COLD Should’ve Dipped, But Not To Pandemic Levels

- COLD reduced guidance for 2021 significantly as the labor issues for COLD and their tenants continued longer than they anticipated. Warehouse Services is the segment that’s really struggling.

- COLD’s AFFO per share should recover over the next few years as a large portion of the costs are passed on to their customers.

- Targets are reduced by 6% to account for weakness in AFFO for 2021 and 2022 with expectations of a high growth rate returning in 2023.

- We anticipate adding to our position soon. Investors shouldn’t be surprised by a trade alert later today. Note: Since posting to subscribers we increased our position.

- Updates to consensus analyst estimates could pressure the share price, but shares are already at a bargain valuation.

Recently Americold (COLD) provided a new presentation and an update to guidance. This event carried little press, but the guidance update was significantly negative.

- Old Range for 2021: $1.34 to $1.40

- New Range for 2021: $1.15 to $1.20

That is about a 14% reduction to the full-year estimate, but the first half of the year is already in the books. When guidance is measured for the second half alone, it represents a nearly 25% decrease in projected AFFO per share. At the midpoint, prior guidance implied $.79 per share for the second half. At the new midpoint, the current guidance implies $.595 per share for the second half. That’s a material reduction about 45 days from their prior update. While the company’s update is primarily negative developments, we want to go a bit deeper.

The Income Statement

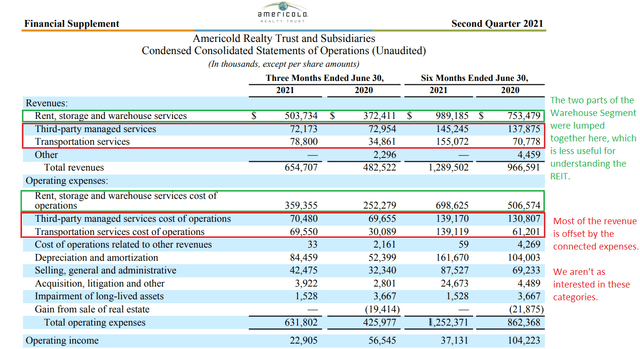

This article wouldn’t make sense without demonstrating the income statement. There are 4 aspects to COLD, but they fall under 3 broad headings:

- Thirty-party managed services (not important)

- Transportation services (not important)

- Warehouse Segment (important)

3A. Warehouse Rent & Storage

3B. Warehouse Services

To briefly cover the first 2 segments, they are considered unimportant because they contribute a smaller portion of total revenues and their expenses almost entirely offset their revenues. Consequently, their net impact for COLD is minimal. Consequently, when COLD prepares presentations they focus overwhelmingly on the “Warehouse Segment”.

As REIT investors, we are primarily interested in the Warehouse Rent & Storage side of the equation, but Warehouse Services is still an important category. The income statement looks like this:

Source: COLD’s Q2 2021 10-Q

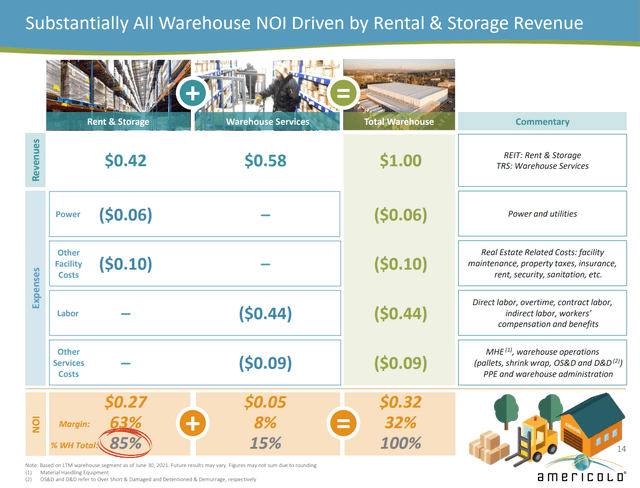

The “Rent & Storage” aspect is akin to our typical REIT. It carries very high margins and contributes the substantial majority of NOI (Net Operating Income) and AFFO (Adjusted Funds From Operations). COLD strives to make this point with the following slide:

