.7 million

- Left to Fund: $212.3 million (estimated)

That's tiny relative to CPT’s equity market cap (about $11.76 billion). CPT should bring in Core FFO around $758 million for the year. Dividends are running about $440 million. That leaves CPT with a good chunk of cash, which is very favorable for handling those development costs.

Future Development

Remember how real (inflation-adjusted) rates went dramatically negative in 2021?

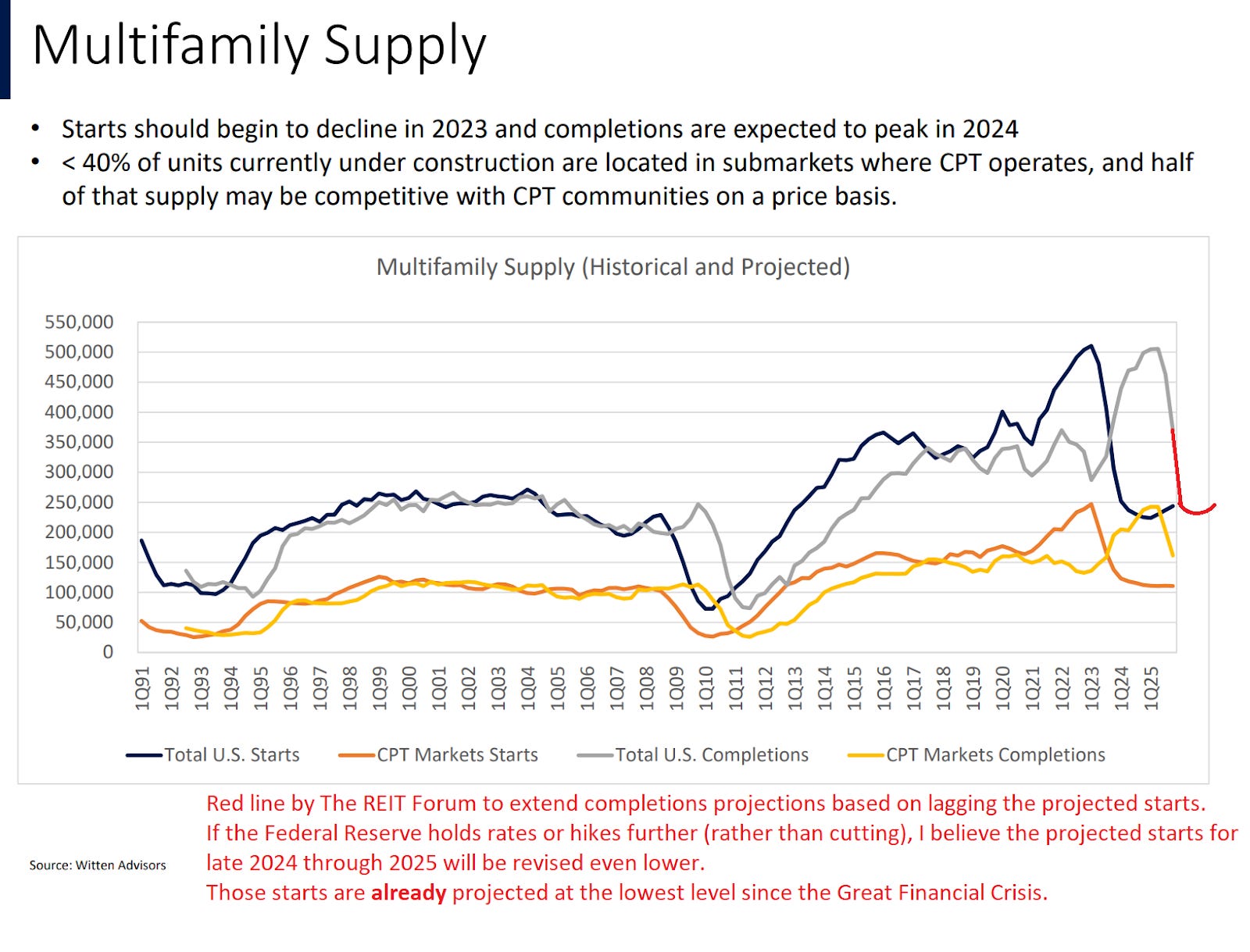

Remember how it spurred massive investment in building new places to live? New apartment starts in the United States soared to record highs. Even adjusted for population growth, housing starts were substantially above levels seen in the prior 30 years.

The free market works. The response to negative risk-free rates was a dramatic increase in housing. That makes sense because housing produces a reliable stream of cash flows and can grow with inflation. When risk-free rates are negative, more capital should go into producing these assets.

Then the Federal Reserve attacked inflation by raising rates, so plans for new construction were scrapped. That’s how we get this boom and bust in construction:

Conclusion

It’s a good quarter. Hard to dislike a quarter where guidance is increased. No big positive surprises, so the score won’t come in very high. I rate this quarter at least a 7, probably an 8 (out of 10). However, investors should know leasing spreads will probably get bad in 2024 and remain bad through Q1 2025 or Q2 2025. These are good companies with good management, and they are doing well in preparing the REITs. However, I’m forecasting significant macroeconomic headwinds from 2024 through early 2025, followed by tailwinds for 2026.

In an update for the sector, I’ll go into greater detail on those headwinds and tailwinds (spoiler: It’s apartment completions in both cases).

Member discussion