Source: COLD’s Fall 2021 presentation

The NOI margin on “Rent & Storage” is 63%. That’s a bit low for the REITs we cover, but not absurdly low. On the other hand, “Warehouse Services” carried a dreadfully low margin of 8%. This is where COLD has significant labor expenses and this is the area where we would expect the REIT to be hit hardest over the next few quarters. If these expenses can be partially eliminated through automation, that would be great for COLD. On the other hand, if they cannot be eliminated they would most likely be passed on to customers over the next few years. Consequently, part of this impact is temporary. Expenses should remain elevated, but revenue for Warehouse Services could climb at a faster rate in 2022 and beyond as COLD passes costs through to customers.

Would customers simply refuse to pay for these services? It seems unlikely since we doubt they can find a cheaper way to do it. Would customers simply stop using cold storage for perishable products? That seems unlikely as well given that their products would spoil. Could customers refine their supply chain process to reduce reliance on cold storage? That’s possible, but it seems unlikely to substantially move the needle. The increase in costs isn’t that significant compared to final retail prices, so it isn’t the most effective area for customers to focus on.

Instead, we’re expecting to see a material short-term hit to AFFO per share followed by an accelerated growth rate over the next few years as costs are passed on to customers.

The Headline Story

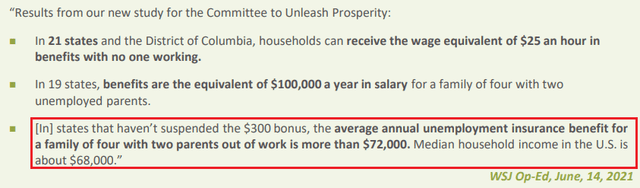

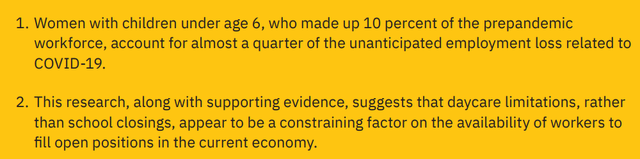

The headlines have incorrectly focused on enhanced unemployment benefits causing unemployed workers to quietly stop seeking work. Most readers have certainly heard these headlines as well. They draw in viewers and they are very easy to understand. It is a clear cause-and-effect relationship. This narrative has been reiterated by the management of COLD in the last two slides of COLD’s Fall 2021 presentation:

Source: COLD Presentation, red box by author

Those points sound very convincing. However, investors should notice that data is not comparable. We will dive into the bullet point in the red box. This statement may be accurate, but it is misleading:

- Averages and medians are different.

- A “Family of Four with two parents” is extremely different from “Household”.

- The “Average” figure came from states with higher cost of living and salaries. The “Median” figure came out from the entire United States.

In the Q2 2021 earnings call, management highlighted the headwinds from unemployment benefits as well. They expected to see their tenants increasing hiring after September since unemployed workers would have a greater incentive to return to work. However, JP Morgan Chase conducted an extensive review on the impact of unemployment benefits. Since that document is 73 pages, we will summarize it briefly.

- The impact on consumer spending is large, as expected. People spent more money.

- The impact on employment (preventing honest job searches) is small, which was unexpected. Removing additional benefits had minimal impact.

Specifically, the researchers wrote:

Matching the stable behavior of the job finding rate before and after their expiration leads us to conclude that the $600 supplements led to reductions in employment through discouraged job search of 0.2-0.4 percent.

A 0.2% to 0.4% reduction in employment matters, but doesn’t warrant the headlines. This is where the work got slower as we needed to evaluate the big picture.

Why Do Those Stories Contradict?

Before we jump into the big picture, we want to address the appearance of a conflict. The bullet points came from a WSJ op-ed article, which was contributed to WSJ by a non-profit. The non-profit is a lobbying firm. The article was designed to influence public opinion. It was short, to the point, and included zero sources. The factors we retrieved from JP Morgan Chase were designed to help their institutional clients better understand and predict macroeconomic outcomes. It was filled with charts, 73 pages long, and 5 entire pages were dedicated to listing sources.

WSJ Published A Real Article

While WSJ publishes a large volume of opinion pieces, they still publish other articles as well. WSJ reported ending enhanced unemployment benefits was ineffective:

States that ended enhanced federal unemployment benefits early have so far seen about the same job growth as states that continued offering the pandemic-related extra aid, according to a Wall Street Journal analysis and economists.

Where Are The Workers?

We know a large portion of the workforce is “unemployed”. We know that enhanced unemployment benefits are not the real cause. So why aren’t these people working and when will they return to work?

Now we’re asking the big question. This matters for predicting COLD’s performance over the next few years because their occupancy, revenues, and labor costs are all tied to the answer. We can’t poll every person who is filing for unemployment. However, we can come up with a few theories and look for evidence to either support or weaken the case.

My prediction is that unemployed individuals are still unemployed for a couple of primary reasons. It should be noted that we are skipping over the typical reasons that apply year-after-year. These are reasons unique to this environment.

- The schools are either not offering in-person classes or the parent is not comfortable sending their child to the school (or daycare).

- The unemployed individual is concerned about COVID exposure or simply wants to work from home.

Evidence for Schools

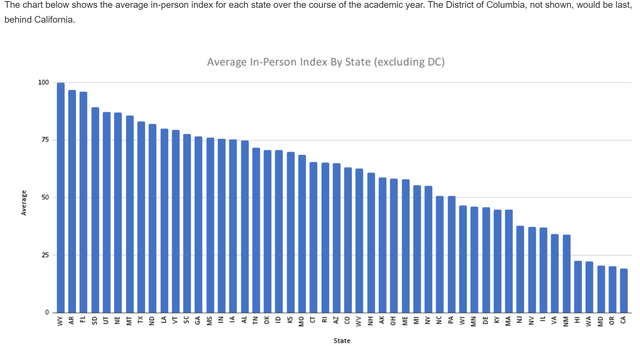

Finding organized data covering school policies on a national level is a bit harder than it might seem. We finally came across the following chart:

Source: Burbio

For investors who really like statistics, Burbio explains the full methodology. The short version is that they checked school districts and assigned a score of 100 for in-person teaching 5 days per week, 50 for in-person 2-3 days per week, and 0 for schools that were only online. It becomes clear that there is a dramatic difference between the states. Since COLD’s portfolio is geographically diverse within the United States, attempting to cross-reference this data with COLD’s geographic exposure was not particularly useful.

My theory is that more schools (and daycares) will open when children are eligible for vaccination. That is generally projected to be around the end of October. Therefore, it wouldn’t be surprising to me if we saw many of the schools which are currently “online-only” transition to in-person classes around January 2022. When that happens, it would dramatically reduce the incentive for parents to remain home.

The Atlanta Federal Reserve confirmed our interpretation saying:

Source: Atlanta Federal Reserve

Evidence for Remote Work

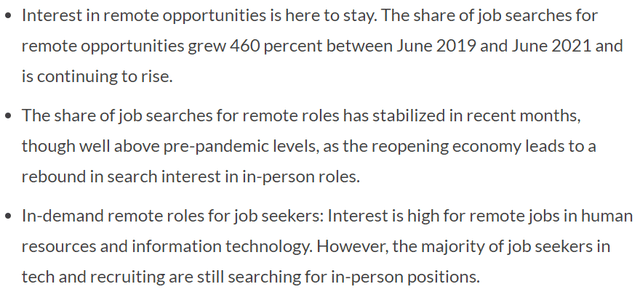

Following the pandemic, many people found it was entirely possible to work from home. Many jobs cannot be done remotely, but workers have a strong preference for the jobs that can be performed from home. Glassdoor compiled data on the volume of job searches by category. Here are the major findings:

This reinforces the idea that unemployed people are still looking for work, but many of them are looking for the same job. Even if it is less than 50% of job seekers searching for remote work, those job openings are dramatically less common. That’s precisely how we can have so many millions of job openings and yet have a high volume of unemployed individuals.

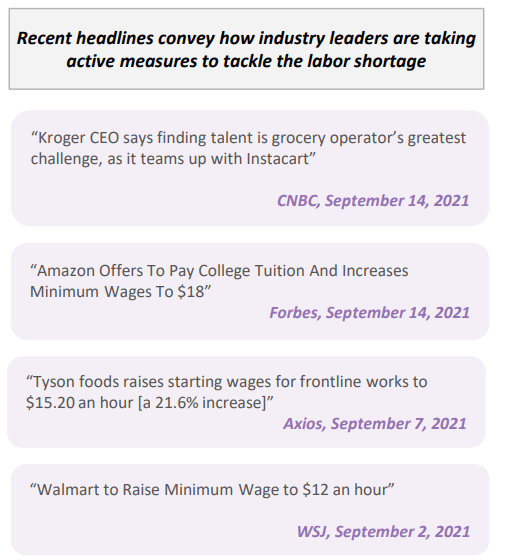

While part of this emphasis on remote work may represent a long-term trend, it also ties into the issue with schools. When the schools are not open or the parents don’t feel safe sending their children, they have an enormous incentive to focus exclusively on remote work opportunities. Consequently, it should be no surprise that the rising wages announced by employers are almost exclusively for “in-person” jobs:

Source: COLD’s Fall 2021 Presentation

Therefore, we would expect that the “in-person” employers (like COLD and their tenants) would have more success finding employees when a greater percentage of the schools are offering in-person education five days per week. My best guess is that this happens around January 2022. Therefore, we would expect COLD’s tenants to be increasing production in Q1 2022 and Q2 2022 which could improve occupancy in the second half of 2022. However, it could take a few quarters to return to prior levels. During that period COLD’s AFFO per share would be depressed by lower occupancy and by increases in operating expenses for “Warehouse Services” occurring before the increase in revenues for those services.

Projections

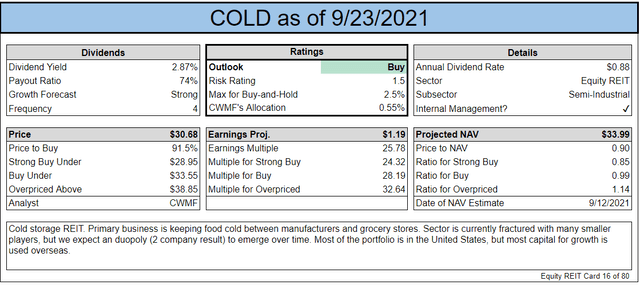

Prior to the announcement, the consensus estimate for COLD’s 2021 AFFO per share was $1.36. Based on the updated guidance, we expect the consensus estimate to trend down to around $1.19. While we usually use the consensus estimate in our spreadsheets, we felt it was appropriate to update COLD’s estimate based on new guidance before the consensus estimate updates.

Looking out to 2022, we see the occupancy improving towards the second half of the year. That gives suppliers enough time to build up some inventory if they are expanding labor forces in Q1 2022. However, the challenges to COLD’s labor expense will still be present. Therefore, we would expect 2022 AFFO per share to have a range of about $1.10 to $1.25. The mid-point of that range comes in below the current year estimate as more periods of elevated expense are partially offset by the contractual rent bumps. However, the timing of other events such as development projects could throw that off. We expect that by 2023 growth in AFFO per share will have resumed (from the depressed levels set in 2021 and 2022) and that year-over-year growth rates will be quite high.

If those events play out as projected, COLD would most likely have the relevant data from tenants (indicating increasing production) by the time they report Q4 2021 earnings (and provide 2022 guidance). However, we won’t know if the theory is playing out during the Q3 2021 earnings announcement since that will be before January 2022.

Long-Term and Near-Term

Looking at a long-term valuation we see a more muted impact. We don’t expect the current events to have a significant impact on where AFFO per share would be in 2030. The main weakness would simply be that the REIT would have less AFFO per share available for reinvesting into growing the business in the near-term.

Target Adjustments

We’re lowering targets on COLD by 6%. A decade from now the impact should be much smaller. The long-term impact is primarily missing out on some additional near-term cash flows that would’ve been reinvested in the business. However, we’re setting the lower target to reflect the weaker AFFO in 2021 and 2022 since we expect it to continue weighing on sentiment for the next few months. I would expect the total cumulative impact to AFFO/share to be in the range of $.50 to $.80 spread across the next 24 months or so.

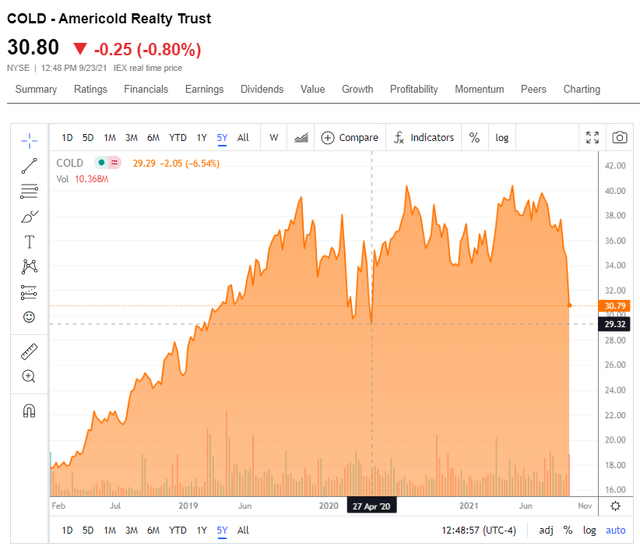

That's a rough estimate, but it certainly shouldn't be anywhere close to the $9.00 per share decline in the share price.

Valuation

We find COLD attractive. Even after reducing the targets, they are battling for the shares deepest in our target buying range. Looking at their historical price range, the current dip has share prices almost as low as they were during the pandemic:

Source: Seeking Alpha

Shares rarely see such a low valuation. While the near-term issues facing the REIT are material, they are not as significant as the issues they were facing in the heart of the pandemic. We’re comfortable with a bullish outlook on shares of COLD at this valuation.

The long-term picture should only see modest damage from these headwinds. We currently have a small position in COLD and are planning to add to that position on the current dip.

Note: We purchased additional shares on the afternoon of 9/23/2021.

Dividends

COLD’s dividend rate is only $.88 per share. That low dividend rate is dramatically easier to cover even if we see a period of weak AFFO per share. Consequently, we don’t expect any reductions to the dividend level. We suspect COLD would like to establish the company as a dividend champion, so the dividend will most likely be increased slightly in 2023. Historically they’ve increased the dividend in March and then maintained that level throughout the year. That trend seems likely to continue unless the situation with labor worsens rather than improving.

Conclusion

COLD remains a solid long-term choice for investors and will likely see a small dividend increase in 2022. In the next several quarters we should see pressure on AFFO/share maintained as a result of higher labor expenses hurting their “Warehouse Services” margin and modest pressure on occupancy as tenants will need longer to rebuild their supply levels. We’re projecting that difficulties in hiring will ease in early 2022 as we believe the lower volume of applicants is reflecting the situations with schools rather than with unemployment benefits. However, wages are sticky and will likely remain elevated. Passing these costs on to customers will be a gradual process over the next few years. Tenants are unlikely to find a cheaper option and COLD remains an important part of the supply chain.

Predicting near-term price fluctuations is inherently complex. The consensus analyst estimates for 2021 and 2022 will take time to update, though we’ve already adjusted our sheets. Those consensus estimates could push further weakness in the share price, but within the next 18 months, we expect to see a healthy recovery. It could happen much sooner, but the timing is less important for an investor with a long-term plan for the position.

The current multiples appear more attractive than REITs in other sectors with weaker long-term growth prospects. Despite lowering targets, COLD trades at one of the largest discounts to our target prices and we responded by adding shares Thursday afternoon. The addition increased our portfolio allocation from 0.55% to 1.48%.

Member discussion